Blank Apparel Market Size, Share, Trends, Industry Analysis Report

By Type (T-shirts & Tanks, Hoodies/ Sweatshirts, Bottoms, Shirts, Others), By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM4135

- Base Year: 2024

- Historical Data: 2020-2023

Overview

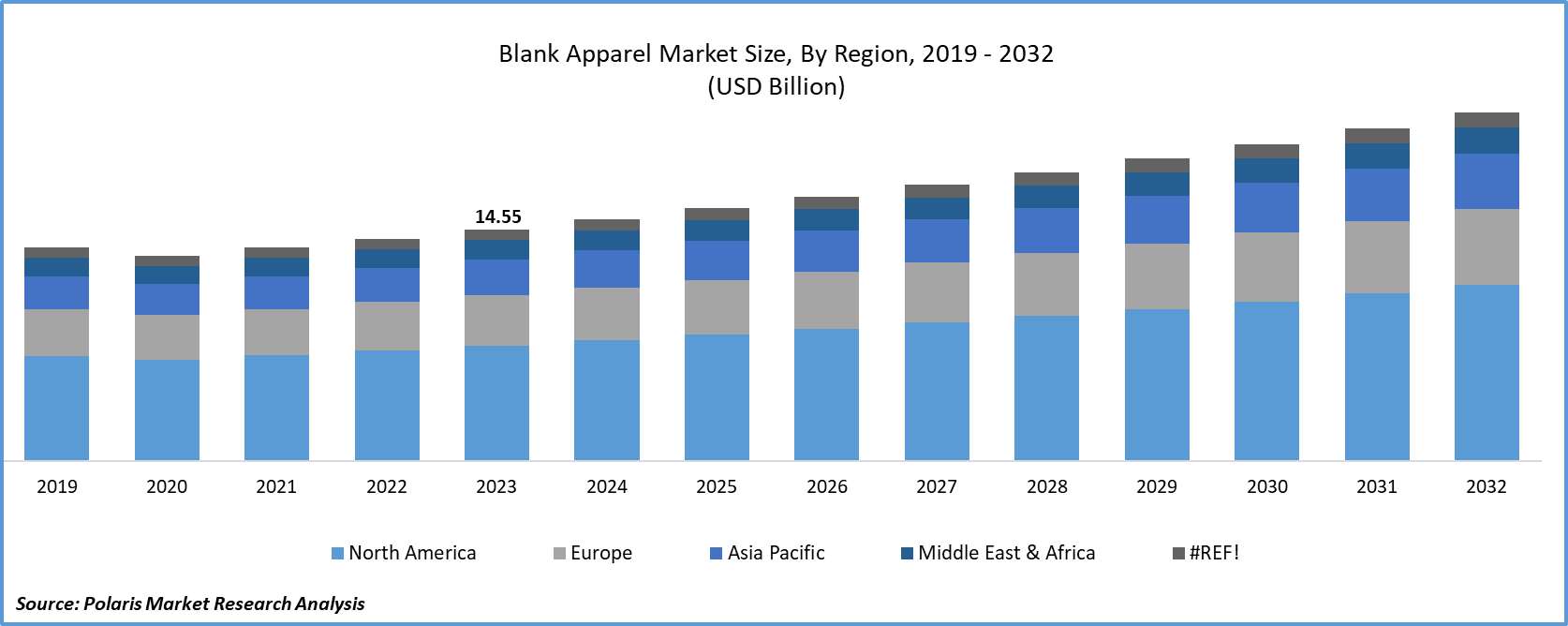

The global blank apparel market size was valued at USD 15.18 billion in 2024, growing at a CAGR of 4.78% from 2025 to 2034. Key factors driving demand for blank apparel include growing urbanization worldwide, increasing disposable income, and the expanding e-commerce sector.

Key Insights

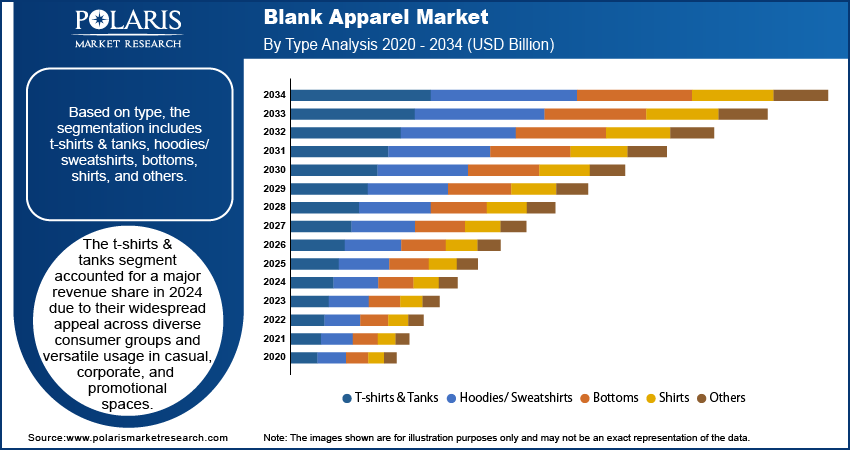

- The t-shirts & tanks segment accounted for a major revenue share in 2024 due to their widespread usage in casual, corporate, and promotional spaces.

