Bimodal HDPE Market Size, Share, Trend, & Industry Analysis Report

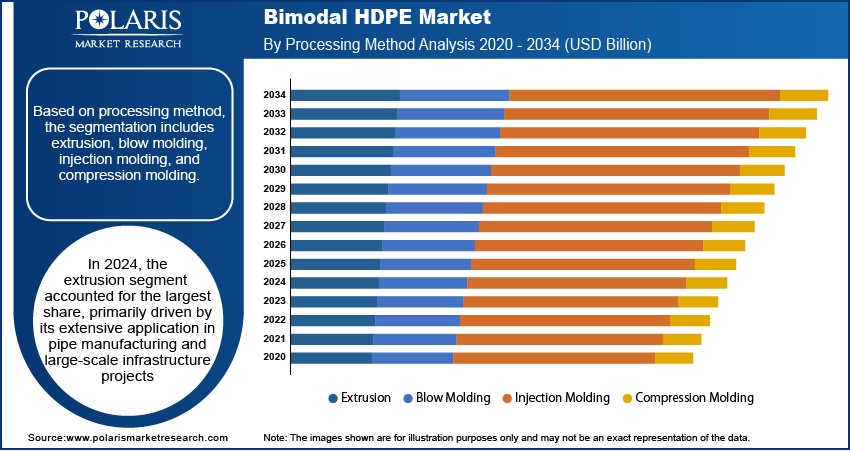

: By Processing Method (Extrusion, Blow Molding, Injection Molding, and Compression Molding), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5762

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

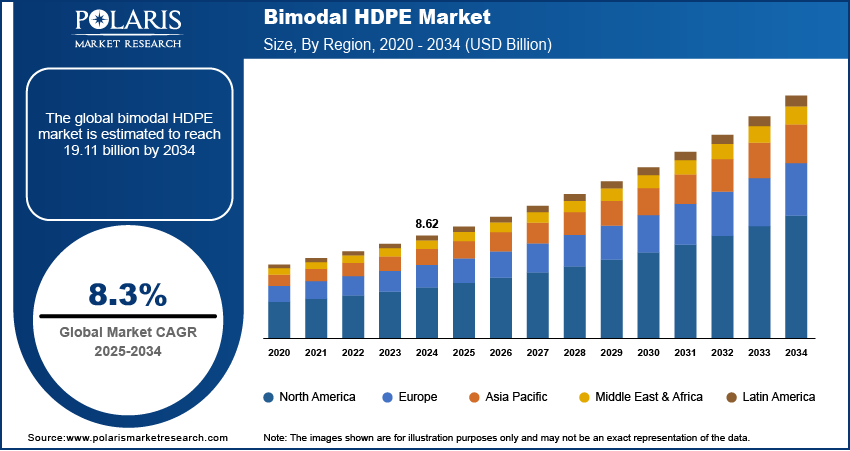

The global bimodal HDPE market size was valued at USD 7.97 billion in 2024 and is projected to register a CAGR of 8.3% during 2025–2034. Rising demand for durable piping solutions boosts demand for the bimodal HDPE. It is extensively used in gas and water distribution networks due to its excellent long-term durability and leak-proof joints, driving adoption globally.

The bimodal high-density polyethylene (HDPE) market refers to a specialized category of HDPE resins engineered with two distinct molecular weight distributions, offering enhanced mechanical properties such as improved strength, impact resistance, and stress crack resistance. These materials are widely used in applications such as pressure pipes, blow molding, injection molding, and film production, particularly in the oil & gas, water supply, and packaging industries. Governments focusing on modernizing aging water systems prefer bimodal HDPE pipes for their longevity and low maintenance requirements, which is driving demand for these pipes.

To Understand More About this Research: Request a Free Sample Report

The dual-structure of bimodal HDPE offers better toughness and processability compared to standard HDPE, making it preferable for high-stress applications. Additionally, rapid urban infrastructure growth in Asia Pacific, Latin America, and Africa increases the consumption of advanced polymer materials for construction and industrial uses. For instance, according to the Asian Development Bank, by 2030, in Asia, more than 55% of the population will be urban.

