Smart Retail Market Size, Share, Trends, Industry Analysis Report

By Component, By Technology, By Deployment Mode, By Retail Format, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 124

- Format: PDF

- Report ID: PM1995

- Base Year: 2024

- Historical Data: 2020-2023

What is the smart retail market size?

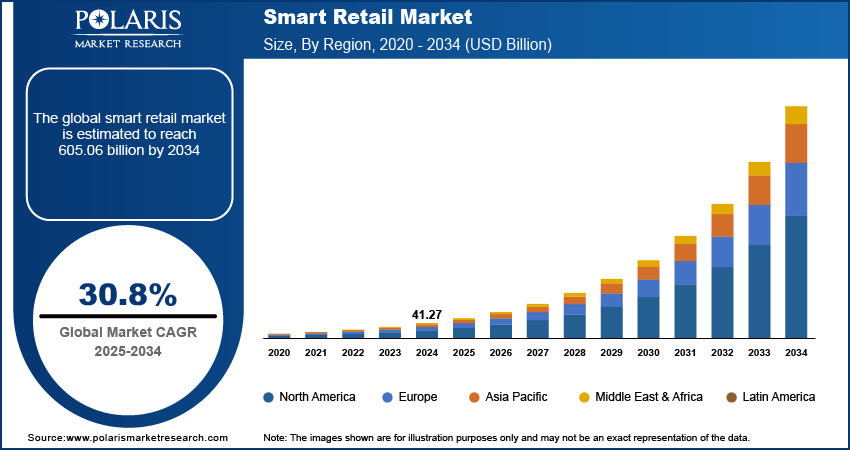

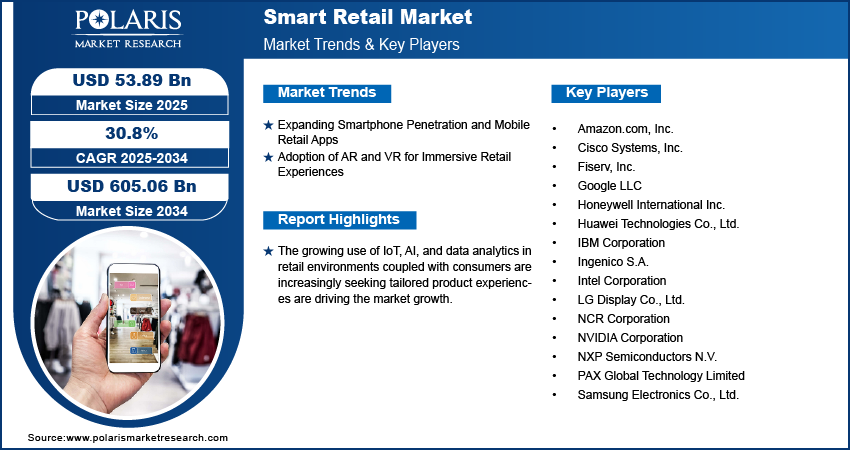

The global smart retail market size was valued at USD 41.27 billion in 2024, growing at a CAGR of 30.8% from 2025 to 2034. Expanding smartphone penetration and mobile retail apps along with adoption of AR and VR for immersive retail experiences driving the market growth.

Key Insights

- Cloud deployment dominated the market in 2024, due to its scalability, affordability, and simplicity of integration for multi-store businesses.

- Software solutions are anticipated to grow at a fast pace driven by increasing demand for real-time analytics, predictive analysis, and automation platforms.

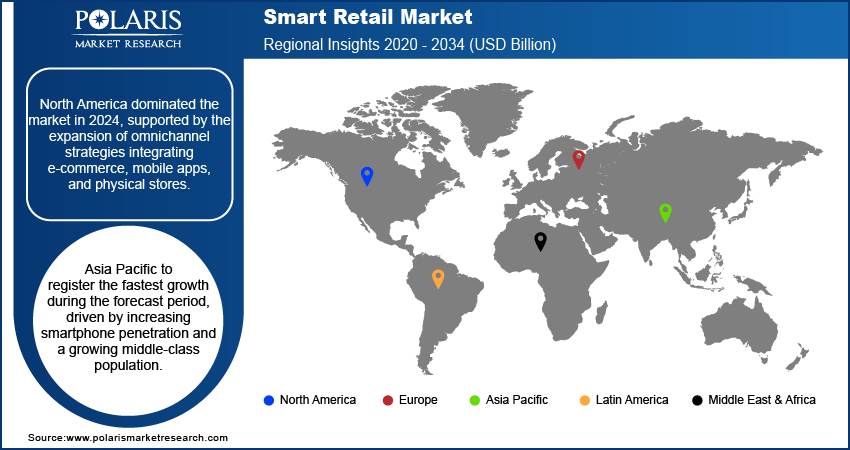

- North America held the largest share in 2024, driven by growing in omnichannel strategies that involve e-commerce, mobile applications, and brick-and-mortar stores.

