Oilfield Chemicals Market Size, Share, Trends, Industry Analysis Report

By Product (Rheology Modifiers, Inhibitors, Others); By Application; By Location; By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 125

- Format: PDF

- Report ID: PM1134

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

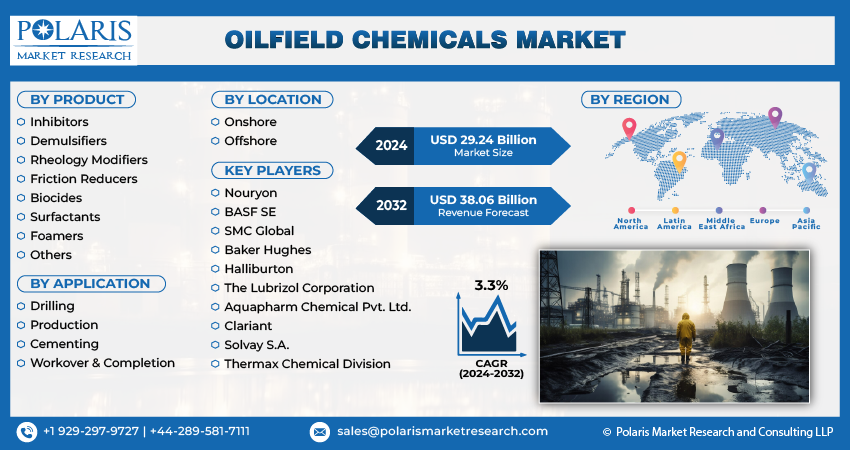

The global oilfield chemicals market was valued at USD 32.07 billion in 2024 and is projected to grow at a CAGR of 4.50% from 2025 to 2034. This growth is driven by the resurgence in oil exploration and production activities, particularly in mature and aging wells, and technological advancements in drilling operations.

Market Insights

- Base on application, the workover & completion segment is expected to record a significant CAGR during the forecast period. Workover (maintaining, repairing, or enhancing a well after its initial drilling) and completion (preparing a well for production) require specialized chemicals to optimize well performance, prevent corrosion, enhance production efficiency, and manage reservoir conditions.

- The rheology modifiers segment dominated the market by product in 2024 due to their major role in managing crucial characteristics such as yield, stress, viscosity, responsiveness to change, and the time taken for relaxation of oil wells.

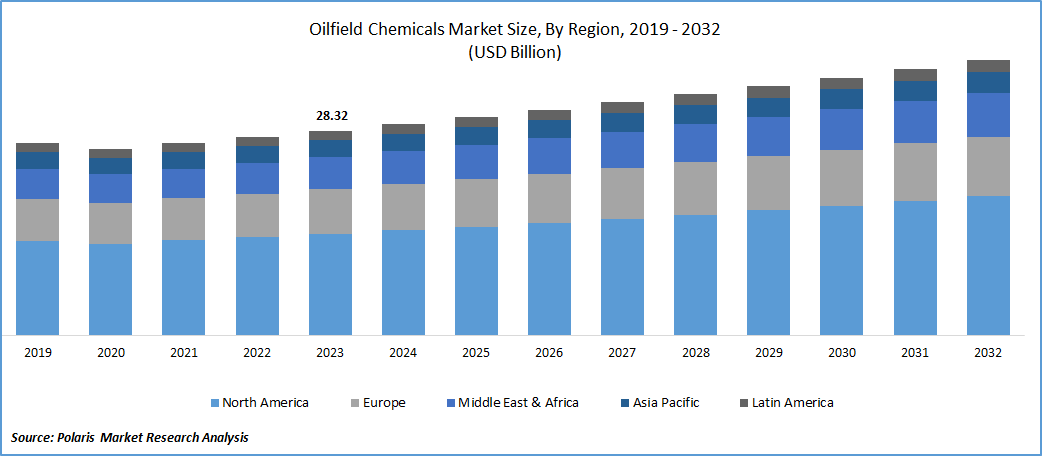

- In 2024, North America dominated the market. Canada, ranking as the world's fourth-largest producer of crude oil, makes a significant contribution to its growth.