- The B2B segment held the largest revenue share in 2024, due to strong demand from promotional product distributors and corporate buyers.

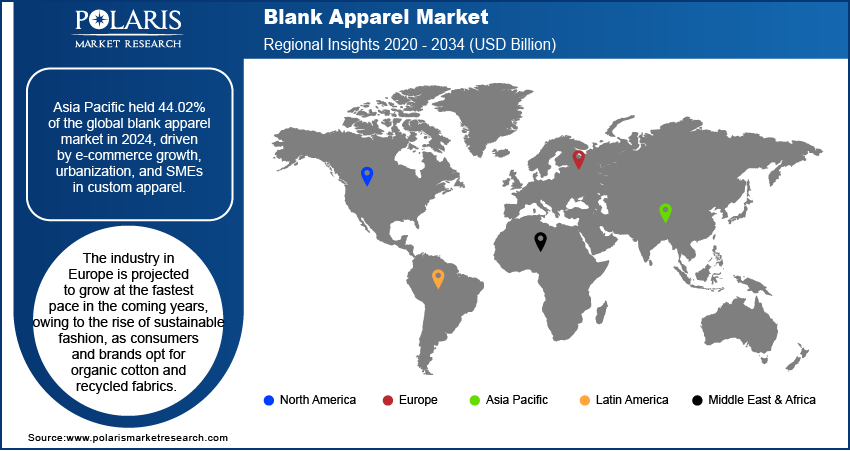

- The Asia Pacific blank apparel market accounted for 44.02% of global blank apparel revenue share in 2024, due to the rapid growth of the e-commerce sector and increasing urbanization.

- China held the largest revenue share in the Asia Pacific blank apparel landscape in 2024, due to the growing popularity of streetwear and customization.

- The industry in Europe is projected to grow at the fastest pace in the coming years, owing to the expanding urbanization and increasing disposable income.

Industry Dynamics

- The growing urbanization worldwide is fueling the adoption of blank apparel by increasing the need for affordable, versatile blank clothing that individuals and businesses can easily personalize for uniforms, events, or branding.

- The increasing disposable income is driving the growth of the blank apparel market by encouraging consumers to buy blank apparel made of higher-quality material, such as organic cotton or premium fabrics.

- The rising population of youth in emerging countries is projected to create a lucrative market opportunity during the forecast period.

- The high competition between key players hinders the market growth.

Artificial Intelligence (AI) Impact on Blank Apparel Market

- AI helps in analyzing trends and consumer behavior to optimize inventory, reducing overproduction and waste.

- AI-powered design tools enable faster, automated customization for print-on-demand businesses.

- AI helps improve logistics, predict delays, and optimize manufacturing for faster, cost-effective production.

- Artificial intelligence (AI) helps brands source eco-friendly materials and reduce excess inventory through data-driven decisions.

Market Statistics

- 2024 Market Size: USD 15.18 Billion

- 2034 Projected Market Size: USD 24.17 Billion

- CAGR (2025–2034): 4.78%

- Asia Pacific: Largest Market Share

Blank apparel refers to clothing items that are free of branding, logos, or designs, providing a clean and neutral base for customization. These garments are usually made from high-quality fabrics and come in various styles, including t-shirts, hoodies, polo shirts, sweatshirts, and more. The absence of pre-printed graphics or labels makes blank apparel ideal for businesses, designers, and individuals looking to create personalized clothing for branding, fashion, or promotional purposes.

Designers and independent brands prefer blank garments as a canvas for their unique prints, embroidery, or dye techniques. High-quality blanks, such as those from brands like Gildan, Bella+Canvas, and Fruit of the Loom, are favored for their durability and comfort, ensuring that custom designs look polished and last long. Streetwear brands often use premium blank hoodies or tees to create limited-edition collections with exclusive artwork. Blank apparel is also popular among individuals for DIY projects. Many consumers buy plain clothing to personalize with screen printing, heat transfers, tie-dye, or hand-painted designs, allowing for creative self-expression. Additionally, blank garments are widely used in sublimation printing, where vibrant, all-over designs are transferred onto polyester-based fabrics.

