Bionic Ears Market Share, Size, Trends, Industry Analysis Report

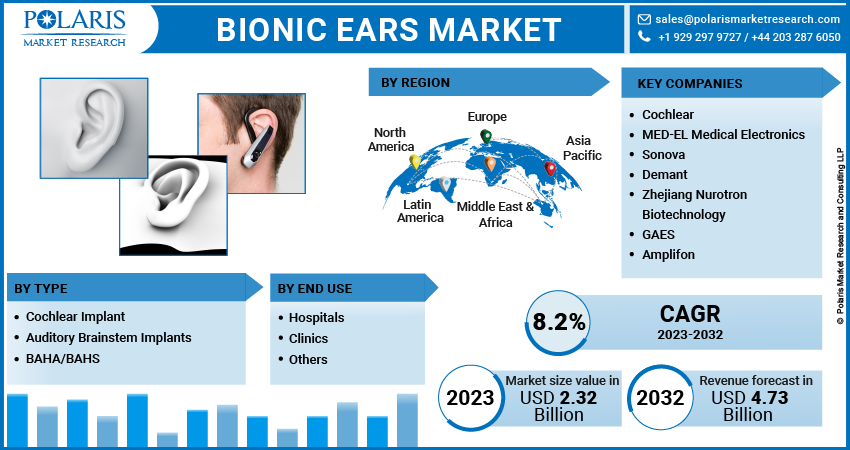

By Type (Cochlear Implant, Auditory Brainstem Implants, BAHA/BAHS); By End-use; By Region, And Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3597

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

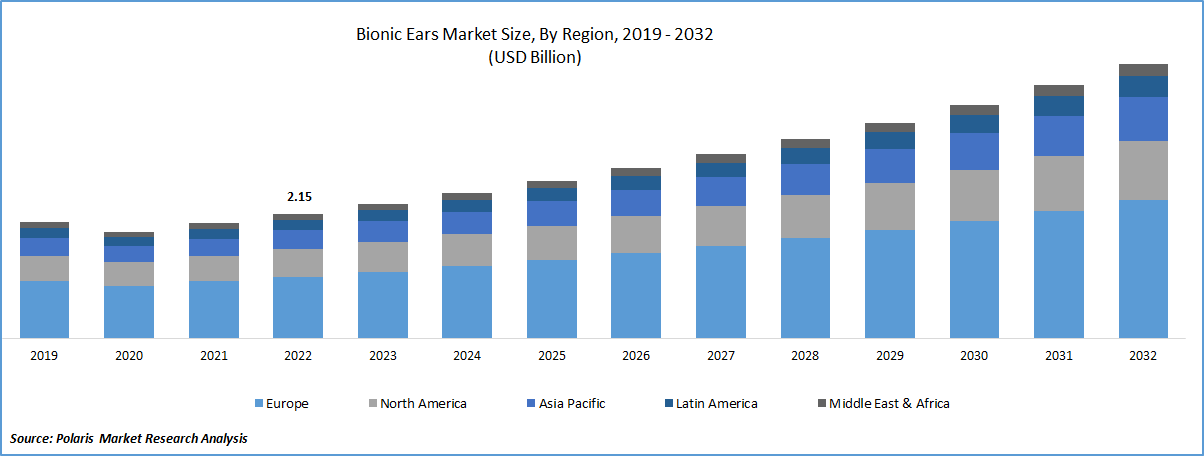

The global bionic ears market was valued at USD 2.15 billion in 2022 and is expected to grow at a CAGR of 8.2% during the forecast period. Growing geriatric population worldwide has contributed to the increased demand for bionic ears. As individuals age, the likelihood of experiencing hearing loss rises, creating a larger market for hearing solutions such as bionic ears. Additionally, the prevalence of hearing loss is on the rise globally, leading to an increased need for effective hearing restoration options. Bionic ears, also known as cochlear implants, provide a viable solution for individuals with severe hearing loss or profound deafness, further driving the market's growth.

To Understand More About this Research: Request a Free Sample Report

According to the World Health Organization (WHO), it is projected that around 2.5 billion individuals will experience some form of hearing loss by 2050, with at least 700 million people requiring hearing rehabilitation. Alarming statistics also reveal that nearly 1 Bn young people are at risk of developing the permanent hearing loss due to the un-safe listening practices. As a result, the demand for bionic ears is expected to increase significantly in the coming years to address the needs of individuals with hearing impairments.

Advancements in technology have also played a significant role in the expansion of the bionic ear market. Continuous innovation and improvements in cochlear implant technology have led to enhanced hearing capabilities and better outcomes for patients. These technological advancements, such as improved speech processing algorithms and wireless connectivity features, have made bionic ears more appealing to individuals with hearing impairments. Moreover, favorable reimbursement policies implemented by governments and insurance providers have facilitated better access to bionic ear devices. Increased coverage and financial assistance for cochlear implants have made them more affordable and accessible to a larger population, contributing to market growth.

Market experienced significant disruptions due to the COVID-19 pandemic, which caused disruptions in the global supply chain and manufacturing processes. The availability and production of bionic ears were affected as a result. Furthermore, many hospitals had to postpone elective non-urgent surgeries to accommodate the high influx of patients with COVID-19, further impacting the market. The pandemic's overall impact led to a decline in the market during the period, as healthcare systems focused on managing the pandemic and prioritized urgent medical needs.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

In recent years, remarkable advancements have taken place in bionic ear technology, particularly in the field of cochlear implants. One notable development is the integration of wireless connectivity, which has expanded the capabilities of these devices. The inclusion of wireless connectivity in cochlear implants allows users to establish connections with external devices such as smartphones, televisions, and audio equipment. This feature enables individuals with cochlear implants to stream audio content directly to their implants, enhancing their overall hearing experience. By leveraging wireless connectivity, users can wirelessly transmit audio signals from compatible devices to their cochlear implants, eliminating the need for additional accessories or intermediary devices. This seamless integration enables individuals to enjoy enhanced accessibility to phone calls, music, videos, and other audio content without relying solely on external speakers or hearing aids.

