Biopharma Cold Chain Logistics Market Size, Share, Trends, & Industry Analysis Report

By Component (Storage, Transportation, and Monitoring Components), By Region -Market Forecast, 2025 – 2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM1766

- Base Year: 2024

- Historical Data: 2020-2023

Overview

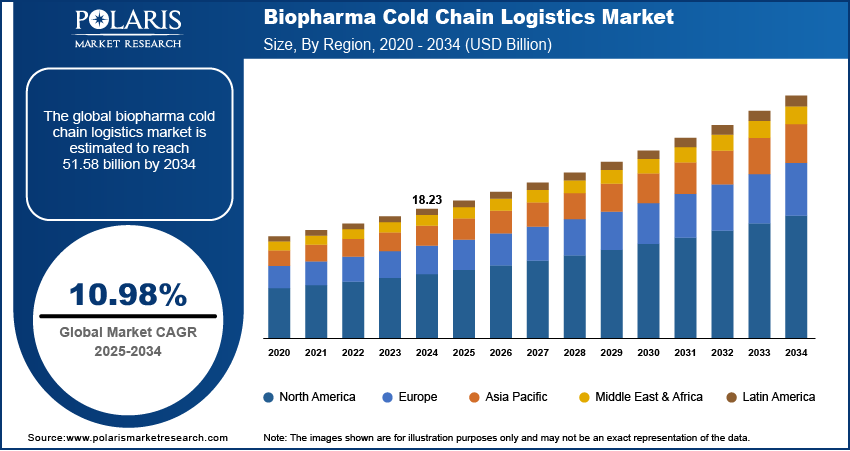

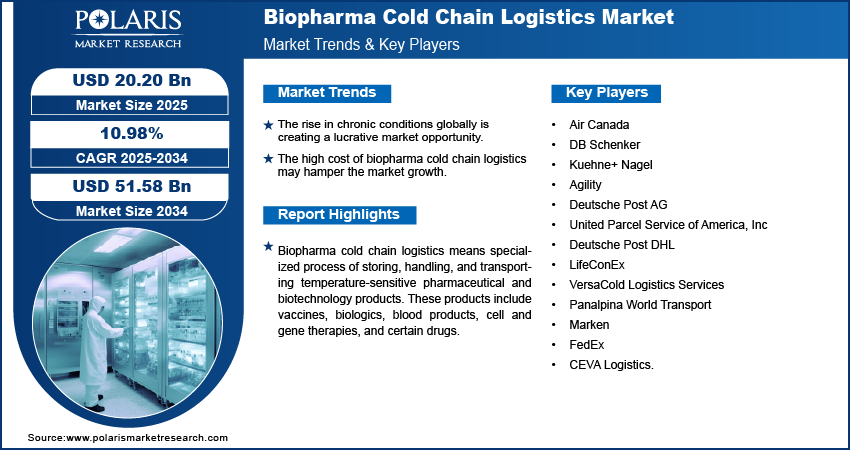

The global biopharma cold chain logistics market size was valued at USD 18.23 billion in 2024 and is anticipated to grow at a CAGR of 10.98% from 2025 to 2034. Key factors driving demand for biopharma cold chain logistics include high prevalence of chronic diseases, growth in healthcare expenditure and R&D, and regulatory compliance.

