Automotive Adhesive Tapes Market Share, Size, Trends, Industry Analysis Report

By Backing Material (Polyvinylchloride, Polypropylene, Paper, Others); By Adhesive Chemistry; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4544

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

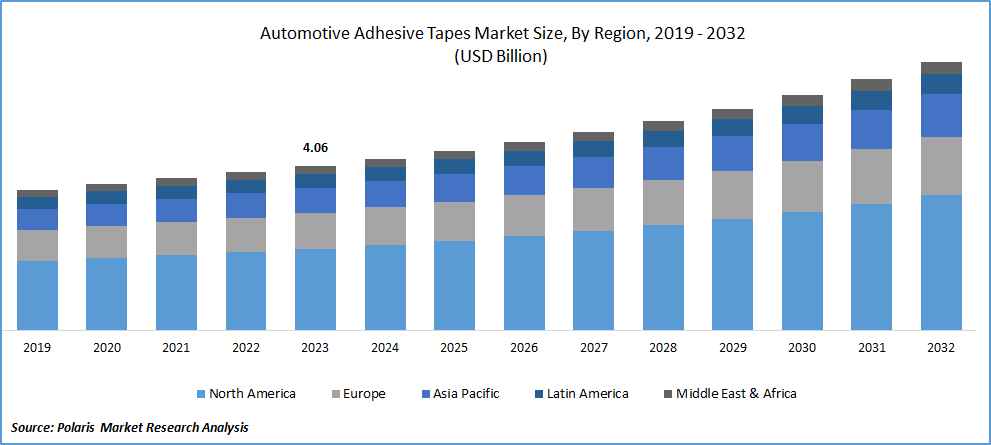

- The global automotive adhesive tapes market size and share was valued at USD 4.06 billion in 2023.

- The automotive adhesive tapes industry is anticipated to grow from USD 4.24 billion in 2024 to USD 6.63 billion by 2032, exhibiting a CAGR of 5.8% during the forecast period.

Market Introduction

Stringent global automotive regulations are driving substantial growth in the automotive adhesive tapes market. Governments and regulatory bodies demand compliance with strict standards for vehicle safety, emissions, and fuel efficiency. Automotive adhesive tapes play a pivotal role by contributing to safety enhancement, reducing vehicle weight, and improving fuel efficiency. In addition, based on automotive market trends, these tapes are crucial for meeting safety standards, providing reliable bonding for automotive components, and facilitating the use of lightweight materials. As the automotive industry faces increasing regulatory pressures, the demand for adhesive tapes continues to rise, with a focus on developing formulations that align with evolving global automotive standards.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen Industry Development.

To Understand More About this Research: Request a Free Sample Report

- For instance, in September 2020, Avery Dennison Performance Tapes expanded its range of Acrylic Foam Bonding (AFB) solutions by introducing the 94 Series product line. These tapes are specifically crafted for diverse applications, encompassing aerospace, appliances, automotive, recreational vehicles, building and construction, electronics, print and packaging, and various transportation uses.

Advanced bonding tapes, ensuring robust adhesion for lightweight materials, are replacing traditional adhesives. The integration of smart technologies, such as sensors and data monitoring, enhances real-time structural monitoring and safety standards in vehicles. Additionally, a growing focus on sustainability is evident with the rise of eco-friendly adhesive tapes, aligning with the automotive industry's commitment to greener practices.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces the automotive adhesive tapes market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

Industry Growth Drivers

Rising vehicle production is spurring the demand for automotive adhesive tapes

The automotive adhesive tapes market is thriving, fueled by the escalating market trends on vehicle production rates. As the automotive market scope expands, especially in emerging economies, there's a substantial surge in demand for adhesive tapes employed in various automotive applications, such as interior and exterior trim, electronic component bonding, and lightweight structural assemblies. Automakers are increasingly relying on automotive adhesive tapes for versatility, cost-effectiveness, and performance attributes, contributing to improved aesthetics, durability, and streamlined assembly processes. Further, based on current automotive industry development, the major key players will foresee market future opportunities during the forecast period.

