Blood Culture Test Market Size, Share, Trends, Industry Analysis Report

: By Product (Consumables, Instruments, and Software & Services), Technique, Technology, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM3742

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

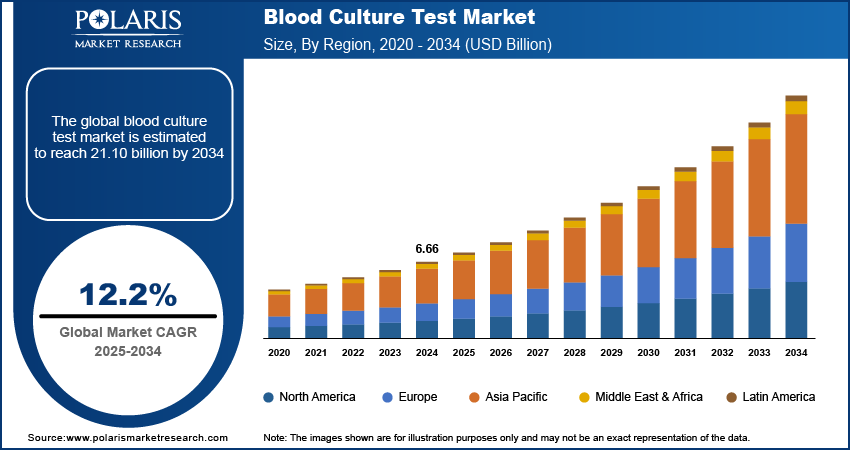

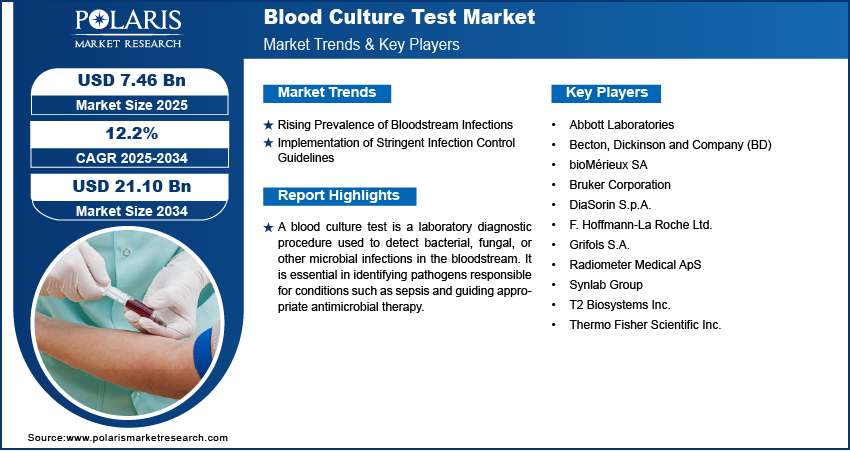

The blood culture test market size was valued at USD 6.66 billion in 2024, exhibiting a CAGR of 12.2% during 2025–2034. The market is driven by the rising prevalence of bloodstream infections, increasing sepsis cases, growing antimicrobial resistance, expanding geriatric population, technological advancements in diagnostics, and global efforts to enhance infection control through improved healthcare infrastructure and regulatory guidelines.

