Sludge Dewatering Equipment Market Size, Share, Trends, Industry Analysis Report

By Technology Type (Belt Filter Press, Centrifuges, Screw Press, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM6104

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

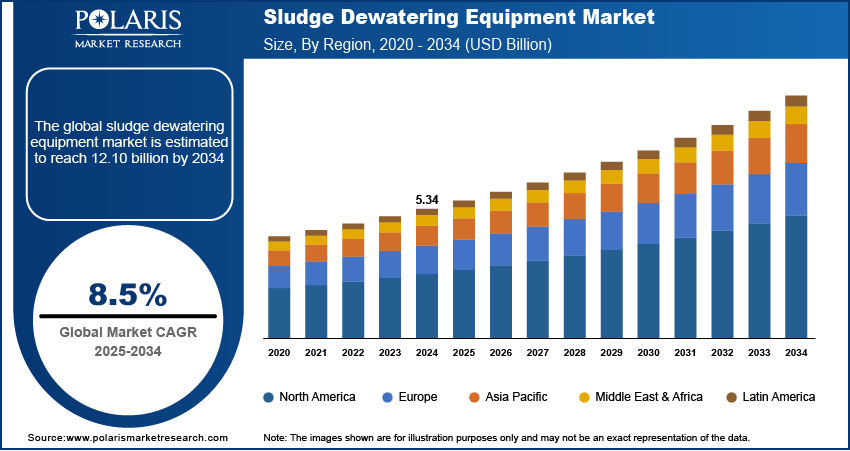

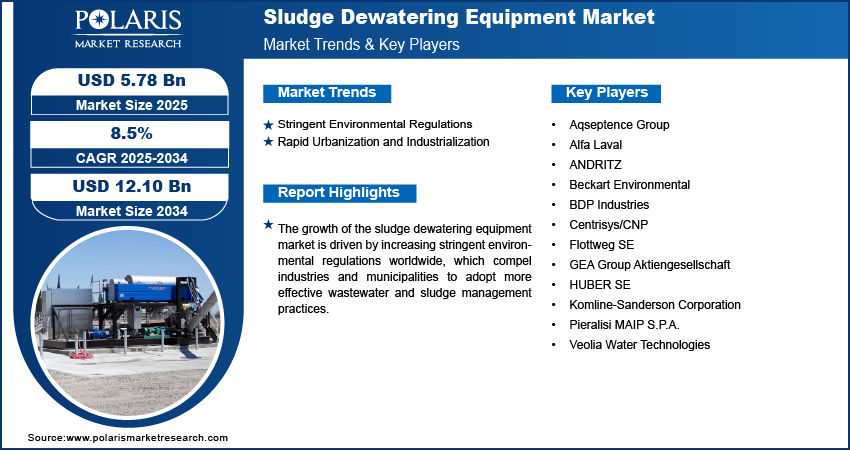

The global sludge dewatering equipment market size was valued at USD 5.34 billion in 2024 and is anticipated to register a CAGR of 8.5% from 2025 to 2034. Stricter environmental rules prompt industries and cities to manage wastewater better. Also, increasing population in cities and growing industrialization lead to wastewater generation, propelling the need for efficient sludge treatment.

Key Insights

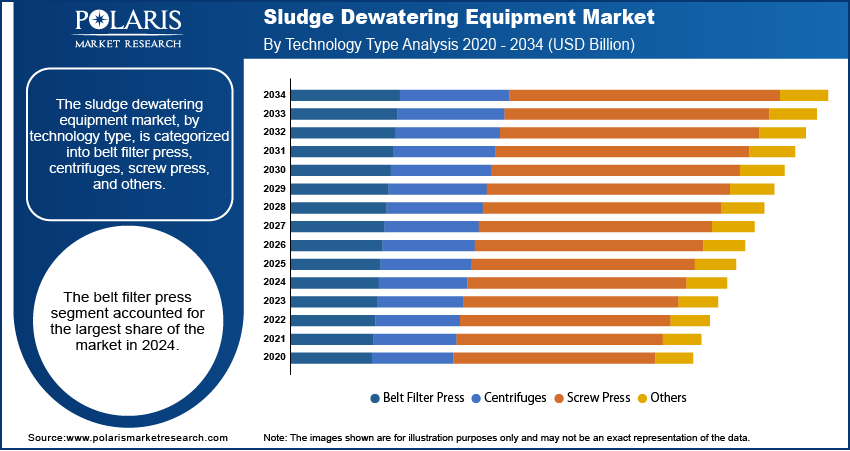

- By technology type, the belt filter presses segment held the largest share in 2024. These systems are widely favored, especially in municipal wastewater treatment plants and certain industrial applications.

