Athletic Footwear Market Share, Size, Trends, Industry Analysis Report

By Type (Aerobic Shoes, Running Shoes, Walking Shoes, Trekking & Hiking Shoes, Sports Shoes); By End-Use; By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jul-2022

- Pages: 112

- Format: PDF

- Report ID: PM1262

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

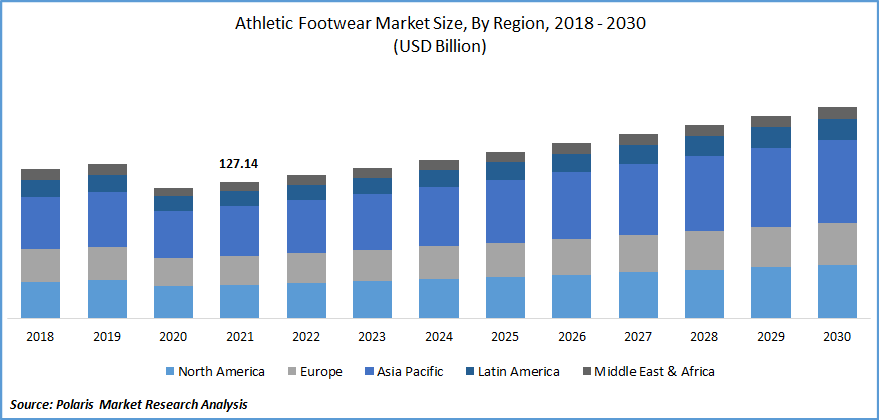

The global athletic footwear market was valued at USD 127.14 billion in 2021 and is expected to grow at a CAGR of 5.0% during the forecast period. The rise in consumer disposable income, expansion of the retail e-commerce industry, and increased participation of women in international competitions where they represent their nations through running have all contributed to the athletic footwear industry's rapid expansion.

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Athletic Footwear Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Know more about this report: Request for sample pages

Shoes produced for sports and other outdoor activities are referred to as athletic footwear. The volume of global consumption shows a tendency of people to wear this as casual as well as fashionable footwear. To meet the demands and budgets of various customers, the industry offers a range of athletic footwear in a variety of colors, styles, and prices.

The popularity of athletic footwear is further increased by the rise in fitness centers and gyms. Growing e-commerce is increasing options for businesses to offer their goods online and is fueling demand for the sector. The production process is hampered by uncertain fluctuations in the cost and availability of raw materials, which is expected to impede industry expansion. Additionally, growing competition among significant companies makes it difficult for new competitors to enter the athletic footwear market and restrains it from expanding.

Since December 2019, the COVID-19 pandemic has minimally affected the global athletic footwear market. The global production and supply of athletic footwear have been interrupted by the COVID-19 epidemic in these key markets, which has led to a decline in market share. This was primarily caused by the lockdowns that many governments had implemented, which prevented many business establishments from operating.

Additionally, a stringent prohibition on sporting events harmed market expansion and altogether halted crowd-gathering operations. Universities and schools were closed, which limited the number of athletic activities available to children and youth. However, it is anticipated that the athletic footwear market will expand during the forecast period as more people become health-conscious and start participating in physical activities.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

According to athleisure, consumers choose designer sports. The ongoing shift towards active lifestyles is a major driver of the industry for athletic footwear. With the number of women participating in fitness and sports activities increasing along with the popularity of sports and fitness activities like yoga, running, and aerobics, stylish and comfortable athletic footwear is becoming quite popular. As a result, consumers, especially women, are purchasing more sports footwear.

In addition, athleisure is becoming more popular, which affects how millennial parents choose their sports shoes. The global athletic footwear market appears to be fragmented because of the existence of so many established businesses. Additionally, this intensifies the market's level of competition.

Therefore, players are employing various techniques like joint ventures, mergers, and acquisitions to keep their dominant industry position. For instance, in June 2022, a new pair of sneakers designed by Jacquemus and Nike were introduced. The designs of Jacquemus frequently incorporate elements from the world of sports, including hiking and even diving attire, in addition to the company's cheerful style.

Report Segmentation

The market is primarily segmented based on type, end-use, distribution channel, and region.

|

By Type |

By End-Use |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Online channels are expected to witness the fastest growth

Global demand for e-commerce, which exclusively entails the purchasing and selling of goods and services through online platforms, is quite high. Online shopping is the most well-known type of e-commerce. By making it simpler and more convenient, it has streamlined the purchasing process for consumers.

When compared to developing nations like India and China, developed nations like the United States and Japan are more popular with online shopping. The retail environment was different than it is today. Since e-commerce has made shopping more straightforward, convenient, and easy, there is a huge athletic footwear market opportunity for sports footwear.

