Blood Group Typing Market Share, Size, Trends, Industry Analysis Report

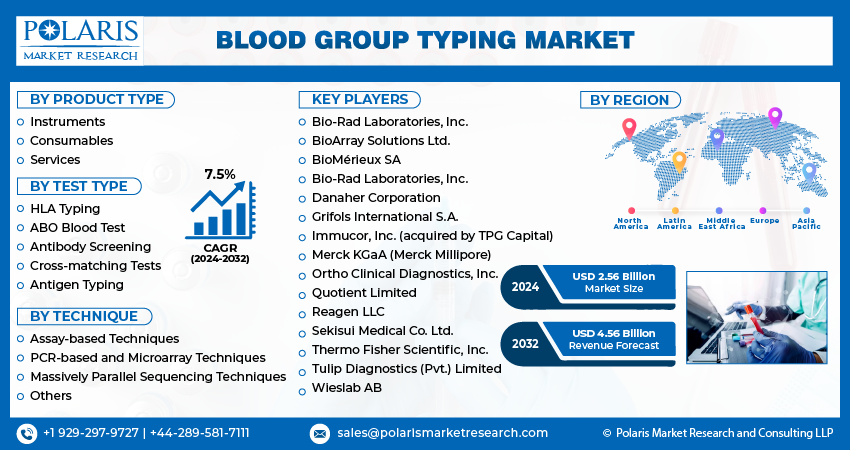

By Test Type (HLA Typing, ABO Blood Test, Antibody Screening, Cross-matching Tests, Antigen Typing); By Product Type; By Technique; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4003

- Base Year: 2023

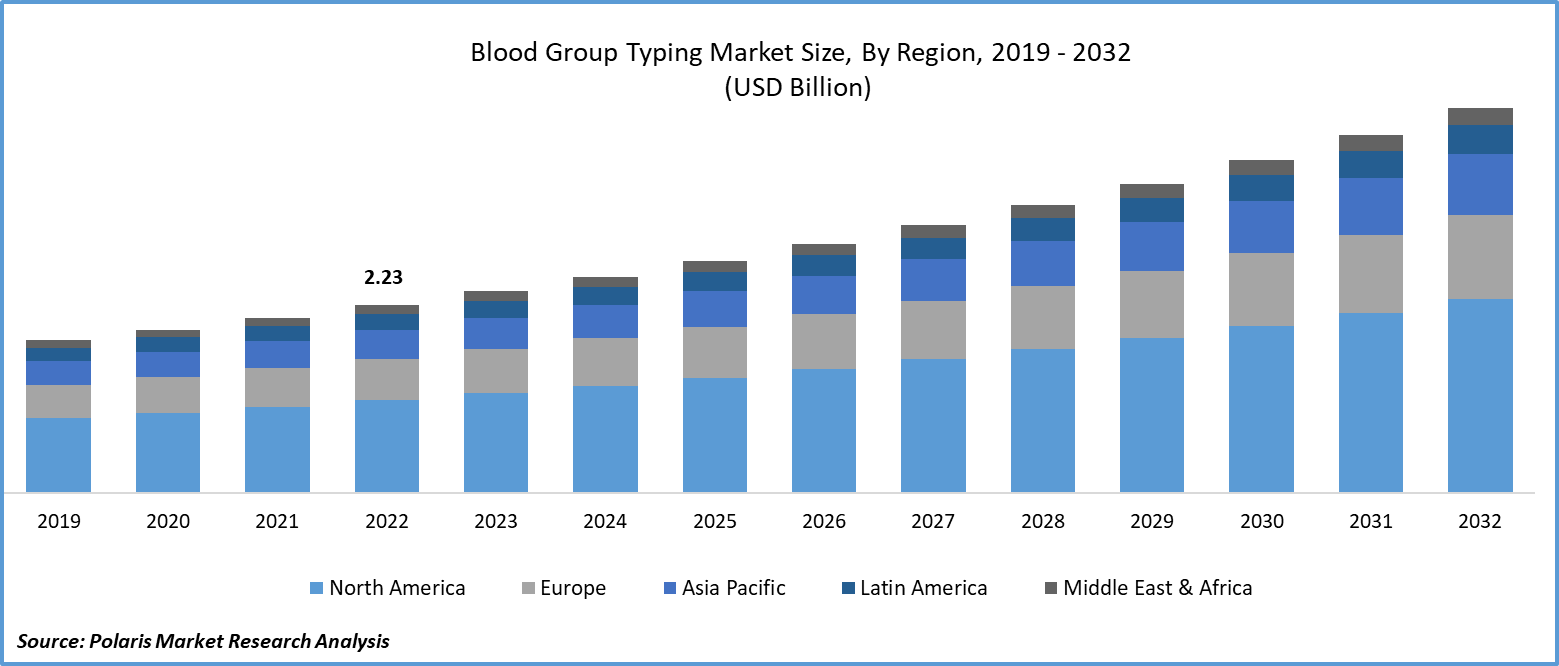

- Historical Data: 2019-2022

Report Outlook

The global blood group typing market size and share was valued at USD 2.39 billion in 2023 and is expected to grow at a CAGR of 7.5% during the forecast period.

