Asia Pacific Polyurethane Market Share, Size, Trends, Industry Analysis Report

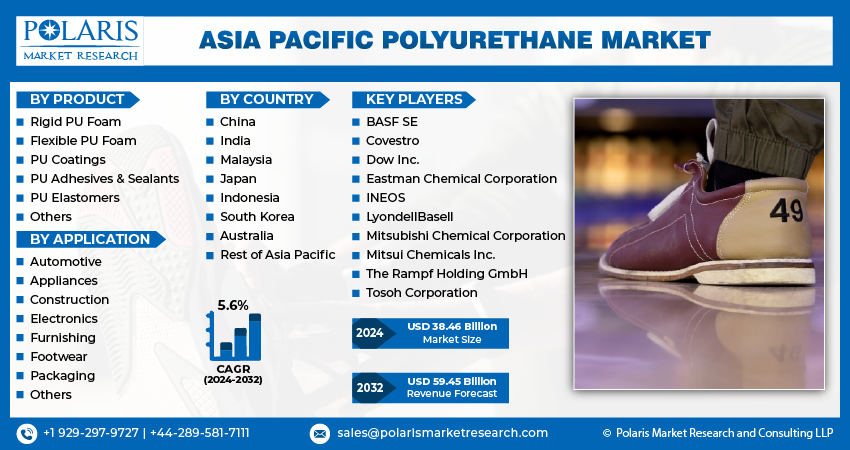

By Product (Rigid PU Foam, Flexible PU Foam, PU Coatings, PU Adhesives & Sealants, PU Elastomers); By Application; By Country; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4470

