Automotive Wiring Harness Market Share, Size, Trends & Industry Analysis Report

By Application (Wires, Connectors, Terminals, Others); By Component; By Vehicle Type; By Transmission Type; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2338

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

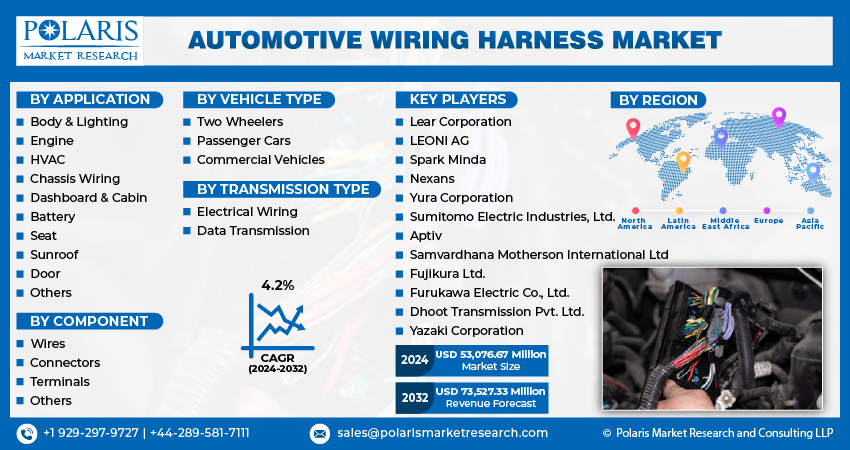

The global Automotive Wiring Harness Market was valued at USD 48.18 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2034. Increasing vehicle electrification and advanced electronics integration are driving demand.

Key Insights

- In 2024, the market was dominated by the wires segment, driven by expansion in the automotive sector, the increasing sophistication of vehicle electronics, stringent safety regulations, and technological advancements in wire technology.

- The commercial vehicles segment is likely to expand at the highest rate, driven by rising demand from the e-commerce and logistics sectors.

- In 2024, Asia Pacific dominated the market, led by large producers and increasing consumer demand, which drove global demand for wiring harnesses.

- North America is projected to register the highest CAGR growth during the forecast period, driven by its robust automotive sector and advancements in technology.

Industry Dynamics

- International government encouragement of sustainability and emission reduction is promoting the adoption of EVs, which in turn creates demand for advanced automotive wiring harnesses.

- The increasing number of advanced features in cars is increasing demand for automotive wiring harnesses.

- The transition towards more environmentally friendly cars is fueling demand for technologically advanced wiring harnesses, presenting robust investment growth opportunities.

- Varying copper and aluminum prices significantly influence the supply and pricing of car wiring harnesses.

Market Statistics

2024 Market Size: USD 48.18 billion

2034 Projected Market Size: USD 75 Billion

CAGR (2025-2034): 4.50%

Asia Pacific: Largest Market Share

AI Impact on Automotive Wiring Harness Market

- AI facilitates more effective and lighter weight wiring harness designs by simulation and data-driven optimization.

- It enhances predictive maintenance through data analysis to identify possible failures prior to their occurrence.

- AI improves production by automating the assembly of harnesses, improving accuracy and lowering labor expenses.

- It facilitates the management of increasing wiring system complexity in EVs and connected vehicles.

To Understand More About this Research:Request a Free Sample Report

Industry Trend

The automotive wiring harness market is experiencing significant growth, driven by several key factors. One major driver is the increasing adoption of electric vehicles (EVs). As governments globally prioritize sustainability and emission reduction, they offer consistent support and incentives for the EV market. This surge in EV adoption necessitates complex wiring systems to power various components, thus fueling demand within the automotive wiring harness market. Additionally, EVs require intricate wiring setups to accommodate their unique powertrain and battery systems, further contributing to market growth.

Simultaneously, within the broader automotive manufacturing industry, there's a heightened demand for wiring harnesses. This demand stems from the industry's continuous innovation and integration of advanced technologies into vehicles. As automotive manufacturers strive to meet consumer demands for smart, connected, and autonomous vehicles, they require sophisticated wiring harnesses to support these features. Consequently, the automotive wiring harness market experiences a parallel surge in demand, driven by the automotive industry's relentless pursuit of innovation.

