Architectural Membranes Market Size, Share, Trends, Industry Analysis Report

By Material Type (PTFE Coated Fabric, PVC Coated Fabric, ETFE Film, Silicone Coated Fabric, Others), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6457

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

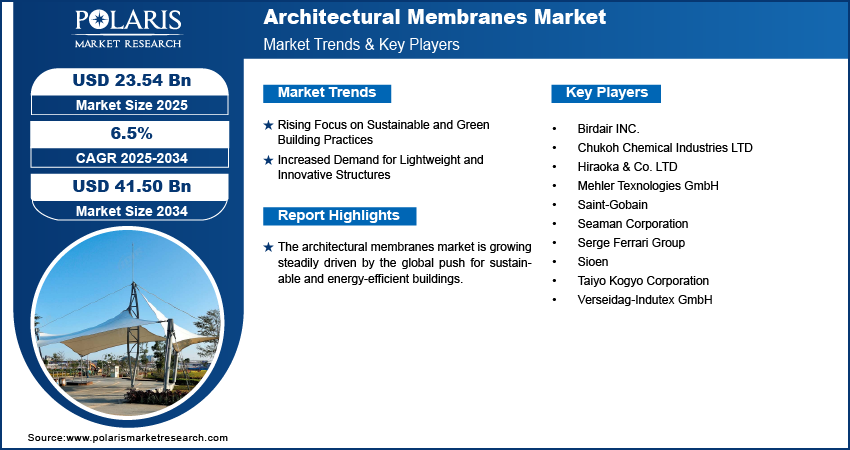

The global architectural membranes market size was valued at USD 22.16 billion in 2024 and is anticipated to register a CAGR of 6.5% from 2025 to 2034. The demand for architectural membranes is driven by a few factors such as growing interest in sustainable and energy-efficient building practices and the increasing building projects, including sports stadiums and transportation hubs. There is also a rising demand for structures that are lightweight and have a unique look, which these membranes can provide.

Key Insights

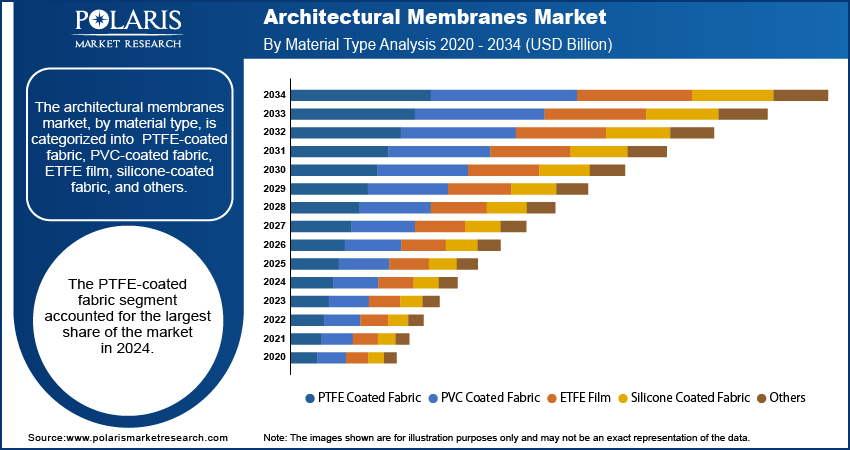

- By material type, the PTFE coated fabric segment held the largest market share in 2024 as it is durable and high-performing material for the sector.

- By end use, the sports and recreation segment dominated the market in 2024. The segment growth is attributed to the large-scale nature of projects that use architectural membranes to create high-quality and visually appealing roofs.

