Baking Enzymes Market Share, Size, Trends & Industry Analysis Report

By Type (Protease, Carbohydrase, Lipase, Others); By Form; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 115

- Format: PDF

- Report ID: PM1816

- Base Year: 2024

- Historical Data: 2020-2023

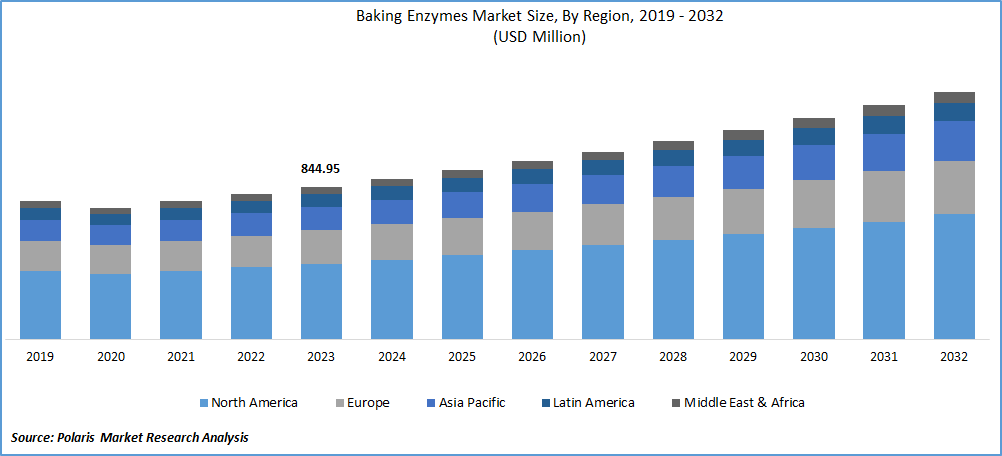

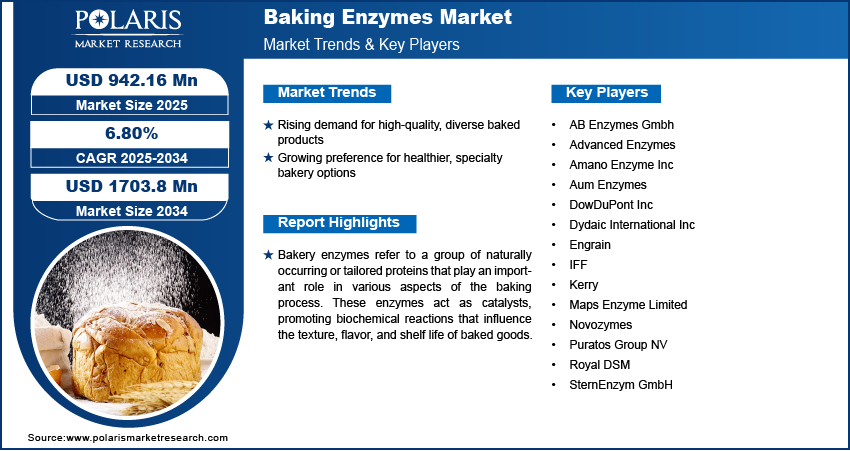

The global baking enzymes market was valued at USD 898.65 million in 2024 and is projected to grow at a CAGR of 6.80% from 2025 to 2034. Growth is supported by rising demand for processed bakery products and clean-label enzyme formulations.

Bakery enzymes refer to a group of naturally occurring or tailored proteins that play an important role in various aspects of the baking process. These enzymes act as catalysts, promoting biochemical reactions that influence the texture, flavor, and shelf life of baked goods. Common bakery enzymes include proteases, which help in gluten development and products by breaking down fats.

The baking process is affected by various factors such as temperature, humidity, equipment changes, and new harvests. Baking enzymes like protease, carbohydrase, and lipase are used to enhance dough machinability, volume, and crumb structure, resulting in consistent products. The demand for lipases is estimated to rise in the forecast period as they help in high-speed mixing. These enzymes improve dough machinability by providing better dough rheology, increased stability, and strength.

To Understand More About this Research: Request a Free Sample Report

The baking enzymes market has experienced significant growth in recent years because of the need for improved product quality in the bakery industry and the increasing demand for convenience foods and ready-to-eat bakery products. The global market for baking enzymes is propelled by advancements in enzyme technology, leading to the development of innovative and efficient enzyme solutions. Manufacturers are investing in research and development to create enzymes that offer improved functionality, stability, and cost-effectiveness in the baking process. This has led to a broader adoption of enzymes by bakery producers globally.

However, the baking enzymes market faces certain restraining factors, such as the stringent regulatory environment, as the approval process for new enzymes involves compliance with various safety and health regulations. Another factor is the concerns of consumers with allergies. Clear labeling and communication regarding the use of enzymes in baked goods become crucial to addressing these concerns and building trust among consumers.

Growth Drivers

- The growing bakery industry across the globe creates a high demand for bakery enzymes.

The expanding bakery industry on a global scale has become a major driver for the increased demand for bakery enzymes. As consumer preferences are continuously changing, the demand for different and high-quality baked products has increased, pushing the industry to seek innovative solutions to enhance the overall quality of baked goods. For instance, in February 2020, DuPont Nutrition & Biosciences launched the DuPont POWER Bake 6000 and 7000 enzyme series, specifically for European bread and bun recipes, to preserve their taste and quality.

