External Catheter Market Size, Share, Trends, Industry Analysis Report

By Product (Self-Adhesive, Non-Adhesive), By Material, By Gender, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6111

- Base Year: 2024

- Historical Data: 2020-2023

Overview

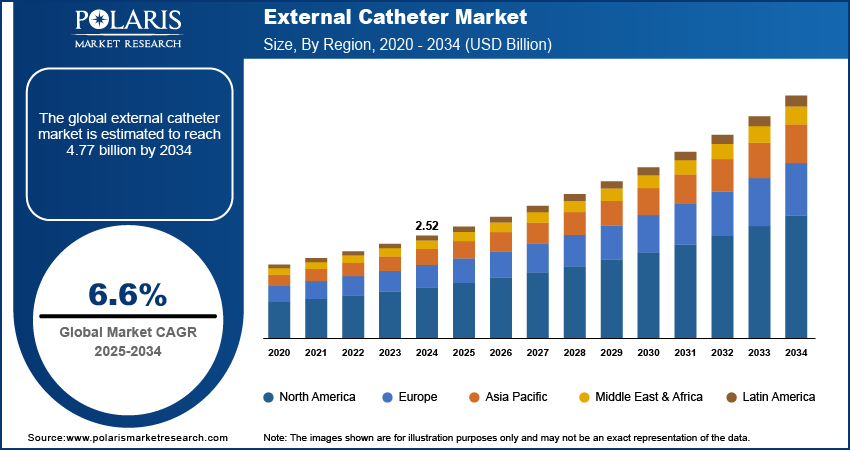

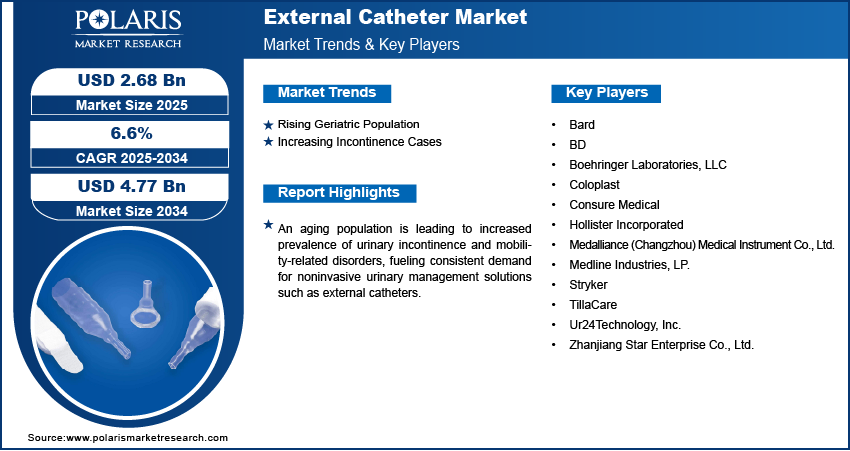

The global external catheter market size was valued at USD 2.52 billion in 2024, growing at a CAGR of 6.6% from 2025 to 2034. An aging population is leading to increased prevalence of urinary incontinence and mobility-related disorders, fueling consistent demand for noninvasive urinary management solutions such as external catheters.

Key Insights

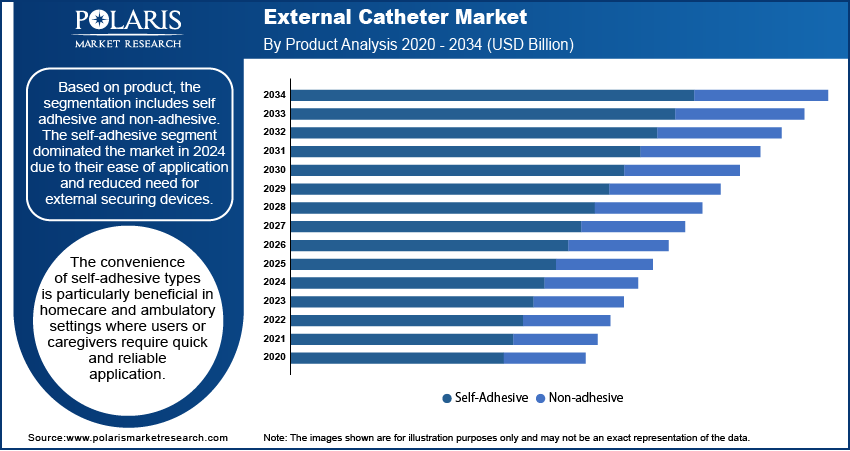

- The self-adhesive segment dominated the market in 2024 due to its ease of application and reduced need for external securing devices.