- The U.S. dominated the North American market, fueled by rising investments in AI, IoT, and cloud retail platforms to boost customer interactions and improve store operations.

- Asia Pacific is expected to grow at the highest rate, fueled by high smartphone penetration and expanding middle-class populations.

- China played a major role in the Asia Pacific market, fueled by the growing e-commerce ecosystem, investments in networked retail infrastructure, data analytics, and AI-powered inventory management solutions.

- Major players operating in the market are Amazon.com, Inc., Cisco Systems, Inc., Fiserv, Inc., Google LLC, Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Ingenico S.A., Intel Corporation, LG Display Co., Ltd., NCR Corporation, NVIDIA Corporation, NXP Semiconductors N.V., PAX Global Technology Limited, and Samsung Electronics Co., Ltd.

Industry Dynamics

- Growing smartphone penetration and rising usage of mobile retail applications are driving the growth of smart retail solutions.

- Increasing use of AR and VR technologies is facilitating immersive shopping experiences, increasing customer engagement.

- The high cost of implementation and maintenance of AI, IoT, and automation technologies continue to restrain the market growth.

- Blockchain-based secure digital payments and transparent supply chain management are creating new opportunities for growth by building trust and improving operational efficiency.

Market Statistics

- 2024 Market Size: USD 41.27 Billion

- 2034 Projected Market Size: USD 605.06 Billion

- CAGR (2025–2034): 30.8%

- North America: Largest Market Share

What is smart retail?

Smart retail market includes sophisticated technologies to elevate shopping experiences using automation, data analysis, and connectivity. Smart retail offerings are extensively used in supermarkets, convenience stores, and online shopping platforms to enhance inventory management, customer interaction, and operational effectiveness. Convergence of AI, IoT, and cloud infrastructure is revolutionizing the way retailers track consumer behavior and streamline store operations.

The growing adoption of IoT, AI, and data analysis in retail environments is transforming store functions and customer engagement. Retailers are spending on intelligent shelves, sensors, and analytics platforms powered by AI that track stock in real time, study consumer trends, and automate checkouts.

Customers are increasingly demanding personalized experiences, which is prompting retailers to incorporate smart technologies into personalized offerings. Insights based data are assisting brands in personalizing promotions, product suggestions, and store planning, leading to greater customer retention and better sales performance.

Drivers & Opportunities

Which are the factors driving the smart retail market growth?

Expanding Smartphone Penetration and Mobile Retail Apps: The increasing use of smartphones and the growing popularity of mobile retail apps are driving the smart retail market. As per the GSMA's State of Mobile Internet Connectivity Report 2023 (SOMIC), over 54% of the world's population, which is approximately 4.3 billion people, own a smartphone. Mobile apps allow customers to view products, compare prices, and pay securely, improving connectivity and convenience. This digital transformation is assisting retailers in strengthening omnichannel approaches and establishing more robust customer relationships.

Adoption of AR and VR for Immersive Retail Experiences: The increasing adoption of augmented reality (AR) and virtual reality (VR) technologies is transforming consumers' interaction with products. Virtual try-ons in fashion or 3D visualization of products in furniture shopping, immersive technologies are enhancing purchase confidence and customer satisfaction. In March 2025, Unilever released digital twin technology, leveraging Real-Time 3D, NVIDIA Omniverse, and OpenUSD, to create photorealistic 3D replicas of its products. The trend is boosting physical spaces of retail becoming digitalized into experience-based interactive spaces.

