Artificial Ventilation And Anesthesia Masks Market Size, Share, Trends & Industry Analysis Report

: By Mask (Disposable Masks and Reusable Masks), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5858

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

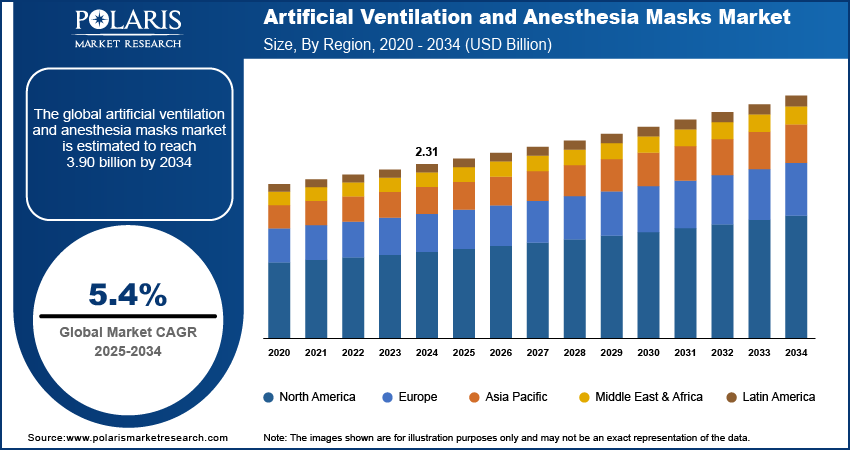

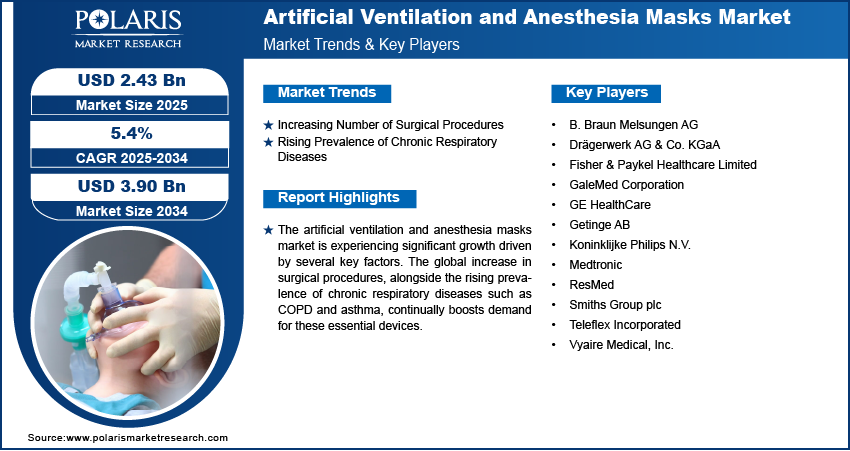

The global artificial ventilation and anesthesia masks market size was valued at USD 2.31 billion in 2024, and is anticipated to grow at a CAGR of 5.4% from 2025 to 2034. The demand for artificial ventilation and anesthesia masks is largely driven by the increasing number of surgical procedures performed worldwide.

The artificial ventilation and anesthesia masks are face masks that involve medical devices crucial for patient care, primarily used to deliver anesthesia during surgeries and to provide breathing support for individuals needing artificial ventilation. These masks ensure the safe and effective administration of gases and air to patients in various medical settings.

Ongoing advancements in the design and materials used for artificial ventilation and anesthesia masks are a significant driver of market growth. Innovations focus on enhancing patient comfort, improving seal integrity to prevent leaks, and integrating features that facilitate better patient monitoring and treatment delivery. This includes the development of lightweight materials, ergonomic shapes that conform better to various facial structures, and masks with integrated sensors for real-time physiological monitoring.

A global increase in healthcare expenditure and the continuous development and modernization of healthcare infrastructure are powerful drivers. As countries invest more in their healthcare systems, there is a greater capacity to deliver advanced medical services, including complex surgeries and critical care interventions that require these masks. This includes building new hospitals, upgrading existing facilities, and equipping them with state-of-the-art medical devices.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Increasing Number of Surgical Procedures

The global rise in surgical procedures is a significant force behind the growth. As medical technology advances and healthcare infrastructure improves worldwide, more people have access to surgical interventions for a variety of conditions. This includes both complex and routine operations, all of which typically require some form of anesthesia and often, post-operative ventilation support.

For example, according to a systematic analysis for the Global Burden of Disease Study 2019, chronic respiratory diseases caused 4.0 million deaths with a prevalence of 454.6 million cases. While this specific instance focuses on chronic respiratory diseases, it highlights the growing global health burden that often necessitates surgical interventions and, consequently, the use of these masks. This increasing volume of surgical cases directly translates to a higher demand for anesthesia and ventilation masks.