- By application, the municipal segment held the largest share in 2024. This is driven by the vast and ever-increasing volume of wastewater generated from urban populations and residential areas globally, requiring extensive and continuous sludge management solutions.

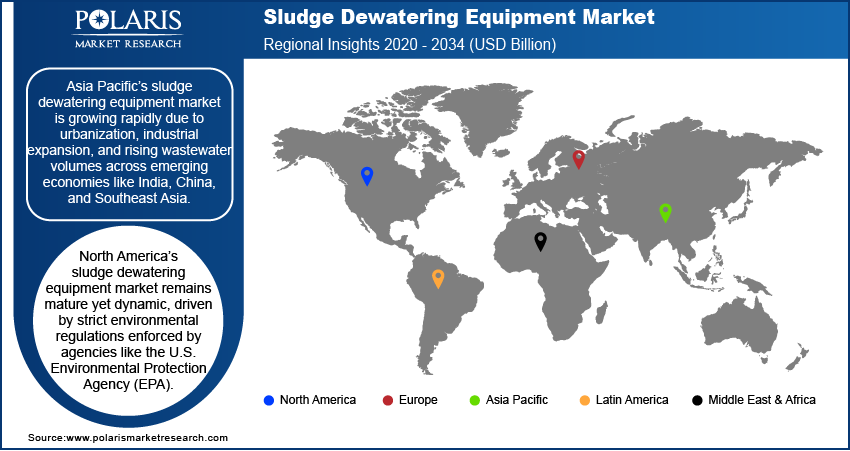

- Asia Pacific held the largest share in 2024 and is rapidly becoming a significant region for the sludge dewatering equipment business. This growth is propelled by rapid urbanization and substantial industrial development across its emerging economies, leading to a massive increase in wastewater generation.

Industry Dynamics

- The imposition of stringent environmental regulations on wastewater treatment drives the market growth.

- The rising volume of wastewater from growing urban areas and industries increases the need for effective treatment.

- Advances in dewatering technologies offer more efficient and cost-effective solutions for sludge management.

- A greater focus on using resources again and cutting down on waste disposal costs also drives demand.

Market Statistics

- 2024 Market Size: USD 5.34 billion

- 2034 Projected Market Size: USD 12.10 billion

- CAGR (2025–2034): 8.5%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Sludge dewatering equipment refers to mechanical systems that remove water from sludge, a semi-solid byproduct of wastewater treatment. This process reduces the volume and weight of the sludge, making it easier and more affordable to handle, transport, and dispose of.

One important factor is the increasing focus on operational cost savings for wastewater treatment plants, packaged wastewater treatment plants, and industrial facilities. Dewatering sludge significantly cuts down on the costs associated with transporting and disposing of this waste, as a drier material is much lighter and takes up less space. This translates into considerable savings for operators.

The U.S. Environmental Protection Agency (EPA) highlights that sludge management can account for a significant portion of a wastewater treatment plant's total operating costs, often ranging from 30% to 50%. By efficiently dewatering sludge, plants can lower these costs. Another less dominant but important driver is the growing trend of resource recovery from wastewater sludge. As facilities seek to convert sludge into valuable products such as biogas or fertilizers, effective dewatering becomes a crucial first step in these processes.

Drivers and Opportunities

Stringent Environmental Regulations: Governments and environmental agencies worldwide are establishing increasingly stringent standards for wastewater discharge and the disposal of sewage sludge. These regulations aim to protect water bodies from pollution and reduce the environmental impact of industrial and municipal waste. This includes limits on the amount of pollutants allowed in treated wastewater and requirements for how solid waste, or sludge, must be processed before it can be safely disposed of or reused.

Compliance with these stricter rules often requires advanced treatment processes that reduce the volume and improve the quality of sludge. For instance, the U.S. Environmental Protection Agency (EPA) has continuously updated its regulations for sewage sludge use and disposal, as detailed in "Sewage Sludge Laws and Regulations" on the EPA website. These regulations, specifically 40 CFR Part 503, establish strict pollutant limits, pathogen reduction requirements, and management practices. Such mandates directly increase the need for efficient dewatering equipment, including dewatering pumps, to ensure that facilities can meet the necessary standards for moisture content and overall sludge quality before disposal or beneficial reuse. This push for compliance significantly drives the demand for innovative sludge dewatering equipment.

Rapid Urbanization and Industrialization: The fast growth of urban areas worldwide, combined with a rise in industrial activities, is leading to a significant increase in the volume of municipal and industrial wastewater generated. As more people move to cities and industries expand their operations, the amount of waste that needs to be treated grows proportionally. This surge in wastewater directly results in a greater quantity of sludge that must be managed.