Moreover, there's a growing consensus regarding safety and security while driving, prompting an increased demand for automotive wiring harnesses. Modern vehicles are equipped with an array of safety features, from advanced driver assistance systems (ADAS) to electronic stability control (ESC). These systems rely on intricate wiring harnesses to function effectively, emphasizing the critical role of wiring harnesses in ensuring vehicle safety.

Consequently, as safety concerns continue to drive consumer preferences and regulatory mandates, the demand for automotive wiring harnesses escalates. The stringent safety norms introduced by authorities worldwide further bolster the automotive wiring harness market.

- For instance, in July 2022, EU's new Vehicle General Safety Regulation enforced advanced driver assistant systems, paving the way for automated vehicles, aiming to save lives. The regulation establishes the legal framework for the EU's approval of fully autonomous and automated vehicles.

It also introduces advanced driver assistance technologies for both passenger and commercial vehicles. Compliance with these standards necessitates advanced wiring harnesses designed to withstand stringent testing criteria, thereby stimulating market growth.

Additionally, the demand for automotive wiring harnesses is propelled by various factors such as the connected car ecosystem, electrification, and the preference for 48V high voltage capacity. As vehicles become increasingly connected and electrified, the complexity of their wiring systems rises, creating opportunities for the wiring harness market.

Key Takeaway

- Asia Pacific dominated the largest market and contributed to more than 38% of the share in 2023.

- The North America market is expected to be the fastest-growing CAGR during the forecast period.

- By component category, the wire segment accounted for the largest market share in 2024.

- By vehicle type category, the commercial vehicles segment is projected to grow at a high CAGR during the projected period.

What are the Market Drivers Driving the Demand for the Automotive Wiring Harness Market?

Rise in Advanced Features in Vehicles

The rise in advanced features in vehicles is significantly driving the demand for the automotive wiring harness market. Modern vehicles are increasingly equipped with complex electronic systems, including advanced driver-assistance systems (ADAS), infotainment systems, and enhanced safety features. These advancements require robust and intricate wiring solutions to ensure seamless communication and operation of various electronic components. As manufacturers strive to offer more technologically advanced vehicles to meet consumer expectations, the need for sophisticated wiring harnesses becomes essential to support these innovations.

Simultaneously, the ongoing transition to electric and hybrid vehicles is significantly influencing the growth of the automotive wiring harness market. Electric vehicles (EVs) and hybrid vehicles come with intricate high-voltage systems that demand specialized wiring harnesses to manage the distribution of electrical power safely and efficiently. The complexity and safety requirements of these systems necessitate the development of more advanced and reliable wiring solutions. As the automotive industry moves towards greener and more sustainable transportation options, the demand for high-quality wiring harnesses that can handle the complexities of EV and hybrid systems is on the rise, providing a promising future for investors in the automotive wiring harness market.

Which Factor is Restraining the Demand for Automotive Wiring Harness?

Fluctuating Prices of Metals such as Copper and Aluminum Hinder the Market Growth.

Fluctuating prices of metals such as copper and aluminum significantly affect the supply chain and pricing of automotive wiring harnesses. Copper and aluminum are essential materials in the production of wiring harnesses due to their excellent electrical conductivity and durability. When the prices of these metals rise, the cost of manufacturing wiring harnesses increases, leading to higher prices for end products. This price volatility creates challenges for manufacturers in maintaining stable production costs and profit margins, impacting their ability to price products competitively.

The impact of these fluctuating metal prices extends to the demand for automotive wiring harnesses. As the cost of raw materials increases, manufacturers may be forced to pass these costs onto consumers, leading to higher prices for vehicles equipped with advanced wiring harnesses. This, in turn, can dampen consumer demand, especially in price-sensitive markets. Additionally, higher costs may prompt automakers to seek alternative materials or technologies that can offer similar performance at a lower cost, potentially disrupting the traditional wiring harness market.