Development in bionic ear technology is the miniaturization of the devices. Bionic ears have become smaller and more discreet, allowing users to comfortably wear them without drawing unnecessary attention. The compact size not only improves aesthetics but also enhances the comfort and convenience of wearing bionic ears throughout the day. Directional microphones have also been integrated into bionic ear technology, enabling users to focus on specific sounds or conversations while reducing background noise. This feature enhances speech understanding and improves communication in noisy environments, enhancing the overall listening experience.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Cochlear implant segment accounted for the largest market share in 2022

Cochlear implant segment dominated the market. This segment's dominance can be attributed to the growing number of cochlear implantation surgeries and increased market penetration. An example of these advancements is Cochlear Ltd’s announcement in January 2022, regarding the approval for the “Cochlear Nucleus Implants” designed to address the single-sided deafness & unilateral hearing loss. This approval signifies the continuous progress in cochlear implant technology, expanding its applications and providing solutions for individuals with specific hearing challenges.

Auditory brainstem implant segment expected to witness steady growth rate. In recent years, there have been several advancements in auditory brainstem implant devices and electrode design, contributing to the segment's development. While the ABI was initially developed for patients with NF2, recent research suggests that this technology can also be utilized to provide hearing capabilities for children and individuals without tumors. These findings expand the potential applications of auditory brainstem implants and indicate promising prospects for the segment's growth in the future.

Hospitals segment expected to hold significant market share

Hospitals segment is projected to hold significant market share in terms of revenue over the study period. The presence of skilled experts capable of performing complex procedures such as cochlear implantations, bone-anchored hearing aid (BAHA) implantations, and auditory brainstem implantations further contributes to the growth of this segment. The expertise and resources available within hospitals make them a preferred choice for patients requiring advanced audiology procedures, thereby driving the growth of the hospitals segment in the market.

Clinics segment expected to witness the steady growth. This growth can be attributed to the increasing availability of cochlear implant procedures in clinics, which aim to restore the auditory functions in individuals with the advanced sensori-neural hearing loss. In recent years, there has been a rise in the number of well-equipped ears, nose, and throat (ENT) clinics offering these procedures. The prevalence of hearing loss, coupled with the convenience and accessibility of clinics, further contributes to the growth of this segment. The expansion of services and specialized expertise in clinics enables individuals with hearing loss to seek treatment and benefit from advanced audiology procedures, thereby driving the growth of the clinics segment in the market.

Europe region dominated the global market in 2022

Europe region dominated the global market with considerable market share in 2022. The region's growth is primarily attributed to the high prevalence of hearing loss, especially among the elderly population. Europe has a significant number of individuals affected by hearing loss, which drives the demand for bionic ear solutions. Additionally, advancements in bionic ear technology, including cochlear implants, have gained significant penetration in both adult and pediatric populations, further supporting market growth.

Moreover, there is increased awareness among the general population about the available treatment options for hearing loss, leading to a higher adoption of bionic ears. The emphasis on early diagnosis and intervention, along with the availability of reimbursement policies, contributes to the growth of the market in Europe. The combination of these factors creates a favorable environment for the bionic ears market to thrive in the region.

The Asia Pacific region is anticipated to be the fastest growing region throughout the projected period. The region's large and rapidly growing population is a key factor driving the increased prevalence of hearing loss. As the population ages and the incidence of age-related hearing loss rises, the demand for bionic ear solutions is expected to increase. Furthermore, factors such as rising disposable incomes and increasing healthcare expenditure in many countries across the region contribute to the growth of the market. With improved economic conditions, individuals have greater affordability to invest in advanced audiology solutions for hearing loss.

Competitive Insight

Some of the major players operating in the global market include Cochlear, MED-EL Medical Electronics, Sonova, Demant, Zhejiang Nurotron Biotechnology, GAES, and Amplifon

Recent Developments

- In April 2022, Cochlear completed the acquisition of the Oticon Medical. This strategic agreement allows Cochlear to extend its support to the existing customer base of Oticon Medical, which includes over 75,000 users of hearing implants. These implants comprise both acoustic and cochlear implants, enhancing Cochlear's ability to serve a broader range of individuals with hearing loss.

- In February 2023, Cochlear introduced support for Audio Streaming for Hearing Aids (ASHA) to enable direct streaming from Fire TV to their hearing implants. This new feature allows users with Cochlear hearing implants to seamlessly stream audio content from Fire TV devices, enhancing their overall listening experience.

Bionic Ears Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.32 billion |

|

Revenue forecast in 2032 |

USD 4.73 billion |

|

CAGR |

8.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2021 – 2022 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Cochlear, MED-EL Medical Electronics, Sonova, Demant, Zhejiang Nurotron Biotechnology, GAES, and Amplifon. |

FAQ's

key companies in Bionic Ears Market are Cochlear, MED-EL Medical Electronics, Sonova, Demant, Zhejiang Nurotron Biotechnology, GAES, and Amplifon.

The global bionic ears market expected to grow at a CAGR of 8.2% during the forecast period.

The Bionic Ears Market report covering key are type, end use, and region.

key driving factors in Bionic Ears Market are Increasing ratio of aging people globally.

The global bionic ears market size is expected to reach USD 4.73 billion by 2032.