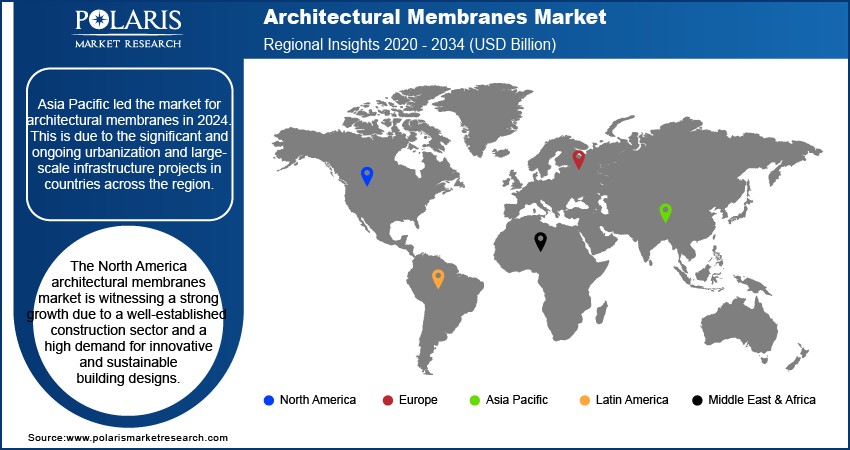

- Asia Pacific led the global architectural membranes market in 2024, because of the ongoing large-scale infrastructure projects in the major countries across the region.

Industry Dynamics

- The rising demand for lightweight and energy-efficient building solutions boosts the industry growth. These materials help reduce the weight of a structure, which lowers construction costs. They also provide excellent thermal insulation and allow for more natural light, reducing the need for artificial lighting and air conditioning.

- The increasing requirement for architectural membranes in large public spaces propels the industry expansion. The membranes are being widely adopted for projects such as airport terminals, shopping malls, and sports arenas. Their ability to create large, open, and aesthetically pleasing spaces without heavy structural supports propels the demand for architectural membranes.

- The growing focus on sustainable building practices across the world drives the demand for architectural membranes. Most of these materials can be recycled and have a long service life. These benefits align well with green building goals. Their use reduces the amount of raw materials needed and the energy consumed during construction and the life of the building.

Market Statistics

- 2024 Market Size: USD 22.16 billion

- 2034 Projected Market Size: USD 41.50 billion

- CAGR (2025–2034): 6.5%

- Asia Pacific: Largest market in 2024

Architectural membranes are lightweight, flexible materials used to create roofing, facades, and other unique structures. They are made from various fabrics and films, including PTFE, ETFE, and PVC. They provide a strong, durable, and weather-resistant covering for buildings.

The modernization of existing buildings and rising urban development drive the adoption of architectural membranes. As cities grow and older structures are renovated, there is a demand for innovative materials, such as architectural membranes that are easy to install and can cover large areas. These membranes are an attractive option for new construction in densely populated areas and for retrofitting older buildings.

The growing requirement for fire and acoustic protection in buildings contributes to the industry development. Architectural membranes can resist fire, which is a key safety feature for public spaces. They can also help manage sound pollution, reducing echoes and noise inside large structures. The U.S. Fire Administration, part of FEMA, provides guidelines that highlight the importance of fire-resistant building materials in public and commercial spaces, which aligns with the properties offered by these membranes.

Drivers and Trends

Rising Focus on Sustainable and Green Building Practices: There is a surging emphasis on sustainable and energy-efficient construction across the globe. Architectural membranes are a key component of modern green building designs as they can minimize the environmental impact of a building. The materials offer various benefits, including high building thermal insulation and increased daylighting. It reduces the energy consumption needed for heating, cooling, and lighting. The rising focus on sustainability propels the use of architectural membranes in new projects and the renovation of older buildings.

As per the United Nations Environment Programme's (UNEP) Global Status Report for Buildings and Construction 2024/2025, the buildings and construction sector is a key factor responsible for the climate crisis. According to the report, the sector consumes 32% of global energy and contributes 34% of global CO2 emissions. It emphasizes the requirement for ambition in building energy codes and renewable energy solutions to achieve climate goals. The increasing focus on reducing environmental footprint and achieving sustainability goals boosts the adoption of eco-friendly and sustainable materials, including architectural membranes.

Increased Demand for Lightweight and Innovative Structures: Traditional building materials are heavy and require extensive support structures, which can limit architectural design. On the other side, architectural membranes are lightweight and can be stretched and shaped into complex, curved forms that are difficult and expensive to achieve with other materials. This flexibility enables architects to create modern, eye-catching designs for a variety of public and commercial buildings.

