Automotive ADAS Sensor Market Share, Size, Trends, Industry Analysis Report

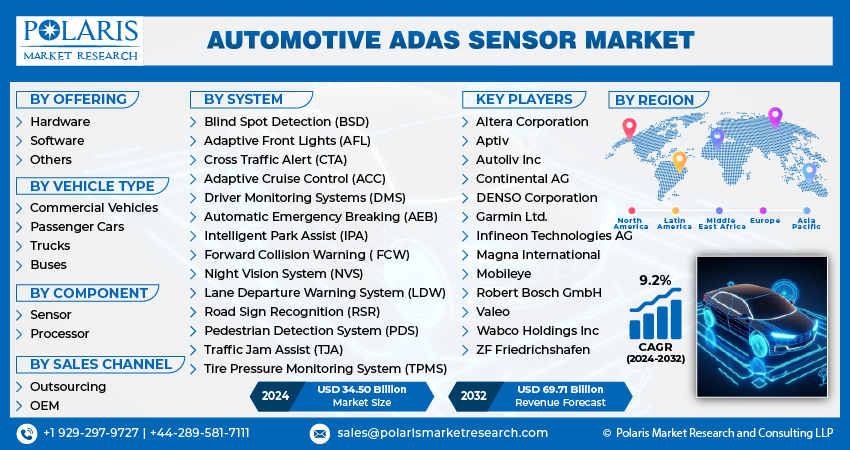

By Offering (Hardware, Software and Others); By Vehicle Type; By Component; By System; By Sales Channel; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4762

