Automotive Traction Motor Market Share, Size, Trends, Industry Analysis Report

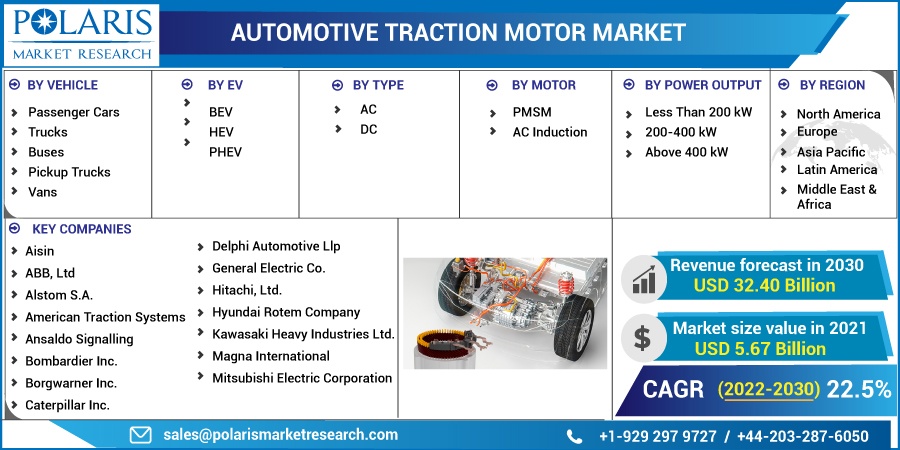

By Vehicle; By EV (BEV, HEV, PHEV); By Type (AC, DC); By Motor (PMSM, AC Induction); By Power Output; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 119

- Format: PDF

- Report ID: PM2624

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

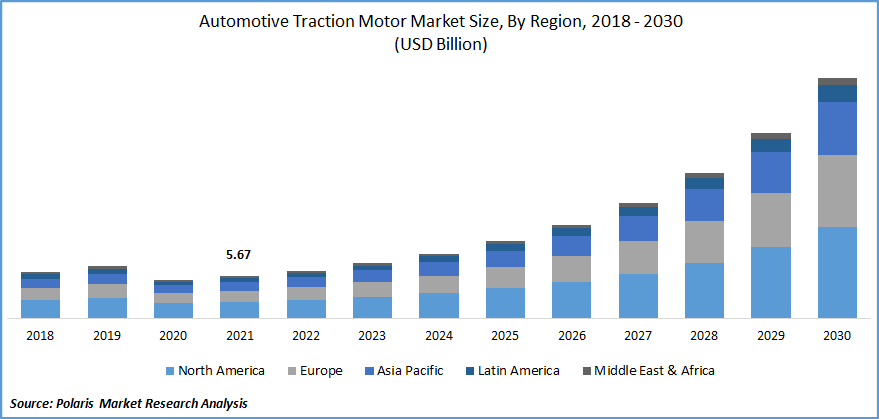

The global automotive traction motor market was valued at USD 5.67 billion in 2021 and is expected to grow at a CAGR of 22.5% during the forecast period. The growing demand for automotive traction motor is expected to be driven by the increasing demand for electric vehicles with high-speed performance, low-speed operation, better immunity to vibration, electromagnetic compatibility robustness, and safe.

Know more about this report: Request for sample pages

The automotive traction motor is replacing traditional engines operating on steam and diesel as the high performance, low maintenance, improved reliability, and simple design are expected to drive market growth. Furthermore, due to the presence of electrical braking, the cost of brake shoes, rails, and wheel types has reduced, resulting in less wear and tear in the vehicles. In addition, the growing demand for the product in electric trains, trolleybuses, tramcars, and electric vehicles is expected to influence the market growth.

The COVID-19 pandemic had a negative impact on the growth of the automotive traction motor market. Economic slowdown hampered the supply chain drastically, and the extraction of raw materials such as rare earth material required for the production of motors was also hindered, which led to a decline in the demand for the product across the globe. However, as the activities resumed from the end of 2020, it led to a steady increase in the demand for the product in locomotives, elevators, and industrial machinery.

With technological advancement, OEMs focus on developing drives that comprise electric traction motors, and power electronics which are an essential factor for better vehicle propulsion systems. However, inadequate EV infrastructure and overheating of traction motor are anticipated to restrain the market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global automotive traction motor is likely to be driven by Asia Pacific owing to the increasing government investment in railway and roadway infrastructure, and the growing demand for high-performance motors is driving the market growth. Furthermore, with the rising number of vehicle electrification, the demand for motors that can withstand large loads and has a better tractive system for rapid acceleration is likely to have a positive impact on the market growth for the product.

Growing environmental concerns and stringent government regulations due to carbon emission vehicles, there is a shift toward electric vehicles. The increasing demand for the purchase of BEV and PHEV, which mainly operates on traction motors, is expected to drive the market at a significant rate. Many manufacturers and key player companies are collaborating together to develop traction motor packs that would work under high temperatures, which has created lucrative opportunities for the market.