Increasing demand for lightweight materials is driving the automotive adhesive tapes market growth

The automotive industry's shift towards lightweight materials for improved fuel efficiency has significantly increased the demand for automotive adhesive tapes. The market scope for such adhesive tapes has increased in bonding lightweight materials like composites, plastics, and aluminum, providing a reliable alternative to traditional mechanical fastening methods. As the industry development adapts to meet stringent emission standards and enhance overall fuel efficiency, automotive adhesive tapes contribute to weight reduction in vehicles. This market trend is further accentuated by the rising prominence of electric vehicles, where weight reduction is essential for extending the battery range.

Industry Challenges

Lack of standardization is likely to impede the market growth of automotive adhesive tapes

The automotive adhesive tapes market faces hindrances due to the absence of standardization within the industry. The lack of universally accepted standards for adhesive tape specifications and applications results in inconsistency in product quality, performance, and compatibility across manufacturing processes. Accordingly, the challenges as mentioned above for manufacturers complicate product selection for automakers. The absence of industry-wide standards further elevates the complexity of supply chain management, thus raising the overall cost of production. Moreover, based on market strategic insights, establishing standardized testing methods, performance criteria, and material specifications is crucial for overcoming these challenges.

Report Segmentation

The automotive adhesive tapes market analysis is primarily segmented based on backing material, adhesive chemistry, application, and region.

|

By Backing Material |

By Adhesive Chemistry |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Backing Material Analysis

The demand for polyvinylchloride is expected to increase during the forecast period

The demand for polyvinylchloride is expected to increase during the forecast period. Polyvinylchloride automotive adhesive tapes are essential to provide versatile solutions for diverse applications. Moreover, owing to their robust adhesive properties, these tapes ensure a strong and durable bond on surfaces. They are an ideal solution for wire harnessing, interior trim attachment, and general-purpose bonding in automobiles. These tapes exhibit flexibility, adapting to curved or irregular surfaces, and offer resistance to moisture, chemicals, and temperature variations. Their lightweight nature aligns with the automotive industry's focus on weight reduction, finding applications in interior panels and automotive wiring systems.

By Adhesive Chemistry Analysis

Solvent-based adhesives segment held a significant market revenue share in the year 2023

The solvent-based adhesives segment held a significant revenue share in the year 2023. Solvent-based automotive adhesive tapes are specialized for diverse applications in the automotive sector, utilizing solvents as adhesive carriers. These tapes provide strong and rapid bonding, particularly useful for applications requiring swift and efficient adhesion, such as attaching trims, molding, and interior components. The product's resilience against challenging conditions such as temperature variations and moisture showcases them as suitable for demanding automotive environments. These tapes exhibit versatility by adhering effectively to various substrates, including metals, plastics, and composites.

By Application Analysis

Vehicle interior segment held a significant revenue share in the year 2023

The vehicle interior segment held a significant revenue share in the year 2023. Designed specifically for vehicle interiors, automotive adhesive tapes serve a crucial role in attaching and securing components, including trims, panels, emblems, and decorative elements. Their versatility extends to effective adhesion on diverse interior substrates, including plastics, fabrics, and composites. Common applications involve bonding elements such as dashboard components, door panels, and upholstery. Beyond efficient assembly, the use of automotive adhesive tapes in vehicle interiors contributes to a cleaner aesthetic by eliminating visible mechanical fasteners, aligning with the automotive industry's focus on interior design and comfort.

Regional Insights

Asia-Pacific is expected to experience a significant growth during the forecast period

Asia-Pacific is expected to experience substantial growth during the forecast period. The automotive adhesive tapes industry in Asia-Pacific is thriving, driven by the region's prominence as a global manufacturing hub and the flourishing automotive sector. With heightened automotive production in countries like China, Japan, South Korea, and India, there is a growing demand for adhesive tapes. The industry is also witnessing increased demand for specialized adhesive tapes in electric vehicle (EV) production, specifically for battery bonding and thermal management. The adoption of advanced technologies and materials in automotive design further facilitates the industry's growth.