Running Shoes accounted for the highest market share in 2021

These include shoes designed for advanced running, trail running, track running, and numerous more shoe categories. The fact that running shoes come in a variety of styles and are even worn daily is one of the factors boosting their popularity. Additionally, the network of the running shoe market is being successfully driven by the necessity to engage in numerous activities to prevent chronic ailments.

To suit consumer demand, numerous businesses are working to develop fashionable athletic footwear. For instance, Nike launched the Air Zoom Pegasus 38 FlyEase in April 2021. Numerous hues of the Pegasus 38 are offered, and Nike frequently releases limited-edition versions of the shoe.

The Pegasus 38 boasts a breathable mesh upper that, in terms of thickness and plushness, is comparable to the Brooks upper on the Glycerin 19. The Pegasus 36's racing-style tongue has been replaced with a thicker, padded version to shield the foot from pressure and hot spots. This plushness has also spread to the tongue of the shoe.

Women Segment is expected to hold the significant revenue share

As women's interest in sports continues to rise, particularly in previously untapped countries, women's footwear is increasingly catching up. In general, females of all ages participate less in sports and fitness activities. But over the past few years, more women have started taking part in marathons, running, and jogging, which has greatly aided the industry's expansion. In contrast to developing and undeveloped nations, most developed countries have a higher number of female athletes competing for their respective countries at important sporting events.

Additionally, compared to underdeveloped countries, industrialized countries have far higher levels of total fitness awareness among women. However, the situation is rapidly changing in emerging nations as a result of initiatives taken by the governments of those nations to encourage women to actively participate in sports and other fitness-related activities. In emerging markets, this is projected to significantly increase the sales of women's athletic footwear.

The demand in North America is expected to witness significant growth

The U.S. is the major revenue contributor to the regional market growth due to the significant interest among the populace in sports, fitness, and adventure activities like aerobics, hiking, training, and trail running. For instance, in May 2021, Adidas and Allbirds, two competing sportswear companies, revealed Futurecraft, the first item created through their partnership.

Low carbon footprint jogging shoes. To rethink a lower-emission design process and create a performance running shoe with no carbon impact, the sportswear businesses have teamed up and shared unique technology and material advancements.

Additionally, the disposable income of the population and shifting fashion tastes are promoting market expansion in the area. As consumer expenditure on footwear products rises, so does the region's need for sports shoes. The United States International Trade Commission estimates that consumer spending on footwear in the United States was USD 82.5 billion in 2018, a 3% rise from the previous year.

Over the projected period, APAC is anticipated to develop at the fastest rate. In the Asia Pacific, the demand for athletic footwear is expected to be significantly fueled by the rise of disposable income and expanding e-commerce. The growing interest in taking part in various sporting events, such as the Asian Games, Cricket World Cup, and ACC Asia Cup, is supporting regional market expansion.

Sports are not only widespread in the majority of the population but also have diverse qualities. As a result, Brazil is one of the world's largest markets for athletic shoes, driving sales of athletic shoes in South America. In addition, in recent years, athletic shoes have increased in South America due to growing health awareness, lifestyle changes, a growing desire for comfortable shoes, a growing need for creative shoe design, and rising disposable income levels. Consumers' preference for sneakers is increasing.

Competitive Insight

Some of the major players operating in the global market include Asics Corporation, Adidas group, FILA Korea, Ltd., K-Swiss, Inc., Lotto Sport Italia, Nike, Inc New Balance Athletics, Incorporation., Puma SE, Reebok International Limited, SKECHERS, Inc., Under Armour, Inc., Vans, Inc., VF Corporation, and Wolverine World Wide, Inc.

Recent Developments

In November 2021, the transformational, connected relationship between DICK'S Sporting Goods and NIKE, Inc. is intended to improve the shopping experience for DICK'S and NIKE customers. Through this groundbreaking partnership, DICK'S and NIKE will be able to connect with more customers and give them access to special goods, services, and promotions.

Athletic Footwear Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 127.14 billion |

|

Revenue forecast in 2030 |

USD 196.62 billion |

|

CAGR |

5.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By End-Use, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Asics Corporation, Adidas group, FILA Korea, Ltd., K-Swiss, Inc., Lotto Sport Italia, Nike, Inc New Balance Athletics, Incorporation., Puma SE, Reebok International Limited, SKECHERS, Inc., Under Armour, Inc., Vans, Inc., VF Corporation, and Wolverine World Wide, Inc. |

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Athletic Footwear Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

Browse Our Top Selling Reports:

Antibiotics Market Size, Share 2024 Report

Dental Laboratory Welders Market Size, Share 2024 Report

Catechin Market Size, Share 2024 Report