Brake Friction Products Market Share, Size, Trends, Industry Analysis Report

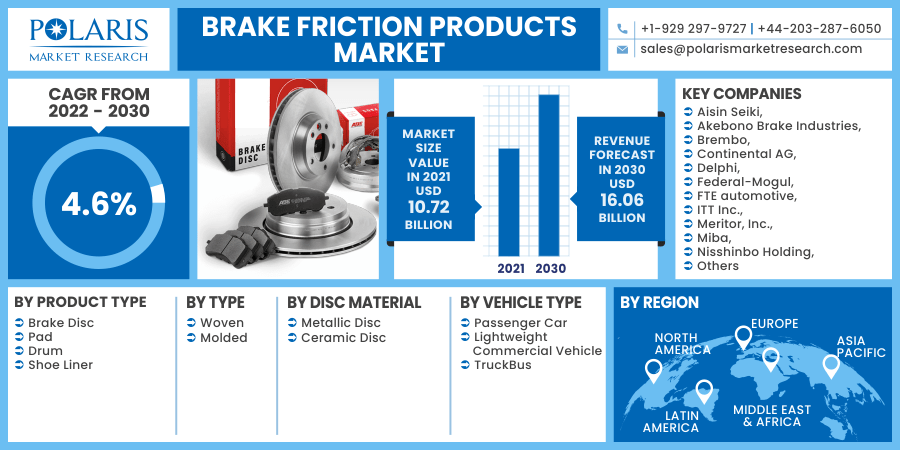

By Product Type (Brake Disc, Pad, Drum, Shoe, Liner), By Type (Woven, Molded), By Disc Material (Metallic Disc, Ceramic Disc), By Vehicle Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2225

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

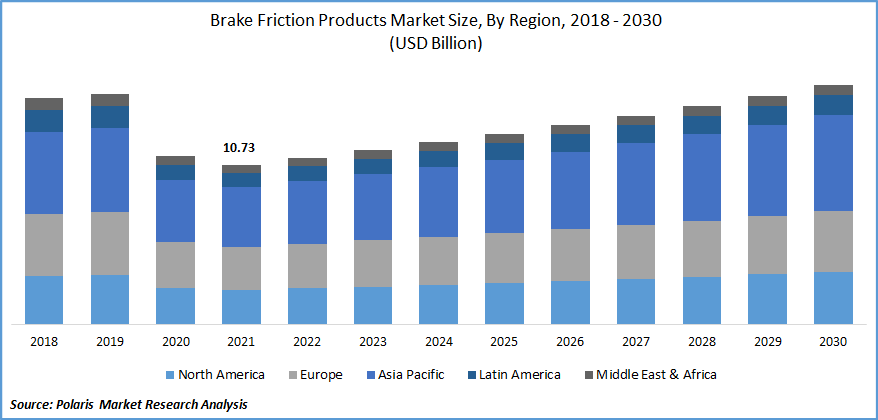

The global brake friction products market was valued at USD 10.72 billion in 2021 and is expected to grow at a CAGR of 4.6 % during the forecast period. The rising trend of the brake disc majorly among passenger cars, along with the execution of stringent government policies for the implementation of these friction products in the vehicle, significantly propels the market demand for these frictional products. These products create a frictional force required in a vehicle system to bring the moving object or vehicle to rest. The brake pad comprises an elastomeric component that works with pressure from a revolving metal disc, produces heat, and allows the vehicle to stop.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Thus, the use of these products helps to prevent accidents and provide safety to drivers, which, in turn, may accelerate the product's demand. Besides, various companies are heavily investing in R&D activities for the development of novel technologies for the ever-demanding automotive OEMs. For instance, Bosch has introduced a new brake disc to decrease pollution due to brake dust. Therefore, these factors are anticipated to fuel the global brake friction products market growth over the forthcoming scenario.

The COVID-19 pandemic has had a negative impact on the brake friction products market. Due to the obligation of stringent lockdown, people are not allowed to travel here and there, which leads to the abrupt drop in vehicles miles traveled (VMT).