Market Dynamics

Growth in Oil & Gas Infrastructure Projects

Growth in oil and gas infrastructure projects has created a substantial demand for advanced piping materials that withstand extreme environmental conditions. According to the US Energy Information Administration, in 2024, natural gas pipeline projects completed in the US expanded takeaway capacity by roughly 6.5 billion cubic feet per day (Bcf/d). The increasing construction of long-distance energy pipelines, particularly in emerging economies, is driving the adoption of bimodal HDPE due to its excellent stress crack resistance, toughness, and long service life. Unlike traditional materials, bimodal HDPE offers a cost-effective and corrosion-resistant alternative for transporting oil, gas, and other hydrocarbons over vast terrains. Its mechanical strength and durability ensure reliable performance under high-pressure and fluctuating temperatures. Growing investments in energy security and pipeline modernization further amplify the material’s relevance. The market is witnessing strong traction from pipeline developers seeking to balance longevity, safety, and compliance with regulatory standards.

Expansion of Packaging Industry

Expansion in the packaging industry is supporting significant growth in the bimodal HDPE market, especially in blow-molded applications. Various industries such as food and beverage, chemicals, and personal care are increasingly demanding containers that are lightweight and durable, as well as sustainable and recyclable. Bimodal HDPE meets these criteria by offering high impact strength, excellent barrier properties, and design flexibility for various container shapes and sizes. The material’s suitability for high-speed manufacturing and resistance to environmental stress make it ideal for producing bottles, cans, and industrial containers. Brand owners and manufacturers are also shifting toward bimodal HDPE to meet evolving regulatory and consumer expectations for eco-friendly packaging solutions. Continuous innovation in blow-molding techniques and material grades further broadens its usage across consumer and industrial packaging formats.

Segment Insights

Market Assessment by Processing Method

Based on processing method, the segmentation includes extrusion, blow molding, injection molding, and compression molding. In 2024, the extrusion segment accounted for the largest share in 2024, primarily driven by its extensive application in pipe manufacturing and large-scale infrastructure projects. The ability of bimodal HDPE to deliver high melt strength and excellent dimensional stability makes it well-suited for continuous extrusion processes used in producing pressure pipes, cable conduits, and geomembranes. Industries value extrusion-grade bimodal HDPE for its durability and stress crack resistance, particularly in environments demanding long service life and mechanical reliability. Demand from the water management and energy pipeline sectors continues to fuel this segment’s dominance due to its consistent processing performance and structural resilience.

The blow molding segment is projected to register the highest CAGR during the forecast period, supported by rising demand for robust, lightweight, and recyclable containers across various end-use sectors. Bimodal HDPE is becoming the material of choice for manufacturers of bottles, drums, and jerrycans due to its ability to maintain shape integrity under impact and its compatibility with high-speed blow molding operations. Increased consumption of packaged beverages, chemicals, and personal care products is creating a steady stream of opportunities for blow molding applications. Moreover, regulatory pressure on sustainable packaging is encouraging manufacturers to adopt materials such as bimodal HDPE that offer both performance and recyclability, further driving growth in this segment.

Market Evaluation by Application

Based on application, the segmentation includes packaging, automotive, electronics & electrical (E&E), construction, and others. In 2024, the packaging segment accounted for the largest share in 2024. The dominance is largely attributed to its superior mechanical strength, stiffness, and excellent processability, making it ideal for high-volume applications such as containers, bottles, and industrial drums. The segment benefits from increasing demand for lightweight, durable, and recyclable materials in both consumer and industrial packaging. Growing emphasis on food safety and product shelf life has further accelerated the use of bimodal HDPE in multilayer packaging solutions. Manufacturers are leveraging the high environmental stress crack resistance of the bimodal HDPE to meet stringent packaging requirements for chemicals, detergents, and edible products, reinforcing its dominance across diverse packaging formats. The shift toward circular packaging and lightweight materials has also increased its adoption across multiple packaging formats.