The expanding e-commerce sector drives the global demand for blank apparel. E-commerce is enabling small businesses, influencers, and startups to launch their own branded merchandise without large upfront costs, driving bulk orders of blank apparel. Additionally, e-commerce marketplaces are exposing blank apparel to a global audience, encouraging higher sales as customers seek affordable, versatile clothing that can be customized. The convenience of e-commerce shopping and streamlined logistics is further accelerating the demand for blank apparel. Therefore, as the e-commerce sector expands globally, the demand for blank apparel also rises.

Drivers & Opportunities

Growing Urbanization Worldwide: Urban areas attract young entrepreneurs and creative professionals who use blank garments to launch their fashion lines or promotional merchandise, with lower production costs. The fast-paced city lifestyle in urban areas also increases the need for affordable, versatile blank clothing that individuals and businesses can easily personalize for uniforms, events, or branding. Additionally, urban centers drive fashion trends, where blank apparel serves as a canvas for unique designs, further accelerating demand as more people seek trendy, customizable options. The concentration of retail stores, print shops, and online businesses in urban areas also makes blank apparel more accessible, fueling its popularity and demand. The United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population in 2050. Therefore, the expanding urbanization is fueling the market growth.

Increasing Disposable Income: Individuals and small businesses with high disposable income experiment with unique designs, ordering bulk blank garments for DIY projects, brand promotions, or resale. The rising disposable income worldwide is also encouraging people to buy higher-quality blank apparel, such as organic cotton or premium fabrics, rather than settling for cheaper alternatives. For instance, Bureau of Economic Analysis, in its report, stated that the disposable personal income in the U.S. increased by 0.6% in April 2025 from March 2025. Additionally, consumers with high disposable income seek self-expression through fashion, which encourages them to turn to customizable blank apparel.

Segmental Insights

Type Analysis

Based on type, the segmentation includes t-shirts & tanks, hoodies/ sweatshirts, bottoms, shirts, and others. The t-shirts & tanks segment accounted for a major revenue share in 2024 due to their widespread appeal across diverse consumer groups and versatile usage in casual, corporate, and promotional spaces. Consumers preferred these products as they combine comfort, affordability, and adaptability to different fashion trends. Businesses and organizations drove demand for t-shirts by increasingly using them for branding purposes, including custom printing and embroidery for events, uniforms, and marketing campaigns. The rise of e-commerce platforms expanded product accessibility, enabling manufacturers to target global audiences more effectively. Furthermore, the rising disposable incomes in emerging regions also encouraged consumers to purchase higher-quality t-shirts & tanks, further boosting segment growth.

The hoodies/sweatshirts segment is expected to grow at a rapid pace in the coming years, as shifting consumer preferences increasingly favor comfort-oriented, seasonless fashion. These garments offer functional benefits, such as warmth and durability, while also providing extensive customization potential for sports teams, lifestyle brands, and independent designers. The surge in remote work and hybrid lifestyles has accelerated the demand for relaxed yet stylish apparel options suitable for both home and outdoor wear. Moreover, advancements in performance fabric, including lightweight and insulating materials, have expanded their year-round usability. Influencer marketing and collaborations between fashion labels and celebrities are further propelling the demand for hoodies/sweatshirts.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes B2B and B2C. The B2B segment held the largest revenue share in 2024, due to strong demand from printing companies, promotional product distributors, and corporate buyers who source plain garments in bulk for customization. Businesses in sectors such as fashion retail, sports teams, and event management relied heavily on wholesale blank clothing to reduce production costs and streamline branding operations. The growth of e-commerce platforms dedicated to bulk ordering, along with efficient supply chain networks, enabled B2B buyers to secure competitive pricing and timely deliveries. Additionally, increasing investments by manufacturers in direct-to-business online portals improved accessibility for small and medium enterprises, further contributing to the dominance of the segment.

The B2C segment is estimated to grow at a rapid pace during the forecast period, owing to rising social media influence, coupled with the popularity of DIY fashion trends. Direct-to-consumer strategies, supported by targeted digital marketing and fast delivery services, continue to attract younger demographics seeking affordable and stylish options. Moreover, the expansion of customized print-on-demand services integrated with e-commerce platforms gives consumers the flexibility to order small quantities without compromising on design preferences, positioning B2C as a leading segment in future market expansion.

Regional Analysis

The Asia Pacific blank apparel market accounted for 44.02% of global revenue share in 2024. This dominance is attributed to the rapid growth of the e-commerce sector, increasing urbanization, and the rise of small and medium-sized enterprises (SMEs) specializing in custom apparel. United Nations Human Settlements Programme, in its report, stated that the urban population in Asia is expected to grow by 50% by 2050. Countries such as India, Indonesia, and Vietnam have witnessed a surge in demand due to expanding middle-class populations and the popularity of DIY fashion trends. Additionally, the region’s strong manufacturing capabilities and cost-effective production make it a hub for bulk blank apparel purchases, catering to both local and global markets.