Key Insights

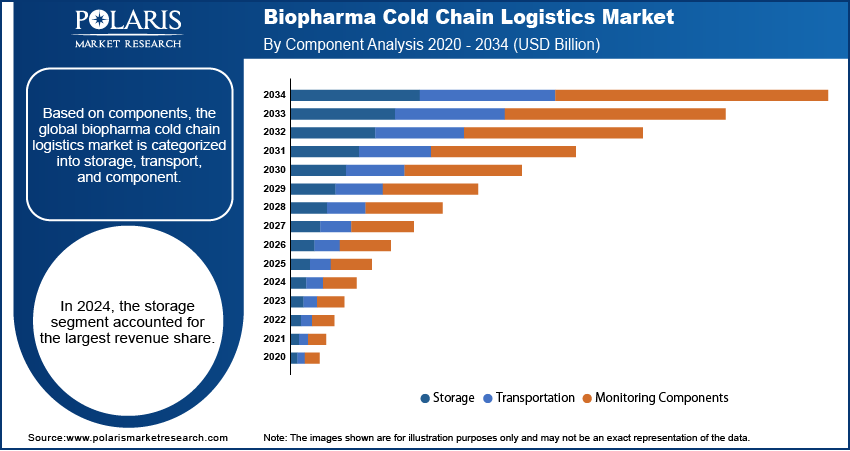

- The storage segment accounted for the largest revenue share in 2024 due to a surge in demand for temperature-sensitive nutritional supplements and temperature-sensitive vaccines.

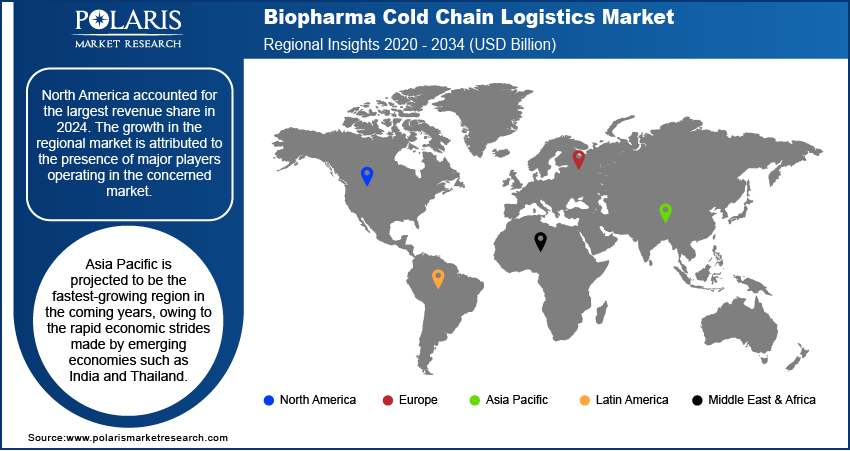

- North America accounted for the largest revenue share in 2024, owing to the presence of major players operating.

- Asia Pacific is projected to grow at the fastest rate in the coming years, owing to the rapid economic strides made by emerging economies.

Industry Dynamics

- The increase in demand for over-the-counter (OTC) drugs is propelling the adoption of biopharma cold chain logistics.

- The increasing healthcare spending across the globe is leading to high investments in biopharma cold chain logistics.

- The rise in chronic conditions globally is creating a lucrative market opportunity.

- The high cost of biopharma cold chain logistics may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 18.23 Billion

- 2034 Projected Market Size: USD 51.58 Billion

- CAGR (2025-2034): 10.98%

- North America: Largest Market Share

Know more about this report: Request a Free Sample Report

AI Impact on Biopharma Cold Chain Logistics Market

- AI improves efficiency, reduces risks, and ensures product integrity in biopharma cold chain logistics.

- AI helps in enhancing demand forecasting and inventory planning.

- AI strengthens real-time monitoring through IoT-enabled sensors.

- AI also helps in reducing transit times and ensuring compliance.

Biopharma cold chain logistics means specialized process of storing, handling, and transporting temperature-sensitive pharmaceutical and biotechnology products. These products include vaccines, biologics, blood products, cell and gene therapies, and certain drugs. The cold chain involves an integrated system of refrigerated storage facilities, temperature-controlled packaging, and specialized transportation modes. The market growth is particularly driven by the huge demand of temperature-sensitive drugs and biopharmaceutical products such as life-saving vaccines and blood plasma in the developed economies. The high incidence of COVID-19 pandemic, the trade of conventional and over the counter drugs has also increased the demand for biopharma cold chain logistics from country to country. For instance, the U.S. Food & Drug Administration (FDA), recently, has approved emergency use authorization (EUA) for the drug hydroxyl-chloroquine, mostly manufactured in India, to be used as an antibiotic for the patients suffering with COVID-19 symptoms. This propelled biopharma logistics companies to focus on developing their supply chain models.

