Baby Toiletries Market Size, Share, Trends, Industry Analysis Report

: By Product (Skin Care, Diapers, Hair Care, Wipes, and Bathing), Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM2076

- Base Year: 2024

- Historical Data: 2020-2023

Baby Toiletries Market Overview

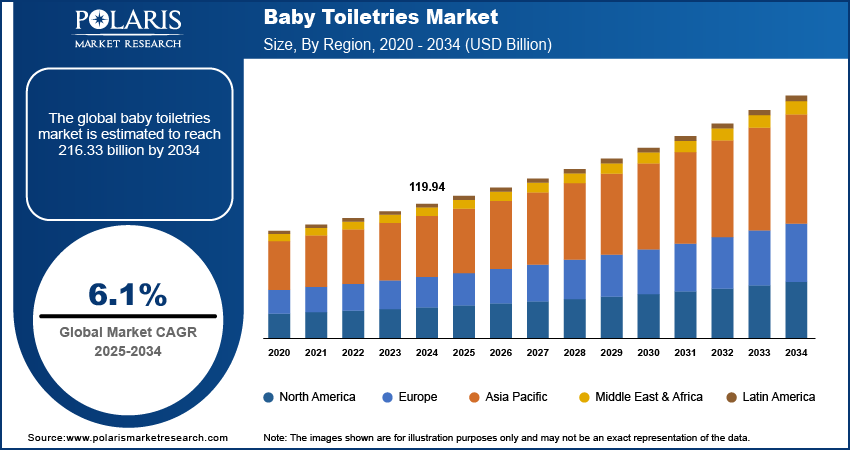

The baby toiletries market size was valued at USD 119.94 billion in 2024. The market is projected to grow from USD 126.96 billion in 2025 to USD 216.33 billion by 2034, exhibiting a CAGR of 6.1% during 2025–2034.

The baby toiletries market encompasses a range of personal care products designed for infants and young children, including baby shampoos, soaps, lotions, wipes, and diapers. This market is driven by increasing parental awareness regarding baby hygiene, rising disposable incomes, and a growing preference for organic and natural baby care products. Additionally, the expansion of e-commerce platforms has made baby toiletries more accessible, contributing to market growth. Regulatory standards emphasizing product safety and hypoallergenic formulations further shape industry trends, as parents prioritize dermatologically tested and chemical-free options for their children.

Key drivers influencing the baby toiletries market include increasing birth rates in emerging economies, advancements in product innovation, and rising consumer demand for sustainable and eco-friendly products. The growing influence of social media and digital marketing strategies has also enhanced brand visibility, impacting consumer purchasing decisions. The increasing focus on premium baby care products and expanding smart retail channels are expected to drive sustained growth in the global market.

To Understand More About this Research: Request a Free Sample Report

Baby Toiletries Market Dynamics

Increasing Parental Awareness of Infant Health and Hygiene

The heightened awareness among parents regarding infant health and hygiene significantly propels the baby toiletries market growth. This awareness leads to a greater emphasis on selecting products that ensure the well-being of their children. For instance, the American Academy of Pediatrics reported in 2021 that 1 in 10 children suffers from eczema, underscoring the need for specialized skincare products to address such conditions. Consequently, parents are increasingly seeking toiletries that cater to these specific health concerns, driving demand for products such as gentle cleansers and moisturizers designed for sensitive skin.

Rising Demand for Organic and Natural Baby Care Products

The shift toward organic and natural baby care products is a significant baby toiletries market driver. Parents are becoming more cautious about the ingredients in baby products, favoring those free from synthetic chemicals. This trend is supported by the growing availability of products with natural ingredients, such as honey, extra virgin oil, and aloe vera, which are perceived as safer for infants. This preference for natural formulations has led to an increase in the production and consumption of organic baby toiletries, reflecting a broader consumer movement toward health-conscious purchasing decisions.

Expansion of E-Commerce Platforms Enhancing Product Accessibility

The proliferation of e-commerce platforms has significantly enhanced the accessibility of baby toiletries, contributing to market growth. Online retail channels offer parents the convenience of browsing and purchasing a wide array of baby care products from the comfort of their homes. This shift is particularly notable in regions experiencing rapid digitalization, where consumers are increasingly turning to online shopping for their needs. The ease of access to product information, reviews, and competitive pricing online has made e-commerce a preferred shopping avenue for many parents, thereby boosting sales in the baby toiletries market.