Blood group typing is a fundamental aspect of transfusion medicine, ensuring safe and compatible blood transfusions, as well as successful organ transplantation. As the demand for these life-saving procedures continues to grow, the blood group typing market has experienced notable advancements.

Blood group typing, also referred to as blood grouping, refers to the process of determining a person’s blood type. It’s primarily done to ensure that individual can safely donate their blood or get a blood transfusion. Along with that, blood group typing is used to assess whether a substance called Rh factor is present on the surface of the red blood cells.

The type of blood is determined based on the kinds of antigens present in the red blood cells. Blood is usually grouped as per the ABO blood typing system. The four major types of blood are type A, type B, type AB, and type O. The type A and type B blood typing systems come with the A and B antigens, respectively. Type AB includes both A and B antigens. Finally, type O doesn’t have both A and B antigens.

In order to perform blood group typing, a blood sample is needed. The test to determine the blood type involves mixing the blood sample with antibodies against type A blood and type B blood. After mixing, the sample is assessed to check if the blood cells stick together. If the sticking of the blood cells takes place, it’s a sign that they’ve reacted with one of the antibodies. The rising number of trauma cases, road cases, and emergencies are driving the blood group typing market forward.

The research report offers a quantitative and qualitative analysis of the blood group typing market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

To Understand More About this Research: Request a Free Sample Report

The emergence of cutting-edge molecular techniques has transformed the landscape of blood group typing. Polymerase Chain Reaction (PCR) and Next-Generation Sequencing (NGS) have ushered in a new era of accuracy and efficiency in blood typing. These methodologies enable the exact identification of blood group antigens, even in the case of rare variants, a critical factor in ensuring secure transfusions and successful transplants.

Moreover, blood group typing plays a pivotal role in personalized medicine. Understanding a patient's blood group is essential for tailoring treatments, especially in oncology and other specialized fields. This personalized approach ensures that therapies are not only effective but also safe for the individual.

For instance, in April 2023, the San Diego Blood Bank (SDBB) unveiled its pioneering Precision Blood initiative expansion, a move anticipated to revolutionize the current standard of care for blood transfusion patients. This nonprofit healthcare organization is poised to elevate the quality of treatment in this vital medical field.

The research study offers an in-depth analysis of the competitive landscape in the industry. It examines the top players in the blood group typing market on the basis of multiple factors, including market position, sales, new developments and products/services offered. Also, it details the key strategies like mergers, partnerships and collaborations that have been taken by blood group typing industry key players to improve their position in the market.

However, cost constraints pose a significant restraint on blood group typing. Implementing advanced techniques like PCR and NGS, though highly accurate, can be financially burdensome for smaller healthcare facilities and blood banks. Ensuring compliance with stringent regulatory standards and maintaining consistent quality in blood typing processes can also be challenging, necessitating substantial investments in training and technology. Access to advanced blood typing technologies may be limited in resource-constrained regions, potentially hindering accurate blood typing services in underserved areas. Additionally, the complexity of NGS and molecular techniques demands skilled personnel, which may pose a challenge for some healthcare settings.

Growth Drivers

Rise in the Number of Road Accidents

The demand for blood transfusions has been increasing due to the rise in road accidents, trauma cases, and emergencies, which in turn has propelled the growth of blood group typing. Accurate blood typing is crucial to ensure safe blood donation and transfusion and to identify the presence of the Rh factor. The expanding use of blood group typing in fields like forensic sciences and prenatal testing has also contributed to the blood group typing market growth.

Additionally, the market is driven by the need to comply with stringent regulatory standards governing blood transfusions. With the increasing incidence of road accidents and blood transfusions, there is a sustained and significant demand for blood typing products in the market.