The other factors favoring the market growth include increase in demand for the over the counter (OTC) drugs, the rising importance of fast-track delivery of the product through technology, cost containment measures to maintain optimal distribution and packaging cost, and investments in the telematics and remote monitoring technologies to reduce cases of product adulteration during transport.

Industry Dynamics

Growth Drivers

Pharma logistics companies are using advanced technologies such as IoT, autonomous vehicles, and blockchain to enhance operational efficiency. Blockchain maintains digital ledger to maintain, record, and authenticate data, while IoT comprises of set of physical devices for communication over the internet. This technology enables biopharma companies to reduce operational transportation costs, lead time, and real time monitoring of cargo. It achieves cost savings by automating error free processes, by streamlining distribution operations. For instance, global logistics service providers such as DHL and Accenture have developed serialization prototype with blockchain technology to track shipment across six geographies.

Know more about this report: request for sample pages

Recently, in September 2020, DHL Global Forwarding, an entity of DHL group, announced technology enhancements to its life sciences services division, to meet the evolving pharma logistics needs, to counter the disruption caused due to COVID-19 pandemic. It launched “New LifeTrack User Interface”, a temperature-controlled shipment tracking portal, providing its customers with real-time analytics, digitalized standard operating procedures (SOP) information, and the lane risk assessment tool. This will enable the company’s LifeConEx and Thermonet clients with real time access to packaging time, lead time, and delivery of products to the target destination. Moreover, Maersk, Denmark based shipping container company, is using IoT enabled refrigerated containers to ensure the safety of the consignment from adulteration, misplacement, and theft. SkyCell offers IoT enabled refrigerated containers specially designed for pharmaceuticals products.

Biopharma Cold Chain Logistics Market Report Scope

The market is primarily segmented on the basis of component, and geographic region.

|

By Component |

By Region |

|

|

Know more about this report: request for sample pages

Insight by Component

Based on components, the global biopharma cold chain logistics market is categorized into storage, transport, and component. In 2024, the storage segment accounted for the largest revenue share. The factors responsible for its growth include the surge in demand for temperature-sensitive nutritional supplements and temperature-sensitive vaccines. The adoption of sea-based pharma logistics, as sea freight is capable of handling personalized medicines, also drove the segment growth. The high aging population in emerging countries such as India and China also contributed to high demand for storage solutions for stroing vaccines which have beeen developed in these nations to tackle rising chronic conditions among aging population. Moreover, the growing healthcare spending, particulary in India and Brazil further drove the segment dominance.

Which technological advancements are being increasingly adopted in the biopharma cold chain logistics market?

The biopharma cold chain logistics industry players adopt various technological advancements, such as IoT, AI, and sustainable solutions. Companies in the industry are investing in these technologies to enhance security and increase efficiency in the process. They are focusing on eco-friendly practices to align with global sustainability goals by lowering carbon footprints. Further, market players are collaborating and partnering with technology providers to obtain innovation in their services and operations. It helps players stay ahead in the competitive landscape. The following table consists of comprehensive information on technological advancements and their benefits in biopharma cold chain logistics operations.

|

Technological Advancements |

Advantages |

|

Internet of Things (IoT) |

During storage and transit, IoT facilitates real-time monitoring of temperature, humidity, and other environmental conditions. It ensures product integrity and compliance. |

|

Artificial Intelligence (AI) |

AI-based systems optimize warehouse management, inventory forecasting, route planning, and predictive maintenance. Their adoption helps reduce costs and enhances operational efficiency. |

|

Robotics and Automation |

Automated storage & retrieval systems (AS/RS) and robotic systems reduce errors, improve throughput, and streamline handling of sensitive biopharmaceuticals. |

|

Blockchain |

Blockchain-based logistics tools provide immutable records of product movement for traceability, compliance, and security in the cold chain. |

|

Sustainable Cold Chain Solutions |

Solar-powered refrigerated units, energy-efficient warehouses, and hydrogen-fueled trucks are being adopted to reduce carbon footprint. |

|

Advanced Packaging Solutions |

Phase-change materials, temperature-controlled containers, and insulated shippers are used to maintain required temperatures during transport. |