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

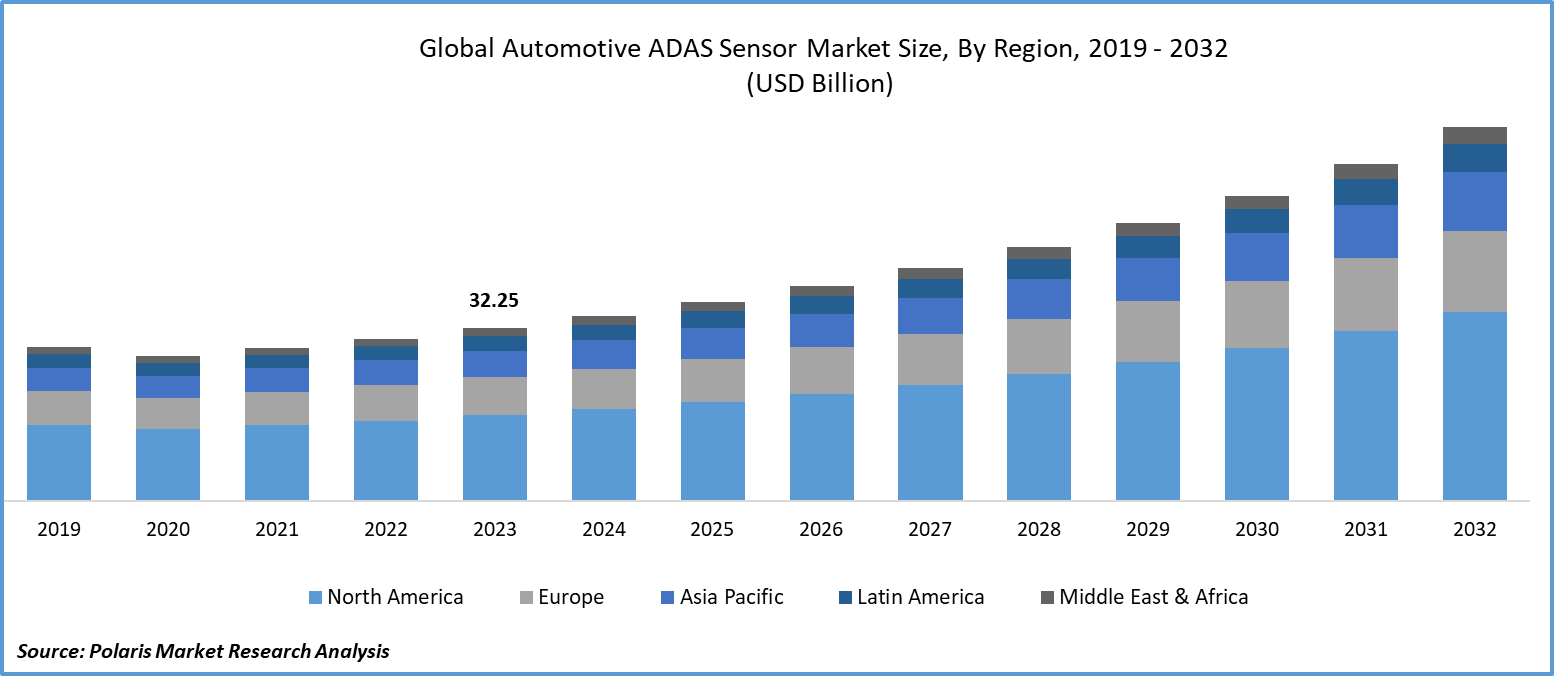

Global automotive ADAS sensor market size was valued at USD 32.25 billion in 2023. The market is anticipated to grow from USD 34.50 billion in 2024 to USD 69.71 billion by 2032, exhibiting the CAGR of 9.2% during the forecast period

Automotive ADAS Sensor Market Overview

The increasing use of semi-autonomous vehicles is a key factor driving the growth of the automotive ADAS sensor market demand. Many countries worldwide now require vehicle manufacturers to include various advanced driver-assistance features. The appeal of improved passenger safety and smoother traffic flow offered by autonomous technology is a major factor driving the adoption of these vehicles.

- For instance, in June 2023, Continental AG announced the development of affordable Advanced Driver Assistance Systems (ADAS) for cars and two-wheelers in India, with the goal of enhancing safety and affordability in the Indian vehicle market.

To Understand More About this Research: Request a Free Sample Report

Consequently, most major vehicle manufacturers are incorporating advanced driver-assistance systems, such as automatic emergency braking, adaptive cruise control, anti-lock braking systems, and automatic parking, into their new vehicles to enhance driving safety. This trend is fueling the global demand for ADAS sensors.

However, the growing demand for premium and luxury cars is driving the growth of advanced driver assistance systems (ADAS) in the automotive industry. As consumer preferences for safety features evolve, some companies are also incorporating ADAS into mid-range cars. This trend reflects a broader industry shift towards prioritizing safety and enhancing the driving experience across different vehicle segments. The deployment of ADAS in mid-range cars not only meets consumer expectations but also indicates a wider market acceptance and integration of these systems into mainstream vehicles. This expansion of ADAS into lower-priced segments is likely to accelerate further the adoption of advanced safety technologies in the automotive ADAS sensor market development.

Automotive ADAS Sensor Market Dynamics

Market Drivers

Modern Driver Assistance Systems to improve car security

Ensuring safety is paramount for car users, leading governments worldwide to enforce the inclusion of features such as lane departure warning (LDW) and automatic emergency braking (AEB). Consequently, various safety functionalities have been devised to aid drivers and diminish accident rates. For instance, the driver monitoring system oversees the driver's alertness, issuing warnings in instances of distraction.

Electrification of Vehicles

The shift towards vehicle electrification is opening up promising growth prospects in vehicle automation and the automotive ADAS sensor market opportunity. The integration of Advanced Driver Assistance Systems (ADAS) is crucial for achieving vehicle automation. Incorporating various ADAS sensors such as LIDAR, radar, and cameras is anticipated to enhance companies' ability to achieve near-precise vehicle automation. This integration represents a significant step towards achieving accurate vehicle automation.

Market Restraints

Inadequate infrastructure in many developing nations

Advanced Driver Assistance Systems (ADAS) rely on essential infrastructure such as well-maintained roads, clear lane markings, and GPS connectivity. Vehicle-to-vehicle (V2V) and Vehicle-to-Everything (V2X) communications also depend on robust connectivity infrastructure. In semi-autonomous and autonomous trucks, crucial information such as traffic conditions, object detection, and traffic conditions, as well as services like navigation require reliable connectivity, which is often limited on highways. Developing countries such as India, Brazil, and Mexico face challenges with limited IT infrastructure and connectivity outside urban areas, hindering the adoption of ADAS features, which ultimately results in a slowdown of global automotive ADAS sensor market development. Government support and improved communication networks are necessary to overcome these barriers in developing regions.

Report Segmentation

The market is primarily segmented based on offering, vehicle type, component, system, sales channel, and region.

|

By Offering |

By Vehicle Type |

By Component |

By System |

By Sales Channel |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Automotive ADAS Sensor Market Segmental Analysis

By Vehicle Type Analysis

- The commercial vehicle segment is projected to grow at the fastest CAGR during the automotive ADAS sensor market forecast period. The light commercial vehicles segment held the largest market share among various commercial vehicle types in 2023. Nevertheless, the European Union has mandated the integration of fundamental ADAS features such as lane departure warning systems, adaptive cruise control systems, and autonomous emergency braking systems in all heavy commercial vehicles. This directive is anticipated to drive the demand for ADAS in heavy commercial vehicles in the coming years.

