Canadian Oilfield Chemicals Market Size, Share, Trends, Industry Analysis Report

: By Product (Corrosion & Scale Inhibitors, Demulsifiers, Biocides, Surfactants, and Polymers) and Application – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5567

- Base Year: 2024

- Historical Data: 2020-2023

Canadian Oilfield Chemicals Market Overview

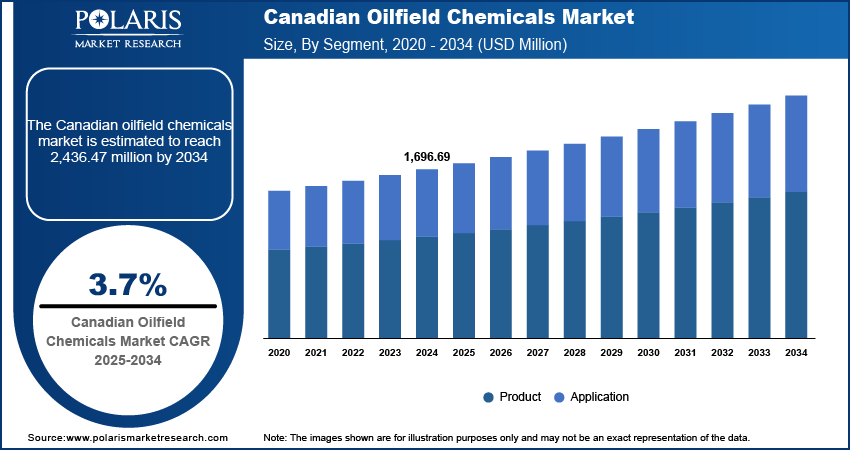

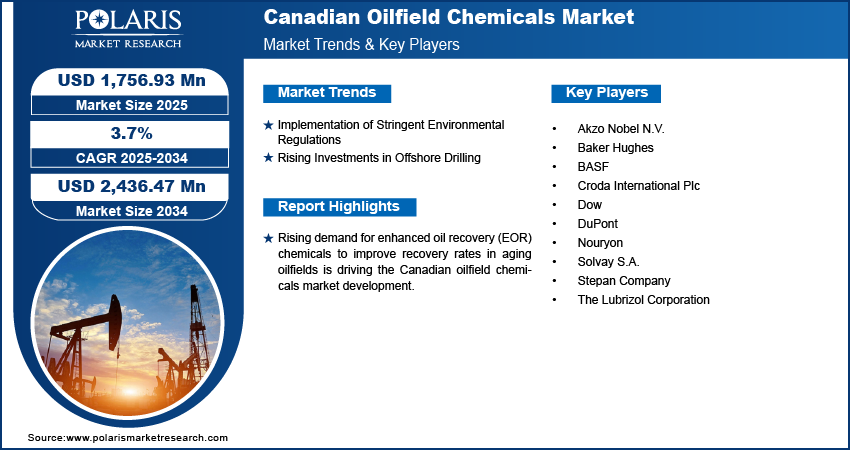

The Canadian oilfield chemicals market size was valued at USD 1,696.69 million in 2024. The market is expected to grow from USD 1,756.93 million in 2025 to USD 2,436.47 million by 2034, exhibiting a CAGR of 3.7% from 2025 to 2034.

The Canadian oilfield chemicals market encompasses a range of specialized chemical products used in oil and gas exploration, drilling, production, and maintenance processes. These chemicals include drilling fluids, corrosion inhibitors, scale inhibitors, demulsifiers, biocides, and gelling agents. They play a critical role in optimizing oilfield operations by enhancing efficiency, ensuring equipment protection, improving oil recovery, and addressing environmental concerns.

The growth of oil sands and shale gas exploration in Canada is driving the demand for oilfield chemicals to support advanced extraction techniques, thereby propelling the Canadian oilfield chemicals market growth. In addition, the increasing adoption of advanced drilling and production technologies is contributing to the market expansion.

Rising demand for enhanced oil recovery (EOR) chemicals to improve recovery rates in aging oilfields is propelling the Canadian oilfield chemicals market development. The ongoing exploration in regions such as Alberta and British Columbia is driving the demand for drilling fluids, stimulation chemicals, and production enhancement solutions, further contributing to market growth.

To Understand More About this Research: Request a Free Sample Report

Canadian Oilfield Chemicals Market Dynamics

Implementation of Stringent Environmental Regulations

Stringent environmental regulations in Canada regarding emissions and waste management are significantly contributing to the oilfield chemicals market expansion. For instance, in November 2024, the Government of Canada published the 2030 Emissions Reduction Plan (ERP) in line with the Paris Agreement. This plan highlights the urgent need to combat climate change and outlines opportunities for transitioning to a low-carbon economy, promoting both emissions reduction and economic growth. The implementation of strict policies aimed at minimizing the environmental impact of oil and gas operations has driven the demand for eco-friendly and biodegradable oilfield chemicals. These chemicals are designed to meet regulatory standards while ensuring operational efficiency, resulting in a shift toward sustainable solutions. Growing environmental awareness is further driving demand for these products, boosting the market in Canada.