Rising Prevalence of Chronic Respiratory Diseases

The growing number of people suffering from chronic respiratory diseases (CRDs) is another major driver. Conditions like chronic obstructive pulmonary disease (COPD), asthma, and other lung-related ailments often require respiratory support, both in acute exacerbations and for long-term management. These masks are essential for delivering oxygen, ventilating patients, and administering medications through nebulizers.

As an illustration, data from the Centers for Disease Control and Prevention (CDC), shows that an estimated 14.2 million US adults had physician-diagnosed COPD in 2021. While the overall prevalence remained stable, the sheer number of individuals affected by such chronic conditions creates a steady and substantial demand for respiratory support devices, including ventilation and anesthesia masks. This continued prevalence of CRDs ensures a consistent demand for these crucial medical devices, driving the market growth.

Segmental Insights

By Mask

Disposable masks currently held the largest share in 2024. This dominance is largely due to their cost-effectiveness, ease of use, and significant role in infection control within healthcare settings. The increasing emphasis on patient safety and reducing the risk of healthcare-associated infections (HAIs) has led many hospitals and clinics to prefer single-use items. For instance, the Centers for Disease Control and Prevention (CDC) provides guidance on masks, noting that disposable surgical/medical masks generally offer more protection than cloth masks by filtering out large particles and reducing the spread of germs.

Reusable masks segment is anticipated to grow at the highest growth rate during the forecast period. This upward trend is driven by increasing awareness about environmental sustainability and the desire for cost-effective solutions over the long term. Hospitals are looking for ways to reduce medical waste and their environmental footprint, making reusable options more appealing. Advancements in sterilization technologies, such as vaporized hydrogen peroxide (VHP) terminal sterilization, as discussed in an October 2023 article in Microorganisms titled "Advances in Vaporized Hydrogen Peroxide Reusable Medical Device Sterilization Cycle Development: Technology Review and Patent Trends," are also making reusable masks a more viable and safe option.

By Application

Operating rooms held the largest share in 2024. This dominance stems from the consistent and high volume of surgical procedures performed globally, ranging from routine operations to complex interventions. Every surgical procedure involving general anesthesia relies heavily on these masks for delivering anesthetic gases and maintaining a patient's airway. For instance, surgical care is an essential part of global healthcare, with the World Health Organization (WHO) noting that millions undergo surgical treatment each year, and surgical interventions account for a significant portion of the world's total disability-adjusted life years (DALYs).

The homecare segment is anticipated to grow at the highest growth rate during the forecast period. This accelerated growth is largely due to the increasing preference for remote patient care and the rising number of individuals managing chronic respiratory conditions from their homes. Advances in portable and user-friendly ventilation devices make it more feasible for patients to receive care outside of traditional hospital settings. For example, the growing prevalence of chronic obstructive pulmonary disease (COPD) and other respiratory ailments, as highlighted by organizations like the CDC, fuels the demand for home-based respiratory support.

Regional Analysis

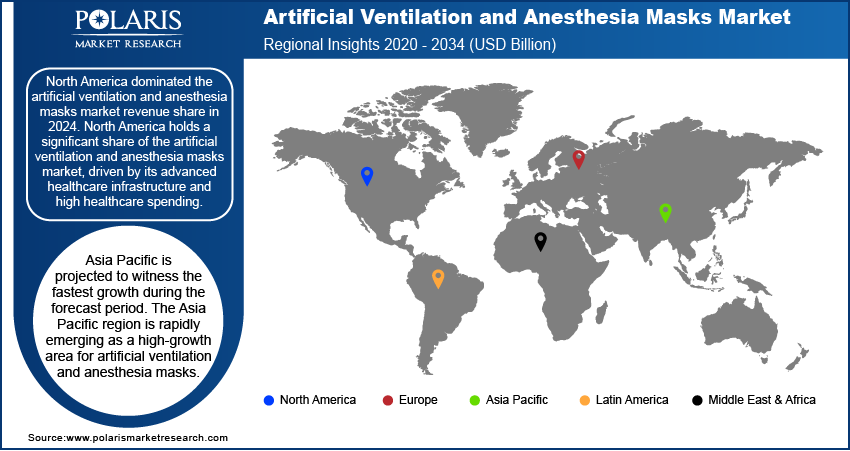

North America artificial ventilation and anesthesia masks market held the largest share in 2024 in the global market, driven by its advanced healthcare infrastructure and high healthcare spending. The region benefits from a strong emphasis on patient safety, rapid adoption of new technologies, and a high prevalence of chronic respiratory diseases. Additionally, the presence of major industry players and favorable reimbursement policies contribute to the robust demand for these medical and anesthesia devices. The well-established healthcare system here ensures a consistent need for advanced ventilation and anesthesia solutions across hospitals, ambulatory surgical centers, and homecare settings.

US Artificial Ventilation and Anesthesia Masks Market Insight

Within North America, the US is a dominant force in the artificial ventilation and anesthesia masks market. The country's large and aging population, coupled with a high volume of surgical procedures, consistently drives demand. The US also sees a high rate of chronic diseases that require respiratory support, such as COPD, further boosting the need for these masks. Furthermore, strong regulatory frameworks and a focus on cutting-edge medical advancements lead to the early adoption of innovative mask designs and technologies, solidifying its leading position.