Managing large volumes of sludge is a major logistical and financial challenge for wastewater treatment plants. Efficient dewatering is crucial to reduce the sludge's weight and volume, making it more cost-effective to transport and dispose of. According to the "Progress on the proportion of domestic and industrial wastewater flows safely treated – Mid-term status of SDG Indicator 6.3.1 and acceleration needs" report by the United Nations Human Settlements Programme (UN-Habitat) and the World Health Organization (WHO) in 2024, 44% of global household wastewater was discharged without safe treatment in 2020. This highlights a critical need for improved treatment infrastructure, including dewatering, to handle the increasing wastewater load from urban centers. This continuous increase in sludge volume, driven by urbanization and industrial expansion, fuels the growth of the sludge dewatering equipment sector.

Segmental Insights

Technology Type Analysis

Based on technology type, the segmentation includes belt filter press, centrifuges, screw press, and others. The belt filter press segment held the largest share in 2024. These systems are widely favored, especially in municipal wastewater treatment plants and certain industrial applications, due to their cost-effective operation, capacity for continuous processing of large volumes of sludge, and relatively straightforward design. Their ability to consistently reduce sludge volume by producing a dewatered cake with a suitable dry solids content makes them a pragmatic choice for facilities seeking reliable and economical sludge management without requiring overly complex operation or extensive energy input.

The centrifuges segment is anticipated to register the highest growth rate during the forecast period. This projected rise is largely driven by their high efficiency in separating solids from liquids, their compact footprint, and their adaptability to a diverse range of sludge characteristics, including those with finer particles or more challenging compositions. As industries and municipalities increasingly seek solutions that offer superior dewatering performance, higher levels of automation, and the ability to achieve a drier final product, the demand for advanced centrifuge technologies continues to rise.

Application Analysis

Based on application, the segmentation includes industrial and municipal. The municipal segment held the largest share in 2024, due to the vast and continuous generation of wastewater from residential and commercial areas in urban centers worldwide. As populations grow and urbanization accelerates, the volume of sewage sludge produced by municipal wastewater treatment plants constantly increases, requiring robust and reliable dewatering solutions. Governments and local authorities are also making significant investments in improving and expanding their sanitation and water treatment infrastructure to meet rising demand and comply with environmental discharge standards. The sheer scale of operations and the ongoing need for efficient sludge volume reduction and disposal in public utilities consistently drive the demand for a wide range of dewatering equipment and water and wastewater treatment equipment within this segment.

The industrial application segment is expected to experience the most significant expansion in the coming years. This accelerated growth is primarily fueled by the rapid expansion of various industries such as food and beverage, chemicals, pharmaceuticals, and mining, all of which generate substantial amounts of industrial wastewater and associated sludge. Stringent environmental regulations specifically targeting industrial effluent discharge and waste management are compelling these sectors to adopt advanced dewatering technologies to ensure compliance and reduce their environmental footprint. Furthermore, industries are increasingly recognizing the operational cost savings associated with efficient sludge dewatering, including reduced disposal expenses and potential for resource recovery, which further stimulates their investments in this equipment.

Regional Analysis

The Asia Pacific sludge dewatering equipment market accounted for the largest share in 2024. The region is rapidly emerging as a dynamic and expanding area for sludge dewatering equipment, driven by swift urbanization and significant industrial growth across many of its developing economies. The enormous and increasing populations in countries such as China and India are generating unprecedented volumes of municipal wastewater, placing immense pressure on existing treatment infrastructure. Many governments in the region are actively investing in new wastewater treatment facilities and upgrading older ones to address pollution concerns and meet public health needs, thus creating substantial demand for dewatering solutions.

China Sludge Dewatering Equipment Market Insights

A major country contributing to this regional growth is China. With its massive population and extensive manufacturing base, China faces immense challenges in managing wastewater and industrial sludge. The government has implemented ambitious environmental protection policies and invested heavily in wastewater treatment infrastructure across the country, leading to a surge in the adoption of dewatering equipment. The drive toward sustainable development and stricter pollution control measures in China means a continuous demand for advanced and high-capacity sludge dewatering technologies to handle the vast quantities of sludge produced by its burgeoning urban centers and industrial zones.

North America Sludge Dewatering Equipment Market Trends

North America exhibits a mature yet continuously evolving landscape for sludge dewatering equipment. The demand here is largely shaped by stringent environmental regulations enforced by bodies such as the US Environmental Protection Agency, which mandate higher levels of wastewater treatment and responsible sludge management. There is a strong focus on upgrading aging infrastructure in many municipalities, leading to investments in more efficient and automated dewatering technologies. Furthermore, a significant industrial base across the region, including sectors such as oil and gas, food and beverage, and pulp and paper, contributes to the ongoing need for sophisticated sludge handling solutions to comply with discharge permits and improve operational efficiency.

