Biostimulants Market Size, Share, Trends, Industry Analysis Report

By Active Ingredient (Acid Based, Seaweed Extract, Microbial, Others), By Crop Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5953

- Base Year: 2024

- Historical Data: 2020-2023

Overview

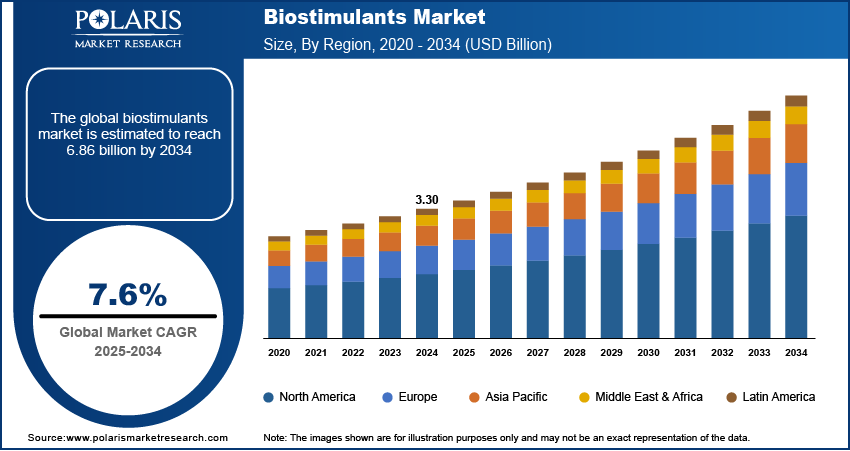

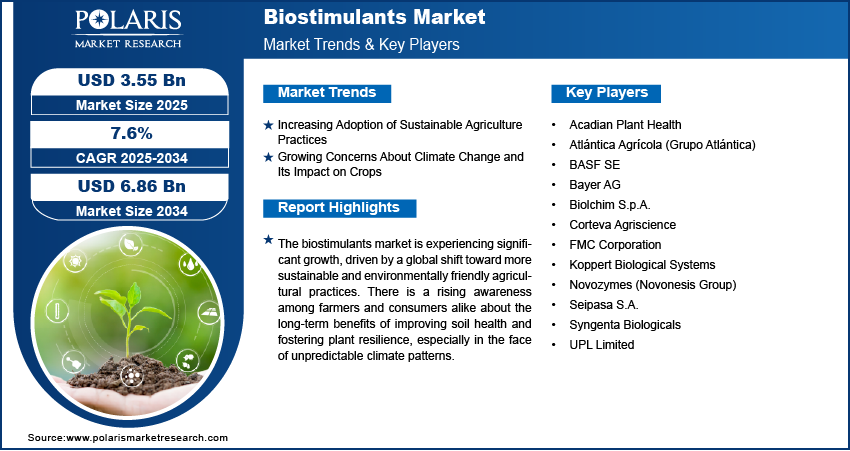

The global biostimulants market size was valued at USD 3.30 billion in 2024 and is anticipated to register a CAGR of 7.6% from 2025 to 2034. The biostimulants industry is growing due to several key factors such as the increasing adoption of sustainable agriculture practices and growing concerns about climate change and its impact on crops are driving market growth.

Key Insights

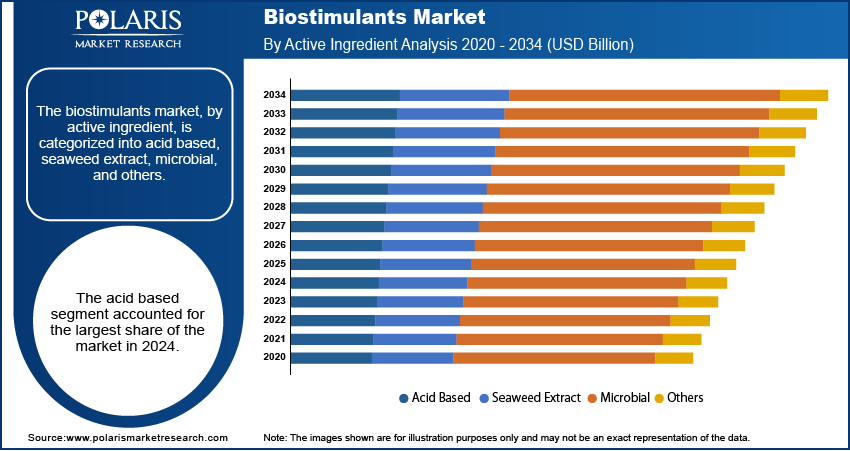

- By active ingredient, the acid based segment, including humic, fulvic, and amino acids, held the largest share of the market in 2024.