Report Segmentation

The market is primarily segmented based on product type, test type, techniques, and region.

|

By Product Type |

By Test Type |

By Technique |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Type Analysis

Consumables Segment Accounted for the Largest Market Share in 2022

The consumables segment dominated the blood group typing market and is projected to maintain its lead throughout the forecast period. This is primarily driven by the increase in surgical procedures such as organ transplantation, which demands the use of serological fluids and reagents in laboratories. The escalating rate of blood donations, leading to a higher volume of blood sample analyses, is also a significant contributing factor. Furthermore, the development of diagnostic test reagents and kits aimed at expediting conclusive outcomes is anticipated to bolster this growth trajectory.

Moreover, with an increasing prevalence of chronic diseases, surgical interventions, and trauma cases, there is a growing demand for blood transfusions worldwide. Accurate blood group typing is imperative to prevent adverse reactions, making it an indispensable component of modern healthcare.

Also, blood banks and transfusion centers are pivotal in maintaining a steady and safe supply of blood. The demand for accurate and efficient blood typing solutions is high, driving the market for both reagents and instruments.

By Application Analysis

ABO Blood Test Segment is Expected to Witness the Highest Growth During the Forecast Period

ABO blood tests have seen significant growth in recent years due to their critical role in healthcare. These tests help determine an individual's A, B, AB, or O blood type, which is essential for safe blood transfusions and organ transplants. The increasing demand for blood transfusions, a rise in trauma cases, and a surge in surgical procedures have all contributed to the need for accurate ABO testing.

Additionally, ABO blood tests also play a crucial role in prenatal care, forensics, and personalized medicine. The growth in demand for these tests has been further accelerated by advancements in testing techniques, which provide rapid and precise results, ensuring patient safety and effective medical interventions.

By Technique Analysis

Assay-Based Techniques Segment Held the Significant Market Revenue Share in 2022

The assay-based techniques segment had a significant market share in revenue in 2022. These techniques are precise and specific in identifying blood group antigens, which makes them essential in ensuring safe blood transfusions and successful organ transplants. The continued evolution of these methods, incorporating advanced technologies such as gel card assays and solid-phase assays, enhances their sensitivity and accuracy.

Moreover, assay-based techniques enable the detection of rare blood group variants, a crucial aspect of specialized transfusions. As healthcare advances, the role of assay-based techniques in blood group typing is set to widen. This expansion will provide better patient care and outcomes in transfusion medicine.

Regional Insights

North America Region Dominated the Global Market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. Blood group typing in North America is a critical component of transfusion medicine. The region boasts advanced healthcare infrastructure, enabling widespread access to accurate typing services. Rigorous regulatory standards ensure high-quality blood typing, which is crucial for safe transfusions and organ transplants. The prevalence of chronic diseases and the aging population further underscores the importance of precise blood typing. Advanced technologies, including molecular techniques like PCR and NGS, have become integral to the process. Additionally, active research and development in the field continue to refine and enhance blood typing methodologies, positioning North America at the forefront of transfusion medicine and ensuring top-tier patient care in blood-related procedures.

The Asia-Pacific region is expected to witness the highest growth during the forecast period. Blood group typing in the Asia-Pacific region is integral to transfusion medicine. The diverse population, including numerous ethnicities and blood types, necessitates precise typing for safe transfusions and organ transplants. Advanced techniques, such as PCR and NGS, are increasingly adopted, enhancing accuracy. The region's significant burden of chronic diseases and surgeries further emphasizes the importance of accurate blood typing.

Key Market Players & Competitive Insights

The blood group typing market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Bio-Rad Laboratories, Inc.

- BioArray Solutions Ltd.

- BioMérieux SA

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Grifols International S.A.

- Immucor, Inc. (acquired by TPG Capital)

- Merck KGaA (Merck Millipore)

- Ortho Clinical Diagnostics, Inc.

- Quotient Limited

- Reagen LLC

- Sekisui Medical Co. Ltd.

- Thermo Fisher Scientific, Inc.

- Tulip Diagnostics (Pvt.) Limited

- Wieslab AB

Recent Developments

- In November 2022, Bio-Rad Laboratories, Inc. partnered with NuProbe USA for exclusive licensing and product development. As per the terms, NuProbe USA will grant Bio-Rad exclusive rights to its allele enrichment technologies for the advancement of multiplexed digital PCR assays. This strategic partnership marks a crucial development in enhancing capabilities in the field of genomics and molecular diagnostics.

- In February 2022, Grifols is partnered with Endpoint Health, Inc. This collaboration is poised to broaden the product portfolio for blood group typing, marking a significant step forward in enhancing the capabilities of both organizations in this vital medical field.

Blood Group Typing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.56 billion |

|

Revenue Forecast in 2032 |

USD 4.56 billion |

|

CAGR |

7.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product Type, By Test Type, By Technique, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Explore the landscape of blood group typing in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.