Report Segmentation

The market is primarily segmented based on application, component, vehicle type, transmission type, and region.

|

By Application |

By Component |

By Vehicle Type |

By Transmission Type |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

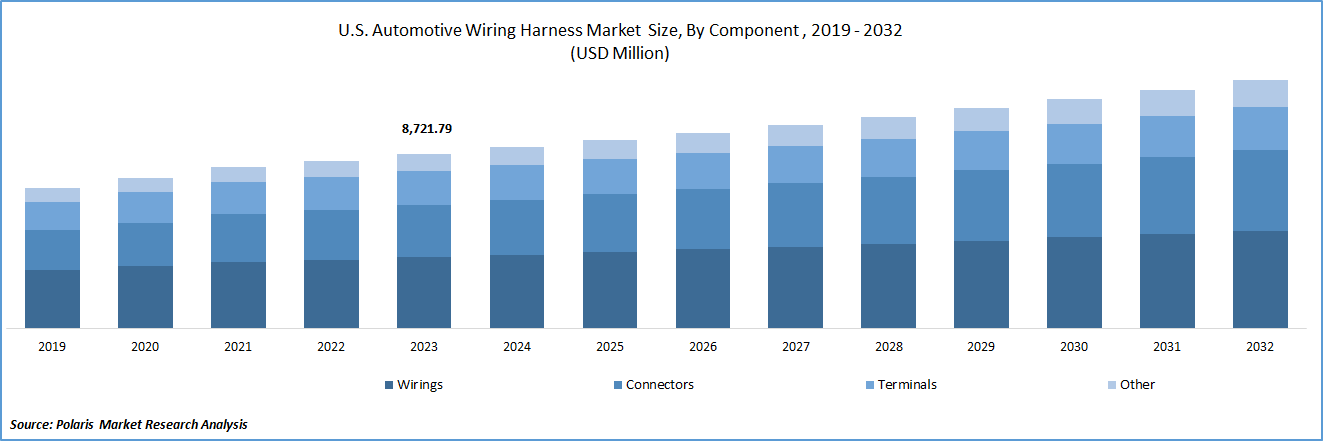

By Component Insights

Based on component analysis, the market is segmented on the wires, connectors, terminals, others. Wires segment held the largest market share in 2024. The demand for wires in automotive wiring harnesses is on the rise due to the expanding automotive industry, the increasing complexity of vehicle electronics, stringent safety, and quality standards, ongoing innovation in wire technology, and the diverse applications of wiring harnesses in various types of vehicles. These factors collectively drive the need for high-quality wires that can reliably transmit power and signals within vehicles, reflecting the dynamic and evolving nature of the automotive wiring harness market.

Automotive wiring harnesses are intricate networks of wires that form the backbone of a vehicle's electrical system. These wires serve as conduits for transmitting power and signals between the various components, ensuring smooth operation of essential functions like engine performance, safety systems, and entertainment features.

By Vehicle Type Insights

Based on vehicle type analysis, the market has been segmented on the basis of two wheelers, passenger cars, commercial vehicles. The commercial vehicles segment expected to be the fastest growing CAGR during the forecast period. The demand for commercial vehicles in the automotive wiring harness market is experiencing significant growth, driven by the rising needs of the e-commerce and logistics industries. As e-commerce continues to expand, there is a corresponding increase in the volume of goods that need to be transported, necessitating more commercial vehicles. This surge in demand for transportation solutions is fueling the need for advanced and reliable automotive wiring harnesses, which are critical for ensuring the efficient operation of commercial vehicles.

Regional Insights

Asia Pacific

Asia Pacific region accounted for the largest market share in 2024. The Asia Pacific region stands as a dynamic and rapidly expanding hub within the automotive wiring harness market. With major automotive manufacturers and a growing consumer base, Asia Pacific drives global demand for wiring harnesses.

As Asia Pacific continues to shape the global automotive landscape, its wiring harness market is poised for significant expansion. This growth caters to the diverse needs of both traditional and electric vehicles, driving advancements in automotive technology. Key players like Minda Corporation Limited, Yura Corporation, Samvardhana Motherson International Ltd, Sumitomo Electric Industries Ltd, Dhoot Transmission Pvt. Ltd., and Yazaki Corporation lead the way as major manufacturers and suppliers of automotive wiring harnesses in the APAC region, fueling the market growth.

For instance, in December 2021, Sumitomo Electric Industries partnered with Valens Semiconductor to collaborate on A-PHY technology and deployments, ensuring alignment with A-PHY specification requirements. Similarly, in February 2023, Hero Electric joined forces with Dhoot Transmission for wiring harness solutions, signaling a joint effort to enhance innovation in the electric two-wheeler industry. Such collaborations underscore the thriving wiring harness market in the APAC region.