Europe Artificial Ventilation And Anesthesia Masks Market

Europe is a substantial region in the artificial ventilation and anesthesia masks market, characterized by its well-developed healthcare systems and a high standard of medical care. The increasing number of surgical interventions and surgical masks, coupled with an aging population susceptible to various respiratory ailments, contributes to a steady demand for these devices. Additionally, stringent healthcare regulations and a focus on improving patient outcomes across European countries encourage the adoption of high-quality and safe ventilation and anesthesia masks. Within Europe, Germany artificial ventilation and anesthesia masks market stands out as a major contributor to the market. The country's strong economy, significant investments in healthcare infrastructure, and a large elderly population lead to a high demand for advanced medical equipment, including artificial ventilation and anesthesia masks. Germany is also known for its robust medical device manufacturing sector and a strong emphasis on research and development, which helps in bringing innovative and effective products to the market. This focus on quality and innovation further strengthens the market presence of these devices in the country.

Asia Pacific Artificial Ventilation And Anesthesia Masks Market Overview

The Asia Pacific region is rapidly emerging as a high-growth area for artificial ventilation and anesthesia masks. This growth is fueled by improving healthcare infrastructure, increasing healthcare spending, and a large patient pool, particularly in populous countries. The rising awareness about respiratory health, combined with a growing number of surgical procedures and increasing prevalence of chronic diseases, significantly contributes to the demand for these masks. As healthcare access expands and medical facilities are modernized, the adoption of advanced ventilation and anesthesia solutions is on the rise across the region. China artificial ventilation and anesthesia masks market is a key country driving the growth in the Asia Pacific market. Its vast population, coupled with a rapidly developing healthcare sector and increasing investment in medical technologies, creates a substantial demand for artificial ventilation and anesthesia masks. The country's efforts to expand access to healthcare services and manage chronic respiratory conditions also play a crucial role in boosting the need for these devices. The growing number of surgeries performed and the aging demographic further contribute to China's strong position in the regional market.

Key Players and Competitive Insights

The artificial ventilation and anesthesia masks market is characterized by a mix of large, established medical device manufacturers and specialized companies. Competition revolves around product innovation, patient comfort, material advancements, and compliance with stringent regulatory standards. Companies are continuously striving to develop masks that offer superior sealing, reduce dead space, and are suitable for various patient demographics and clinical applications, while also considering cost-effectiveness and sustainability.

Prominent companies in the industry include Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V., Medtronic, Fisher & Paykel Healthcare Limited, Getinge AB, ResMed, Teleflex Incorporated, GE HealthCare, B. Braun Melsungen AG, Smiths Group plc, GaleMed Corporation, and Vyaire Medical, Inc.

Key Players

- B. Braun Melsungen AG

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Limited

- GaleMed Corporation

- GE HealthCare

- Getinge AB

- Koninklijke Philips N.V.

- Medtronic

- ResMed

- Smiths Group plc

- Teleflex Incorporated

- Vyaire Medical, Inc.

Industry Developments

November 2024: Besmed introduced the FitMax CPAP Face Mask, a new anaesthetic gas mask. The company states that this mask is designed for individuals who struggle to find sufficient comfort with standard full-face or nasal masks.

March 2025: GE HealthCare announced a collaboration with NVIDIA to advance autonomous imaging, focusing on developing autonomous X-ray technologies and ultrasound applications.

February 2024: ResMed introduced its AirCurve 11 series of devices. These are advanced bi-level machines that use dual-tier pressure settings and digital features to make sleep apnea treatment simpler for healthcare providers and improve how well patients stick to their therapy.

Artificial Ventilation And Anesthesia Masks Market Segmentation

By Mask Outlook (Revenue – USD Billion, 2020–2034)

- Disposable Masks

- Reusable Masks

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Operating Rooms

- ICU

- Emergency Rooms

- Homecare

- ASCs

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Artificial Ventilation And Anesthesia Masks Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.31 billion |

|

Market Size in 2025 |

USD 2.43 billion |

|

Revenue Forecast by 2034 |

USD 3.90 billion |

|

CAGR |

5.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.31 billion in 2024 and is projected to grow to USD 3.90 billion by 2034.

The global market is projected to register a CAGR of 5.4% during the forecast period.

North America dominated the market share in 2024.

Key players in the market include Drägerwerk AG & Co. KGaA, Koninklijke Philips N.V., Medtronic, Fisher & Paykel Healthcare Limited, Getinge AB, ResMed, Teleflex Incorporated, GE HealthCare, B. Braun Melsungen AG, Smiths Group plc, GaleMed Corporation, and Vyaire Medical, Inc.

The disposable masks segment accounted for the largest share of the market in 2024.

The homecare segment is expected to witness the fastest growth during the forecast period.