Based on market strategic insights, in 2023, the Europe region accounted for a significant market share. The European automotive adhesive tapes market is surging, fueled by the industry's emphasis on lightweight materials and sustainability. These tapes play a crucial role in assembling lightweight materials for vehicle construction. With European automakers prioritizing weight reduction for improved fuel efficiency and meeting emissions standards, the demand for innovative adhesive solutions is escalating. Automotive adhesive tapes offer flexibility, weight reduction, and enhanced aesthetics, aligning with evolving industry needs. Compliance with European regulations and standards remains integral, emphasizing safety, environmental considerations, and adherence to industry norms

Key Market Players & Competitive Insights

The automotive adhesive tapes market consists of a diverse array of participants, and the expected entry of new players is poised to intensify competitive dynamics. Major leaders in the market continuously enhance their technologies, striving to maintain a competitive advantage by emphasizing efficiency, reliability, and safety. These entities prioritize strategic actions, including forming alliances, improving product portfolios, and participating in collaborative ventures. Their primary goal is to outperform competitors within the industry, ultimately securing a significant automotive adhesive tapes market share.

Some of the major players operating in the global automotive adhesive tapes market include:

- 3M Company

- Adchem Corporation

- Advance Tapes International

- Avery Dennison Corporation

- Berry Global Group, Inc.

- Henkel AG & Co. KGaA

- Jonson Tapes Limited

- L&L Products, Inc.

- Lintec Corporation

- Lohmann GmbH & Co. KG

- Nitto Denko Corporation

- PPG Industries

- Saint-Gobain Performance Plastics

- Tesa SE

Recent Developments

- In May 2023, Lohmann introduced a novel adhesive tape lineup intended for low-emission attachment in the interior of vehicles. The double-sided pressure-sensitive tapes within the latest DuploCOLL LE 59xxx (Low Emission) series meet the stringent criteria set by OEMs, ensuring low Volatile Organic Compound (VOC) levels, minimal fogging, and low odor values for materials and mechanisms in accordance with VDA 278 standards.

- In October 2023, UPM Specialty Papers and Lohmann collaborated to advocate for the recycling of paper liners within the tape industry.

- In February 2021, Avery Dennison Performance Tapes declared an extension of its automotive product range, introducing a collection of adhesive solutions tailored for electric vehicle (EV) batteries. The EV battery portfolio presents bonding solutions integrated with functional characteristics, including flame retardance and dielectric strength.

Report Coverage

The automotive adhesive tapes market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, backing materials, adhesive chemistries, applications, and their futuristic growth opportunities.

Automotive Adhesive Tapes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.24 billion |

|

Revenue Forecast in 2032 |

USD 6.63 billion |

|

CAGR |

5.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of automotive adhesive tapes in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Dairy Herd Management Market Size, Share 2024 Research Report

Vaginitis Therapeutics Market Size, Share 2024 Research Report

Gaming Peripherals Market Size, Share 2024 Research Report

Urolithiasis Management Devices Market Size, Share 2024 Research Report

Paresthesia Treatment Market Size, Share 2024 Research Report

FAQ's

The global Automotive Adhesive Tapes market size is expected to reach USD 6.63 billion by 2032

3M Company, Adchem Corporation, Avery Dennison Corporation, Berry Global Group, Inc.., Lintec Corporation are the top market players in the market.

Asia-Pacific region contribute notably towards the global Automotive Adhesive Tapes Market.

Automotive Adhesive Tapes Market is exhibiting the CAGR of 5.8% during the forecast period.

The Automotive Adhesive Tapes Market report covering key segments are backing material, adhesive chemistry, application, and region.