- The silicone segment held the largest revenue share in 2024 due to its biocompatibility, durability, and low risk of allergic reactions.

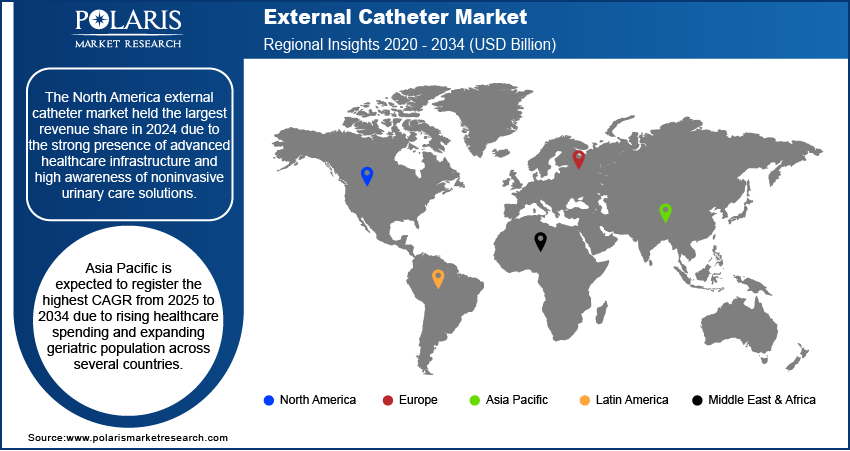

- The North America external catheter market held the largest revenue share in 2024 due to the strong presence of advanced healthcare infrastructure and high awareness of noninvasive urinary care solutions.

- The U.S. dominated the North America market in 2024 due to high volumes of medical procedures.

- The industry in Asia Pacific is expected to register the highest CAGR from 2025 to 2034 due to rising healthcare spending and expanding geriatric population across several countries.

- China led in Asia Pacific in 2024 due to increasing awareness of noninvasive medical devices and expanding access to healthcare services.

- The market in Europe is increasing steadily due to its aging population and growing focus on improving long-term care standards.

Industry Dynamics

- Rising prevalence of urinary incontinence and growing preference for noninvasive solutions are driving market growth globally.

- Increasing adoption in home healthcare settings and expanding geriatric population are key factors boosting demand.

- The market has a strong opportunity in emerging economies where aging populations and improved healthcare access are increasing.

- High product costs and limited awareness in rural and low-income regions restrict widespread adoption of external catheters.

Market Statistics

- 2024 Market Size: USD 2.52 billion

- 2034 Projected Market Size: USD 4.77 billion

- CAGR (2025–2034): 6.6%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The external catheter market refers to the industry focused on the production and distribution of noninvasive urinary drainage devices worn outside the body, primarily by male patients. These catheters are widely used in managing urinary incontinence, post-surgical care, and long-term chronic conditions, offering a lower risk of infection compared to indwelling catheters. Growing incidence of incontinence due to chronic illnesses, neurological disorders, and post-operative conditions is supporting adoption of external catheters, especially among patients requiring long-term care.

Technological advancements in catheter design such as skin-friendly adhesives, breathable materials, and ergonomic designs are improving comfort and usability, enhancing product adoption across homecare and hospital settings. Moreover, the rising preference for home healthcare in chronic disease management is driving demand for easy-to-use, hygienic, and disposable external catheters to reduce hospital dependency.