Key Insights

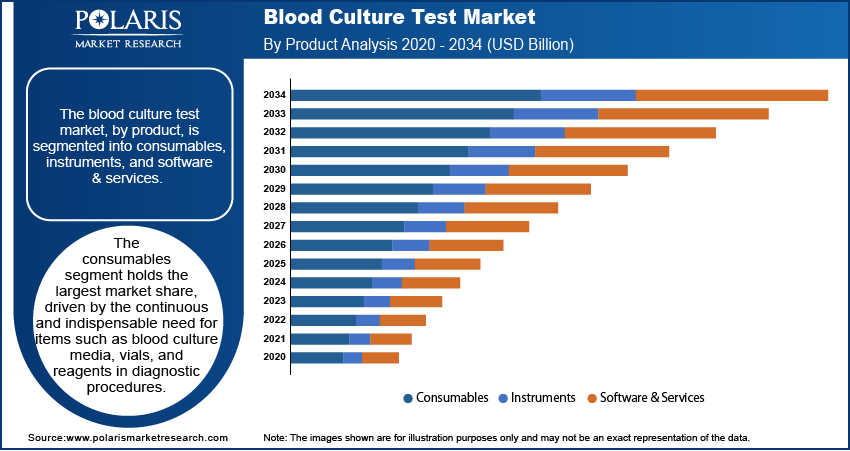

- The consumables segment holds the largest market share due to their frequent use, disposability, and consistent demand in routine diagnostic testing.

- The conventional technique segment leads the market as it is widely adopted across hospitals and labs for its proven effectiveness and familiarity.

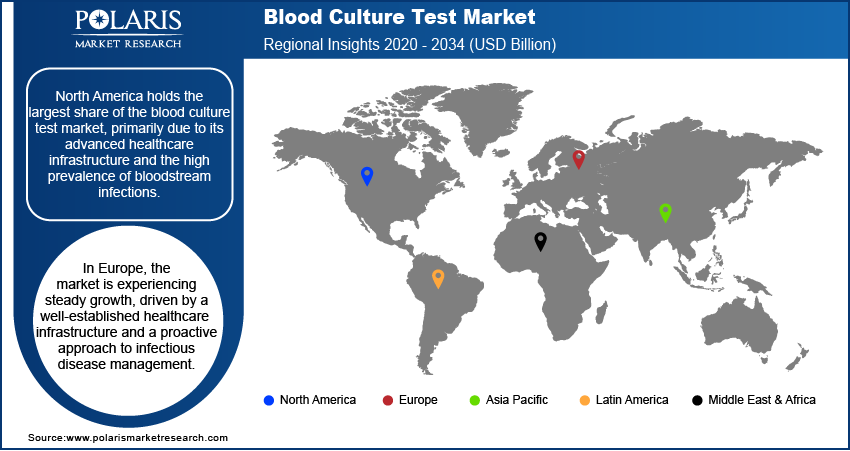

- North America dominates the blood culture test market due to advanced healthcare systems, strong R&D, and high infection prevalence.

- Europe sees steady growth supported by robust healthcare infrastructure, early infection diagnosis, and rising sepsis awareness.

- Asia Pacific is experiencing rapid market expansion fueled by increasing infectious disease rates, rising healthcare spending, and growing diagnostic demand.

Industry Dynamics

- The rising global incidence of sepsis and bloodstream infections increases the demand for accurate and timely diagnostic solutions such as blood culture tests.

- Growing antibiotic resistance drives the need for precise pathogen identification, fueling the adoption of blood culture testing in antimicrobial stewardship programs.

- Increasing healthcare access in emerging economies expands the patient base for diagnostic tests, including blood culture testing in hospitals and clinics.

- High costs of advanced blood culture systems and limited affordability in low-income regions hinder widespread adoption and market penetration.

Market Statistics

2024 Market Size: USD 6.66 billion

2034 Projected Market Size: USD 21.10 billion

CAGR (2025–2034): 12.2%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The blood culture test market is a critical segment within the diagnostic industry, focusing on detecting bloodstream infections such as sepsis and bacteremia. Blood culture tests help identify bacterial and fungal pathogens in the blood, aiding in the timely initiation of targeted antimicrobial therapy. The market encompass consumables, instruments, and software solutions used in clinical laboratories, hospitals, and diagnostic centers. Technological advancements, including automated blood culture systems and molecular diagnostic techniques, have enhanced test accuracy and turnaround times, driving adoption across healthcare settings.

Key drivers of the blood culture test market demand include the rising prevalence of infectious diseases, increasing cases of sepsis, and growing demand for rapid and accurate diagnostic solutions. The surge in antibiotic-resistant infections has further intensified the need for effective blood culture tests to guide antimicrobial stewardship programs. Additionally, the expanding geriatric population, which is more susceptible to bloodstream infections, contributes to market growth. Increasing healthcare expenditure, government initiatives for infection control, and the expansion of diagnostic laboratory infrastructure globally are also supporting blood culture test market expansion.