- The oilfield chemicals industry in Asia Pacific is expected to record the highest CAGR during the forecast period, driven by ramped-up exploration and production activities in offshore and onshore oil and gas fields.

Industry Dynamics

- The oilfield gas market is growing with rising investments in offshore drilling. Offshore drilling serves as a means to access untapped reserves, particularly in deepwater areas, amid soaring global energy demands.

- Burgeoning energy usage in the transportation, manufacturing, and power generation sectors necessitates oil & gas players to ramp up their operations, which in turn bolsters the demand for oilfield chemicals.

- Preference for the implementation of modern oil recovery techniques has led to an upsurge in onshore exploration activities, particularly in developing countries, which creates future growth opportunities for oilfield chemical businesses.

- The high cost of manufacturing these chemicals and ensuring adherence to quality standards limits the growth of the oilfield chemicals industry.

Market Statistics

Market Size in 2024: USD 32.07 billion

Projected Market Size in 2034: USD 49.77 billion

CAGR, 2025–2034: 4.5%

Largest Regional Market, 2024: North America

AI Impact on Oilfield Chemicals Market

- AI-based simulations can analyze well conditions, reservoirs, and drilling parameters to suggest the right chemical type and dosage, reducing wastage and lowering costs.

- AI tools can be deployed to predict equipment degradation by monitoring corrosion, scaling, or fouling, creating the scope for proactive chemical treatment strategies.

- In chemical manufacturing, AI simulations can assist in designing and optimizing polymers, surfactants, and other formulations.

- AI-aided R&D can lead to eco-friendly chemicals for oilfield applications through performance and environmental impact modelling. The use of chemicals is important for adherence to stricter regulatory and ESG requirements in oilfields.

- By integrating AI with IoT sensors in wells and pipelines, operators can automate chemical monitoring.

To Understand More About this Research: Request a Free Sample Report

Oil field chemicals are specialized chemical substances used in the exploration, drilling, production, and refining of oil and gas to enhance efficiency, prevent corrosion, improve flow, and ensure safety in the oil field operations.

The demand for oilfield chemicals is driven by resurgence in oil exploration and production activities, fueled by the shale gas revolution and advancements in technology enabling the extraction of oil and gas from mature and aged wells. Oilfield chemicals are integral to multiple stages of crude oil production, playing a vital role in enhancing the efficiency, safety, and environmental sustainability of oilfield operations. These chemicals are employed in various processes, including drilling, production, well stimulation, and reservoir recovery. Their application contributes to optimizing extraction processes, ensuring the safety of operations, and adhering to environmental standards.

Advancements in technology, the adoption of enhanced oil recovery techniques, and a growing global demand for oil products have led to an uptick in onshore exploration activities worldwide, particularly in developing economies. The Oil and Gas Producers Association in Brazil (ABPIP) notes that small and medium-sized oil companies in Brazil are projected to invest approximately USD 7.74 billion in onshore fields by 2029. This reflects a trend where industry players are directing significant investments in onshore exploration to meet the rising demand for oil and capitalize on technological advancements in the sector.

Market Dynamics

Rising Investment in Offshore Drilling

The oilfield gas market is growing due to rising investments in offshore drilling. For instance, USD 75 million was invested in the offshore segment through the Emissions Reduction Fund (ERF) in Canada. Offshore drilling offers a way to access untapped reserves, particularly in deepwater areas, as global energy demand increases. Technological advancements in drilling and mining equipment and techniques have made offshore operations more efficient and cost-effective, attracting more investment. Additionally, as onshore reserves decline, offshore fields are becoming a major source of new gas production. Government incentives and favorable policies also encourage investment in offshore drilling. Rising oil prices further make these expensive projects financially viable, boosting growth in the oilfield chemicals market.