Drivers and Opportunities

Rising Geriatric Population: Rising life expectancy and a growing elderly population are key factors contributing to the increased demand for external catheters. The World Health Organization (WHO) projects that the global population aged 60 and above will rise from 1.1 billion in 2023 to 1.4 billion by 2030. Older adults are more likely to experience conditions such as urinary incontinence, limited mobility, and chronic diseases that impact bladder control. These issues often require long-term urinary management solutions that are effective and comfortable. External catheters offer a noninvasive option that reduces the risk of urinary tract infections and skin irritation. Their ease of use also makes them suitable for both homecare and clinical settings, supporting patient dignity and caregiver convenience. Healthcare providers are increasingly incorporating these devices into geriatric care routines.

Increasing Incontinence Cases: Increasing cases of urinary incontinence are becoming more common among patients dealing with chronic illnesses, neurological conditions, or recovering from surgery. The World Health Organization (WHO) reports that neurological disorders impact over one-third of the global population, positioning them as the primary contributors to morbidity and disability across various demographics. These individuals often struggle with bladder control, requiring reliable solutions that don't compromise their quality of life. External catheters provide a practical alternative to invasive methods, particularly for those in long-term care facilities or rehabilitation centers. They minimize discomfort, lower infection risks, and reduce the need for frequent interventions by healthcare staff. Their growing use is also linked to rising awareness around better urinary hygiene and patient-centered care. The trend is expected to continue as more patients seek safe and manageable options.

Segmental Insights

Product Analysis

Based on product, the segmentation includes self-adhesive and non-adhesive. The self-adhesive segment dominated the market in 2024 due to their ease of application and reduced need for external securing devices. These products are designed to stick directly to the skin, offering a more streamlined and secure fit, which helps in minimizing leakage and enhancing user comfort. The convenience of self-adhesive types is particularly beneficial in homecare and ambulatory settings where users or caregivers require quick and reliable application. Growing demand from elderly patients and those with limited mobility further supports the segment’s dominance, as these catheters simplify urinary management while maintaining hygiene standards and reducing complications.

The non-adhesive segment is expected to register a higher CAGR from 2025 to 2034, driven by rising adoption among patients with sensitive or allergy-prone skin. These catheters are suitable for individuals who experience irritation from adhesives or who require frequent catheter replacement. Their compatibility with external securing devices offers flexibility in fit and comfort, making them an ideal choice in long-term care scenarios. Increased awareness among healthcare providers regarding patient-specific needs is contributing to the popularity of customizable options. Expanding use in institutional settings where skin tolerance varies across patients is expected to sustain this segment's accelerated growth over the forecast period.

Material Analysis

In terms of material, the segmentation includes silicone, latex, and others. The silicone segment held the largest revenue share in 2024 due to their biocompatibility, durability, and low risk of allergic reactions. These catheters are widely preferred in both clinical and home settings as they provide a comfortable user experience while ensuring high functionality over prolonged periods. Their flexibility and resistance to kinking make them suitable for continuous use, especially in elderly or long-term care patients. Rising awareness about the benefits of silicone particularly its reduced likelihood of causing skin breakdown or irritation is encouraging hospitals and care providers to standardize its use across multiple patient demographics.

The latex segment is expected to register the highest CAGR from 2025 to 2034 due to their lower cost and high elasticity, making them ideal for short-term applications. Despite increasing concerns about latex allergies, many users and institutions prefer them for their performance and fit. Technological improvements in manufacturing have led to enhanced safety, including better coatings and hypoallergenic variants, which is broadening their use. Their growing acceptance in low-resource settings and cost-sensitive healthcare environments is driving demand. Additionally, rising use in temporary recovery scenarios, such as post-surgical care, is contributing to the segment’s anticipated growth trajectory.

Gender Analysis

In terms of gender, the segmentation includes male and female. The male segment held a larger revenue share in 2024 due to the greater prevalence of urinary incontinence among older male populations. The anatomical compatibility and wide product availability, tailored to male patients, have driven consistent adoption across home and clinical settings. Products for male use are typically easier to design for secure and leak-proof application, resulting in higher user satisfaction and better clinical outcomes. Additionally, longstanding familiarity among healthcare professionals and patients has supported the segment’s dominance. Growing preference for noninvasive alternatives to indwelling catheters is further sustaining demand for male external catheter solutions.