In its Public Health Infrastructure Grant fact sheet, the Centers for Disease Control and Prevention (CDC) announced in December 2024 that it had awarded nearly $4.5 billion to help U.S. health departments improve their infrastructure. Large-scale government funding for public and community buildings propels the demand for innovative materials, including lightweight architectural membranes as they offer quick and efficient installation. This growing demand for structures that are lightweight, visually unique, and appealing propels the adoption of architectural membranes.

Segmental Insights

Material Type Analysis

Based on material type, the segmentation includes PTFE-coated fabric, PVC-coated fabric, ETFE film, silicone-coated fabric, and others. The PTFE-coated fabric segment accounted for the largest revenue share in 2024. The material has properties such as exceptional durability, resistance to chemicals and extreme temperatures, a very long lifespan, and others. They are significantly used in large-scale public and private structures, including stadium roofs, where longevity and performance are crucial. The low surface energy of PTFE-coated fabrics gives it self-cleaning properties, which reduces maintenance needs and costs. Owing to these qualities, PTFE-coated fabric has become a preferred material among architects and builders seeking a reliable, long-term solution.

The ethylene tetrafluoroethylene (ETFE) film segment is anticipated to register the highest growth rate during the forecast period due to its various properties such as lightweight, high strength, and transparency. ETFE films allow a great deal of natural light to pass through, which helps create bright, open spaces while still providing protection from UV radiation and harsh weather. They are especially popular for projects that need a lot of light, such as skylights and facades. The material's flexibility also allows for creative and dynamic designs, which is in line with modern architectural trends. As many projects focus on aesthetic appeal and energy savings, the demand for ETFE film is growing rapidly.

End Use Analysis

Based on end use, the segmentation includes sports & recreation, transportation infrastructure, commercial & retail, and others. The sports & recreation segment held the largest share in 2024. This is because these materials are highly sought after for building and renovating large-scale venues such as stadiums, arenas, and sports complexes. Their ability to cover vast spans without heavy support columns allows for unobstructed views and a feeling of openness, which is essential for spectator events. Additionally, these membranes offer excellent weather protection, making it possible for games and other events to happen year-round, regardless of the climate. The visual appeal and unique design possibilities they offer also help create iconic structures that attract tourism and boost a city's profile, further driving demand for architectural membranes across the sports & recreation industry.

The transportation infrastructure segment is anticipated to register the highest growth rate during the forecast period. Rising investments in modernizing transportation infrastructure across cities worldwide boost the need for innovative materials for airports, train stations, and bus terminals. Architectural membranes are an ideal solution for these projects due to their lightweight nature, which enables faster and more efficient construction. The membranes can create open, bright spaces that are welcoming and easy for travelers to navigate. It can provide a durable, low-maintenance covering for large areas. This key benefit helps in reducing long-term operational costs for public facilities. As countries continue to expand and improve their transit networks, the demand for these materials is expected to grow in the coming years.

Regional Analysis

The Asia Pacific architectural membranes market held the largest global revenue share in 2024. The leading position is attributed to rapid urbanization and major infrastructure projects across the region. Countries in Asia Pacific witness rapid growth in urban populations, which is leading to a building boom of new cities, public facilities, and commercial hubs. Architectural membranes are appealing materials for these projects as they are cost-effective for large-scale construction projects and can be installed quickly. Use of such materials allows cities to build new, modern infrastructure to support their increasing populations and growing economies.

China Architectural Membranes Market Insights

China invests heavily in large-scale urban development and transportation projects, including new airports and high-speed rail stations. This massive investment boosts the requirement for modern building materials. The country's rising focus on increasing "green" and sustainable construction, outlined in its national development plans, drives the use of lightweight, energy-saving materials such as architectural membranes. This rising focus on rapid and efficient infrastructure development and an increasing move toward sustainable practices boost the industry expansion in China.

North America Architectural Membranes Market Trends

The North America architectural membranes industry growth is attributed to a well-established construction sector and a high demand for innovative and sustainable building designs. The region increasingly focuses on developing large commercial and public projects, such as airports, sports stadiums, and convention centers, where architectural membranes are widely used. A favorable regulatory environment that promotes energy efficiency and green building standards boosts industry expansion. The push for new and renovated infrastructure across major cities fuels the adoption of these modern building materials.

