Backhoe Loaders Market Share, Size, Trends, Industry Analysis Report

By Product Type (Center Pivot Backhoe Loaders and Side Shift Backhoe Loaders); By Engine Power; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3500

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

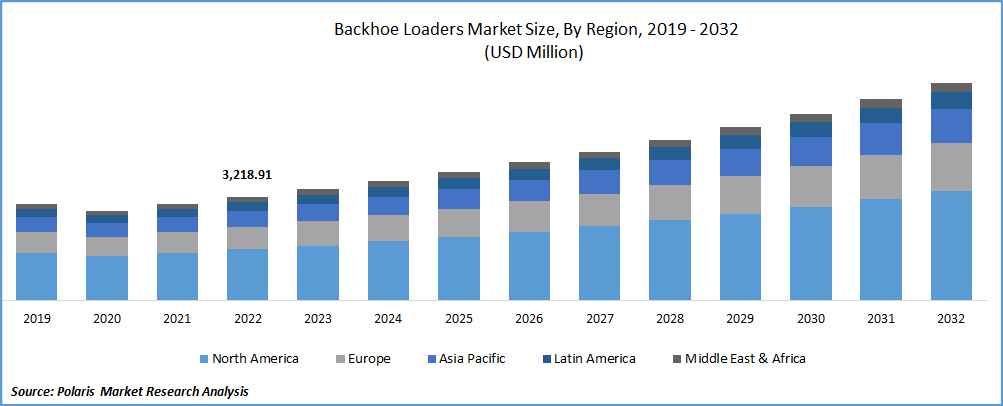

The global backhoe loaders market was valued at USD 3458.72 million in 2023 and is expected to grow at a CAGR of 7.80% during the forecast period. Rapidly growing usage of backhoe loaders across the construction industry because of its high versatility in operations and compact size that allows them to be efficiently used even in small spaces along with the drastic population expansion and rise in the gross household disposable income in both developing and developed nations, are driving the market growth. In addition, increasing government initiatives and programs towards the infrastructure development and high focus on major players on developing new and more improved machines with advanced capabilities, is also likely to create lucrative growth opportunities for the market.

To Understand More About this Research: Request a Free Sample Report

For instance, in February 2022, New Holland, introduced D Series Back-hoe Loader Range, which delivers significant benefits in operator comfort, safety, and productivity. The new loader is integrated power-train technology developed by the FPT Industrial and comes with F 36 3.6 liter, 4-cylinder engines.

Moreover, some backhoe loader manufacturers across the globe has started focusing on developing modular designs that allow customers to customize their equipment to meet specific needs and it further allows customers to select the most appropriate components for their applications, providing greater flexibility and cost savings, creating significant growth opportunities for the market.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the backhoe loaders market. The rapid emergence of pandemic has led to a reduction in demand for backhoe loaders as many construction projects were halted or delayed due to lockdowns and social distancing measures imposed by governments, which has resulted in lower sales and revenue for manufacturers. It has also disrupted supply chains across the globe, leading to delays in the production and delivery of backhoe loaders.

Industry Dynamics

Growth Drivers

The rapid growth in the development of several novel infrastructure designs which has resulted in new momentum and trend in the construction sector and increasing usage of these loaders in both large and small construction projects particularly for material excavation, powering building equipment, demolitions, paving pads, landscaping, digging, and transporting building material among others are the primary factors driving the global backhoe loaders market growth at significant pace.

Furthermore, a constant surge in the public & private infrastructure, growing FDI reforms for the construction sector, increasing number of highway projects, and exponential growth in the economy especially in APAC region, has all fostering the demand and growth of the market and spurring the adoption of these equipment at significant pace.

For instance, in November 2022, India, Israel, U.S., and UAE has established a new quadrilateral economic forum, in order to increase their focus on the infrastructure development projects across these regions and also strengthens the bilateral cooperation.

Report Segmentation

The market is primarily segmented based on product type, engine power, application, and region.

|

By Product Type |

By Engine Power |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Center pivot backhoe loaders segment is expected to witness highest growth

The center pivot backhoe loaders segment is expected to grow at high CAGR during the projected period, on account of growing popularity and prevalence regarding the adoption of these types of loaders across the globe due to its high versatility, exceptional performance, and better job site efficiency. Additionally, these machines are designed with operator comfort in mind, with features such as adjustable seats, air conditioning, and ergonomic controls, which makes them more comfortable to operate, increase operator productivity, and reduce fatigue, are also driving the segment growth.