Segmental Insights

By Component

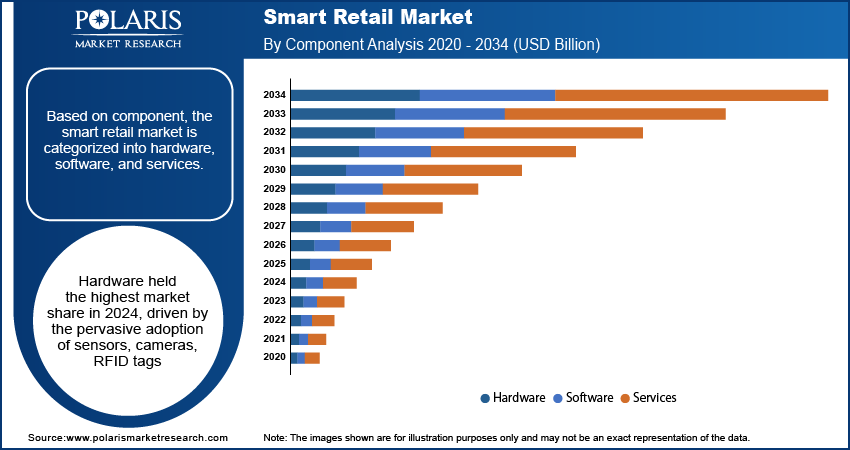

Based on component, the smart retail market is categorized into hardware, software, and services. Hardware held the highest market share in 2024, driven by the pervasive adoption of sensors, cameras, RFID tags, and interactive kiosks that provide visibility into operations and facilitate customer interaction.

Software solutions are expected to see vigorous growth, propelled by increasing demand for real-time analysis, predictive intelligence, and automation platforms that assist retailers in personalizing experiences and simplifying operations.

By Technology

On the basis of technology, the market is divided into Internet of Things (IoT), artificial intelligence and machine learning, robotics and automation, augmented/virtual reality, cloud and edge computing, and big data and analytics. IoT dominated the market in 2024 driven by its broad usage in making devices in stores connectible, improving inventory visibility, and automating store management.

Artificial intelligence and machine learning are projected to grow at a fastest rate, fueled by advanced personalization, demand planning, and customer sentiment analysis.

By Deployment Mode

Based on deployment mode, the smart retail market is segmented into on-premises, cloud, and hybrid solutions. Cloud deployment accounted for a major market share in 2024 due to its scalability, affordability, and simplicity of integration in multi-store operations.

The hybrid model is likely to grow rapidly, offering retailers the agility in handling data in the cloud and on-premises and the assurance of data security and compliance.

By Retail Format

By retail format, the market is segmented into hypermarkets and supermarkets, convenience stores, department stores, specialty stores, and e-commerce fulfillment centers. Hypermarkets and supermarkets held the largest share of the market in 2024, led by high penetration of smart shelves, digital signage, and automated checkouts to enhance customer experience.

E-commerce fulfillment centers are anticipated to grow at a high rate, driven by increasing online shopping and the adoption of AI-powered warehouse management and robotics.

By Application

On the basis of application, the market is segmented into inventory management, brand protection, foot-traffic monitoring, customer loyalty and payments, predictive equipment maintenance, smart shelves/planogram compliance, augmented-reality-assisted shopping, and others. Inventory management accounted for the maximum share in 2024, as retailers focus on accurate stock monitoring and forecasting demand to minimize losses.

Smart shelves and planogram compliance are anticipated to grow at a rapid pace during the forecast period, driven by its features including product placement and customer interaction.

Regional Analysis

North America dominated the smart retail market in 2024, driven by the development of omnichannel strategies unifying e-commerce, mobile applications, and bricks-and-mortar stores. Retailers are increasingly making investments in contactless payment facilities, self-checkout, and cashier-less store concepts to develop more convenience and efficiency in operations.

U.S. Smart Retail Market Overview

The U.S. held highest market share in North America, due to the increasing investments in AI, IoT, and cloud-based retail platforms to enhance customer interactions and optimize in-store processes. In January 2025, President Trump outlined a private sector pledge of USD 500 billion to construct infrastructure for artificial intelligence. These public sector-based investments are creating significant demand for smart retail industry, thus fueling the market growth.

Asia Pacific Smart Retail Market Insights

The Asia Pacific is anticipated to grow at a rapid pace during the forecast period, driven by rising smartphone penetration and expanding middle-class populations. Government support for digital economies and smart city initiatives is promoting the growth of networked retail ecosystems.