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

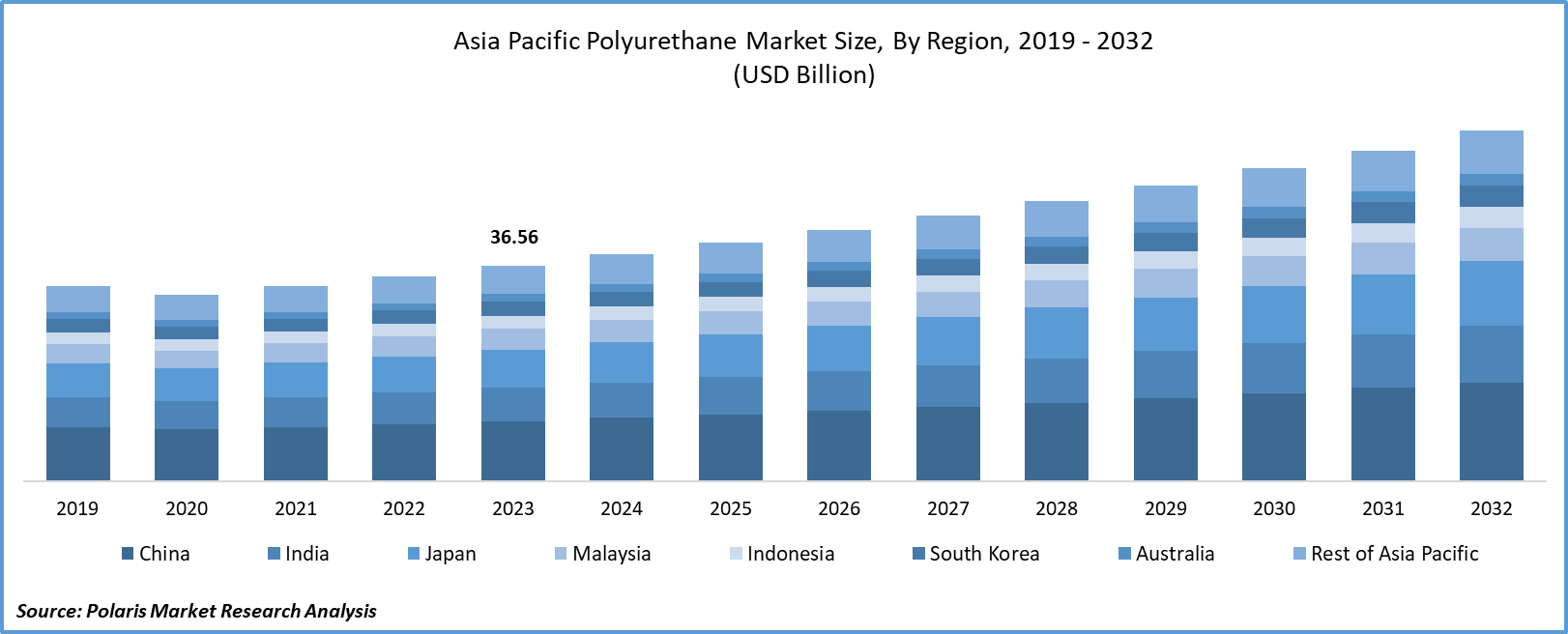

The asia pacific polyurethane market size was valued at USD 36.56 billion in 2023. The market is anticipated to grow from USD 38.46 billion in 2024 to USD 59.45 billion by 2032, exhibiting the CAGR of 5.6% during the forecast period.

Industry Trends

The Asia Pacific polyurethane market is dominating the global market for polyurethane, accounting for a substantial share of the total demand. The market in this region is driven by various factors, such as increasing demand for rigid PU foam, flexible PU foam, and PU adhesives and sealants, particularly in countries like China, India, Japan, Australia, and Indonesia. The growing construction sector in the region has created a huge demand for polyurethane products such as insulation materials, adhesives, and sealants.

Moreover, the automotive industry in the Asia Pacific region is also a major consumer of polyurethane products, with applications in car seats, dashboards, and other interior components. The rise in vehicle production and sales in countries like China, India, and Thailand has further boosted the demand for polyurethane. Another important factor contributing to the growth of the polyurethane market in the region is the increasing focus on sustainability and environmental protection. Polyurethane products are known for their excellent insulating properties, which can help reduce energy consumption and greenhouse gas emissions. This has led to increased demand for eco-friendly polyurethane products in various industries, including building and construction, furniture, and appliances.

To Understand More About this Research: Request a Free Sample Report

However, the market is hindered by the volatility in raw material prices, which affects the profitability of manufacturers. Also, stringent regulations regarding the use of certain chemicals in polyurethane products have been implemented in countries like India, Australia, and New Zealand, which limits the market's expansion.

Key Takeaways

- China dominated the market and contributed over 23% of the share in 2023

- India is expected to grow with a significant CAGR over the estimated period

- By product category, the flexible PU segment accounted for the largest market share in 2023

- By application category, the construction segment held the dominating revenue share in 2023

What are the Market Drivers Driving the Demand for the Asia Pacific Polyurethane Market?

Expanding Applications of Polyurethane in the Automotive Industry Drive Market Growth

The expanding applications of polyurethane in the automotive industry are considered as significant driver for the growth of the market. Polyurethane is increasingly being used in various automotive parts such as seals, gaskets, bushings, and insulation materials due to its excellent resistance to wear and tear, chemicals, and abrasion. In addition, it is also being used in the production of lightweight and durable components such as composite leaf springs, engine mounts, and suspension components, which has led to increased fuel efficiency and reduced greenhouse gas emissions.

Also, the growing trend towards electric vehicles (EVs) in the region is driving the demand for polyurethane, as it is used extensively in EV batteries and other components. The use of eco-friendly polyurethane products that contain bio-based raw materials or have lower VOC (Volatile Organic Compounds) content is also gaining traction in the region's automotive industry, further boosting the overall demand for polyurethane.

Which Factor is Restraining the Demand for Polyurethane?

The Volatility in Raw Material Prices Hinders Market Growth

The production of polyurethane relies heavily on raw materials such as crude oil, natural gas, and other petrochemicals. The prices of these materials are highly unpredictable due to factors like global demand, geopolitical tensions, and supply chain disruptions. When raw material prices increase, manufacturers face higher production costs, which negatively impacts their profitability and pricing power. Consequently, the increased cost of production makes polyurethane products less attractive to customers, leading to lower demand and reduced sales.

Moreover, the uncertainty surrounding raw material prices makes it challenging for manufacturers to predict future costs and plan their operations effectively. This volatility can discourage investments in new capacity additions or expansion plans, limiting the growth potential of the Asia Pacific polyurethane market.