U.S. Sludge Dewatering Equipment Market Overview

In North America, the U.S. is a key driver for the sludge dewatering equipment sector. The country's demand is propelled by considerable investments in modernizing municipal wastewater treatment facilities, many of which are facing the dual challenge of increasing wastewater volumes from urban growth and the need to replace or update older equipment. Regulatory pressures aimed at reducing pollutants in water bodies and minimizing landfill waste also play a crucial role, pushing for technologies that achieve drier sludge cakes and enable beneficial reuse options. The large and diverse industrial sector in the U.S., with its continuous need for efficient process water treatment, further contributes to the steady demand for advanced dewatering solutions.

Europe Sludge Dewatering Equipment Market Assessment

Europe represents a significant and well-established region for the sludge dewatering equipment business, characterized by strong environmental consciousness and comprehensive regulatory frameworks such as the Urban Wastewater Treatment Directive. These regulations drive continuous improvements in wastewater treatment and sludge management practices across the continent. There is a notable emphasis on resource recovery from sludge, including the production of biogas and nutrient-rich fertilizers, which necessitates effective dewatering as a preliminary step. Innovation in dewatering technologies, including more energy-efficient and automated systems, is a consistent trend in the region, reflecting a commitment to sustainability and operational optimization.

The Germany sludge dewatering equipment market stands out as a prominent market in the European landscape. Its robust industrial sector, coupled with a strong national commitment to environmental protection and circular economy principles, creates a high demand for advanced sludge treatment solutions. German engineering expertise often translates into the development and adoption of high-quality, efficient dewatering equipment. The country’s wastewater treatment plants are known for their high standards, often incorporating sophisticated dewatering technologies to manage municipal and industrial sludge effectively, including processes that prepare sludge for energy generation or agricultural application.

Key Players and Competitive Insights

The sludge dewatering equipment sector features a competitive landscape with several established players, including Alfa Laval, ANDRITZ, Veolia Water Technologies, HUBER SE, GEA Group, and Flottweg. These companies strive to offer a diverse range of technologies, from centrifuges and belt filter presses to screw presses, to meet the varied needs of municipal and industrial clients. The competition is often centered on providing equipment that offers higher efficiency, lower energy consumption, reduced operational costs, and the ability to achieve a drier sludge cake for easier disposal or beneficial reuse. Companies also compete through service offerings, technological innovation, and strategic partnerships to enhance their global reach and product portfolios in this essential environmental technology area.

A few prominent companies in the industry include Alfa Laval, ANDRITZ, Veolia Water Technologies, HUBER SE, GEA Group Aktiengesellschaft, Flottweg SE, Pieralisi MAIP S.P.A., BDP Industries, Komline-Sanderson Corporation, Centrisys/CNP, Beckart Environmental, and Aqseptence Group.

Key Players

- Aqseptence Group

- Alfa Laval

- ANDRITZ

- Beckart Environmental

- BDP Industries

- Centrisys/CNP

- Flottweg SE

- GEA Group Aktiengesellschaft

- HUBER SE

- Komline-Sanderson Corporation

- Pieralisi MAIP S.P.A.

- Veolia Water Technologies

Sludge Dewatering Equipment Industry Development

November 2024: The Los Angeles Department of Water and Power committed over USD 6 billion to a major advanced water infrastructure project, formerly referred to as Operation Next (OpNEXT).

Sludge Dewatering Equipment Market Segmentation

By Technology Type Outlook (Revenue – USD Billion, 2020–2034)

- Belt Filter Press

- Centrifuges

- Screw Press

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Industrial

- Pulp & Paper

- Textile

- Food & Beverage

- Chemical

- Others

- Municipal

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Sludge Dewatering Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.34 billion |

|

Market Size in 2025 |

USD 5.78 billion |

|

Revenue Forecast by 2034 |

USD 12.10 billion |

|

CAGR |

8.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.34 billion in 2024 and is projected to grow to USD 12.10 billion by 2034.

The global market is projected to register a CAGR of 8.5% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Alfa Laval, ANDRITZ, Veolia Water Technologies, HUBER SE, GEA Group Aktiengesellschaft, Flottweg SE, Pieralisi MAIP S.P.A., BDP Industries, Komline-Sanderson Corporation, Centrisys/CNP, Beckart Environmental, and Aqseptence Group.

The belt filter press segment accounted for the largest share of the market in 2024.

The industrial segment is expected to witness the fastest growth during the forecast period.