Molecular Biology Enzymes, Reagents and Kits Market Size, Share, Trends, & Industry Analysis Report

By Product (Kits & Reagents and Enzymes), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6099

- Base Year: 2024

- Historical Data: 2020-2023

Overview

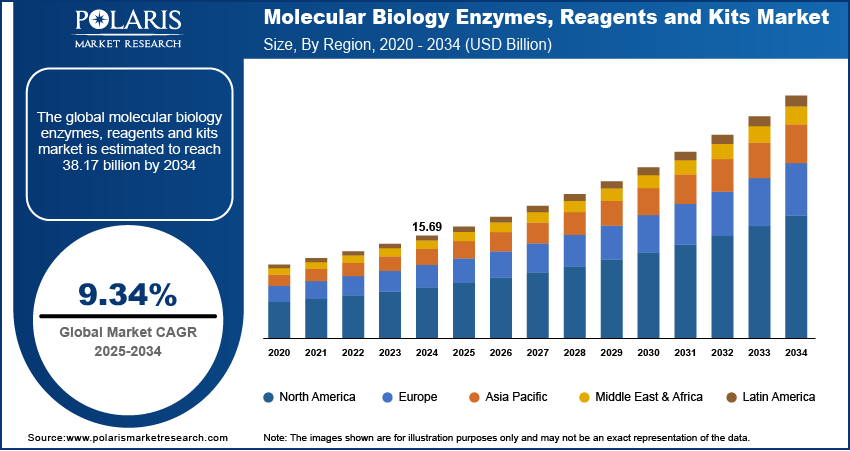

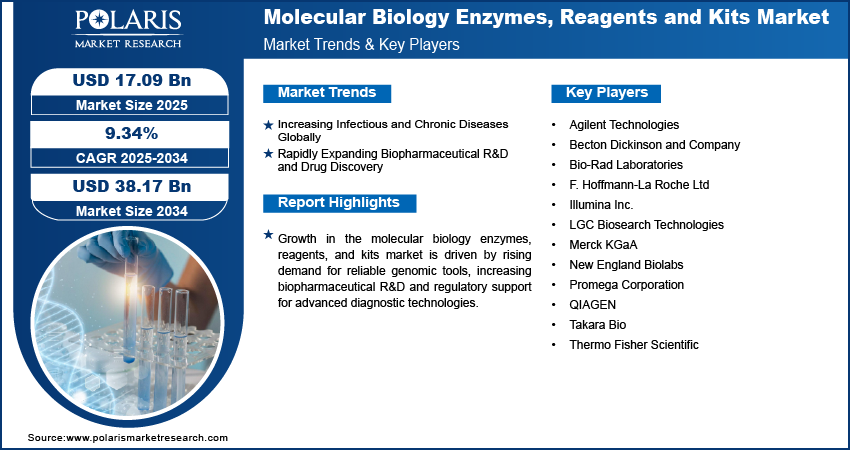

The global molecular biology enzymes, reagents and kits market size was valued at USD 15.69 billion in 2024, growing at a CAGR of 9.34% from 2025–2034. Rising incidence of infectious and chronic diseases along with expanding biopharmaceutical R&D activities is driving the demand for molecular biology enzymes, reagents, and kits to support diagnostics, biomarker discovery and therapeutic development.

Key Insights

- The kits and reagents segment dominated the market share in 2024.

- The pharmaceutical and biotechnology companies segment is projected to grow at the fastest rate over the forecast period, driven by rising investments in drug discovery and molecular diagnostics.

- The North America molecular biology enzymes, reagents and kits market dominated the global market share in 2024.

- The US molecular biology enzymes, reagents and kits market held the largest regional share of the North America market in 2024, fueled by robust life sciences research infrastructure and high adoption of molecular diagnostics.

- The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, owing to increasing deployment of molecular tools in clinical diagnostics, pharmaceutical R&D, and academic research.

- China molecular biology enzymes, reagents and kits market is expanding steadily, driven by growing investment in local biotechnology capabilities, diagnostic test development, and genomic research across public and private institutions.

Market Dynamics

- Rise in infectious and chronic diseases is driving the use of molecular biology enzymes, reagents and kits to support molecular diagnostics, early disease detection and genetic analysis in clinical settings.

