Automotive Sensors Market Share, Size, Trends, Industry Analysis Report

By Sensor Type (Temperature, Pressure, Position, Level, Speed); By Technology; By Vehicle Type; By Application; By Region; Segment Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 114

- Format: PDF

- Report ID: PM1440

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

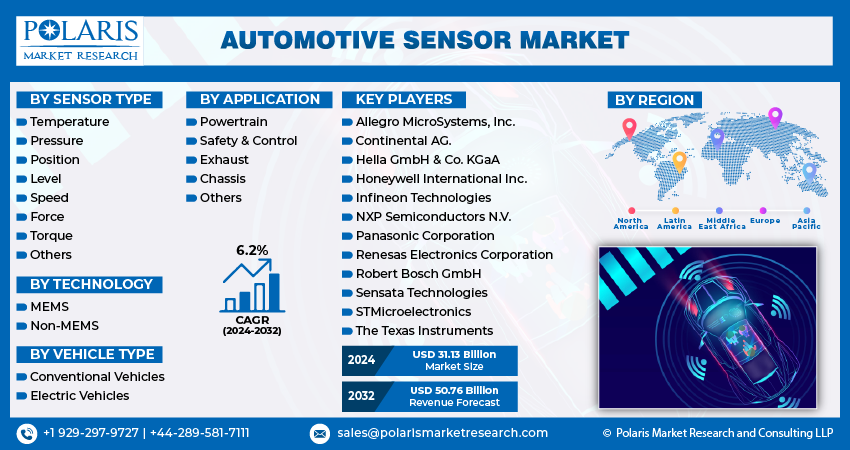

The global automotive sensor market was valued at USD 46.7 billion in 2024 and is expected to grow at a CAGR of 12.40% from 2025 to 2034. The market is expanding due to increasing integration of ADAS and the proliferation of connected car technologies.

Key Insights

- In 2024, the pressure sensor segment accounted for the largest revenue share. Rising need for fuel-efficient cars and real-time tire pressure monitoring fuels the demand for pressure sensors.

- The powertrain segment accounted for the largest share in 2024. The increasing demand for fuel-efficient vehicles, driving the development of advanced engine control systems, contributes to the segment's dominance.

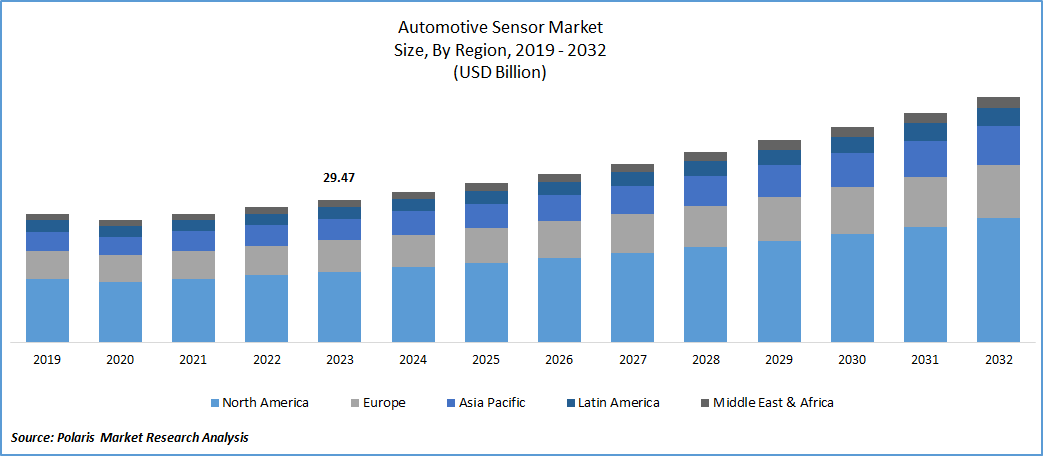

- In 2024, North America accounted for the largest share. The adoption of numerous energy efficiency regulations fuels the demand for automotive sensors in the region.

- The Europe industry is anticipated to witness the fastest growth during the forecast period. The growing popularity of electric and hybrid vehicles boosts demand for various sensor types, such as temperature sensors, position sensors, and battery management system sensors.

Industry Dynamics

- Increasing demand for superior vehicles due to consumer affection toward luxury and comfort facilitates demand for automotive sensors.

- The rising emphasis on compliance with environmental regulations is expected to offer lucrative opportunities during the forecast period.

- Growing focus on advancing airbag technology, comfort features, and electronic stability programs propels the requirement for automotive sensors.

- High cost and stringent regulations associated with the sensors hamper the market growth.