- By crop type, the row crops & cereals segment held the largest share in 2024.

- By application, the foliar treatment segment held the largest share in 2024.

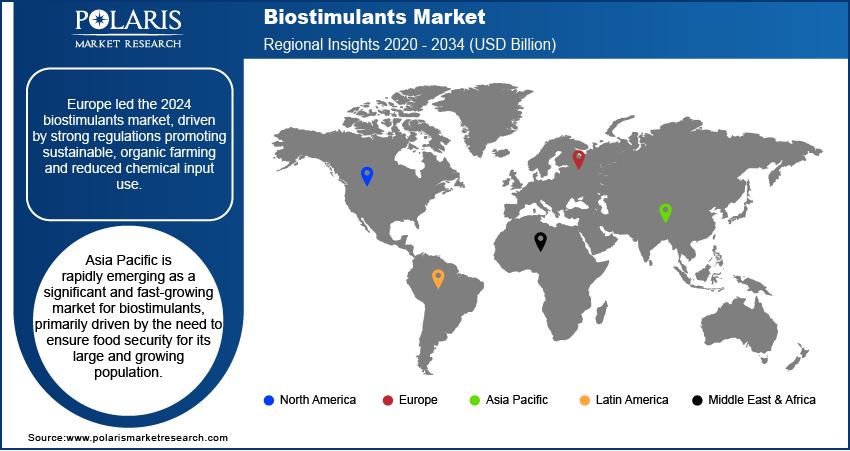

- By region, Europe led the biostimulants market share in 202, driven by its strong regulatory framework that actively promotes sustainable agriculture and organic farming practices.

To Understand More About this Research: Request a Free Sample Report

The biostimulants industry involves products that contain natural substances or microorganisms, which, when applied to plants, seeds, or soil, boost natural processes to improve nutrient uptake, stress tolerance, and overall crop quality, without acting primarily as

The increasing global consumer preference for organic food and beverages and high-quality produce is a significant driver for the biostimulants industry. Consumers are becoming conscious of food safety, environmental impact, and the nutritional value of their food, leading to a growing demand for products grown with fewer synthetic chemicals. Biostimulants offer a natural and sustainable way to meet these demands by enhancing crop quality, improving nutrient content, and minimizing residues in the final product. This shift in consumer behavior creates a strong incentive for farmers to adopt biostimulants as part of their production strategy.

Ongoing technological advancements in the formulations and application of biostimulants are playing a crucial role in expanding the market. Researchers and companies continuously develop more effective and targeted biostimulant products through innovations in biotechnology, microbial culturing, and natural extract processing. These advancements lead to more stable, potent, and efficient formulations that can deliver specific benefits to plants, such as improved nutrient uptake, enhanced stress tolerance, and better root development. The ability to create tailored solutions for different crops and environmental conditions makes biostimulants more attractive to farmers.

Industry Dynamics

- There is a rising demand for sustainable farming methods and organic food choices globally.

- Increasing concerns about soil health and the need to improve crop resilience against issues such as drought and changing weather are pushing farmers to use these products.

- The government support and policies that promote environmentally friendly agriculture also play a big role in driving demand.

- The variability and inconsistency in product quality and efficacy hinder the industry growth in the coming years.

Increasing Adoption of Sustainable Agriculture Practices: The global agricultural sector is increasingly focused on sustainable methods to minimize environmental impact and conserve natural resources. Biostimulants fit well into these practices by improving nutrient efficiency, reducing the need for chemical fertilizers, and enhancing soil health. This shift is driven by a desire for more environmentally friendly food production systems and a long-term outlook on agricultural viability.

The Indian government, through the Ministry of Agriculture & Farmers Welfare, has launched various initiatives to promote sustainable farming, including the National Mission for Sustainable Agriculture (NMSA). As of February 7, 2025, the Ministry of Agriculture & Farmers Welfare reported that programs under the National Innovations in Climate Resilient Agriculture (NICRA) have benefited over 693,000 farmers through technology demonstrations focused on climate-resilient agriculture, which often involves sustainable inputs. This ongoing push for sustainable farming directly increases the demand for biostimulants.

Growing Concerns About Climate Change and its Impact on Crops: Climate change is causing more frequent and intense extreme weather events, such as droughts, floods, and heatwaves, which negatively affect crop yields and overall agricultural productivity. Farmers are seeking solutions to help their crops withstand these stresses, and biostimulants offer a way to enhance plant resilience and adaptation.