Report Segmentation

The market is primarily segmented based on vehicle, EV, type, motor, power output and region.

|

By Vehicle |

By EV |

By Type |

By Motor |

By Power Output |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Buses accounted for the largest share in 2021

The buses segment accounted for the highest revenue share in 2021, owing to the rising demand for emission-free public transportation that drives demand for electric buses, which eventually drives the demand for automotive traction motor. In addition, continuous torque and power supply, double up the torque in the motor, which is required for quick start, strong acceleration, and high climbing angle to operate a vehicle and has massive demand in the bus segment that is expected to complement market growth over the forecast period.

BEV segment is anticipated to dominate the market

The demand for the BEV segment is driven by the rising demand from the automotive industry for offering zero-emission vehicles with high fuel efficiency at a reasonable price. In addition, a permanent magnet synchronous machine (PMSM) is best suited for such vehicles because of its efficiency, compact size, and high density, which is expected to drive segment growth.

AC type is expected to lead the market during the forecast period

The AC type is expected to lead the market over the forecast period owing to its higher torque output and tractive efforts. The growing demand for AC traction motors in electric vehicles, industrial machinery, and rail industries due to their dynamic breaking ability is expected to drive market growth.

Moreover, this type of motor has better slip control and maximum adhesion after breaking traction; and only drops load on the motor that is not functioning. As the motors are simple, have low maintenance, and can easily be controlled the demand for the motors is expected to witness significant growth.

PMSM segment is expected to account for the largest share in 2030

Permanent Magnet Synchronous Motor (PMSM) is expected to dominate the market over the forecast period owing to its high reliability and efficiency. The PMSM has become smaller and lighter due to the presence of a rare earth magnet that has the capability to create a rotating field to run the vehicle that, makes it cost-efficient and easily available, which is likely to have a positive impact on revenue growth over the forecast period.

Moreover, the small size, lightweight, and high torque structured motors are used to create unique vehicles like gauge-adjustable trains and low floor, light rail vehicles with gearless direct drive systems, which is expected to drive the market growth.

Less than 200 Kw accounted for the highest revenue share in 2021

Less than 200 kW acquired for the highest revenue share and is expected to see a significant surge over the forecast period owing to the growing demand for traction motors in electric vehicles, which require an average power of less than 200 kW, which is expected to drive the market growth.

In addition, many passenger cars also require a power output range between 30 to 50 kW to operate, which is also supporting the market growth. 200 to 400kw is expected to be the second largest segment to lead the market owing to applications in many commercial vehicles such as metro, subway trains, and high-speed trains that contributes to the revenue growth.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

Asia Pacific is the largest region for automotive traction motor and is expected to witness faster growth over the forecast period owing to rising urbanization and advancement and development in electric vehicles, creating opportunities for traction motor in countries like China, Brazil, Mexico, and India. In addition, increasing government initiatives and a surge in demand for high-performance motors is expected to drive demand over the forecast period.

Europe is expected to be the second largest region for automotive traction motor on account of the growing government’s proactive assistance through various grants and incentives. Furthermore, the rising demand for near zero-carbon emission public transport, delivered by traction motors as they don’t emit smoke, is likely to positively impact revenue growth.

Competitive Insight

Some of the major players operating in the global market include Aisin, ABB, Ltd, Alstom S.A., American Traction Systems, Ansaldo Signalling, Bombardier Inc., Borgwarner Inc., Caterpillar Inc., CG Power and Industrial Solutions Ltd., Delphi Automotive Llp, General Electric Co., Hitachi, Ltd., Hyundai Rotem Company, Kawasaki Heavy Industries Ltd., Magna International, Mitsubishi Electric Corporation, Nidec Corporation, Prodrive Technologies, Robert Bosch Gmbh, Schaeffler Group, Siemens AG, The Curtiss-Wright Corporation, Toshiba Corporation, VEM Group, Voith Gmbh, ZF Friedrichshafen AG

Recent Developments

In May 2022, ZF Friedrichshafen AG introduced new electric drive modules which includes hairpin electric motor, silicon carbide inverter architecture and electric powertrain. The company has recently launched a product named eWorX that provides fully electric system solutions in a small package with a single interface.

In April 2022, BorgWarner Inc. completed its acquisition of Santroll automotive components which will enable BorgWarner to strengthen its market in light vehicle e-motors.

Automotive Traction Motor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.67 billion |

|

Revenue forecast in 2030 |

USD 32.40 billion |

|

CAGR |

22.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Raw Material, By Polyurea Type, By Technology, By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aisin, ABB, Ltd, Alstom S.A., American Traction Systems, Ansaldo Signalling, Bombardier Inc., Borgwarner Inc., Caterpillar Inc., CG Power And Industrial Solutions Ltd., Delphi Automotive Llp, General Electric Co., Hitachi, Ltd., Hyundai Rotem Company, Kawasaki Heavy Industries Ltd., Magna International, Mitsubishi Electric Corporation, Nidec Corporation, Prodrive Technologies, Robert Bosch Gmbh, Schaeffler Group, Siemens AG, The Curtiss-Wright Corporation, Toshiba Corporation, VEM Group, Voith Gmbh, ZF Friedrichshafen AG |