The female segment is expected to register the highest CAGR from 2025 to 2034, fueled by increasing innovation in gender-specific product design. Traditional challenges related to anatomical fit and leakage control are being addressed through newer, ergonomically designed systems. Rising awareness among women about available noninvasive solutions and an aging female demographic are key contributors to growing demand. Hospitals and long-term care facilities are also adopting female-specific products to reduce the risks of infection and improve comfort. These developments are gradually overcoming historical barriers to female adoption, resulting in expanded usage across outpatient and institutional care.

End Use Analysis

In terms of end use, the segmentation includes home care, hospitals, and others. The home care segment accounted for the largest revenue share in 2024 due to the growing aging population and the shift toward decentralized healthcare. Patients managing chronic conditions or recovering from surgery prefer external catheters for their convenience and ease of use in nonclinical environments. Caregivers find these products simple to manage, which improves overall care efficiency and reduces dependency on institutional facilities. Increased availability of home-use kits and growing support from healthcare payers for home-based care are also key contributors. The preference for dignity-preserving, low-maintenance solutions is making home care the most prominent application segment.

The hospitals segment are projected to grow significantly from 2025 to 2034 due to the rising incidence of post-operative urinary incontinence and mobility impairments. Acute care settings demand reliable and hygienic urinary solutions to prevent hospital-acquired infections (HAIs) and support patient recovery. External catheters reduce the need for invasive procedures, lowering infection risks while improving patient outcomes. Their role in short-term use during hospitalization particularly among elderly, post-operative, or immobilized patients is gaining more attention among healthcare providers. Increased focus on patient-centered care and hospital workflow efficiency is leading to broader adoption of external catheter systems in medical institutions.

Regional Analysis

The North America external catheter market held the largest revenue share in 2024 due to the strong presence of advanced healthcare infrastructure and high awareness of noninvasive urinary care solutions. Hospitals and long-term care centers are increasingly standardizing external catheter use to reduce infection rates and improve patient comfort. Widespread insurance coverage and favorable reimbursement frameworks support broader adoption across clinical and home care settings. The region also benefits from a mature medical device distribution network and active health education programs, encouraging timely diagnosis and treatment of urinary disorders. These factors continue to drive consistent demand and solidify the region’s market dominance.

U.S. External Catheter Market Insights

The U.S. dominated the North America market due to the increasing prevalence of age-related urinary incontinence and mobility impairments among the elderly. A large base of long-term care facilities and home healthcare services is supporting steady product utilization. Investments in noninvasive patient care technologies is rising across public and private health systems, encouraging the shift toward external catheter solutions. The rapid adoption of patient-centered care models and growing clinical focus on reducing catheter-associated infections are accelerating demand. Strong manufacturer presence and active regulatory engagement are also enhancing product availability and quality, reinforcing the U.S. position as a key contributor to market value.

Asia Pacific External Catheter Market

The market in Asia Pacific is expected to register the highest CAGR from 2025 to 2034 due to rising healthcare spending and expanding geriatric population across several countries. The National Bureau of Statistics of China reported that individuals aged 60 and above account for nearly 20% of the total population, a figure expected to increase in the coming years. Increasing cases of incontinence and mobility-related disorders are pushing demand for convenient and hygienic urinary solutions. Efforts to modernize public health infrastructure are creating new opportunities for external catheter adoption in both hospital and home settings. Government programs promoting elderly care and chronic disease management are also supporting the uptake of assistive medical devices. These combined trends are accelerating regional growth and attracting international investments in localized manufacturing and distribution.

China External Catheter Market Overview

China led the Asia Pacific market in 2024 due to increasing awareness of noninvasive medical devices and expanding access to healthcare services. China’s government has invested heavily in modernizing healthcare facilities, with policies such as the Healthy China 2030 initiative aiming to enhance medical services and expand universal healthcare coverage. Urbanization and income growth have improved demand for personalized and comfortable medical care options. External catheters are gaining traction in hospitals, rehabilitation centers, and homecare environments due to their ease of use and lower risk of infection. Domestic production capacity is growing, leading to better product affordability and faster distribution. Medical device regulations are evolving to support innovation, which is encouraging the adoption of advanced urinary care technologies. These dynamics position China as a critical growth engine in the regional market.