U.S. Architectural Membranes Market Overview

The U.S. dominated the revenue share in North America in 2024, due to significant investments in modernizing public and commercial infrastructure across the country. The U.S. is reporting an upsurge in projects that use architectural membranes for their aesthetic and functional benefits. The use of these materials in new and upgraded sports stadiums, like those seen in various major leagues, has become a common trend. The demand for architectural membranes is high in the transportation sector, as the construction of new airport terminals and railway hubs features these innovative materials. The robust economy and a culture that values unique, high-performance architecture accelerate the industry expansion in the U.S.

Europe Architectural Membranes Market Assessment

Europe is a significant regional industry for architectural membranes. A strong focus on sustainability and renovation of historical buildings propels the use of architectural membranes across the region. The region’s long history of urban development means that many infrastructure projects include updating existing structures to be more energy-efficient and modern. Architectural membranes offer an excellent solution for these renovations, providing a lightweight way to upgrade facades and roofs while keeping the original character of the buildings. Additionally, Europe's commitment to climate goals and strict building codes for energy performance encourages the use of these materials.

In 2024, Germany dominated the Europe market revenue share. The advanced construction industry of the country and a strong commitment to energy-efficient and high-quality buildings boost the Germany architectural membranes market. New construction and retrofitting projects across the country boost the adoption of architectural membranes. German architects and engineers are known for their precision and for creating functional and visually impressive structures. This expertise as well as government initiatives for green building projects make Germany a key hub for the architectural membranes industry in Europe.

Key Players and Competitive Insights

The architectural membranes market has a highly active competitive landscape. It comprises a mix of established global companies and smaller, specialized manufacturers. These companies compete on product innovation, material performance, ability to handle complex architectural projects, and other factors. Partnerships and collaborations between fabric manufacturers and engineering firms are essential for designing and building large, custom structures. This environment encourages continuous improvements and a focus on developing more advanced materials to meet the evolving needs of modern architecture, particularly for applications requiring unique aesthetic and functional properties.

A few prominent companies in the industry include Serge Ferrari, Sioen, Taiyo Kogyo Corporation, Mehler Texnologies GmbH, Birdair INC., Saint-Gobain, Seaman Corporation, Verseidag-Indutex GmbH, Hiraoka & Co. LTD, and Chukoh Chemical Industries LTD.

Key Players

- Birdair INC.

- Chukoh Chemical Industries LTD

- Hiraoka & Co. LTD

- Mehler Texnologies GmbH

- Saint-Gobain

- Seaman Corporation

- Serge Ferrari Group

- Sioen

- Taiyo Kogyo Corporation

- Verseidag-Indutex GmbH

Architectural Membranes Industry Developments

March 2025: Birdair was awarded a contract to upgrade the retractable roof of Houston's NRG Stadium with durable PTFE panels. This project is a key part of the stadium's preparations for hosting matches in the upcoming 2026 FIFA World Cup.

Architectural Membranes Market Segmentation

By Material Type Outlook (Revenue – USD Billion, 2020–2034)

- PTFE Coated Fabric

- PVC Coated Fabric

- ETFE Film

- Silicone Coated Fabric

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Sports & Recreation

- Transportation Infrastructure

- Commercial & Retail

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Architectural Membranes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 22.16 billion |

|

Market Size in 2025 |

USD 23.54 billion |

|

Revenue Forecast by 2034 |

USD 41.50 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 22.16 billion in 2024 and is projected to grow to USD 41.50 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Serge Ferrari, Sioen, Taiyo Kogyo Corporation, Mehler Texnologies GmbH, Birdair INC., Saint-Gobain, Seaman Corporation, Verseidag-Indutex GmbH, Hiraoka & Co. LTD, and Chukoh Chemical Industries LTD.

The PTFE-coated fabric segment accounted for the largest share of the market in 2024.

The transportation infrastructure segment is expected to witness the fastest growth during the forecast period.