Barite Market Share, Size, Trends, Industry Analysis Report

By Application (Fillers, Oil & Gas, Chemicals, Fillers), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3625

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

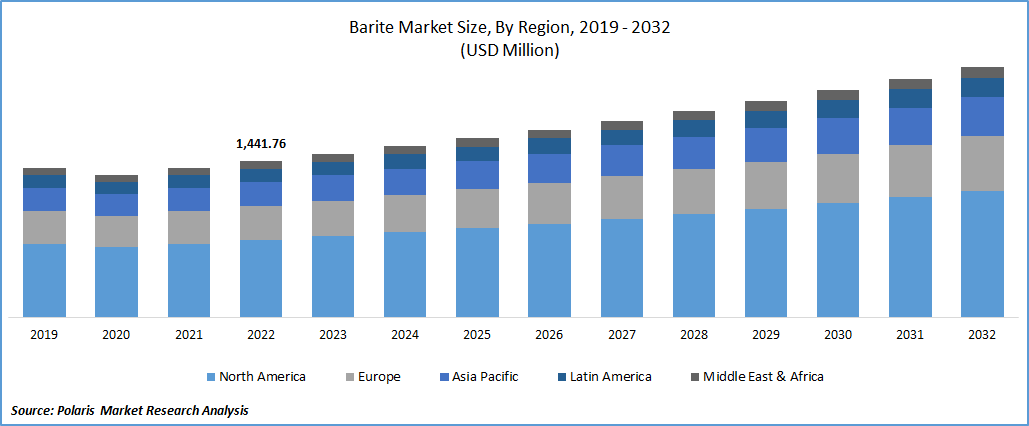

The global barite market was valued at USD 1509.09 million in 2023 and is expected to grow at a CAGR of 4.90% during the forecast period. The market is growing due to increasing global oil and gas exploration and drilling activities. Factors such as population growth, urbanization, infrastructure development projects, and energy requirements drive the demand for oil and gas.

To Understand More About this Research: Request a Free Sample Report

This creates a favorable environment for future market expansion, leading to significant growth in the demand for barite. Barite is commonly used as a weighting agent in drilling fluids for oil and gas wells. It is also gaining importance in various applications such as paints and coatings, rubber, plastics, cement, and cosmetics. Barite is an excellent substitute for other fillers like titanium dioxide, basofor, and crypton, without compromising glossiness and fluidity. The United States is one of the largest consumers of barite globally, mainly due to its significant oil and gas production. The exploration of shale gas and tight oil reserves has increased drilling fluid demands, including barite. According to the United States Geological Survey (USGS), the annual average rig counts in the country saw a nearly 50% increase.

Growth Drivers

Growth can be attributed to the consistent investments made in exploration and tight oil production, which have significantly driven the market forward. The output of tight oil in the United States has witnessed a remarkable increase in recent years and is expected to peak by 2029, according to the Carnegie Endowment for International Peace. Furthermore, the market is anticipated to receive a boost from increased offshore oil and gas drilling activities and investments made by major oil companies in deep and ultra-deep offshore exploration. These activities are expected to contribute to the market's growth over the forecast period. The rising demand for paints and coatings in constructing new residential and non-residential buildings is another factor driving the demand for barite. As construction activities increase, the need for paints and coatings also rises, fueling the demand for barite in this sector.

The construction industry is experiencing significant growth due to rapid urbanization, industrialization, population growth, and improved living standards. These factors drive the demand for paints and coatings, which in turn influences barite production. The construction sector uses paints and coatings for residential, commercial, and infrastructure projects. In addition to its role as a radiopaque agent, barite is also used in the pharmaceutical industry. It is a filler in tablets and capsules, helping maintain their shape and size. Moreover, barite can function as a rheology modifier in liquid medications, ensuring optimal flow and consistency of the medicine.

Report Segmentation

The market is primarily segmented based on application, and region.

|

By Application |

By Region |

|

|

To Understand the Scope of this Report: Speak to Analyst

Oil & gas segment accounted for the largest market share in 2022

In 2022, the oil and gas industry had the largest share of the barite market due to the important role of barite as a weighting agent in drilling fluids. Barite helps increase the density of drilling fluids and raise hydrostatic pressure during drilling operations, stabilizing and preventing well blowouts. Barite also acts as a lubricant, reducing friction and wear on drilling tools, and has cooling properties that prevent overheating. Due to these benefits, barite is in high demand and is dominant in the market.

Barite also has potential in the biomedical field due to its biocompatibility and wound-healing properties, which make it useful in tissue engineering and drug delivery systems. The chemical segment is expected to grow rapidly due to barite's exceptional properties, such as low oil absorption, chemical inertness, and insolubility. Barite is also used in paints and coatings as a filler to improve thickness, durability, and strength. Additionally, it can block gamma rays and X-ray emissions, making it useful in hospitals, power plants, laboratories, and other settings where radiation protection is necessary.

North America region dominated the global market in 2022

The North America region dominated the global market with a considerable revenue share in 2022. This can be attributed to the region's dominant use of barite as a weighting agent in drilling fluids during oil and gas exploration and production activities. The demand for barite is closely linked to the expansion of the energy generation industry in the region. The growth of the oil and gas sector in the region is further supported by initiatives undertaken by respective governments to promote the industry. For example, in April 2022, the Government of Canada approved the offshore oil project proposed by Equinor ASA. Such initiatives and approvals contribute to the increased demand for barite in the region, as drilling fluids are essential for efficient and safe oil and gas exploration and production operations.

Competitive Insight

Some of the major players operating in the global market include Anglo Pacific Minerals, Ashapura Group, CIMBAR Performance Minerals, Demeter O&G Supplies, Excalibur Minerals, International Earth Products, P & S Barite Mining, PVS Chemicals, SLB, and Andhra Pradesh Mineral Development Corporation.

Recent Developments

- In January 2022, the National Hydrocarbons Commission (CNH) of Mexico authorized onshore and offshore plans proposed by the Pemex Exploracion y Produccion. These plans involved a significant investment of USD 800 Mn. The authorization from CNH allows Pemex to proceed with its exploration and production activities in the designated areas, contributing to the development of Mexico's hydrocarbon resources.

- In January 2023, Wintershall Dea AG, a Germany-based oil and gas company, announced the discovery of a new gas field in the eastern Damanhur region of Egypt's Nile Delta. The gas field was found onshore, indicating the presence of significant hydrocarbon reserves in the area.

Barite Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1580.17 million |

|

Revenue forecast in 2032 |

USD 2,315.12 million |

|

CAGR |

4.90% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Anglo Pacific Minerals, Ashapura Group, CIMBAR Performance Minerals, Demeter O&G Supplies, Excalibur Minerals, International Earth Products, P & S Barite Mining, PVS Chemicals, SLB, and Andhra Pradesh Mineral Development Corporation |

FAQ's

The global barite market size is expected to reach USD 2,315.12 million by 2032.

Key players in the barite market are Anglo Pacific Minerals, Ashapura Group, CIMBAR Performance Minerals, Demeter O&G Supplies.

North America contribute notably towards the global barite market.

The global barite market is expected to grow at a CAGR of 4.9% during the forecast period.

The barite market report covering key segments are application, and region.