A study published in 2022, titled "Role of biostimulants in mitigating the effects of climate change on crop performance," highlighted how biostimulants have shown great potential in helping plants cope with climate change-induced stresses such as drought and temperature extremes. This research further supports the increased use of biostimulants as a tool to ensure food security in a changing climate. The continued threat of climate variability and its direct impact on

Segmental Insights

Active Ingredient Analysis

The acid-based segment held the largest share in 2024. This category primarily includes humic acids, fulvic acids, and amino acids. These compounds are widely adopted due to their proven effectiveness in enhancing plant growth, improving nutrient uptake, and increasing plant tolerance to various environmental stresses. Their versatility allows them to be used across a broad range of crops and soil types, making them a go-to choice for many farmers seeking to improve crop performance and soil health. The benefits of acid-based biostimulants in improving soil structure, water retention, and nutrient availability have cemented their leading position in the industry.

The microbial segment of biostimulants is anticipated to register the highest growth rate during the forecast period. This category includes various beneficial microorganisms such as bacteria and

Crop Type Analysis

The row crops & cereals segment held the largest share in 2024. This includes major staple crops such as corn, wheat, rice, and soybeans, which are cultivated on vast acreages globally. The sheer scale of these crops' production means that even a small per-acre application of biostimulants translates into significant overall demand. Farmers growing these crops are increasingly adopting biostimulants to enhance nutrient efficiency, improve stress tolerance against common issues such as drought or nutrient deficiencies, and ultimately boost yields to meet global food demand. The wide-ranging applicability and economic importance of these crops make them the primary consumers of biostimulant products.

The fruits & vegetables segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is attributed to the high value placed on the quality, appearance, and shelf life of horticultural produce. Consumers are increasingly seeking blemish-free, nutritious, and organically grown fruits and vegetables, which drives growers to utilize biostimulants. These products help improve fruit size, color, sweetness, and overall yield, while also enhancing the plant's natural defenses against diseases and environmental stresses. The intensive cultivation practices often associated with fruits and vegetables, coupled with the higher economic returns per acre, encourage farmers to invest in biostimulants to optimize their production and meet evolving consumer preferences.

Application Analysis

The foliar treatment segment held the largest share in 2024. This method involves spraying biostimulant solutions directly onto plant leaves, allowing for the quick absorption of active ingredients. The popularity of foliar application stems from its efficiency and rapid response time, as nutrients and beneficial compounds can be directly taken up by the plant's metabolic system. It is particularly effective during critical growth stages or when plants are under stress, enabling swift corrective action and providing targeted benefits. The ease of integrating foliar sprays into existing farming practices, using common agricultural equipment, also contributes significantly to its widespread adoption across various crop types and farm sizes.

The seed treatment segment is anticipated to register the highest growth rate during the forecast period. This technique involves coating or priming seeds with biostimulant formulations before planting. The appeal of seed treatment lies in its ability to provide early-stage benefits to the plant, promoting stronger germination, more vigorous seedling growth, and enhanced resilience from the very beginning of the crop cycle. It offers a precise and cost-effective way to deliver active ingredients directly where they are needed most, optimizing initial plant establishment and increasing the chances of survival under challenging conditions. As farmers increasingly seek ways to maximize crop potential and minimize risks from the outset, the efficiency and targeted impact of biostimulant seed treatments are driving their rapid expansion.

Regional Analysis

The Europe biostimulants market held the largest share in 2024, largely driven by its stringent environmental regulations and a strong emphasis on organic farming practices. The European Union's initiatives, such as the European Green Deal, actively promote sustainable agriculture and the reduction of chemical

The Italy biostimulants market has been at the forefront of biostimulant adoption and development within Europe, with a high proportion of agricultural land dedicated to organic farming. The country's strong tradition in specialty crops, such as fruits, vegetables, and grapes, where quality and premium yields are crucial, drives the demand for biostimulants. Italian farmers readily embrace these products to improve crop quality, enhance stress tolerance, and support sustainable production systems, making it a key player in the regional landscape.

North America Biostimulants Market Overview

The North America biostimulants market is driven by a strong focus on sustainable agriculture and a growing demand for organic food products. Farmers in this region are increasingly seeking ways to improve crop yields and quality while minimizing environmental impact, leading to a greater adoption of biostimulants. The region's advanced agricultural infrastructure and continuous innovation in agricultural technologies also support the use of these products. There's a clear trend toward reducing reliance on traditional chemical inputs, making biostimulants an attractive alternative for enhancing plant resilience and overall farm productivity.