The side shift backhoe loaders segment led the industry market with substantial share in 2022, which is mainly attributed to its ability to perform efficiently in tight spaces and job sites with very limited access and they are relatively easy to operate, which makes them attractive to customers who might not have extensive experience in operating heavy equipment.

80-100 HP segment accounted for the largest market share in 2022

The 80-100 HP segment accounted for largest market share, mainly due to its numerous beneficial characteristics including higher fuel saving, much faster response time in excavation, and better loading and diggings. The rapidly increasing investment of governments towards the infrastructure development, that includes construction of roads, bridges, buildings, and many others, is likely to spur the demand for backhoe loaders in the coming years.

The under 80 HP segment is also likely to gain significant growth rate over the coming years, mainly attributable to its higher affordability and fuel efficiency, which encourages small contractors and even farmers to opt for these machines coupled with the surging government support and focus on promoting the use of small machinery equipment for agriculture as well as construction.

Construction segment held the significant market share in 2022

The construction segment held the significant market share in terms of revenue in 2022, which is largely accelerated to growing use of these machines in various construction applications such as excavation, digging, lifting, and loading and increasing demand for residential and commercial buildings, infrastructure projects, and mining activities particularly in the emerging economies.

The introduction of advanced technologies like GPS and telematics, that has made these loaders more efficient and productive by enabling operators to track machine performance, improve fuel efficiency, and reduce downtime, which can enhance the overall productivity of construction projects, has been positively affecting the market growth.

The agriculture segment is expected to gain considerable growth rate during the anticipated period, owing to continuously growing demand for food products and emerging trend towards the mechanization in the agriculture sector. Additionally, with the rising penetration regarding the use of backhoe loaders in precision farming for several activities such as soil preparation and drainage, has resulted in increased adoption and fostering the demand of the segment.

North America region dominated the global market in 2022

The North America region dominated the global market for backhoe loaders in 2022, and is expected to maintain its dominance over the projected period. The regional market growth can be highly attributable to rapid development of several large-scale construction projects and increasing focus on government authorities on infrastructure development mainly in developed countries like US and Canada. There have been significant technological advancements backhoe loaders in the recent years such as the integration of GPS and telematics systems, that encourage companies to invest higher in these machines to boost up their productivity and maximize their revenues, which in turn, driving the market growth in the region.

The Asia Pacific region is anticipated to be the fastest growing region with a significant CAGR over the forecast period, due to rapid rate of urbanization and industrialization and prevalence of these loaders as a cost-effective and efficient alternative to several other equipment along with the surge in the number of companies offering rental services, allowing even small players to opt these machines without investing large amounts.

Competitive Insight

Some of the major players operating in the global market include Action Construction Equipment, CNH Industrial, Escorts Limited, Doosan Corporation, Komatsu Europe, Volvo Construction, Mahindra Construction, Hitachi Ltd., Bobcat Company, Terex Corporation, Caterpillar, JCB, Shandong Lingong Construction, and Hyderma.

Recent Developments

- In July 2022, Tata Hitachi, introduced 5-tonne Wheel Loader ZW 22% from their Kharagpur plant. The new loader is integrated with state-of-the-art innovative technologies. It is a versatile loader that maximize the customer’s earning potential and gained higher emphasis on operator convenience and comfort.

- In October 2021, Case Construction Equipment, launched of its new series of backhoe loaders including 580SV, 590SV, and 695SV models, comes with redesigned cab and put the operator comfort at the forefront. The new loader SV series has several improvements which boost the productivity gains and provide significant emissions savings while maintaining the performance.

Backhoe Loaders Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3718.47 million |

|

Revenue forecast in 2032 |

USD 6,771.22 million |

|

CAGR |

7.80 % from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product type, By Engine Power, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Action Construction Equipment Ltd., CNH Industrial America LLC, Escorts Limited, Doosan Corporation, Komatsu Europe International N.V., Volvo Construction Equipment, Mahindra Construction Equipment, Hitachi Ltd., Bobcat Company, Terex Corporation, Caterpillar, JCB, Shandong Lingong Construction Machinery Co. Ltd., and Hyderma. |

FAQ's

The global backhoe loaders market size is expected to reach USD 6,771.22 million by 2032.

Key players in the backhoe loaders market are Action Construction Equipment, CNH Industrial, Escorts Limited, Doosan Corporation, Komatsu Europe, Volvo Construction, Mahindra Construction.

North America contribute notably towards the global backhoe loaders market.

The global backhoe loaders market is expected to grow at a CAGR of 7.7% during the forecast period.

The backhoe loaders market report covering key segments are product type, engine power, application, and region.