Thereby, the spread of COVID-19 resulted in no traffic jam that declined the demand for these friction products. Moreover, it also hampers the manufacturing process due to the lack of availability of raw materials. Accordingly, this scenario causes slow economic recovery that may result in the recovery of aftermarket demand may take years to get on 2019 levels. However, industry players are taking several steps to boost their business strategy and come out stronger from the crisis. Hence, these tactical movements by the industry vendors and the gradual opening of them may augment the market growth for these frictional products in the near future.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The growing number of vehicle manufacturing is directly associated with the demand for brake friction products demand. Every vehicle is equipped with brake friction systems that include a wide range of these friction products. Besides, the growing demand for convenience and comfort modes of transportation is also propelling the demand for vehicles around the world. In addition, the growing population and improved economic conditions have leads the demand for vehicles, which, in turn, has ultimately propelled the brake friction products market.

Furthermore, strategic movements by the leading industry players such as expanding portfolio, product innovation, acquisition & mergers, product launch or up-gradation, etc., also act as a catalyzing factor for the industry development. For instance, Nisshinbo Holdings was owned by the TMD Friction in March 2021. The objective behind the acquisition is to upgrade the product segment by launching brake linings for new vehicle models.

Report Segmentation

The market is primarily segmented on the basis of product type, type, disc material, vehicle type, and region.

|

By Product Type |

By Type |

By Disc Material |

By Vehicle Type |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product Type

The brake disc segment is accounted for the largest revenue share in the global industry and is projected to retain its dominance over the coming years. The disc brake utilizes the calipers to compress pairs of pads against a disc to generate friction. This action slows the rotary motion of a shaft like a vehicle axle, either to lessen its speed. The growing adoption of these systems across various vehicles segments, along with its features such as is lightweight, durable, and most-effective, is the prime factor that may drive the segment demand.

However, the liner segment of the market accounts for the highest CAGR in the overall industry. Brake lines are the fundamental part of the vehicle braking system as it acts as a crucial role in ensuring the proficient stopping distance. Thus, these features acknowledged the growing demand for break liners in the wide range of automotive. Besides, the rise in investments for the technology advancements by the companies, escalating demand for passenger cars, and rising disposable income may accelerate the segment growth in the approaching period.

Geographic Overview

Geographically, Asia Pacific is accounted with the highest shares in the global industry in 2020 and is likely to dominate the market of these frictional products over the upcoming scenario. This is because of the increasing industrialization and urbanization in developing nations such as India, China, Indonesia, and Thailand. Additionally, improving socio-economic conditions, rising GDP post-COVID, as well as the growing population in the APAC region is also creating a high demand for transport facilities, which may boost the demand of these products. For instance, the urban population of China rose from 59% in 2018 to over 61% in 2021, as per the World Bank Group. Furthermore, the increasing demand for the buses, trucks, trains and rising production of these vehicles across the region also brings the up-surge in the market demand.

Moreover, Europe is likely to exhibit progressive growth over the forecasting years. The presence of leading market players in the region and the implementation of stringent government norms is anticipated to impel market growth. Moreover, SUVs and other vehicles are also gaining traction among the population. Owing to the high-speed capacities and heavyweight, such braking systems, made up of ceramic, or carbon composites, allow them to make these friction products. Moreover, the increasing infrastructural development and construction activities are further fueling market growth in the near future.

Competitive Insight

Some of the major players operating in the global market include Aisin Seiki, Akebono Brake Industries, Brembo, Continental AG, Delphi, Federal-Mogul, FTE automotive, ITT Inc., Meritor, Inc., Miba, Nisshinbo Holding, Robert Bosch, Robert Bosch, SGL Group, Tenneco.

Brake Friction Products Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 10.72 billion |

|

Revenue forecast in 2030 |

USD 16.06 billion |

|

CAGR |

4.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product Type, By Type, By Disc Material, By Vehicle Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Aisin Seiki, Akebono Brake Industries, Brembo, Continental AG, Delphi, Federal-Mogul, FTE automotive, ITT Inc., Meritor, Inc., Miba, Nisshinbo Holding, Robert Bosch, Robert Bosch, SGL Group, Tenneco |