Report Segmentation

The market is primarily segmented based on product, application, and country.

|

By Product |

By Application |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented on the basis of rigid PU foam, flexible PU foam, PU coatings, PU adhesives & sealants, PU elastomers, and others. The flexible PU foam segment accounted for the largest revenue share in the Asia Pacific market in 2023, owing to its extensive application in various industries such as furniture and bedding, automotive, and packaging. Flexible PU foam is widely used in cushioning, mattresses, and upholstery due to its excellent comfort, durability, and support properties.

The growing demand for comfortable and luxurious living spaces, particularly in countries such as China and India, has fueled the demand for high-quality furniture, which in turn has driven the growth of the flexible PU foam market. Moreover, the increasing production of vehicles in the region, coupled with the growing demand for electric vehicles, has also augmented the demand for flexible PU foam in the automotive sector which further contributed to its popularity in the region.

By Application Insights

Based on application analysis, the market has been segmented on the basis of automotive, appliances, construction, electronics, furnishing, footwear, packaging, and others. The construction segment emerged as the leading application area for polyurethane in the Asia Pacific region in 2023, and this dominance is because of the increasing demand for polyurethane materials in various construction applications such as insulation, sealants, adhesives, and coatings. Polyurethane-based products offer excellent thermal insulation properties, which are essential for energy-efficient buildings and reduce heat transfer, thereby reducing energy consumption.

In addition, polyurethane-based sealants and adhesives provide superior bonding strength and durability, making them ideal for use in construction activities. Also, polyurethane coatings offer excellent resistance to corrosion, abrasion, and chemicals, making them suitable for various industrial and commercial flooring applications. The infrastructure development in Asia Pacific countries has led to an increase in residential and non-residential construction projects, further boosting the demand for polyurethane materials in the region.

Country-wise Insights

India

India is expected to grow with a significant CAGR in the assessment period because of several factors, such as increasing demand from various end-use industries like automotive, construction, and home furnishing. Also, government initiatives like "Make in India" and "Smart City Mission" are driving the demand for polyurethane in various applications. Moreover, the presence of prominent players in the country and their focus on innovation and product development further boost the market's growth. Overall, India is anticipated to be a key contributor to the growth of the Asia-Pacific market for polyurethane during the forecasted years.

China, on the other hand, held the dominating revenue share in 2023 thanks to the country's massive manufacturing sector, low labor costs, and government support, which have enabled it to maintain a competitive edge in terms of pricing and production efficiency. Furthermore, China's strategic geographical location allows for easy access to raw materials such as crude oil, which is essential for producing polyurethane, giving Chinese companies an advantage in terms of sourcing and transportation costs.

Competitive Landscape

The manufacturers of polyurethane in the Asia Pacific region are engaged in various activities, such as R&D, expansion, and ventures, to increase their market share and revenue. They are investing heavily in research and development to introduce new and innovative products that cater to the growing demand from various end-use industries. Also, they are focusing on expanding their production capacities and setting up new plants in emerging markets to meet the increasing demand.

Some of the major players operating in the Asia Pacific market include:

- BASF SE

- Covestro

- Dow Inc.

- Eastman Chemical Corporation

- INEOS

- LyondellBasell

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- The Rampf Holding GmbH

- Tosoh Corporation

Recent Developments

- In January 2020, Mitsubishi Chemical Corporation disclosed its acquisition of the Thermoplastic Polyurethane Elastomer (TPU) business of U.S.-based AdvanSource Biomaterials Corporation. This strategic move was aimed at expanding the corporation's product offerings and strengthening its position in the global market.

Report Coverage

The Asia Pacific Polyurethane market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, application, and their futuristic growth opportunities.

Polyurethane Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 38.46 billion |

|

Revenue forecast in 2032 |

USD 59.45 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Application, By Country |

|

Regional scope |

China, India, Malaysia, Japan, Indonesia, South Korea, Australia, Rest of Asia Pacific |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The Asia Pacific Polyurethane Market report covering key segments are product, application, and country.

Asia Pacific Polyurethane Market Size Worth USD 59.45 Billion By 2032

Asia Pacific Polyurethane Market exhibiting the CAGR of 5.6% during the forecast period.

key driving factors in Asia Pacific Polyurethane Market are 1. Expanding applications of polyurethane in the automotive industry