Urolithiasis Management Devices Market Share, Size, Trends, Industry Analysis Report

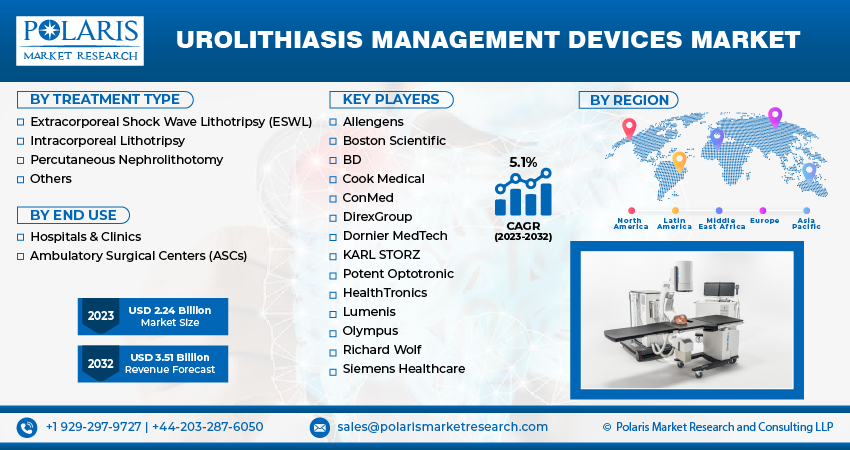

By Treatment Type (Intracorporeal Lithotripsy, Percutaneous Nephrolithotomy); By End-use; By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Nov-2023

- Pages: 118

- Format: PDF

- Report ID: PM3989

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

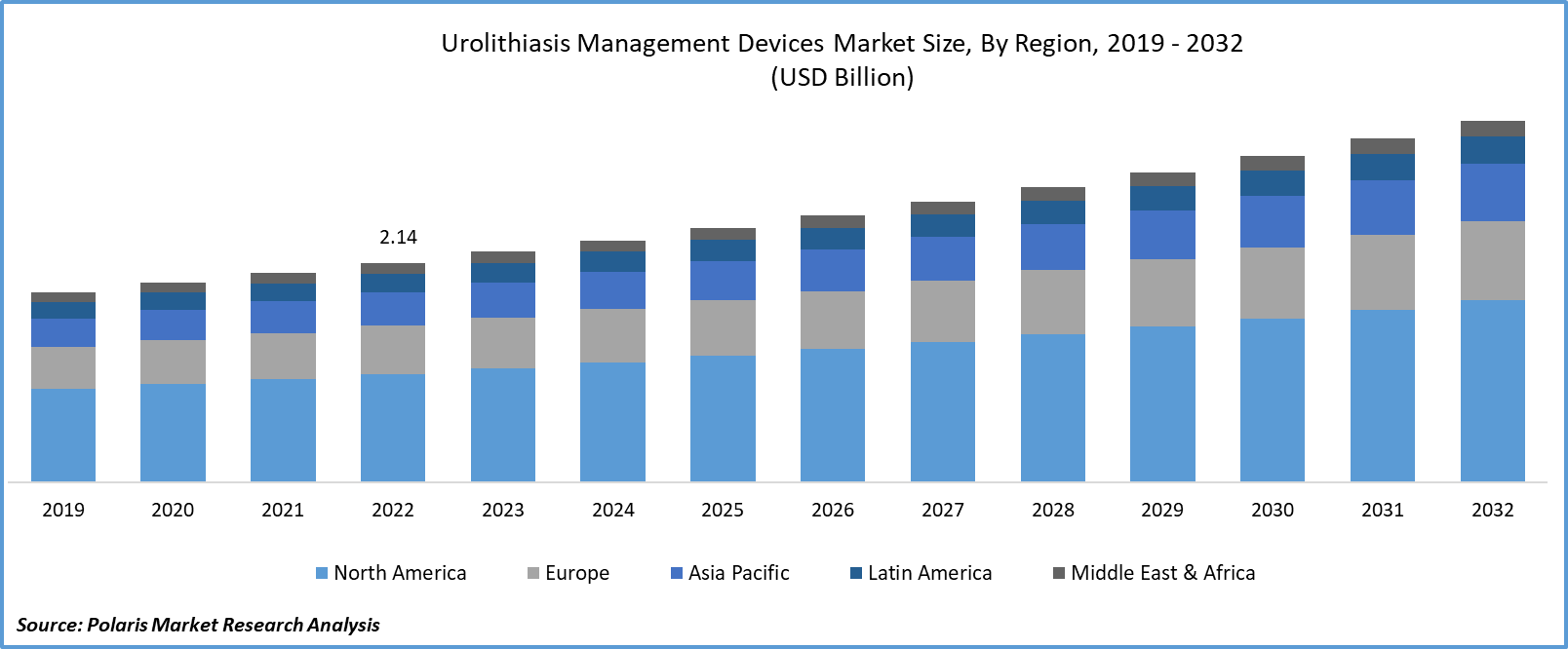

The global urolithiasis management devices market size and share was valued at USD 2.14 billion in 2022 and is expected to grow at a CAGR of 5.1% during the forecast period.