- Expanding biopharmaceutical R&D and drug discovery efforts are increasing the demand for high-quality enzymes and assay-ready kits that enable efficient gene expression studies, mutation analysis and biomarker identification.

- Adoption of automation-compatible and contamination-free reagents is creating opportunities for product innovation in high-throughput research and clinical laboratories.

- Fluctuations in raw material supply and high production costs for high-purity enzymes continue to pose challenges for smaller manufacturers aiming to scale operations or enter regulated international markets.

Market Statistics

- 2024 Market Size: USD 15.69 billion

- 2034 Projected Market Size: USD 38.17 billion

- CAGR (2025-2034): 9.34%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Molecular biology enzymes, reagents, and kits are essential components used in genomic research, diagnostics and biotechnology-based processes. These products support applications such as polymerase chain reaction (PCR), DNA and RNA sequencing, gene expression analysis and molecular cloning. For instance, in November 2024, Takara Bio introduced a high-throughput, cost-effective qPCR system designed to support large-scale clinical research applications. This launch enhances the growing demand for efficient and scalable molecular biology consumables in gene expression analysis and clinical diagnostics workflows. The growing demand for precise and rapid testing methods is driving the use of high-quality reagents and enzymes across pharmaceutical, academic and clinical research laboratories. Key formulations include restriction enzymes, DNA ligases, reverse transcriptase and nucleotides used in various assay protocols and workflows.

The increasing investments in genetic research and the rising focus on personalized medicine are accelerating the adoption of molecular biology kits globally. Additionally, market participants are focusing the development of stable, contamination-free and scalable formulations that comply with international quality standards. This shift significantly supports industry efforts to meet regulatory expectations and address growing demand for reliable molecular diagnostics and genomics tools.

The growing demand for high-performance and application-specific molecular biology products is driving innovation in enzyme and reagent development. Research and commercial laboratories are focusing on consistency, accuracy and simplified workflows, which is increasing the adoption of ready-to-use kits and optimized formulations. Enzyme stability, contamination control and rapid reaction efficiency are key priorities for enhancing assay reproducibility. The rise of automated lab systems is further driving the need for reagents compatible with high-throughput platforms. Thus, suppliers are offering specialized kits for areas such as epigenetics, microbiome studies, and single-cell analysis, enabling faster data generation and improved operational efficiency.

Drivers & Opportunities

Increasing Infectious and Chronic Diseases Globally: The rising global burden of infectious and chronic diseases such as cancers, cardiovascular diseases, cancer, diabetes, and respiratory illnesses are increasing the need for accurate molecular diagnostics and genetic testing. As per the World Health Organization (WHO), around 20 million new cancer cases and 9.7 million cancer-related deaths were reported in 2022. Nearly 53.5 million people were living within five years of a cancer diagnosis. One in five people are expected to develop cancer in their lifetime, with about 1 in 9 men and 1 in 12 women dying from it. By 2050, new cancer cases are expected to rise to over 35 million, marking a 77% increase from 2022. Healthcare providers are adopting molecular biology enzymes, reagents and kits to detect pathogens, monitor disease progression and support early intervention. These tools enable reliable results across a range of sample types and testing environments. As demand grows for faster and more sensitive diagnostics, manufacturers are expanding product lines to meet clinical requirements and improve patient outcomes.

Rapidly Expanding Biopharmaceutical R&D and Drug Discovery: Biopharmaceutical companies are increasing investments in research and drug development to target complex diseases and genetic conditions. This trend is driving the demand for molecular biology enzymes, reagents, and kits that support key processes such as gene expression, target validation and mutation detection. Ready-to-use kits and high-purity reagents are used to streamline workflows and reduce variability in results. As drug pipelines expand, suppliers are focusing on delivering consistent and scalable solutions for advanced laboratory applications.