Bakery enzymes play an important role in meeting these demands by offering functional benefits that positively impact various aspects of the baking process. Enzymes contribute to improved dough handling, enhanced texture, prolonged shelf life, and overall product consistency. The need for healthier alternatives and the ability to cater to specific dietary preferences, such as gluten-free or low-carb options, has further accelerated the adoption of bakery enzymes by manufacturers.

Report Segmentation

The market is primarily segmented based on type, form, application, and region.

|

By Type |

By Form |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

-

The carbohydrase segment held a significant market share in 2024.

In 2023, the carbohydrase segment has emerged as a dominant segment as it plays an important role in influencing the texture, flavor, and overall quality of baked goods. Carbohydrases, including amylases and xylanases, are enzymes that target complex carbohydrates, breaking them down into simpler sugars. In the context of bakery applications, amylases help in the hydrolysis of starch into maltose and glucose, thereby initiating better dough fermentation and improving the final product's softness and crumb structure. The adaptability of carbohydrates in addressing a range of challenges faced in the baking process, such as dough machinability and crumb structure, has made them essential for bakers seeking to achieve consistent and high-quality results.

By Application Analysis

- The bread segment dominated the revenue share in 2024.

The bread segment accounted for the largest revenue share in 2023 because of the important role that bakery enzymes play in addressing key challenges associated with bread production and meeting consumer expectations for high-quality bread products. Enzymes, particularly amylases and xylanases, play a crucial role in enhancing the texture, volume, and shelf life of bread. The use of baking enzymes in bread production makes it easier to handle the dough, facilitates gas formation, and helps to retain the gas in the dough. This results in improved bread characteristics, such as texture, color, crumb structure, and volume. Also, the baking enzyme industry is affected by several factors, including the growing population, increasing consumption of fast foods like pizzas and burgers, and rising concerns about food safety. There is a growing demand for organic and whole wheat-based bread, which contains oats, bran, and seeds, contributing to the increased need for baking enzymes in this segment.

Regional Insights

- North America region dominated the market in 2024.

In 2023, the North American region showcased its dominance in the bakery enzymes market by holding a significant share of the total revenue, and this is because of the well-established and continually evolving bakery industry in North America, marked by a wide range of products and a strong consumer base. The region's consumer choices for high-quality, innovative, and health-conscious bakery items have driven the adoption of enzymes as essential ingredients to enhance product properties.

Also, stringent regulations regarding food safety and labeling have led to an increased emphasis on clean-label ingredients in the North American food industry. The dominance of baked goods in North America, particularly in the United States, is the result of their high consumption by the population. This region's baking enzyme market is driven by the high disposable income of consumers, growth in consumption of convenience food, and increasing awareness regarding nutrition. Additionally, the busy lifestyles of consumers further boost the market growth for baking enzymes

The Asia Pacific region is expected to grow with a significant CAGR because the region is experiencing an increase in population and an expanding middle class, leading to increased disposable income and changing consumer preferences. As the lifestyles of consumers evolve in the region, there is a rising demand for convenience foods and a wide range of bakery products, driving the need for innovative solutions like bakery enzymes that enhance product quality and shelf life.

Key Market Players & Competitive Insights.

The use of baking enzymes is becoming more popular among food manufacturers as it contributes to sustainability and enhances the appearance of baked goods. In response to the growing demand for enzyme-based bakery products, manufacturers are working on increasing production capacity to make the supply chain more efficient and reduce the likelihood of shortages of enzyme-based bakery products.

Some of the major players operating in the global market include:

- AB Enzymes Gmbh

- Advanced Enzymes

- Amano Enzyme Inc

- Aum Enzymes

- DowDuPont Inc

- Dydaic International Inc

- Engrain

- IFF

- Kerry

- Maps Enzyme Limited

- Novozymes

- Puratos Group NV

- Royal DSM

- SternEnzym GmbH

Recent Developments

- In March 2024, Kerry launched Biobake Fresh Rich, an enzyme system designed for sweet baked goods. The enzyme extends freshness, softness, and moistness over shelf life, helping reduce food waste and improve sustainability in bakeries.

- In June 2023, Kerry introduced an enzyme called Biobake EgR, which can help bakers reduce their egg use by up to 30% in various products.

- In May 2023, IFF has recently introduced a new product line in Europe called ENOVERATM 2000. This range has been added to their existing bakery industry solutions. ENOVERATM 2000 is a type of enzyme dough strengthener that is ideal for bakery manufacturers who are looking for gluten substitutes. It is especially useful in applications like whole wheat bread.

Baking Enzymes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 942.16 Million |

|

Revenue Forecast in 2034 |

USD 1703.8 Million |

|

CAGR |

6.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Form, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

We provide our clients the option to personalize the Baking Enzymes Market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

Browse Our Top Selling Reports

Electronic Filtration Market Size, Share 2024 Research Report

Silicone In Electric Vehicles Market Size, Share 2024 Research Report

Automotive Adhesive Tapes Market Size, Share 2024 Research Report

Biotechnology and Pharmaceutical Services Outsourcing Market Size, Share 2024 Research Report

Cell Therapy Human Raw Materials Market Size, Share 2024 Research Report

FAQ's

Key companies in Baking Enzymes Market are AB Enzymes Gmbh, Advanced Enzymes, Amano Enzyme Inc, Aum Enzymes.

Baking Enzymes Market is expected to grow at a CAGR of 6.80% during the forecast period.

The Baking Enzymes Market report covering key segments are type, form, application, and region

The driving factors in Baking Enzymes Market are 1. The growing bakery industry across the globe creates a high demand for bakery enzymes

The global baking enzymes market was valued at USD 898.65 Million in 2034 .