- The passenger cars segment led the industry market with a substantial revenue share in 2023. The segment's growth is due to the growing demand for safety systems in developing economies, which is a result of rising consumer awareness, supportive laws, and advancing road safety regulations.

By Component Analysis

- The sensor segment accounted for the largest market share in 2023 and is likely to retain its position throughout the automotive ADAS sensor market forecast period. ADAS relies heavily on the precision and performance of its sensors, which include ultrasonic, camera, radar, LiDAR, and various other sensors that collaborate to deliver the intended assistance and safety features.

By System Analysis

- The adaptive cruise control (ACC) segment held the largest revenue share in 2023. This segment's growth is attributed to an increase in the demand for safety features, advancements in technologies such as radar and sensors, and government regulations mandating the installation of ACC systems in certain vehicle categories, including commercial vehicles.

- The blind spot detection system (BSD) segment is expected to grow at the fastest CAGR over the global automotive ADAS sensor market forecast period. Blind Spot Detection (BSD) systems utilize sensors to identify vehicles in a driver's blind spot, notifying them through visual or audible alerts. This feature helps reduce accidents resulting from lane changes made without checking blind spots. The BSD segment is experiencing growth not only due to rising demand for safety features but also because of technological progress, making BSD systems more cost-effective and dependable.

Automotive ADAS Sensor Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. North America leads the market, fueled by prominent automakers such as Tesla, General Motors, and Ford. These companies are actively innovating autonomous vehicles for industries such as pharmaceuticals, healthcare, and logistics, which is projected to bolster market sales. Stringent regulations concerning driver safety in passenger, heavy, and light commercial vehicles are also expected to contribute to market expansion. Manufacturers are urged to incorporate advanced sensor-based innovations to improve comfort and navigation in contemporary and autonomous vehicles, thereby reducing collisions. This pattern is likely to sustain sales growth over the forecast period.

The Asia Pacific region is expected to be the fastest-growing region with a healthy CAGR during the global automotive ADAS sensor market forecast period. The ADAS market is being driven by increasing demand for a better, safer, and more convenient driving experience, as well as rising disposable income in emerging economies and stringent safety regulations globally. Significant developments in ADAS have been seen in the Asia Pacific region, particularly in China, which has made considerable advancements in recent years.

Japan has also invested in ADAS development for years, with manufacturers such as Honda, Nissan, and Toyota implementing features such as adaptive cruise control, automatic emergency braking, and lane departure warnings. The Japanese government has also been promoting ADAS technology through various initiatives and funding programs.

Competitive Landscape

The automotive ADAS sensor market growth is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Altera Corporation

- Aptiv

- Autoliv Inc

- Continental AG

- DENSO Corporation

- Garmin Ltd.

- Infineon Technologies AG

- Magna International

- Mobileye

- Robert Bosch GmbH

- Valeo

- Wabco Holdings Inc

- ZF Friedrichshafen

Recent Developments

- In June 2023, Continental AG launched a new high-performance computer (HPC) designed for automobiles, which combines the cluster, infotainment, and advanced driver-assistance systems (ADAS) into a single-piece unit.

- In January 2023, NXP Semiconductors, a U.S.-based automotive radar manufacturer, unveiled a new one-chip radar IC series aimed at next-generation ADAS and automated driving systems. The SAF85xx series merges NXP's cutting-edge radar detector and processing technologies into a single device, offering tier-one suppliers and original equipment manufacturers (OEMs) increased flexibility. Additionally, it caters to short to long-range radar applications that adhere to increasingly stringent NCAP safety standards.

- In January 2023, ZF Friedrichshafen AG introduced the Smart Camera 4.8, which expands the field of view for autonomous vehicles, allowing them to detect cyclists, pedestrians, and other vehicles.

Report Coverage

The automotive ADAS sensor market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offering, vehicle type, component, system, sales channel, and their futuristic growth opportunities.

Automotive ADAS Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 34.50 billion |

|

Revenue forecast in 2032 |

USD 69.71 billion |

|

CAGR |

9.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By Vehicle Type, By Component, By System, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Automotive ADAS Sensor Market report covering key segments are offering, vehicle type, component, system, sales channel, and region.

Automotive ADAS Sensor Market Size Worth $69.71 Billion By 2032

Global Automotive ADAS Sensor Market exhibiting the CAGR of 9.2% during the forecast period

North America is leading the global market

key driving factors in Automotive ADAS Sensor Market are • Modern Driver Assistance Systems to improve car security