U.S. Biostimulants Market Insight

The U.S. plays a significant role in the North America biostimulants market, primarily due to its large-scale commercial farming operations and a growing consumer preference for sustainably produced food. The country's extensive cultivation of major row crops such as corn, soybeans, and wheat creates substantial opportunities for biostimulant application to optimize performance and yield. While there is strong market potential, the regulatory landscape in the country can be complex, with individual state-level requirements sometimes posing challenges for product approval and distribution. Despite this, the increasing awareness among farmers about the long-term benefits of biostimulants for soil health and crop resilience continues to fuel demand across the country.

Asia Pacific Biostimulants Market Overview

Asia Pacific is rapidly emerging as a significant and fast-growing market for biostimulants, primarily driven by the need to ensure food security for its large and growing population. Farmers in this region are facing pressures to increase agricultural productivity while also addressing concerns about soil degradation and environmental sustainability. This has led to a rising interest in biostimulants as a way to enhance crop yields, improve nutrient use efficiency, and boost plant defenses against various abiotic and biotic stresses. The diverse climatic conditions and extensive agricultural lands across the region create ample opportunities for biostimulant applications across a wide range of crops.

India Biostimulants Market Overview

India is a key contributor to the growth of the biostimulants market in Asia Pacific. The country's agriculture-centric economy, combined with a rising awareness among farmers about modern and sustainable farming techniques, is propelling the adoption of biostimulants. The Indian government's supportive policies and initiatives to promote organic farming and reduce reliance on chemical inputs also play a crucial role. Farmers in India are increasingly using biostimulants to improve crop quality, increase resistance to challenging environmental conditions, and enhance overall farm profitability, thereby driving significant demand for these products.

Key Players and Competitive Insights

The biostimulants industry features a mix of large, established agricultural companies and specialized biological solution providers. Some major players actively shaping this landscape include UPL, Syngenta Biologicals, Corteva Agriscience, BASF SE, Bayer AG, FMC Corporation, and Novozymes. The competitive landscape is quite fragmented, with numerous regional and smaller players alongside the global giants. While larger companies benefit from extensive R&D capabilities and broad market access, specialized biostimulant firms often maintain a strong foothold through their deep expertise in specific product categories or local market dynamics. This blend of global reach and niche specialization fosters a dynamic environment where both innovation and market penetration are crucial for success.

A few prominent companies in the industry include UPL (UPL Limited), Syngenta Biologicals, Corteva Agriscience, BASF SE, Bayer AG, FMC Corporation, Novozymes (Novonesis Group), Koppert Biological Systems, Acadian Plant Health, Biolchim S.p.A., Atlántica Agrícola, and Seipasa S.A.

Key Players

- Acadian Plant Health (Acadian Seaplants Limited)

- Atlántica Agrícola (Grupo Atlántica)

- BASF SE

- Bayer AG

- Biolchim S.p.A.

- Corteva Agriscience

- FMC Corporation

- Koppert Biological Systems

- Novozymes (Novonesis Group)

- Seipasa S.A.

- Syngenta Biologicals

- UPL Limited

Industry Developments

March 2025: Seipasa introduced SeiZen as a new biostimulant registered in Europe. This product is designed to revitalize, recover, and help crops regrow when facing

Biostimulants Market Segmentation

By Active Ingredient Outlook (Revenue – USD Billion, 2020–2034)

- Acid Based

- Seaweed Extract

- Microbial

- Others

By Crop Type Outlook (Revenue – USD Billion, 2020–2034)

- Row Crops & Cereals

- Fruits & Vegetables

- Turf & Ornamentals

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Foliar Treatment

- Soil Treatment

- Seed Treatment

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Biostimulants Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.30 billion |

|

Market Size in 2025 |

USD 3.55 billion |

|

Revenue Forecast by 2034 |

USD 6.86 billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.30 billion in 2024 and is projected to grow to USD 6.86 billion by 2034.

The global market is projected to register a CAGR of 7.6% during the forecast period.

Europe dominated the market share in 2024.

A few key players in the market include UPL (UPL Limited), Syngenta Biologicals (Syngenta Group), Corteva Agriscience, BASF SE, Bayer AG, FMC Corporation, Novozymes (Novonesis Group), Koppert Biological Systems, Acadian Plant Health, Biolchim S.p.A., Atlántica Agrícola, and Seipasa S.A.

The acid based segment accounted for the largest share of the market in 2024.

The fruits & vegetables segment is expected to witness the fastest growth during the forecast period.