Market Dynamics

Rising Prevalence of Bloodstream Infections

The increasing incidence of bloodstream infections, including sepsis, has significantly impacted the blood culture test market. Blood culture tests are essential for identifying the causative pathogens, enabling timely and appropriate antimicrobial therapy. According to the Agency for Healthcare Research and Quality (AHRQ), central line-associated bloodstream infections (CLABSIs) result in approximately 28,000 deaths in the US annually. This alarming statistic underscores the critical need for effective diagnostic tools, such as blood culture tests, to detect and manage these infections promptly.

Implementation of Stringent Infection Control Guidelines

The adoption of rigorous infection prevention protocols by healthcare organizations has bolstered the utilization of blood tests. For instance, the World Health Organization (WHO) released new guidelines in May 2024 aimed at reducing bloodstream infections associated with catheter use. These guidelines recommend best practices for the insertion, maintenance, and removal of catheters to minimize infection risks. The emphasis on preventing healthcare-associated infections has led to increased blood culture testing to monitor and control potential outbreaks effectively. Thus, the implementation of stringent infection control guidelines boosts the blood culture test market growth.

Segment Insights

Market Assessment – By Product

The blood culture test market, by product, is segmented into consumables, instruments, and software & services. The consumables segment holds the largest share of the blood culture test market revenue, driven by the continuous and indispensable need for items such as blood culture media, vials, and reagents in diagnostic procedures. The recurrent demand for these products in routine testing and their single-use nature contribute to sustained consumption, ensuring a steady revenue stream for manufacturers. Additionally, the consumables segment benefits from advancements in formulation and quality, enhancing the accuracy and reliability of blood culture tests, which further solidifies its dominant position in the blood culture test market.

Market Evaluation – By Technique

The blood culture test market, by technique, is segmented into conventional and automated. The conventional technique segment holds a larger market share. This dominance is attributed to its extensive utilization across hospitals, pathology laboratories, and clinical settings. The widespread adoption of conventional methods is due to their established reliability and the familiarity of healthcare professionals with these procedures. Additionally, ongoing research and development efforts aim to enhance the efficiency and accuracy of these traditional techniques, further solidifying their prominent position in the market.

Regional Insights

By region, the study provides blood culture test market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. According to the blood culture test market statistics, North America holds the largest market share, primarily due to its advanced healthcare infrastructure and the high prevalence of bloodstream infections. The region benefits from significant investments in research and development, leading to the adoption of innovative diagnostic technologies. Additionally, the presence of key industry players and supportive government initiatives boost the market expansion in this region.

In Europe, the blood culture test market is experiencing steady growth, driven by a well-established healthcare infrastructure and a proactive approach to infectious disease management. Countries such as Germany, France, and the UK are leading contributors, with a strong focus on early diagnosis and treatment of bloodstream infections. The rising prevalence of sepsis and other severe infections has heightened the demand for advanced diagnostic tools, including blood culture tests. Additionally, government initiatives aimed at combating antimicrobial resistance and improving patient outcomes further support market growth in the region.

The Asia Pacific blood culture test market is anticipated to witness significant growth, primarily due to the increasing incidence of infectious diseases and improving healthcare infrastructure. Countries such as China, India, and Japan are at the forefront of this expansion, with rising healthcare expenditures and heightened awareness of early and rare disease detection. The growing burden of sepsis and other bloodstream infections necessitates efficient diagnostic solutions, propelling the adoption of blood culture tests. Moreover, strategic initiatives by key industry players to establish a presence in these emerging markets are expected to drive market growth.

Key Players and Competitive Insights

In the blood culture test market, several key players are actively contributing to advancements in diagnostic technologies. A few notable players in the market are Abbott Laboratories; Becton, Dickinson and Company (BD); bioMérieux SA; Bruker Corporation; DiaSorin S.p.A.; F. Hoffmann-La Roche Ltd.; Grifols S.A.; Radiometer Medical ApS; Synlab Group; T2 Biosystems Inc.; and Thermo Fisher Scientific Inc.