Baby Toiletries Market Segment Insights

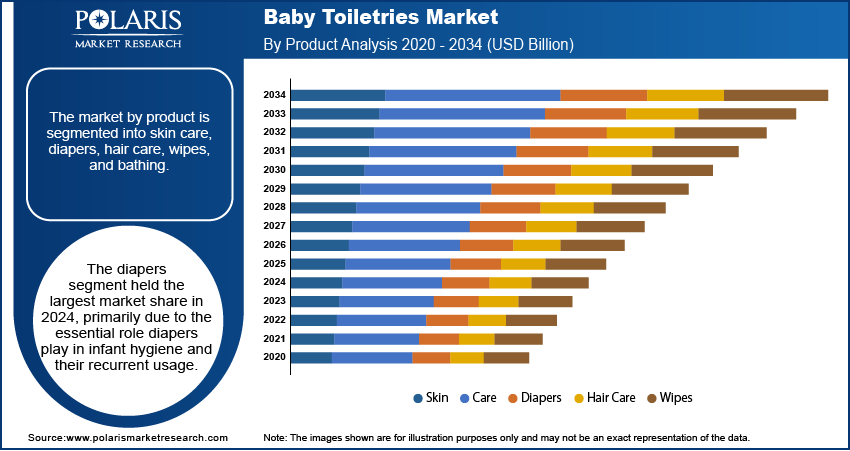

Baby Toiletries Market Assessment by Product

The baby toiletries market segmentation, based on product, includes skin care, diapers, hair care, wipes, and bathing. The diapers segment held the largest baby toiletries market share in 2024, primarily due to the essential role diapers play in infant hygiene and their recurrent usage. Advancements in product design, such as the development of ultra-absorbent and skin-friendly materials, have further boosted this segment's dominance. Additionally, there is a growing consumer preference for eco-friendly and biodegradable diapers, reflecting a shift towards sustainable products.

The hair care segment is experiencing the highest growth rate within the baby toiletries market. This surge is attributed to increasing parental awareness regarding the importance of early hair and scalp care. Parents are seeking gentle shampoos and conditioners that do not irritate sensitive baby skin, leading manufacturers to innovate with tear-free formulations enriched with natural ingredients. Marketing initiatives highlighting the benefits of early hair care routines and the safety of these products have further propelled this segment's growth.

Baby Toiletries Market Evaluation by Distribution Channel

The baby toiletries market is segmented by distribution channel into hypermarkets, chemist & pharmacy stores, e-commerce, and others. The hypermarkets held the largest market share in 2024. These retail giants offer a comprehensive selection of baby care products, providing parents with the convenience of one-stop shopping. Their expansive layouts and dedicated baby product sections allow consumers to easily compare various brands and products, enhancing the shopping experience. Hypermarkets frequently implement promotional campaigns and discounts, attracting cost-conscious parents and further solidifying their dominant position in the market. The physical presence of these stores enables customers to inspect products firsthand, which is particularly important for items intended for infants. The widespread presence of hypermarkets in both urban and rural areas has made them accessible to a broad demographic, contributing to their substantial market share.

The e-commerce segment is experiencing the highest baby toiletries market CAGR. The convenience of online shopping allows parents to purchase baby care products from the comfort of their homes, a significant advantage for those with busy schedules or limited access to physical stores. E-commerce platforms often provide a wider variety of products compared to brick-and-mortar stores, giving consumers more choices to find items that best suit their needs. The ability to easily compare prices, read reviews, and access detailed product information online empowers parents to make informed purchasing decisions. The increasing penetration of smartphones and the internet, especially in emerging markets, has expanded the reach of online retail, making it a rapidly growing distribution channel for baby toiletries. Many e-commerce platforms also offer attractive discounts and subscription services, providing cost-effective and convenient options for parents.

Baby Toiletries Market Regional Insights

By region, the study provides baby toiletries market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest market share, a dominance attributed to several key factors. The region's high spending rate and advanced technology contribute to a robust market for baby care products. Additionally, the presence of established manufacturers such as Procter & Gamble Company, Kimberly-Clark Corporation, and Johnson & Johnson Limited enhances product availability and consumer trust. These companies’ consistent investment in research, innovation, and product development caters to the increasing demand for high-quality baby toiletries in North America.

The baby toiletries market in Europe is experiencing steady growth, driven by increasing awareness of infant hygiene and a preference for high-quality products. The presence of established manufacturers such as Beiersdorf AG and Unilever PLC contributes to a competitive market landscape, fostering continuous product innovation. Additionally, the rise in dual-income households has led to higher disposable incomes, enabling parents to invest more in premium baby care products. Germany, in particular, is expected to register significant growth, reflecting the region's robust market dynamics.

Asia Pacific is witnessing rapid expansion in the baby toiletries market, attributed to factors such as high birth rates and rising disposable incomes. Countries such as China and India are experiencing significant market growth, driven by large infant populations and increasing consumer spending on baby care products. There is a growing demand for organic and natural baby care products in this region, with parents seeking safer options for their children. Major manufacturers are responding by launching products with natural ingredients, catering to this shift in consumer preference.

Baby Toiletries Market – Key Players and Competitive Insights

The competitive landscape of the baby toiletries market features global and regional players competing through innovation and strategic alliances. Global players leverage R&D capabilities and technological advancements to deliver advanced solutions, meeting the demand for disruptive technologies. Baby toiletries market trends highlight rising technological adoption driven by economic growth and geopolitical shifts. Companies focus on strategic investments, mergers, and joint ventures to strengthen market positions. Regional players offer cost-effective solutions tailored to local needs. The market experiences ongoing technological transformation, with companies investing in supply chain management and sustainability strategies. Competitive intelligence and pricing insights are critical for identifying growth opportunities.