Market Statistics

2024 Market Size: USD 46.7 billion

2034 Projected Market Size: USD 149.5 billion

CAGR (2025–2034): 12.40%

North America: Largest market in 2024

AI Impact on Automotive Sensors Market

- In Advanced Driver Assistance Systems (ADAS), artificial intelligence is integrated with sensors such as radar, LiDAR, and cameras. It enables features, including adaptive cruise control, automatic emergency braking, and lane-keeping assistance. These systems rely on real-time data processing, which helps them assist drivers and predict hazards.

- AI algorithms predict component failures before they occur by analyzing sensor data. This minimizes downtime and maintenance costs by monitoring various metrics such as battery condition, engine temperature, and tire pressure.

To Understand More About this Research:Request a Free Sample Report

Automotive sensors detect and measure changes in the vehicle's environment, converting physical signals into electrical signals for control systems. They monitor and regulate engine performance, safety features, and vehicle efficiency.

Automotive sensors are widely used in various vehicles, from motorcycles to large trucks. They are used for a variety of applications such as wipers, lighting, dashboard systems, rain detectors, sunroof operation, parking assistance, seat adjustments, climate control, tailgate release and closure, trailer management, tilt alarms, rear door monitoring, anti-theft security alarms, immobilizers, and radio controls. Due to the challenging conditions in automotive environments, such as exposure to heat, cold, and continuous vibrations, highly reliable and robust sensors are required.

For instance, Google uses quad-core personal computers in its self-driving cars, which can process 1.3 million laser readings per second and make 20 decisions in the same amount of time. As the demand for computer-controlled driving increases, the need for more advanced sensors becomes apparent.

The integration of internet-connected sensors in automobiles has significantly improved driving safety and led to the growth of the automotive industry. The development of advanced vehicle technologies, such as autonomous cars, along with the increase in global car sales, is the primary driver of the continuous expansion of the automotive sensor market. The rising evolution of environmental regulations, airbag technology, comfort features, and electronic stability programs contribute to the growing demand for sensors in the market.

According to S.M.R., a comprehensive analysis reveals that a modern car's engine alone is equipped with 15 to 30 sensors, which monitor every aspect of its functionality. In total, a typical car may have around 70 sensors overseeing a diverse range of functions and operations.

The COVID-19 pandemic has significantly impacted the automotive sensors market. The initial outbreak caused widespread manufacturing shutdowns and supply chain disruptions, which affected the production and availability of automotive sensors. As a result, the demand for sensors decreased, leading to a slowdown in the market. However, the pandemic has also accelerated trends such as the adoption of electric vehicles and autonomous driving technologies, which require advanced sensors. The need for sensors that enable features like gesture recognition, touchscreens, and in-cabin monitoring systems has also increased due to the emphasis on reducing human contact and increasing vehicle connectivity. As a result, the automotive sensor market has transformed, with a greater focus on innovation and integration of smart technologies. Despite the challenges posed by the pandemic, ongoing technological advancements and evolving consumer preferences are likely to drive sustained growth in the automotive sensors market.

Customers are becoming more conscious of the latest safety systems and technology, and as a result, they are choosing vehicles with better safety features. Automotive manufacturers have been compelled to equip their vehicles with driver assistance systems due to growing concerns about passenger safety. These factors are driving the demand for sensors.

Industry Dynamics

Growth Drivers

Increasing Demand for Superior Vehicles Due to Consumer Affection Towards Luxury and Comfort Will Facilitate Market Growth

The automotive sensors market growth during the forecast period is primarily driven by the increasing demand for prime vehicles owing to the appetite of consumers for luxury and comfort. Growing customer preferences for enhanced quality, superior performance, heightened comfort, and cutting-edge design and technology have driven an increased demand for luxury vehicles. Notable markets for luxury automobiles include China, Japan, the U.S., Canada, India, and various European countries. The surge in disposable income and elevated living standards within these regions has contributed to a rising desire for luxury vehicles.

Moreover, premium vehicles like the BMW 7 series, Audi 8, and Mercedes Benz E-class are equipped with over 100 individual sensors. These sensors operate in harmony with microcontrollers and embedded systems housed within the Engine Control Unit (ECU). Contemporary luxury vehicles feature a higher integration of ECUs compared to traditional vehicles. The escalating consumer demand for additional vehicle features has led to an augmented number of ECUs, consequently driving the necessity for more advanced sensors, propelling the growth of the market.

Report Segmentation

The automotive sensors market is primarily segmented based on sensor type, technology, vehicle type, application, and region.

|

By Sensor Type |

By Technology |

By Vehicle Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Sensor Type Analysis

The Pressure Sensor Segment Accounted for the Largest Revenue Share in 2024

In 2024, the pressure sensor segment accounted for the largest revenue share. Several factors, such as the need for fuel-efficient cars and real-time tire pressure monitoring, are driving the demand for pressure sensors. These sensors help to reduce fuel consumption and carbon emissions, which in turn improves the overall economy of the vehicle. Furthermore, the strict regulations on automobile emissions imposed by governments worldwide are also contributing to the need for pressure sensors.