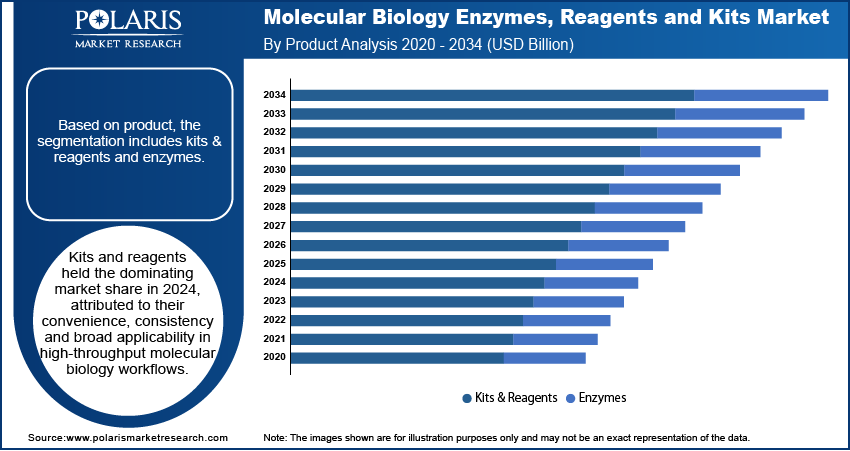

Segmental Insights

Product Analysis

Based on product, the segmentation includes kits & reagents, and enzymes. The kits & reagents segment dominated the market in 2024, due to their widespread use in routine laboratory workflows and diagnostic procedures. In November 2023, BioEcho launched the EchoLUTION FFPE RNA Kit to enhance RNA extraction efficiency from formalin-fixed paraffin-embedded (FFPE) tissues. This advancement meets the growing demand for high-quality molecular biology consumables that support reliable gene expression analysis in preserved tissue samples. The demand for ready-to-use formulations that reduce handling errors and improve result consistency is driving adoption across research and clinical laboratories. These products support a wide range of molecular biology applications, including PCR, sequencing, and gene expression analysis. Manufacturers are focusing on improved reagent stability and simplified protocols to enhance user experience. As research volumes increase, demand for high-quality and application-specific reagent kits remains strong across academic and commercial settings.

The enzymes segment is expected to grow at the fastest rate during the forecast period. This is driven by rising demand for high-fidelity, application-specific, and thermostable enzymes in genetic research and biopharmaceutical development. Enzymes such as DNA polymerases, ligases, and nucleases are rapidly used in synthetic biology, cloning, and CRISPR-based workflows. Manufacturers are developing engineered enzymes that offer higher efficiency and specificity across diverse reaction conditions. As laboratories transition to more complex and automation-driven protocols, the need for robust enzyme formulations is expanding. The shift toward customized and scalable enzyme solutions is further boosting the growth of this segment globally.

Application Analysis

By application, the segmentation includes sequencing, cloning, polymerase chain reaction (PCR), restriction digestion, synthetic biology, epigenetics, and other applications. The polymerase chain reaction (PCR) segment dominated the market in 2024, due to its essential role in gene amplification, diagnostics, and pathogen detection. The method is widely adopted in research, clinical diagnostics, and forensic testing due to its sensitivity and reliability. With the increasing demand for fast and precise molecular detection, PCR-based assays continue to be a preferred choice in routine and high-complexity laboratories. The availability of advanced PCR kits, thermal cyclers, and high-fidelity polymerases is driving workflow efficiency and output quality. Continuous innovation in real-time and digital PCR technologies is expected to maintain segment dominance.

The epigenetics segment is projected to grow at the fastest pace through 2034. This is owing to the rising interest in gene regulation studies, personalized medicine, and cancer research. Researchers are using molecular biology kits and enzymes to investigate DNA methylation, histone modification, and chromatin accessibility. These applications require high-precision reagents and sequencing tools to support complex analysis. Pharmaceutical and academic institutions are expanding epigenetic research to identify biomarkers and develop targeted therapies. The growing use of single-cell epigenomics and integrated omics approaches is accelerating product demand, driving segment expansion across advanced research facilities.

End User Analysis

Based on end user, the segmentation includes academic and research institutes, pharmaceutical and biotechnology companies, hospitals and diagnostic laboratories, contract research organizations (CROs), forensic laboratories, food and agriculture research centers, and environmental testing labs. The pharmaceutical and biotechnology companies segment accounted for the highest market share in 2024. This is due to increasing investments in drug discovery, genomics and personalized medicine. These end users require reliable molecular biology products to support compound screening, biomarker discovery, and validation processes. The growing use of enzymes and assay kits in early-phase trials and gene therapy research is strengthening segment growth. The expansion of biologics pipelines and the regulatory push for precision diagnostics are driving companies to adopt high-performance, scalable solutions. Partnerships with reagent suppliers and CROs are further enabling consistent access to quality inputs and streamlined laboratory workflows.