The industry's growth is driven by technological innovation, market adaptability, and strategic regional investments, ensuring sustained competitiveness in a dynamic global market. A few major players are Beiersdorf AG; Burt’s Bees (The Clorox Company); Chicco (Artsana Group); Earth Mama Organics; Farlin Infant Products Corporation; Johnson & Johnson; Kao Corporation; Kimberly-Clark Corporation; Mustela (Laboratoires Expanscience); Pigeon Corporation; Procter & Gamble Co.; Sebapharma GmbH & Co. KG; The Himalaya Drug Company; The Honest Company, Inc.; and Unilever.

Beiersdorf AG is a German multinational company headquartered in Hamburg, Germany, specializing in the development and marketing of personal care products and self-adhesive solutions. Founded in 1882, the company is renowned for its wide portfolio of skincare brands, such as NIVEA, Eucerin, La Prairie, Labello, and Hansaplast. NIVEA, in particular, is recognized as one of the world's largest skincare brands, offering products ranging from face care to body care. Beiersdorf operates globally with over 160 affiliates. The company is structured into two main segments: Consumer Business, which focuses on skin and body care products, and Tesa SE, which specializes in self-adhesive products. In the baby toiletries segment, Beiersdorf's NIVEA brand plays a substantial role by offering high-quality baby care products such as lotions, creams, shampoos, and wipes tailored to sensitive infant skin. These products are developed with dermatological expertise to ensure safety and efficacy for delicate skin types. Beiersdorf's commitment to innovation and sustainability drives its efforts to create gentle formulations that meet global standards for baby care.

Chicco, a flagship brand of the Italian Artsana Group, is a global manufacturer of baby care products, such as baby toiletries. Founded in 1958 by Pietro Catelli, Chicco was inspired by the needs of parents and children, offering innovative solutions for infants and toddlers. The brand operates in over 120 countries and is widely recognized for its commitment to quality, safety, and design. Chicco’s baby toiletries range includes products such as baby shampoos, lotions, creams, and wipes, all developed with a focus on sensitive skin. These products are dermatologically tested and formulated to be gentle on delicate skin while meeting the highest safety standards. Chicco’s dedication to research is clear through its Osservatorio Chicco in Italy, where experts collaborate with pediatricians and parents to understand the psycho-physical and emotional needs of babies. This research-driven approach ensures that Chicco’s toiletries cater to the unique requirements of infants during their early developmental stages. Additionally, Chicco emphasizes sustainability through initiatives like eco-friendly packaging and responsible sourcing.

List of Key Companies in Baby Toiletries Market

- Beiersdorf AG

- Burt’s Bees (The Clorox Company)

- Chicco (Artsana Group)

- Earth Mama Organics

- Farlin Infant Products Corporation

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Mustela (Laboratoires Expanscience)

- Pigeon Corporation

- Procter & Gamble Co.

- Sebapharma GmbH & Co. KG

- The Himalaya Drug Company

- The Honest Company, Inc.

- Unilever

Baby Toiletries Market Developments

- January 2025: Panacea Biotec's subsidiary PBPL launched infant care products diapers and wipes under the brand NikoMom, marking its entry into the baby care market.

- September 2024: Dove introduced the Baby Dove Eczema Care range, including a Soothing Bath Treatment and Eczema Care Cream, designed for eczema-prone baby skin. Free from harmful additives and enriched with natural nutrients, the products are National Eczema Association-approved to provide gentle and effective skin relief.

Baby Toiletries Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Skin Care

- Diapers

- Hair Care

- Wipes

- Bathing

By Distribution Channel Outlook (Revenue-USD Billion, 2020–2034)

- Hypermarkets

- Chemist & Pharmacy Stores

- E-Commerce

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Baby Toiletries Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 119.94 billion |

|

Market Size Value in 2025 |

USD 126.96 billion |

|

Revenue Forecast by 2034 |

USD 216.33 billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The baby toiletries market size was valued at USD 119.94 billion in 2024 and is projected to grow to USD 216.33 billion by 2034.

The market is projected to register a CAGR of 6.1% during the forecast period, 2025-2034.

North America had the largest share of the market in 2024.

The baby toiletries market key players include Beiersdorf AG; Burt’s Bees (The Clorox Company); Chicco (Artsana Group); Earth Mama Organics; Farlin Infant Products Corporation; Johnson & Johnson; Kao Corporation; Kimberly-Clark Corporation; Mustela (Laboratoires Expanscience); Pigeon Corporation; Procter & Gamble Co.; Sebapharma GmbH & Co. KG; The Himalaya Drug Company; The Honest Company, Inc.; and Unilever.

The diapers segment accounted for the largest share of the market in 2024.

Baby toiletries refer to a range of personal care products specifically designed for infants and toddlers to maintain hygiene, protect sensitive skin, and ensure overall well-being. These products include baby skincare items (lotions, creams, and powders), diapers, baby wipes, shampoos, soaps, and bath products. They are formulated with gentle, hypoallergenic, and often dermatologically tested ingredients to minimize irritation and suit delicate baby skin. Baby toiletries are widely used by parents and caregivers to provide essential hygiene and comfort for infants while ensuring safety and nourishment for their sensitive skin.