Rising Investments in Offshore Drilling

Increasing investment in offshore drilling activities across Canadian waters is playing a pivotal role in fueling the Canadian oilfield chemicals market revenue. For instance, a USD 75 million offshore investment through the Emissions Reduction Fund (ERF) is aimed at helping Canada meet its environmental commitments and reduce greenhouse gas emissions. As oil and gas companies prioritize tapping into offshore reserves, the demand for specialized oilfield chemicals, such as corrosion inhibitors, drilling fluids and chemicals, is rising significantly. These chemicals are essential for ensuring operational efficiency and equipment longevity in challenging offshore environments. In addition, the growing complexity of offshore projects is promoting the adoption of innovative chemical solutions, enhancing market value.

Canadian Oilfield Chemicals Market Segment Insights

Canadian Oilfield Chemicals Market Assessment by Product Insights

The Canadian oilfield chemicals market segmentation, based on product, includes corrosion & scale inhibitors, demulsifiers, biocides, surfactants, and polymers. The corrosion & scale inhibitors segment accounted for the largest market share in 2024 due to the increasing need to protect critical infrastructure in oil and gas operations. Corrosion and scaling significantly impact the efficiency and safety of pipelines, drilling equipment, and production facilities, particularly in Canada’s harsh operational environments. The use of corrosion and scale inhibitors minimizes equipment failure, reduces maintenance costs, and enhances the lifespan of assets, driving their widespread adoption. Additionally, the rising investment in offshore drilling and enhanced oil recovery (EOR) techniques in Canadian waters supports the demand for these inhibitors, contributing to the segment’s dominance.

The surfactants segment is expected to witness the highest CAGR during the forecast period due to its critical role in improving oil recovery efficiency and optimizing drilling fluid performance. Surfactants enhance wettability and reduce interfacial tension, which is crucial for maximizing production output in mature Canadian oilfields. Their use in hydraulic fracturing and foam-based stimulation technologies has gained significant traction with the rise of unconventional oil and gas exploration in Canada. Additionally, advancements in environmentally friendly and biodegradable surfactant formulations are meeting stringent regulatory demands, accelerating their adoption. This shift highlights the growing emphasis on sustainable oilfield operations and supports the segment's rapid growth.

Canadian Oilfield Chemicals Market Evaluation by Application Insights

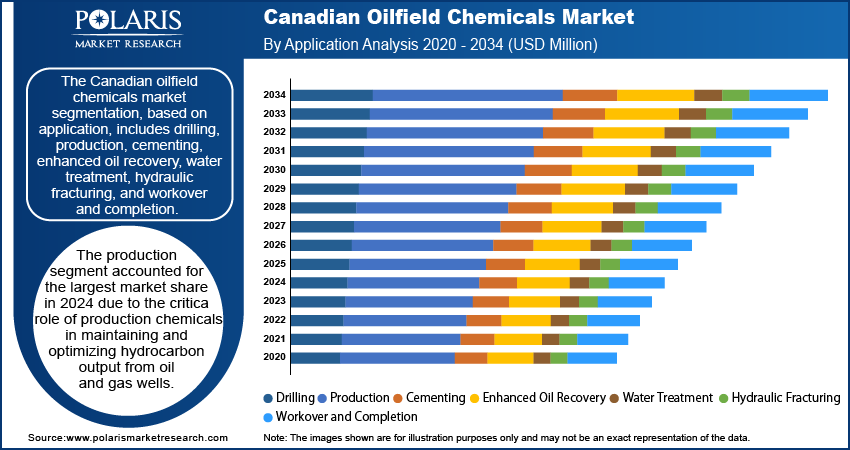

The Canadian oilfield chemicals market segmentation, based on application, includes drilling, production, cementing, enhanced oil recovery, water treatment, hydraulic fracturing, and workover and completion. The production segment accounted for the largest market share in 2024 due to the critical role of production chemicals in maintaining and optimizing hydrocarbon output from oil and gas wells. These chemicals, including corrosion inhibitors and paraffin inhibitors, are essential for addressing challenges such as equipment corrosion, emulsions, and scale formation, which are prevalent in Canadian oilfields. The increasing exploration of offshore reserves and mature onshore fields further drives the demand for production chemicals. Additionally, the focus on maintaining production efficiency and reducing downtime aligns with the use of specialized oilfield chemicals, driving the segment’s leading position in the market.