The competitive landscape of the blood culture test market is characterized by continuous innovation and strategic collaborations among these key players. Companies are investing heavily in research and development to introduce automated and rapid diagnostic systems that enhance the accuracy and speed of pathogen detection. For instance, BD's acquisition of specific technologies has expanded its portfolio, enabling the company to offer more integrated blood culture solutions. Similarly, bioMérieux's development of the VITEK REVEAL system exemplifies efforts to provide rapid antimicrobial susceptibility testing directly from positive blood cultures.

Becton, Dickinson and Company (BD) is a prominent global medical technology firm specializing in the development and production of medical supplies, devices, laboratory equipment, and diagnostic products. Serving a diverse clientele that includes healthcare institutions, life science researchers, clinical laboratories, and the pharmaceutical industry, BD is committed to enhancing patient care and advancing healthcare outcomes. The company's extensive portfolio encompasses products essential for blood culture testing, such as advanced diagnostic instruments and consumables.

bioMérieux SA is a leading provider of in vitro diagnostic solutions, dedicated to identifying the sources of diseases and ensuring consumer safety. With a strong focus on infectious disease diagnostics, bioMérieux offers a comprehensive range of products, including automated blood culture systems and reagents designed to detect bloodstream infections. The company's innovations in microbiology and molecular biology have significantly contributed to the efficiency and accuracy of blood culture testing in clinical settings.

List of Key Companies

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- Bruker Corporation

- DiaSorin S.p.A.

- F. Hoffmann-La Roche Ltd.

- Grifols S.A.

- Radiometer Medical ApS

- Synlab Group

- T2 Biosystems Inc.

- Thermo Fisher Scientific Inc.

Blood Culture Test Industry Developments

- June 2023: T2 Biosystems announced that its Candida auris test application was submitted to the FDA for Breakthrough Device Designation. The test was added to the T2Candida Panel for rapid, direct-from-blood detection.

- October 2022: BD and Magnolia Medical announced a co-exclusive commercial agreement to reduce blood culture contamination. Steripath and Steripath Micro devices were marketed to improve testing accuracy and clinical outcomes.

Blood Culture Test Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Consumables

- Instruments

- Software & Services

By Technique Outlook (Revenue – USD Billion, 2020–2034)

- Conventional

- Automated

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Culture-Based Technology

- Molecular Technology

- Proteomic Technology

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Bacterial Infections

- Fungal Infections

- Mycobacterial Infections

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Laboratories

- Reference Laboratories

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.66 billion |

|

Market Size Value in 2025 |

USD 7.46 billion |

|

Revenue Forecast by 2034 |

USD 21.10 billion |

|

CAGR |

12.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The blood culture test market has been segmented into detailed segments of product, technique, technology, application, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

Companies in the blood culture test market focus on expanding their product portfolios through research and development, introducing automated and rapid diagnostic solutions to improve detection efficiency. Strategic partnerships, and mergers and acquisitions are commonly pursued to strengthen market presence and enhance technological capabilities. Geographic expansion into emerging markets is a key strategy, driven by rising healthcare investments and increasing awareness of bloodstream infections. Additionally, players emphasize regulatory approvals and compliance to ensure product adoption in clinical settings. Digital marketing and educational initiatives targeting healthcare professionals further support market penetration and brand recognition.

FAQ's

The size was valued at USD 6.66 billion in 2024 and is projected to grow to USD 21.10 billion by 2034.

The market is projected to register a CAGR of 12.2% during the forecast period.

North America held the largest share of the market in 2024

A few key players in the market include Abbott Laboratories; Becton, Dickinson and Company (BD); bioMérieux SA; Bruker Corporation; DiaSorin S.p.A.; F. Hoffmann-La Roche Ltd.; Grifols S.A.; Radiometer Medical ApS; Synlab Group; T2 Biosystems Inc.; and Thermo Fisher Scientific Inc.

The consumables segment accounted for the largest share of the market in 2024.

The conventional segment accounted for a larger share of the market in 2024.