Bioanalytical Testing Services Market Size, Share, Trends, Industry Analysis Report

By Molecule (Small Molecule, Large Molecule, Others), By Test, By Workflow, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 120

- Format: PDF

- Report ID: PM1934

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

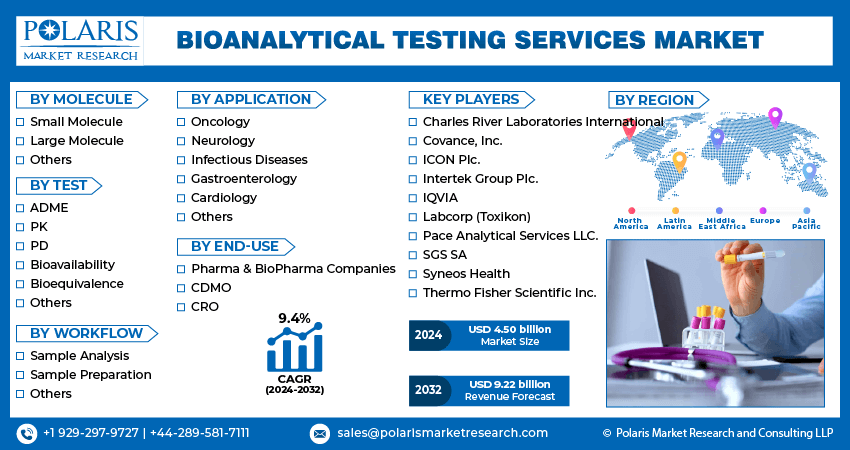

The global bioanalytical testing services market was valued at USD 4.87 billion in 2024 and is projected to register a CAGR of 9.70% from 2025 to 2034. Increasing R&D investments in biopharmaceuticals boost the market growth. Moreover, the increasing adoption of artificial intelligence (AI) and machine learning (ML) in bioanalytical testing services propels the industry growth.

Key Insights

- In 2024, the bioavailability segment dominated the market revenue share. Bioavailability plays a crucial role in assessing the effectiveness of a new drug's pharmacokinetic profile after administration in clinical trials.

- The sample preparation segment dominated the market in 2024, owing to its selectivity, convenience, speed, and extraction phase configurations.

- North America dominated the global revenue share in 2024. The rising R&D investments in new drug development contributed to this dominance.

- The Asia Pacific bioanalytical testing services industry is expected to register the highest CAGR from 2025 to 2034. The growth is attributed to the rise in pharmaceutical and biotechnology activities in the region.

Industry Dynamics

- Rising expansion of contract research organizations (CROs) drives the industry growth.

- Increasing focus on technological advancements in bioanalytical instruments, such as automated sample preparation and parallel LC separation, propel the market demand.

- The high costs of testing and the lack of skilled professionals hinder the market growth.

- Growing investments in research and development in the pharmaceutical industry are expected to provide lucrative opportunities during the forecast period.

Market Statistics

2024 Market Size: USD 4.87 billion

2034 Projected Market Size: USD 12.24 billion

CAGR (2025–2034): 9.70%

North America: Largest market in 2024

AI Impact on Bioanalytical Testing Services Market

- The integration of artificial intelligence (AI) technology has led to enhanced data extraction and analysis. It provides a precise understanding of the chemical components of biological samples, leveraging AI algorithms.

- AI enables predictive modeling, drug target identification, drug screening, and image screening.

- AI-powered robotics streamlines sample preparation and analysis. It helps reduce the risks of manual errors and turnaround times.

To Understand More About this Research:Request a Free Sample Report

Bioanalytical testing services analyze biological samples to quantify substances, assess drug efficacy, and ensure safety. They utilize advanced techniques to support drug development, clinical trials, and personalized medicine. The bioanalytical testing services market is experiencing robust growth driven by technological advancements, including chromatography, mass spectrometry, and immunoassays, which are extensively utilized in clinical trial protocols

There is a rising demand for well-equipped laboratories offering services for bioanalytical investigations involving small molecules in a variety of matrices, such as tissues, blood, serum, and plasma, to meet patient demands and enhance patient outcomes. This encourages the construction of new bioanalytical labs and facilities with highly skilled professionals.