The automotive segment is projected to register a significant CAGR from 2025 to 2034, driven by the rising focus on vehicle weight reduction, fuel efficiency, and sustainability. Automakers are increasingly incorporating bimodal HDPE in components such as fuel tanks, fluid reservoirs, and under-the-hood parts due to its chemical resistance, lightweight properties, and structural reliability. The material's ease of processing and design flexibility allow for cost-effective manufacturing of complex automotive parts. Additionally, increasing demand for electric vehicles (EVs) and pressure on automakers to meet stringent emission regulations are encouraging the use of high-performance plastics, placing bimodal HDPE in a strong position to meet evolving industry needs.

Regional Analysis

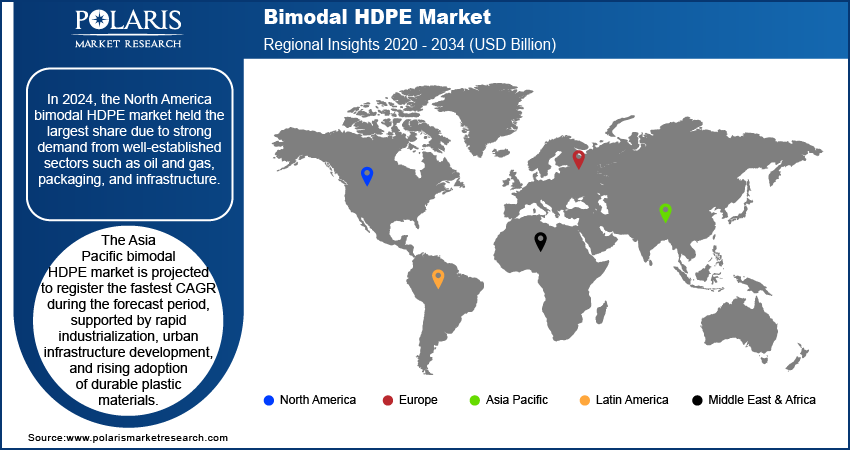

In 2024, the North America bimodal HDPE market held the largest share due to strong demand from well-established sectors such as oil and gas, packaging, and infrastructure. The region’s advanced pipeline network and emphasis on modernization have accelerated the adoption of high-performance piping solutions where bimodal HDPE offers superior stress crack resistance and long-term durability. Manufacturers are also leveraging the material’s recyclability to meet regulatory guidelines and corporate sustainability goals. In addition, robust investments in packaging innovations, particularly for industrial and food-grade applications, have reinforced the region’s position as a key consumer of bimodal HDPE across extrusion and blow molding processes. According to the US Economic Development Administration, the US Department of Commerce invested USD 500,000 to advance Wisconsin's environmentally sustainable packaging sector, promoting innovation and adoption of sustainable practices within the industry.

US Bimodal HDPE Market

In 2024, the bimodal HDPE market in the US held the dominant share in North America, driven by large-scale pipeline replacement programs and a thriving packaging sector. Increased demand for corrosion-resistant materials in water infrastructure and energy transport projects has elevated the role of bimodal HDPE. The country’s dynamic regulatory landscape also favors eco-efficient materials, prompting manufacturers to transition from traditional plastics. Moreover, a growing focus on domestic manufacturing and sustainable product design in consumer packaging has further propelled demand. Leading processors in the US continue to adopt advanced extrusion and blow molding techniques to maximize material performance and cost-efficiency.

Asia Pacific Bimodal HDPE Market

The bimodal HDPE market in Asia Pacific is projected to register the highest CAGR during the forecast period, supported by rapid industrialization, urban infrastructure development, and rising adoption of durable plastic materials. Emerging economies across the region are investing heavily in water management systems, power transmission, and logistics, all of which require strong, lightweight materials such as bimodal HDPE. Increased production of consumer goods and the expansion of e-commerce are also driving packaging innovation, favoring high-performance plastics. According to the International Trade Administration, China holds the position of the largest e-commerce market in the world, accounting for nearly 50% of global transaction volume. Local manufacturers are enhancing production capabilities and adopting new processing technologies to meet the region’s growing demand for sustainable and efficient materials.