China Blank Apparel Market Insights

China held the largest revenue share in the Asia Pacific blank apparel landscape in 2024, due to the rise of influencer and social commerce and the growing popularity of streetwear and customization. Domestic brands and e-commerce platforms such as Taobao and Pinduoduo drove bulk purchases of blank garments for private-label businesses. Additionally, China’s strong textile manufacturing sector ensured a steady supply of affordable, high-quality blanks, making it a key country in both import and export.

North America Blank Apparel Market Trends

The market in North America is projected to hold a substantial revenue share by 2034, due to the expanding custom printing industry, the popularity of athleisure, and the rise of direct-to-garment (DTG) printing businesses. The region’s focus on sustainability is also increasing demand for organic and eco-friendly blank garments. Additionally, the gig economy and side hustles, such as Etsy shops and small apparel brands, are contributing to the need for high-quality blanks that can be customized and sold online.

U.S. Blank Apparel Market Overview

The demand for blank apparel in the U.S. is being driven by the growth of online merchandising, influencer culture, and the DIY fashion movement. Platforms such as Shopify, Printful, and Etsy are enabling entrepreneurs to launch custom apparel brands easily, increasing the need for blank tees, hoodies, and sweatshirts. The athleisure trend and preference for premium basics from brands such as Bella+Canvas and Gildan are also sustaining demand for blank apparel.

Europe Blank Apparel Market Analysis

The industry in Europe is projected to grow at the fastest pace in the coming years, owing to the rise of sustainable fashion, with consumers and brands opting for organic cotton and recycled fabrics. The region’s strong streetwear culture and customization trends are also contributing to demand. E-commerce growth, particularly in the UK, Germany, and France, is supporting small businesses that rely on blank garments for print-on-demand services. Additionally, strict environmental regulations are pushing brands toward ethically sourced blanks, further expanding market.

Key Players & Competitive Analysis

The blank apparel market is highly competitive, with key players such as Gildan, HanesBrands, and Bella+Canvas dominating through extensive distribution networks, cost efficiency, and brand recognition. These companies leverage economies of scale to offer affordable, high-quality basics, catering to wholesale buyers, print-on-demand businesses, and DIY consumers. Emerging brands such as Next Level Apparel and AS Colour differentiate themselves with premium fabrics and sustainable practices, appealing to eco-conscious buyers. Private-label manufacturers and regional suppliers further intensify competition by offering low-cost alternatives. E-commerce platforms such as Amazon and Alibaba have also disrupted the market, increasing price transparency and accessibility. Additionally, customization trends and direct-to-garment printing advancements drive demand for blank apparel, pushing brands to innovate in fabric technology, sizing inclusivity, and ethical sourcing to maintain market share in this fast-evolving industry.

A few major companies operating in the blank apparel industry include BELLA+CANVAS; Spectra USA; Gildan; Soffe Apparel, Inc.; Los Angeles Apparel Inc.; LANE SEVEN APPAREL; AS Colour; Independent Trading Company; Stanley/Stella; and Next Level Apparel.

Key Companies

- AS Colour

- BELLA+CANVAS

- Gildan

- Independent Trading Company

- LANE SEVEN APPAREL

- Los Angeles Apparel Inc.

- Next Level Apparel

- Smartex Apparel

- Soffe Apparel, Inc.

- Spectra USA

- Stanley/Stella.

Blank Apparel Industry Developments

In May 2025, Lane Seven Apparel launched two new colors, Sandshell and Sports Green, for its LS14001YH Premium Youth Pullover Hoodie. Crafted from 3-End fleece, the hoodie was designed to endure seasonal wear and tear.

In August 2023, Smartex Apparel unveiled two new designs within the Smart Blanks apparel line: Style PD200 and Style PD1000.

Blank Apparel Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- T-shirts & Tanks

- Hoodies/Sweatshirts

- Bottoms

- Shirts

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- B2B

- B2C

- Online

- Offline

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Blank Apparel Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 15.18 Billion |

|

Market Size in 2025 |

USD 15.88 Billion |

|

Revenue Forecast by 2034 |

USD 24.17 Billion |

|

CAGR |

4.78% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 15.18 billion in 2024 and is projected to grow to USD 24.17 billion by 2034.

The global market is projected to register a CAGR of 4.78% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are BELLA+CANVAS; Spectra USA; Gildan; Soffe Apparel, Inc.; Los Angeles Apparel Inc.; LANE SEVEN APPAREL; AS Colour; Independent Trading Company; Stanley/Stella; and Next Level Apparel.

The t-shirts & tanks segment dominated the market revenue share in 2024.

The B2C segment is projected to witness the fastest growth during the forecast period.