China Smart Retail Market Analysis

China is dominating the market in Asia Pacific, due to growing e-commerce ecosystem along with investments in networked retail infrastructure, data analytics, and AI-powered inventory management systems. According to the International Trade Administration, India e-commerce industry expanded by 11.9% in 2023 to USD 2.2 trillion and is expected to maintain the growth pace, growing at a CAGR of 9.9% during 2024-2028 to reach USD 3.6 trillion by 2028. This rapid digital shift is solidifying the country’s position as the world leader in smart retail innovation and technology upgrade.

Europe Smart Retail Market Assessment

Europe held significant market share driven by sustainable and energy-efficient retail businesses, fueling the need for IoT-based systems for real-time inventory monitoring and power management. In June 2025, Advantech debuted IoTMart Europe, a B2B online commerce platform designed to ease digital purchasing for small and medium industrial consumers, featuring localized logistics, viewable stock presence, and quicker consumer fulfillment.

Key Players & Competitive Analysis

The global smart retail industry is marked by strong competition and fast-paced technological development as retailers continue to adopt digital and connected technologies to enrich customer experience and operational effectiveness. Firms are concentrating on AI, IoT, data analytics, and automation to develop seamless omnichannel experiences, streamline inventory management, and support personalized engagement. The sector is witnessing robust cooperation between technology vendors, payment solution creators, and retail chains to develop intelligent store ecosystems and sophisticated POS systems.

Who are the major key players in smart retail market?

Key players in the global smart retail market include Amazon.com, Inc., Cisco Systems, Inc., Fiserv, Inc., Google LLC, Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Ingenico S.A., Intel Corporation, LG Display Co., Ltd., NCR Corporation, NVIDIA Corporation, NXP Semiconductors N.V., PAX Global Technology Limited, and Samsung Electronics Co., Ltd.

Key Players

- Amazon.com, Inc.

- Cisco Systems, Inc.

- Fiserv, Inc.

- Google LLC

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Ingenico S.A.

- Intel Corporation

- LG Display Co., Ltd.

- NCR Corporation

- NVIDIA Corporation

- NXP Semiconductors N.V.

- PAX Global Technology Limited

- Samsung Electronics Co., Ltd.

Smart Retail Industry Developments

In May 2025, In May 2025, Intel Corporation partnered with ASUSTeK Computer Inc. to launch an AI developer toolkit to enable faster development of AI applications. The toolkit simplifies deployment for industry-specific scenarios, such as smart retail solutions that observe customer behavior and recommend product placement.

In January 2025, Google launched AI retail solutions with Google Agentspace, a platform that allows retailers to create smart AI agents for customized shopping, real-time support, and automated tasks like inventory control and customer support.

Smart Retail Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Internet of Things (IoT)

- Artificial Intelligence and Machine Learning

- Robotics and Automation

- Augmented / Virtual Reality

- Cloud and Edge Computing

- Big-Data and Analytics

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- On-Premises

- Cloud

- Hybrid

By Retail Format Outlook (Revenue, USD Billion, 2020–2034)

- Hypermarkets and Supermarkets

- Convenience Stores

- Department Stores

- Specialty Stores

- E-commerce Fulfilment Centres

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Inventory Management

- Brand Protection

- Foot-Traffic Monitoring

- Customer Loyalty and Payments

- Predictive Equipment Maintenance

- Smart Shelves / Planogram Compliance

- Augmented-Reality Assisted Shopping

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Retail Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 41.27 Billion |

|

Market Size in 2025 |

USD 53.89 Billion |

|

Revenue Forecast by 2034 |

USD 605.06 Billion |

|

CAGR |

30.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Kilotons and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 41.27 billion in 2024 and is projected to grow to USD 605.06 billion by 2034.

The global market is projected to register a CAGR of 30.8% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Amazon.com, Inc., Cisco Systems, Inc., Fiserv, Inc., Google LLC, Honeywell International Inc., Huawei Technologies Co., Ltd., IBM Corporation, Ingenico S.A., Intel Corporation, LG Display Co., Ltd., NCR Corporation, NVIDIA Corporation, NXP Semiconductors N.V., PAX Global Technology Limited, and Samsung Electronics Co., Ltd.

The hardware segment dominated the market revenue share in 2024.

The artificial intelligence and machine learning segment is projected to witness the fastest growth during the forecast period.