Europe External Catheter Market Assessment

The industry in Europe is increasing steadily due to its aging population and growing focus on improving long-term care standards. Healthcare systems are actively promoting noninvasive alternatives to indwelling catheters to lower the incidence of urinary tract infections. External catheters are being adopted in elderly care homes, post-operative units, and outpatient settings to support patient dignity and reduce hospital stays. The integration of assistive technologies into routine care and the presence of favorable reimbursement policies are also supporting market expansion. Investments in healthcare worker training and device quality control are reinforcing patient trust, leading to a stable and growing demand for external catheter solutions across the region.

Key Players and Competitive Analysis

The competitive landscape of the external catheter market reflects a dynamic environment shaped by rapid product innovation, technology advancements, and evolving user needs. Industry analysis highlights a growing emphasis on designing catheters with improved comfort, skin-friendly adhesives, and longer wear times to reduce the risk of leakage and skin irritation. Market participants are pursuing expansion strategies through targeted mergers and acquisitions aimed at strengthening their product portfolios and geographic reach. Strategic alliances between medical device manufacturers and healthcare providers are enhancing clinical validation and accelerating market entry for newer designs. Joint ventures focused on local manufacturing in emerging markets are gaining traction to improve cost-effectiveness and ensure timely distribution.

Post-merger integration efforts are streamlining supply chains and harmonizing regulatory processes across borders. Research and development (R&D) investments are rising across the sector, driving development of breathable materials and gender-specific designs to increase adoption among diverse patient populations. Increasing demand from home care settings is prompting companies to adopt direct-to-consumer models, supported by digital platforms for education and remote ordering. Sustainability goals are also influencing material selection and packaging strategies. These competitive moves are collectively reshaping the global external catheter market, driving innovation while responding to clinical, economic, and regulatory pressures.

Key Players

- Bard

- BD

- Boehringer Laboratories, LLC

- Coloplast

- Consure Medical

- Hollister Incorporated

- Medalliance (Changzhou) Medical Instrument Co., Ltd.

- Medline Industries, LP.

- Stryker

- TillaCare

- Ur24Technology, Inc.

- Zhanjiang Star Enterprise Co., Ltd.

External Catheter Industry Developments

August 2024: Avalon’s Laboratory Services Management Services Organization (MSO) initiated the marketing of its proprietary FDA-registered external male catheter device.

November 2022: Ur24Technology launched its innovative ‘TrueClr’ external catheter line, designed to enhance comfort and effectiveness in urinary management.

External Catheter Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Self-Adhesive

- Non-Adhesive

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Silicone

- Latex

- Others

By Gender Outlook (Revenue, USD Billion, 2020–2034)

- Male

- Female

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Home Care

- Hospitals

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

External Catheter Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.52 billion |

|

Market Size in 2025 |

USD 2.68 billion |

|

Revenue Forecast by 2034 |

USD 4.77 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.52 billion in 2024 and is projected to grow to USD 4.77 billion by 2034.

The global market is projected to register a CAGR of 6.6% during the forecast period.

The North America external catheter market held the largest revenue share in 2024 due to the strong presence of advanced healthcare infrastructure and high awareness of noninvasive urinary care solutions.

A few of the key players in the market are Bard; BD; Boehringer Laboratories, LLC; Coloplast; Consure Medical; Hollister Incorporated; Medalliance (Changzhou) Medical Instrument Co., Ltd.; Medline Industries, LP.; Stryker; TillaCare; Ur24Technology, Inc.; and Zhanjiang Star Enterprise Co., Ltd.

The self-adhesive segment dominated the market in 2024 due to their ease of application and reduced need for external securing devices.

The home care segment accounted for the largest revenue share in 2024 due to the growing aging population and the shift toward decentralized healthcare.