For instance, in September 2023, Eurofins established a biopharma services campus in India's Genome Valley to provide services to international pharmaceutical corporations in the areas of formulation development, safety toxicology, bio-analytical services, and discovery chemistry and biology.

Bioanalytical Testing Services Market Trends

Rising Expansion of Contract Research Organizations (CROs) Drives Market Growth

The market growth rate for bioanalytical testing services is being fueled by the increasing expansion of CROs. They aim to provide efficient, accelerated, and personalized clinical trial solutions that meet the unmet research and development needs of pharmaceutical and biotech companies worldwide.

For instance, in July 2024, Harvest Integrated Research Organization (HiRO) acquired CRO DeltaMed Solutions as part of its ongoing efforts to expand its cross-border operations in the US. The acquisition will help HiRO harness the expertise of both organizations in key therapeutic areas and service offerings while also improving its capability.

Rising Technological Advancements in Bioanalytical Instruments

The bioanalytical testing services market is experiencing significant growth, driven by the rising need for technologically advanced bioanalytical instruments to meet the demands of scientists, research and development centers, and healthcare professionals.

HPLC-MS, an essential bioanalytical instrument, is constantly witnessing technological advancements in areas like automated sample preparation and parallel LC separation to improve the efficiency and detection of diseases among patients. This, in turn, drives the bioanalytical testing services market revenue.

For instance, in December 2023, HPLC-MS combined the mass spectral selectivity of MS with the separation capability of LC to generate great throughput, sensitivity, and selectivity in the pharmaceutical sector for both in vitro and in vivo applications.

Bioanalytical Testing Services Market Segment Insights

Bioanalytical Testing Services Test Insights

The global bioanalytical testing services market segmentation, based on test, includes ADME, PK, PD, bioavailability, bioequivalence, and others. In 2024, the bioavailability segment dominated the market for bioanalytical testing services. Bioavailability plays a crucial role in assessing the effectiveness of a new drug's pharmacokinetic profile after administration in clinical trials.

Moreover, there has been a rise in the number of ongoing clinical trials. Therefore, integrating bioavailability testing into these trials is essential to ensure consistency and stability between formulations used, ultimately improving patient outcomes.

For instance, according to a report published in February 2023 by the WHO International Clinical Trials Registry Platform (ICTRP), in 2022, the Western Pacific region has seen a significant rise in clinical trial registrations per year. This increase is mainly attributed to the high number of clinical trial registrations in China and Japan, ranking first and second in the region, respectively.

Bioanalytical Testing Services Workflow Insights

The global bioanalytical testing services market segmentation, based on workflow, includes sample analysis, sample preparation, and others. The sample preparation segment dominated the market owing to its selectivity, convenience, speed, and extraction phase configurations. Technology oriented sample preparations are being developed to meet the increasing need for automation, reduced solvent usage, and miniaturization, leading to on-site, in situ, and in vivo applications.

For instance, in November 2023, Thermo Fisher Scientific launched automated sample preparation solutions for laboratories that are approved for in vitro diagnostic (IVD) and in vitro diagnostic regulation (IVD-R). The new solutions will help streamline and automate respiratory diagnostic testing.