China Bimodal HDPE Market

The bimodal HDPE market in China accounted for the largest share in 2024, fueled by extensive investments in infrastructure, manufacturing, and logistics. The country’s aggressive expansion of its oil and gas pipeline network, urban drainage systems, and construction projects has created substantial demand for extrusion-grade HDPE. In parallel, the packaging sector in China is shifting toward recyclable and lightweight solutions, increasing the consumption of blow-molded products. Government-led initiatives promoting eco-friendly materials and industrial upgrades have incentivized domestic producers to increase capacity and adopt bimodal HDPE for high-demand applications. Strong domestic consumption and favorable policy direction continue to reinforce China's market leadership.

Europe Bimodal HDPE Market

The bimodal HDPE market in Europe is experiencing steady growth, driven by stringent regulations promoting recyclable materials and increasing preference for high-performance polymers in critical infrastructure. Investments in water and gas distribution networks and an ongoing transition to more energy-efficient and long-lasting pipeline systems have encouraged the use of bimodal HDPE. The packaging sector is also undergoing a significant shift toward lightweight, sustainable solutions, reinforcing demand for blow molding applications. In addition, the region’s advanced automotive and electronics sectors are adopting high-grade polymers to reduce component weight and enhance product longevity. These factors collectively contribute to consistent demand across multiple end-use industries.

Key Players & Competitive Analysis Report

The competitive landscape of the bimodal HDPE market is shaped by strategic collaborations, innovation pipelines, and focused market expansion strategies. Industry analysis indicates a strong emphasis on joint ventures and post-merger integration to strengthen production capacity and enhance distribution networks. Key players are adopting technology advancements to refine polymerization techniques, enabling the manufacture of grades tailored for high-pressure piping, blow molding, and film extrusion. Mergers and acquisitions are being utilized to consolidate regional footprints and gain access to proprietary catalyst technologies. Strategic alliances are formed to support R&D in recyclable and lightweight formulations, aligning with growing sustainability demands. Frequent product launches in customized grades reflect a response to dynamic end user requirements across the packaging, automotive, and infrastructure sectors. Investments in process optimization and circular economy initiatives are further redefining value chains in the global bimodal HDPE market. Continuous innovation and regional diversification are central themes guiding competitive positioning and long-term growth within this space.

List of Key Companies

- Braskem

- Chevron Phillips Chemical Company

- Dow Inc.

- Exxon Mobil Corporation

- FKuR Plastics Corp.

- INEOS

- Mitsui Chemicals Inc.

- SABIC

- SCG Chemicals Public Company Limited

Bimodal HDPE Industry Development

In May 2025, Univation Technologies launched its design capacity for the UNIPOL Polyethylene (PE) process technology, achieving a substantial scale of 800,000 tonnes per year. This advancement highlights the technology's capability to meet the increasing demands of the polyethylene market through enhanced efficiency and production capacity.

Bimodal HDPE Market Segmentation

By Processing Method Outlook (Revenue USD Billion, 2020–2034)

- Extrusion

- Blow Molding

- Injection Molding

- Compression Molding

By Application Outlook (Revenue USD Billion, 2020–2034)

- Packaging

- Automotive

- Electronics & Electrical (E&E)

- Construction

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bimodal HDPE Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.62 billion |

|

Market Size Value in 2025 |

USD 9.33 billion |

|

Revenue Forecast by 2034 |

USD 19.11 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.62 billion in 2024 and is projected to grow to USD 19.11 billion by 2034.

The global market is projected to register a CAGR of 8.3% during the forecast period.

In 2024, the North America bimodal HDPE market held the largest share due to strong demand from well-established sectors such as oil & gas, packaging, and infrastructure.

A few of the key players include Braskem, Chevron Phillips Chemical Company, Dow Inc., Exxon Mobil Corporation, FKuR Plastics Corp., INEOS, Mitsui Chemicals Inc., SABIC, and SCG Chemicals Public Company Limited.

In 2024, the blow molding segment accounted for the largest share, largely due to the widespread use of bimodal HDPE in blow-molded containers, caps, and closures.

In 2024, the packaging segment accounted for the largest share of the bimodal HDPE market, largely due to its superior mechanical strength and stiffness.