The enhanced oil recovery segment is expected to witness the highest CAGR during the projected period due to the growing emphasis on maximizing output from mature and declining oilfields in Canada. Enhanced oil recovery (EOR) techniques rely heavily on oilfield chemicals such as polymers, surfactants, and alkali agents to improve oil displacement and extraction efficiency. The increasing adoption of tertiary recovery methods, especially in Canada's unconventional reservoirs, is driving the demand for these chemicals. Moreover, advancements in EOR technologies, coupled with the rising need to optimize resource utilization and reduce environmental impact, are accelerating the segment’s expansion.

Canadian Oilfield Chemicals Market – Key Players and Competitive Insights

The competitive landscape of the Canadian oilfield chemicals market is characterized by the presence of major players focusing on meeting the specific needs of Canada’s oil and gas industry. Key players compete based on product innovation, sustainability, and tailored chemical formulations to address challenges such as harsh environmental conditions and complex reservoirs. Companies are increasingly investing in research and development to create eco-friendly and performance-enhancing solutions, complying with Canada’s stringent environmental regulations. Strategic collaborations and mergers and acquisitions are prevalent, enabling firms to expand their product portfolios and market presence. Additionally, advancements in enhanced oil recovery and water treatment applications are driving competition in niche segments, shaping the market dynamics.

BASF is a global chemical corporation operating across seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. The chemicals segment provides petrochemicals and intermediates, while the materials segment offers advanced materials and their precursors, such as isocyanates and polyamides, for various applications. It also supplies inorganic basic products and specialties for the plastic and plastic processing industries. BASF delivers advanced solutions for drilling, cementing, production, stimulation, and enhanced oil recovery, focusing on high-performance products such as surfactants, polymers, and corrosion inhibitors. These solutions enhance operational efficiency while addressing environmental sustainability. BASF’s innovative portfolio aligns with the demands of the Canadian oilfield chemicals market, emphasizing eco-friendly and efficient chemical applications.

Dow Inc. (Dow) is a material science company operating through its wholly owned subsidiary, The Dow Chemical Co (TDCC). Its product portfolio includes plastics, performance materials, coatings, silicones, and industrial intermediates. Dow offers a range of products and solutions for customers in packaging, infrastructure, mobility, and consumer care segments. The company’s products are used in home and personal care, durable goods, adhesives and sealants, coatings, and food and specialty packaging. Dow Inc. is also active in the oilfield chemicals market, providing a wide range of solutions for oil and gas production, including drilling fluids, production chemicals, and enhanced oil recovery. The company’s innovative products help improve operational efficiency, reduce environmental impact, and increase production performance.

List of Key Companies in Canadian Oilfield Chemicals Market

- Akzo Nobel N.V.

- Baker Hughes

- BASF

- Croda International Plc

- Dow

- DuPont

- Nouryon

- Solvay S.A.

- Stepan Company

- The Lubrizol Corporation

Canadian Oilfield Chemicals Industry Developments

In May 2024, Dow, the State of Wyoming, and the University of Wyoming partnered to improve oil recovery techniques by using advanced technologies and research methods to enhance extraction efficiency from existing reserves.

In May 2024, BASF expanded the production capacity of its Basoflux line of paraffin inhibitors. This investment highlights BASF's commitment to advancing innovative and sustainable aqueous-based dispersions tailored for the oil & gas sector.

Canadian Oilfield Chemicals Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Corrosion & Scale Inhibitors

- Demulsifiers

- Biocides

- Surfactants

- Polymers

By Application Outlook (Revenue, USD Million, 2020–2034)

- Drilling

- Production

- Cementing

- Enhanced Oil Recovery

- Water Treatment

- Hydraulic Fracturing

- Workover and Completion

Canadian Oilfield Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,696.69 million |

|

Market Size Value in 2025 |

USD 1,756.93 million |

|

Revenue Forecast by 2034 |

USD 2,436.47 million |

|

CAGR |

3.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The Canadian oilfield chemicals market size was valued at USD 1,696.69 million in 2024 and is projected to grow to USD 2,436.47 million by 2034.

The market is projected to register a CAGR of 3.7% during the forecast period.

Some of the key players in the market are Akzo Nobel N.V.; Baker Hughes; BASF; Croda International Plc; Dow; DuPont; Nouryon; Solvay S.A.; Stepan Company; and The Lubrizol Corporation.

In 2024, the corrosion & scale inhibitors segment accounted for the largest market share due to the increasing need to protect critical infrastructure in oil and gas operations.

The production segment held the largest market share in 2024 due to the critical role of production chemicals in maintaining and optimizing hydrocarbon output from oil and gas wells.