The academic and research institutes segment is projected to grow at the fastest pace during the forecast period. This segment due to their consistent demand for enzymes and reagents in basic and applied molecular research. These institutions rely heavily on PCR, cloning, sequencing, and gene editing workflows for fundamental discoveries and innovation. Government and university funding programs continue to support life sciences research globally. Universities and public research centers are also key contributors to technological advancements in synthetic biology and genomics. The large volume of experiments and continued training of scientific personnel in these institutes further drive product consumption on a regular basis.

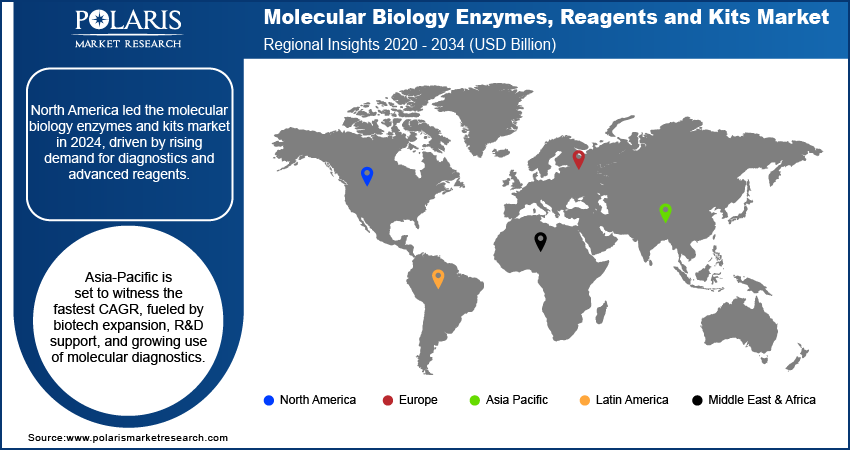

Regional Analysis

North America molecular biology enzymes, reagents and kits market dominated the global market in 2024. This is due to rising investment in biomedical research across academic and clinical laboratories. Moreover, the region’s strong biopharmaceutical industry is fueling large-scale usage of molecular tools in therapeutic development and quality testing. In addition, high demand for advanced molecular diagnostics is boosting the integration of PCR and sequencing kits into routine clinical workflows.

The US Molecular Biology Enzymes, Reagents and Kits Market Insight

The US held dominating market share in the North America molecular biology enzymes, reagents and kits landscape in 2024, due to high funding support for genomic research and biomedical innovation across research universities and government laboratories. Moreover, the rising collaborations between prominent companies for the development and launch of advanced enzymes are accelerating market growth. As an example, in September 2024, TriLink BioTechnologies partnered with Alphazyme to launch CleanScribe RNA Polymerase, an advanced enzyme designed to support high-yield, high-purity in vitro transcription. This product expansion strengthens the molecular biology consumables portfolio by addressing the rising demand for specialized reagents in mRNA synthesis and gene expression workflows. In addition, growing demand for regulatory-compliant diagnostic tools across clinical labs, driving higher procurement of standardized PCR and sequencing reagents.

Asia Pacific Molecular Biology Enzymes, Reagents and Kits Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is witnessed due to expanding biotechnology infrastructure across research institutions and commercial laboratories. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), the combined share of commercial trial starts in Asia and China increased from 16% in 2013 to 33% in 2023. Within this, China’s share rose significantly from 5% to 18% over the same period. Moreover, rising demand for molecular testing in disease surveillance and precision diagnostics is accelerating market growth across the region. In addition, the growing presence of contract research and manufacturing services is pushing large-scale procurement of high-purity enzymes and application-specific kits.

China Molecular Biology Enzymes, Reagents and Kits Market Overview

The market in China is expanding due to the rising focus on biotechnology advancement across research institutes and biotech hubs. Moreover, the demand for molecular tools in infectious disease testing is boosting widespread adoption of molecular biology consumables in public health and clinical laboratories. In addition, rapid expansion of high-throughput sequencing and gene editing capabilities is increasing the need for robust and application-specific reagent kits.