Rising Energy Demand

Global energy consumption continues to rise due to population growth and industrialization, driving an increased demand for oil and gas production. According to the Indian Ministry of Power, Energy demand in India alone has increased by 8.6% to 11,02,887 MU in 2023 from 10,15,908 MU in 2022. This surge necessitates efficient and effective oilfield chemicals to support exploration, drilling, production, and refining processes. Chemicals play a major role in maintaining well integrity, enhancing extraction methods, and improving the overall efficiency of oilfield operations. Growing energy needs across sectors such as transportation, manufacturing, and power generation ensure the oil & gas industry remains a key player, further fueling the demand for oilfield chemicals.

Segment Analysis

Market Assessment by Application

The oilfield chemicals market segmentation, based on application, includes drilling, production, cementing, and workover & completion. The workover & completion segment is expected to witness significant growth during the forecast period. Workover refers to the process of maintaining, repairing, or enhancing a well after its initial drilling, while completion involves preparing the well for production. Both stages require specialized chemicals to optimize well performance, prevent corrosion, enhance production efficiency, and manage reservoir conditions. The demand for chemicals used in workover and completion processes will increase as global oil and gas production continues to rise and operators focus on maximizing well output, driving the segment growth.

Market Evaluation by Product

The oilfield chemicals market segmentation, based on product, includes inhibitors, demulsifiers, rheology modifiers, friction reducers, biocides, surfactants, foamers, and others. The rheology modifiers segment dominated the market in 2024 due to the major role of rheology modifiers in modifying the rheological properties of oil wells. They serve as additives in synthetic-based drilling fluids, as well as in water and oil emulsions. Rheology pertains to the deformation and flow of materials under applied stress or force. In the context of an oil well, rheological properties encompass crucial characteristics such as yield, stress, viscosity, responsiveness to change, and the time taken for relaxation. Additionally, micro-fibrillated cellulose (MFC) is a major rheological modifier in oilfield operations. It offers stabilization under low shear rates while maintaining ease of pumping compared to alternatives such as xanthan gum, due to its high viscosity.

Regional Insights

By region, the study provides the oilfield chemicals market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market. Canada boasts a robust offshore oil and gas industry, ranking as the world's fourth-largest producer of crude oil. The country hosts significant oil-producing facilities, particularly in the provinces of Alberta, where the oil reserves amount to approximately 161.7 billion barrels, and British Columbia, with a crude oil production of around 12,000 barrels per day in 2021. The primary locations for offshore oil exploration in Canada are concentrated in the regions of Labrador & Newfoundland, hosting six major exploration sites. About 30% of the total crude oil produced in Canada undergoes domestic processing, while the remaining portion is refined & purified at the US refineries.

The oilfield chemicals industry in Asia Pacific is expected to record the highest CAGR during the forecast period, driven by increasing exploration and production activities in offshore and onshore oil and gas fields. Countries such as China, India, Australia, and Indonesia are major contributors to the market, with growing investments in energy infrastructure and technological advancements. The region's expanding industrial base, coupled with rising energy demand, is propelling the need for efficient oilfield chemicals. Moreover, strict environmental regulations and the growing need for enhanced oil recovery (EOR) are accelerating the adoption of these chemicals in various oilfield operations across Asia Pacific.

The market in India is growing rapidly, due to its growing oil and gas exploration activities and rising energy demand. The country’s expanding offshore exploration in the Krishna-Godavari Basin and the increasing number of onshore fields require efficient oilfield chemicals to optimize drilling and production processes. India’s energy demand, driven by industrialization and population growth, is fueling the demand for oil and gas, further boosting the need for these chemicals. Additionally, government initiatives such as “Make in India” are encouraging foreign investments in the oil and gas sector, contributing to the market expansion in India.

Key Players and Competitive Analysis

The oilfield chemicals market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the oilfield chemical industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players in the market include Nouryon, BASF SE, SMC Global, Baker Hughes, Halliburton, The Lubrizol Corporation, Aquapharm Chemical Pvt. Ltd., Clariant, Solvay S.A., and Thermax Chemical Division.