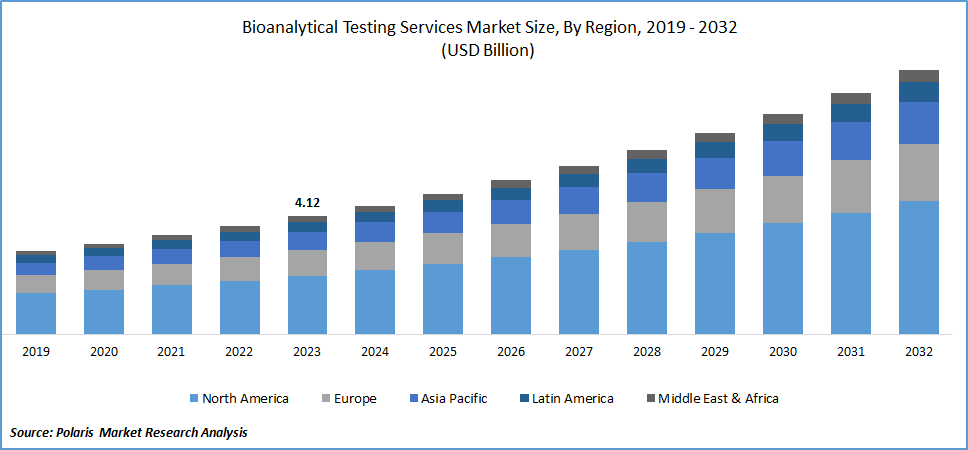

Global Bioanalytical Testing Services Market, Segmental Coverage, 2020 - 2034 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Bioanalytical Testing Services Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America dominated the bioanalytical testing services market owing to the rising R&D investments in new drug development. Also, the rise in the expansion of pharmaceutical companies in the North American region is propelling market growth.

For instance, in May 2024, Mercodia expanded its bioanalytical testing services in the United States. This expansion will enhance the company’s ability to offer bioassay testing for preclinical and clinical programs, thus increasing Mercodia’s regional and global footprint.

Moreover, the United States accounted for the largest share in the North American bioanalytical testing services market, driven by increasing demand for biopharmaceutical products, the need for specialized tests such as electrophoresis, electrochemical assays, and immunoassays, and other cutting-edge medications in this region.

Global Bioanalytical Testing Services Market Regional Coverage, 2020 - 2034 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The Asia-Pacific bioanalytical testing services market is expected to grow at the fastest CAGR from 2025 to 2034 attributed to the rise in pharmaceutical and biotechnology activities in Asia Pacific region. Further, the increase in healthcare spending, rising investments, and acquisitions from companies in developed nations to improve regional healthcare are driving the market growth.

For instance, in November 2023, Resolian, an international bioanalytical contract research organization (CRO) specializing in drug metabolism and pharmacokinetics for small and large molecules, acquired Denali Medpharma, a prominent bioanalytical CRO based in China. The acquisition will enable Resolian to expand clinical trials to nearly any location without the need to switch bioanalytical CROs.

Moreover, China’s bioanalytical testing services market held the largest market share in the Asia Pacific region over the forecast period, driven by the rising demand for bioanalytical testing services to cater to the large population and diverse patient demographics.

Bioanalytical Testing Services Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the bioanalytical testing services market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the bioanalytical testing services industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global bioanalytical testing services industry to benefit clients and increase the market sector. In recent years, the bioanalytical testing services industry has witnessed some technological advancements. Major players in the bioanalytical testing services market include Charles River Laboratories International, Covance, Inc., ICON Plc., Intertek Group Plc., IQVIA, Labcorp (Toxikon), Pace Analytical Services LLC, SGS SA, Syneos Health and Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. offers a wide range of specialty diagnostics, life sciences solutions, laboratory products, analytical instruments, and biopharma services. The Analytical Instruments division provides a broad portfolio of consumables, instruments, software, and services for use in biotechnology, pharmaceutical, academic, environmental, government, and other research and industrial markets, as well as clinical laboratories. For instance, in February 2024, Thermo Fisher Scientific Inc. extended its good manufacturing practices (GMP) facility in the United States to include mycoplasma and biosafety testing capabilities. This analytical testing service will help clients to provide safe medications to patients.