Europe Molecular Biology Enzymes, Reagents and Kits Market

The molecular biology enzymes, reagents and kits landscape in Europe is projected to hold a substantial share in 2034. This is owing to the strong focus on translational genomics and life sciences research across academic and commercial settings. For instance, in May 2024, QIAGEN launched a new library preparation kit designed to support multiomic studies by enabling simultaneous analysis of RNA and protein expression from the same sample. This development expands the portfolio of molecular biology consumables by enhancing workflow efficiency in precision medicine research and translational genomics. Moreover, growing regulatory harmonization and funding programs are promoting the adoption of standardized reagent systems in clinical diagnostics and pharmaceutical workflows. Furthermore, rising demand for automation-compatible molecular kits is driving innovation and procurement across research facilities and diagnostic labs in the region.

Key Players & Competitive Analysis Report

The molecular biology enzymes, reagents and kits is moderately competitive, with key players focusing on product reliability, workflow compatibility and application-specific innovation. Leading companies are investing in advanced enzyme engineering, contamination-free packaging and pre-formulated reagent kits to support efficiency in research and clinical applications. Core strategies include expanding manufacturing capacity, strengthening distribution networks and partnering with academic and pharmaceutical institutions to accelerate adoption. Moreover, market participants are focusing automation-ready and high-throughput compatible products to meet evolving laboratory standards. Rising focus on product standardization and expansion into high-growth sectors such as synthetic biology and precision medicine are accelerating long-term competitive positioning.

Major companies operating in the molecular biology enzymes, reagents and kits industry include Thermo Fisher Scientific, Merck KGaA, QIAGEN, New England Biolabs, Takara Bio, Promega Corporation, Agilent Technologies, Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd, LGC Biosearch Technologies, Illumina Inc., and Becton Dickinson and Company.

Key Players

- Agilent Technologies

- Becton Dickinson and Company

- Bio-Rad Laboratories

- F. Hoffmann-La Roche Ltd

- Illumina Inc.

- LGC Biosearch Technologies

- Merck KGaA

- New England Biolabs

- Promega Corporation

- QIAGEN

- Takara Bio

- Thermo Fisher Scientific

Industry Developments

- April 2025: QIAGEN announced its plan to launch three new sample preparation instruments by 2026 to enhance laboratory automation. This strategic initiative is expected to strengthen its molecular biology consumables portfolio by driving demand for high-throughput kits and reagents optimized for automated platforms.

- March 2025: Bio-Techne’s Asuragen brand launched a new molecular biology kit that simplifies the detection of complex carrier screening genes using long-read sequencing. This consumable helps labs avoid multiple testing steps by combining long-range PCR and nanopore technology in a single workflow.

Molecular Biology Enzymes, Reagents and Kits Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Kits & Reagents

- Enzymes

- Polymerases

- Ligases

- Restriction Endonucleases

- Reverse Transcriptase’s

- Phosphatases

- Proteases and Proteinases

- Other Enzymes

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Sequencing

- Cloning

- Polymerase Chain Reaction (PCR)

- Restriction Digestion

- Synthetic Biology

- Epigenetics

- Other Application

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Forensic Laboratories

- Food and Agriculture Research Centers

- Environmental Testing Labs

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Molecular Biology Enzymes, Reagents and Kits Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.69 Billion |

|

Market Size in 2025 |

USD 17.09 Billion |

|

Revenue Forecast by 2034 |

USD 38.17 Billion |

|

CAGR |

9.34% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.69 billion in 2024 and is projected to grow to USD 38.17 billion by 2034.

The global market is projected to register a CAGR of 9.34% during the forecast period.

North America dominated the market in 2024, due to high consumption of kits and reagents across advanced research facilities and strong funding for genomics and molecular diagnostics.

A few of the key players in the market are Thermo Fisher Scientific, Merck KGaA, QIAGEN, New England Biolabs, Takara Bio, Promega Corporation, Agilent Technologies, Bio-Rad Laboratories, F. Hoffmann-La Roche Ltd, LGC Biosearch Technologies, Illumina Inc., and Becton Dickinson and Company.

The kits and reagents segment dominated the market in 2024, driven by their widespread use in PCR, sequencing, and gene expression workflows across research and clinical labs.

The academic and research institutes segment is expected to witness the fastest growth during the forecast period, due to consistent demand for enzymes and reagents in fundamental and applied molecular research.