North America

North America is expected for the growth of fastest CAGR during the forecast period. North America stands out as a pivotal region in the automotive wiring harness market, fueled by its robust automotive industry and technological progress. Wiring harnesses, also known as cable harnesses, serve as essential conduits for transmitting electrical power and signals across various industries, including automotive, food & beverage, agriculture, and electronics.

In North America, market players face stringent regulations and standards, with the IPC/WHMA-A-620 Revision D standard being a prominent example. Developed by IPC and the Wiring Harness Manufacturer's Association (WHMA), this standard plays a pivotal role in steering the market for automotive wiring harnesses by setting forth guidelines and requirements for the acceptance and production of wire harness assemblies, ensuring quality and reliability in automotive electrical systems.

Moreover, the increasing complexity of modern vehicles, where components like engines, air conditioning systems, instrumentation, audio systems, lights, and batteries are interconnected through front, rear, and roof wire harnesses, further boosts the demand for wire harnesses in the automotive industry. For instance, automotive components producer Yazaki North America, Inc. recently announced a significant investment of US$10 Billion in a pilot project factory in western Guatemala to expand its production capacity and meet the rising demand for wire harnesses.

Competitive Landscape

The market is fiercely competitive, characterized by the presence of numerous prominent players. These industry leaders have implemented diverse strategies, including acquisitions, product launches, collaborations, and partnerships, all while actively developing innovative products with heightened speed and enhanced features.

Some of the major players operating in the global market include:

- Lear Corporation

- LEONI AG

- Spark Minda

- Nexans

- Yura Corporation

- Samvardhana Motherson International Ltd

- Sumitomo Electric Industries, Ltd.

- Aptiv

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Dhoot Transmission Pvt. Ltd.

- Yazaki Corporation

Recent Developments

- In October 2024, Japanese automotive wiring manufacturer Sumitomo Electric plans to begin operations at its new facility, supported by an investment of approximately $24 million.

- In May 2024, Toray Industries, Inc. and Yazaki Corporation unveiled a joint venture to pioneer a new grade of recycled polybutylene terephthalate (PBT) resin. This innovative resin is crafted from discarded materials sourced from manufacturing operations and tailored to meet the stringent requirements for producing connectors utilized in automotive wire harnesses.

- In December 2023, Nexans entered into two Memorandums of Understanding (MoU) with the Moroccan government to establish a third medium-voltage power cable manufacturing plant.

- In September 2023, In UAE, HH Sheikh Saud bin Saqr Al Qasimi inaugurated Motherson's wiring harness facility in the Ras Al Khaimah Economic Zone (RAKEZ).

- In February 2023, Hero Electric partnered with Dhoot Transmission for wiring harness solutions, a collaborative effort to improve and innovate in the electric two-wheeler industry.

- In December 2022, Sumitomo Electric Industries agreed with Morocco's Ministry of Industry and Trade to make a substantial investment of approximately MAD 2 billion ($190 Billion) in Morocco's automotive ecosystem.

- In January 2021, Yazaki and Sumitomo announced plans to establish new production facilities in Morocco, with a total investment of $103 Billion. Yazaki will invest $52 Billion to construct three new factories in Tangier, Kenitra, and Meknes. These facilities will primarily cater to the automotive sector's demand for wiring harnesses.

Report Coverage

The automotive wiring harness market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, application, component, vehicle type, transmission type, and their futuristic growth opportunities.

Automotive Wiring Harness Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 50.5 Billion |

|

Revenue forecast in 2034 |

USD 75 Billion |

|

CAGR |

4.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Application, By Component, By Vehicle Type, By Transmission Type, And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The key companies in Automotive Wiring Harness Market are Lear Corporation, LEONI AG, Spark Minda, Nexans, Yura Corporation, Samvardhana Motherson International Ltd

The automotive wiring harness market exhibiting a CAGR of 4.50% during the forecast period

Automotive Wiring Harness Market report covering key segments are application, component, vehicle type, transmission type, and region.

The key driving factors in Automotive Wiring Harness Market are Rise in Advanced Features in Vehicles.

Automotive Wiring Harness Market Size Worth $ 75 Billion by 2034