SGS SA is an inspection, testing, and certification company. The company provides a wide range of services, including testing, verification, training, and certification, to help customers reduce risk, access new markets, control quality and quantity, and ensure regulatory compliance for their products, processes, and systems. SGS SA has an operating network of laboratories and 2,600 offices across 116 countries. For instance, in September 2021, SGS officially declared the expansion of their bioanalytical testing facility in France, incorporating a new 800-m2 structure. This development will enable SGS SA to facilitate the advancement of small molecules, peptides, biotherapeutics, as well as cell and gene therapies to effectively address the increasing need for bioanalytical testing services.

Key companies in the bioanalytical testing services market include:

- Charles River Laboratories International

- Covance, Inc.

- ICON Plc.

- Intertek Group Plc.

- IQVIA

- Labcorp (Toxikon)

- Pace Analytical Services LLC.

- SGS SA

- Syneos Health

- Thermo Fisher Scientific Inc.

Bioanalytical Testing Services Industry Developments

In August 2024, SGS introduced new specialized bioanalytical testing services in the North American pharmaceutical and biopharmaceutical markets.

May 2024: BioAgilytix and BBI Solutions OEM Limited (BBI) collaborated to combine BioAgilytix's bioanalytical testing services with BBI's capacity to effectively generate high-quality antibody reagents for a range of testing applications. This will streamline bioanalytical testing services for pharmaceutical and biopharmaceutical sectors more efficiently.

February 2024: Azzur Group launched analytical laboratory testing services for advanced therapeutic medicinal products (ATMPs). The introduction of these testing services has led to the development of a new platform model that is specifically designed to cater to the manufacturing infrastructure, processes, and expertise required for ATMPs.

March 2023: SGS SA inaugurated the SGS China Bioanalysis Center in Shanghai with highly specialized instruments, adhering to official OECD, FDA, NMPA, ICH, and EMA guidelines. The bioanalytical center has the capability to develop testing protocols, examine biological samples, and furnish comprehensive data analysis reports tailored to the requirements of the clients.

Bioanalytical Testing Services Market Segmentation:

Bioanalytical Testing Services Molecule Outlook

- Small Molecule

- Large Molecule

- LC-MS Studies

- Immunoassays

- PK

- ADA

- Others

- Others

Bioanalytical Testing Services Test Outlook

- ADME

- In-Vivo

- In-Vitro

- PK

- PD

- Bioavailability

- Bioequivalence

- Others

Bioanalytical Testing Services WorkFlow Outlook

- Sample Analysis

- Hyphenated technique

- Chromatographic technique

- Electrophoresis

- Ligand Binding Assay

- Mass Spectrometry

- Nuclear Magnetic Resonance

- Sample Preparation

- Protein Precipitation

- Liquid-Liquid Extraction

- Solid Phase Extraction

- Others

- Others

Bioanalytical Testing Services Application Outlook

- Oncology

- Neurology

- Infectious Diseases

- Gastroenterology

- Cardiology

- Others

Bioanalytical Testing Services End-Use Outlook

- Pharma & BioPharma Companies

- CDMO

- CRO

Bioanalytical Testing Services Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Bioanalytical Testing Services Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.87 billion |

|

Market Size Value in 2025 |

USD 5.33 billion |

|

Revenue Forecast in 2034 |

USD 12.24 billion |

|

CAGR |

9.70% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global bioanalytical testing services market size was valued at USD 5.33 billion in 2025 and will be valued at USD 12.24 billion in 2034

The global market is projected to grow at a CAGR of 9.70% during the forecast period, 2025-2034.

North America had the largest share of the global market.

The key players in the market are Charles River Laboratories International, Covance, Inc., ICON Plc., Intertek Group Plc., IQVIA, Labcorp (Toxikon), Pace Analytical Services LLC, SGS SA, Syneos Health and Thermo Fisher Scientific Inc.

The bioavailability category dominated the market in 2023.

The sample preparation held the largest share in the global market