On the other hand, the temperature sensor segment is anticipated for the fastest growth throughout the forecast period. Temperature sensors play a crucial role in monitoring the temperatures of various systems in a vehicle, including the engine and transmission. The demand for these sensors is increasing due to the rising popularity of electric vehicles, which require precise temperature monitoring. Moreover, the growing use of advanced driver-assistance systems (ADAS) is expected to further boost the demand for temperature sensors in the automotive industry. These sensors help in monitoring the temperature of the surroundings and alerting the driver of any potential hazards.

By Application Analysis

The Powertrain Segment Accounted for the Highest Market Share During the Forecast Period

The powertrain segment accounted for the highest automotive sensors market share during the forecast period. The market is driven by the surging need for fuel-efficient vehicles, leading to the development of advanced engine control systems. These systems, essential for managing and monitoring engine performance, need a diverse set of sensors such as oxygen sensors, crankshaft position sensors, and throttle position sensors. The rising trend of electric vehicles is anticipated to boost the demand for sensors in the powertrain sector, as electric motors rely on various sensors for effective performance monitoring and management.

On the other hand, the safety and control segment is anticipated to experience the fastest growth throughout the forecast period. The suspension system of a vehicle comprises various parts, such as shock absorbers, steering systems, and brakes, which are monitored and managed by chassis sensors. With the surging demand for advanced driver assistance systems (ADAS), which rely heavily on sensors for monitoring and managing vehicle dynamics, the market is anticipated to grow rapidly.

Regional Insights

North America Accounted for the Largest Market Share in 2024

In 2024, North America accounted for the largest market share in the automotive sensors market. Over the projected period, the adoption of numerous energy efficiency regulations is anticipated to drive the demand for automotive sensors in the region. The growing use of autonomous and electric vehicles is also contributing to the demand for a variety of sensors such as radar, ultrasonic, and LiDAR sensors. Additionally, the region's strict safety regulations have increased the demand for advanced driver assistance systems (ADAS), further fueling the demand for sensors. The presence of significant automakers and suppliers in the area is another key factor facilitating the expansion of the market.

Europe is anticipated for the fastest growth during the forecast period. The industrial and automotive industries are the main sectors in the region, with Germany leading in production across Europe. The need for advanced safety and comfort features in vehicles is driving the demand for sensors in these sectors. The growing popularity of electric and hybrid vehicles is also increasing the demand for various types of sensors, such as temperature sensors, position sensors, and battery management system sensors. Moreover, the strict pollution standards in the region are contributing to the use of sensors in automobiles.

Key Market Players & Competitive Insights

The automotive sensors market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Allegro MicroSystems, Inc.

- Continental AG.

- Hella GmbH & Co. KGaA

- Honeywell International Inc.

- Infineon Technologies

- NXP Semiconductors N.V.

- Panasonic Corporation

- Renesas Electronics Corporation

- Robert Bosch GmbH

- Sensata Technologies

- STMicroelectronics

- The Texas Instruments

Recent Developments

- In April 2025, OMNIVISION launched the OX01N1B, a 1.5-megapixel global shutter image sensor designed for automotive driver monitoring systems. The sensor offers industry-leading performance, low power consumption, and compact design, making it ideal for next-generation vehicle safety applications.

- In March 2023, Aves Reality and dSpace developed a technological collaboration, enabling developers of autonomous vehicles to evaluate sensors and algorithms through virtual test drives under diverse and realistic conditions.

- In June 2022, Allegro Microsystems Inc. launched the A33110 and A33115 magnetic position sensors specifically crafted for applications in advanced driver assistance systems (ADAS).

- In May 2022, Infineon Technologies AG launched the XENSIV 60 GHz radar sensor designed for automotive use.

Automotive Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 52.49 billion |

|

Revenue forecast in 2034 |

USD 149.5 billion |

|

CAGR |

12.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Sensor Type, By Technology, By Vehicle Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation |

FAQ's

The automotive sensors market size is anticipated to be worth USD 149.5 billion by 2034.

The top market players in the automotive sensors market include Allegro MicroSystems, Inc., Continental AG, Hella GmbH & Co. KGaA, and Honeywell International Inc.

The North America region contributes notably to the automotive sensors market growth.

The global automotive sensors market is expected to grow at a CAGR of 12.40% during the forecast period.

The automotive sensors market report covering key segments are sensor type, technology, vehicle type, application and region.