The global increase in urolithiasis, or urinary stones, is a significant factor. The formation of stones in the urinary tract is a complex process influenced by various factors. Metabolic imbalances, genetic predisposition, anatomical and functional abnormalities, as well as nutritional status all play significant roles. The composition of one's diet can impact the presence of risk factors in urine, leading to supersaturation with salts responsible for stone formation.

Urolithiasis is a terminology utilized to narrate calculi or stones that configure the urinary tract. The urolithiasis management devices market demand is on the rise as this condition includes the configuration of calcifications in the urinary system, normally in the kidneys or uterus. Still, it might also influence the bladder or urethra. Urolithiasis is a frequent situation that with several probability elements and bases involving lifestyle practices and alternate applications.

The management of urolithiasis will rely on the particular patient case and be dependent on elements such as showcasing indicators and the proportion and whereabouts of the stones. The majority of stones are eliminated in the urine on their own and do not require invasive surgical technologies. Staying hydrated to flush the stones over the body is endorsed at the outset if the pain is feasible for the patient. Effortless analgesic medication such as paracetamol can assist in pain relief.

The urolithiasis management devices market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

To Understand More About this Research: Request a Free Sample Report

Tailoring dietary therapy to match an individual's specific biochemical and dietary risk profile has proven to be more effective than applying general dietary measures in preventing new stone formation. There is not a universal diet plan suitable for all cases; instead, guidelines encompassing various dietary recommendations such as sufficient fluid intake, moderate calcium consumption, low dietary sodium, and restricted animal protein have demonstrated effectiveness in preventing stones.

The European Association of Urology reports a prevalence ranging from 1% to 20%, with renal stones being more common (>10%) in developed countries like Canada, Sweden, and the U.S. According to the British Association of Urological Surgeons' 2021 report, kidney stones are prevalent, with an 8% probability of development in patients undergoing a CT scan. Their incidence has been consistently rising, and about 9% of individuals will experience stone-related symptoms during their lifetime.

- For instance, according to NHS information, kidney stones are most observed in individuals aged between 30 and 60 years old. Approximately 3 out of 20 males and up to two out of 20 females will experience kidney stones, indicating their high prevalence. The medical term for kidney stones is nephrolithiasis, and the condition causing severe pain is referred to as renal colic. According to a report from May 2023 by St. Pete Urology, about 500,000 people in the U.S. seek kidney stones emergency treatment each year.

Surgically accessing lower pole kidney stones poses technical challenges and often results in lower stone-free rates (SFRs). To enhance the success of ureteroscopy (URS) for removing lower pole kidney stones, it is recommended to displace these stones to more accessible areas within the kidney, such as the upper pole calyx, before performing laser lithotripsy. Using a stone retrieval basket for displacement can facilitate stone fragmentation, potentially improving SFRs.

The report provides information on urolithiasis management devices market revenue and sales at the global, national and regional levels. Besides, it includes a detailed segmentation of the market, primarily based on types, applications, end-uses and regions. The segmentation helps businesses and stakeholders plan their products, finances and business strategies by considering the upcoming development rate for every segment.

For Specific Research Requirements: Request for Customized Report

In emergencies, the primary treatment focus should be on addressing dehydration, managing urinary infections, identifying patients with single-functional kidneys, and minimizing the risk of acute kidney injury from contrast nephrotoxicity. It is especially crucial for patients with pre-existing conditions such as elevated creatinine levels (>2 mg/dL), diabetes, and dehydration, where the risk is higher.

Industry Dynamics

Growth Drivers

- Increasing incidence of obesity

Lifestyle factors such as excessive alcohol consumption and insufficient water intake are believed to contribute to the development of kidney stones. Additionally, the growing prevalence of obesity, a significant risk factor for kidney stone formation, is linked to sedentary habits, poor dietary choices, and lack of physical activity. This trend could further drive the urolithiasis management devices market. According to the European Association of Urology, approximately 10% of the global population is affected by kidney stones. Furthermore, this condition has a recurrence rate of about 50% throughout a patient's lifetime. The increasing incidence and prevalence rates of urinary stones, connected with the global selection for minimally invasive surgeries, are pivotal factors boosting the demand for urolithiasis management procedures.