BASF is a chemical corporation that operates all across the world. It operates through seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. BASF offers advanced solutions for drilling, cementing, production, stimulation, and enhanced oil recovery. The company focuses on delivering high-performance products such as surfactants, polymers, and oil and gas corrosion protection that enhance operational efficiency while addressing environmental sustainability. BASF’s innovative portfolio aligns with the demands of the oilfield chemicals market, emphasizing eco-friendly and efficient chemical applications.

Clariant AG is a Swiss multinational company specializing in specialty chemicals. Founded in 1995 as a spin-off from Sandoz, the company is headquartered in Muttenz, Switzerland, and operates in over 36 countries with more than 10,400 employees as of 2024. The company focuses on developing chemical products that address various industrial and consumer needs, with attention to environmental and regulatory considerations. Clariant’s operations are divided into three main segments: Care Chemicals, Catalysts, and Adsorbents & Additives. The Care Chemicals segment supplies specialty chemicals used in personal and home care products, crop protection, lubricants, paints, coatings, and automotive fluids. The Catalysts segment provides catalyst technologies used in chemical processes such as biofuel production, petrochemicals, and specialty chemicals manufacturing. The Adsorbents & Additives segment produces materials used for purification, foundry applications, cargo protection, and additives for coatings, adhesives, and polymers. These products serve a variety of industries, including agriculture, automotive, aviation, construction, electronics, energy, healthcare, mining, packaging, and textiles. Clariant has a global presence with manufacturing and research facilities located in Europe, North and South America, China, and India. Clariant Oil Services supplies specialty chemicals for oilfield production, including solutions for enhanced oil recovery, corrosion inhibition, demulsification, scale and wax control, water clarification, and flow assurance across global oil and gas operations.

List of Key Companies in Oilfield Chemicals Market

- Aquapharm Chemical Pvt. Ltd.

- Baker Hughes

- BASF SE

- Clariant

- Halliburton

- Nouryon

- SMC Global

- Solvay S.A.

- The Lubrizol Corporation

- Thermax Chemical Division

Oilfield Chemicals Industry Developments

In May 2024, BASF announced the expansion of its Basoflux paraffin inhibitor production capacity at its Tarragona, Spain site. The investment aimed to meet growing global demand, with the first deliveries expected in early 2025, supporting sustainable oilfield solutions.

In May 2024, BASF expanded the production capacity of its Basoflux line of paraffin inhibitors. This investment highlights BASF to advancing innovative and sustainable aqueous-based dispersions tailored for the oil & gas sector.

Oilfield Chemicals Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Inhibitors

- Demulsifiers

- Rheology Modifiers

- Friction Reducers

- Biocides

- Surfactants

- Foamers

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Drilling

- Production

- Cementing

- Workover & Completion

By Location Outlook (Revenue USD Billion, 2020–2034)

- Onshore

- Offshore

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Oilfield Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 32.07 billion |

|

Market Size Value in 2025 |

USD 33.51billion |

|

Revenue Forecast in 2034 |

USD 49.77 billion |

|

CAGR |

4.50% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The market size was valued at USD 32.07 billion in 2024 and is projected to grow to USD 49.77 billion by 2034.

The global market is projected to record a CAGR of 4.50% during the forecast period.

North America held the largest share in the global market in 2024.

A few key players are Nouryon, BASF SE, SMC Global, Baker Hughes, Halliburton, The Lubrizol Corporation, Aquapharm Chemical Pvt. Ltd., Clariant, Solvay S.A., and Thermax Chemical Division.

The rheology modifiers segment dominated the market in 2024, due to the major role of rheology modifiers in modifying the rheological properties of oil wells.

The workover & completion segment is expected to witness significant growth during the forecast period, attributed to the utilization of workover and completion chemicals by oil companies post-oil extraction from wells.