|

Cloud-Based Supply Chain Platforms |

Cloud-based platforms help in centralized monitoring and analytics for distributed networks. They enhance reporting, compliance with regulatory requirements, and coordination between stakeholders. |

|

Connected Sensors and Telematics |

Integration of GPS and smart sensors in logistics systems monitors temperature, location, and environmental conditions in real time during transportation. |

|

Predictive Analytics |

Predictive analysis processes historical data to predict maintenance needs, temperature excursions, and demand fluctuations to avoid disruptions. |

|

Cold Storage Infrastructure Upgrades |

Automated refrigeration, energy-efficient systems, and zoned storage are integrated in warehouses for various temperature requirements. |

Geographic Overview

North America accounted for the largest revenue share in 2024. The growth in the regional market is attributed to the presence of major players operating in the concerned market. These players are involved in several strategic initiatives, which is taking the market forward. For instance, in August 2018, ICS, Texas-based pharma distribution services company, established its new third-party logistics and distribution center in Ohio. This 350,000 sq. ft. facility will strengthen the company’s robust distribution capabilities with embedded state of art technology. Both the U.S. and Canada have a well-developed infrastructure of pharma logistics and distribution, and the players are focusing on newer technologies and investing in supply chain processes to minimize wastage and losses. According to the statistics published by the WHO and the Parenteral Drug Association (PDA), more than 25% of the transported vaccines incorrectly reach their target destination, 20% of the temperature-sensitive product were damaged due to temperature excursion, and the average cost for the root cause of damaged goods is USD 7 thousand.

Asia Pacific is projected to be the fastest-growing region in the coming years, owing to the rapid economic strides made by emerging economies such as India and Thailand. The pharmaceutical industry these nations are undergoing a rapid change, owing to a surge in demand for drugs and vaccines from the huge population base. This is paving the way for a pharma logistics firm to build their own biopharama cold storages. China being the largest producer of raw materials of APIs, which is used in the pharma industry for generics and OTC drugs is also driving the market growth. For instance, It is being estimated that more than 60% of the raw material being used is procured from China alone.

Competitive Insight

The biopharma cold chain logistics market is evolving quickly. This is due to companies in the market competing for temperature-controlled transport of biologics, vaccines, and advanced therapies. Players compete by improving real-time tracking systems, expanding cold storage networks, and strengthening compliance with strict global standards. Many firms are investing in digital tools, such as IoT monitoring and predictive analytics, to cut risks and reduce product losses. Partnerships between pharmaceutical manufacturers, logistics providers, and packaging innovators are also reshaping the competitive field. With demand growing in both mature and emerging regions, the ability to manage complex shipments ranging from frozen vaccines to ultra-low temperature therapies has become a key factor that distinguishes leading providers from their rivals.

Key players operating in the global biopharma cold chain logistics market include Air Canada, DB Schenker, Kuehne+ Nagel, Agility, Deutsche Post AG, United Parcel Service of America, Inc., Deutsche Post DHL, LifeConEx, VersaCold Logistics Services, Panalpina World Transport, Marken, FedEx, and CEVA Logistics.

Industry Developments

April 2025, DHL Group announced to invest EUR 2 Billion by 2030 in DHL Health Logistics to boost globally integrated healthcare solutions.

Biopharma Cold Chain Logistics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 18.23 Billion |

|

Market Size in 2025 |

USD 20.20 Billion |

|

Revenue Forecast by 2034 |

USD 51.58 Billion |

|

CAGR |

10.98% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

.

FAQ's

• The global market size was valued at USD 18.23 billion in 2024 and is projected to grow to USD 51.58 billion by 2034.

• The global market is projected to register a CAGR of 10.98% during the forecast period.

• North America dominated the market in 2024

• A few of the key players in the market are Air Canada, DB Schenker, Kuehne+ Nagel, Agility, Deutsche Post AG, United Parcel Service of America, Inc., Deutsche Post DHL, LifeConEx, VersaCold Logistics Services, Panalpina World Transport, Marken, FedEx, and CEVA Logistics.

• The storage segment dominated the market revenue share in 2024.