Report Segmentation

The market is primarily segmented based on treatment type, end-use, and region.

|

By Treatment Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Treatment Type Analysis

- The intra-corporeal lithotripsy segment held the largest market share in 2022

In 2022, the intra-corporeal lithotripsy segment held the largest market share. In intracorporeal lithotripsy, stones are visualized using an endoscope and simultaneously disintegrated into manageable fragments using lasers. Patients with large stones who are unsuitable for Extracorporeal Shock Wave Lithotripsy (ESWL) typically undergo intracorporeal lithotripsy. This method boasts an impressive 95% stone-free rate and involves minimal implantation. Despite being an invasive technique, intracorporeal lithotripsy delivers exceptional stone-free outcomes, requires less time than ESWL, and presents no apparent side effects.

The percutaneous nephrolithotomy segment will grow at a significant pace. Large stones situated in the kidney or upper ureter can be extracted through a minimally invasive procedure known as percutaneous nephrolithotomy. This method is employed when other techniques prove ineffective in breaking or removing the stone and is considered a "salvage" treatment option. Unlike Extracorporeal Shock Wave Lithotripsy (ESWL), percutaneous nephrolithotomy enables the treatment of stones in challenging locations that are hard to access or target. Additionally, it can effectively address larger quantities of stones in a single session. However, a major drawback is the higher risk of injury, particularly bleeding, which might require a blood transfusion or additional medical intervention to halt the bleeding.

By End-Use Analysis

- The hospital segment accounted for the fastest market share during the forecast period.

The hospital segment accounted for the fastest market share during the forecast period. This growth is attributed to investments in surgical infrastructure expansion by hospitals, a rise in kidney stone treatments performed within hospital settings, and the establishment of new hospitals across diverse regions. Moreover, the segment's growth is bolstered by satisfactory reimbursement policies offered by hospitals.

The ambulatory surgical center segment will grow at a significant pace. ASCs are gaining popularity due to their time-saving, cost-effective options and reduced hospital stays. Technological advancements, including minimally invasive surgical tools, enable painless stone removal.

Regional Insights

- North America region dominated the largest market share in 2022

In 2022, the North American region dominated the largest market share. The region's growth is primarily due to the increasing prevalence of urolithiasis-related stone formations, elevated risks of end-stage renal disease in the population, and growing approvals for new products. Globally, nephrolithiasis affects around 10-12% of men and 7-8% of women, as per the 2021 guidelines from the Canadian Urological Association. Despite geographical variations, the prevalence of urolithiasis is steadily increasing.

Moreover, kidney disorders are a leading cause of death in the U.S., with a significant portion of adults, out of the 37 million diagnosed with chronic kidney disease, remaining undiagnosed, according to the Centers for Disease Control and Prevention (CDC). Additionally, the expanding awareness among patients about novel treatment options and the availability of advanced medical devices in the region are poised to fuel market growth.

APAC will grow at the fastest rate during the forecast period. Kidney stone prevalence is on the rise in this region due to various factors such as dietary changes, lifestyle shifts, and climate variations. According to the National Center for Biotechnology Information (NCBI), it is projected that the prevalence of kidney stones will reach 14.3% in China and 12.7% in India by 2030. Healthcare spending in the region is increasing significantly as both governments and individuals are becoming increasingly health-conscious. This heightened awareness is driving the market, as more patients are inclined to seek treatment for kidney stones.

Key Market Players & Competitive Insights

The market exhibits moderate competitiveness with numerous players. Key strategies such as product launches, regulatory approvals, strategic acquisitions, and innovations are employed by market participants to expand their global presence. Some players are investing in research and development of non-invasive solutions for kidney stone treatment, a factor expected to propel market growth.

Some of the major players operating in the global market include:

- Allengens

- Boston Scientific

- BD

- Cook Medical

- ConMed

- DirexGroup

- Dornier MedTech

- KARL STORZ

- Potent Optotronic

- HealthTronics

- Lumenis

- Olympus

- Richard Wolf

- Siemens Healthcare

Recent Developments

- In July 2022, Calyxo recently announced the successful closure of its Series C investment round, securing USD 32.7 million. Based in California, Calyxo has developed the CVAC Aspiration system, designed to eliminate kidney stones without the need for surgery, utilizing irrigation and aspiration methods.

- In March 2022, The FDA recognized Applaud Medical's Acoustic Enhancer technology as a breakthrough product. It is designed to break down calcium-based urinary stones that are obstructing or pose a significant risk of future hindrance, provided they are between 6mm and 20 mm in diameter.

Uroliathiasis Management Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.24 billion |

|

Revenue Forecast in 2032 |

USD 3.51 billion |

|

CAGR |

5.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Treatment Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of urolithiasis management devices in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Want to check out the urolithiasis management devices market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.