Bran Market Share, Size, Trends, Industry Analysis Report

By Source (Wheat, Rice, Corn, Barley); By Application (Food, Animal Feed, Health & Wellness); By Distribution Channel (B2B, B2C); By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3764

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

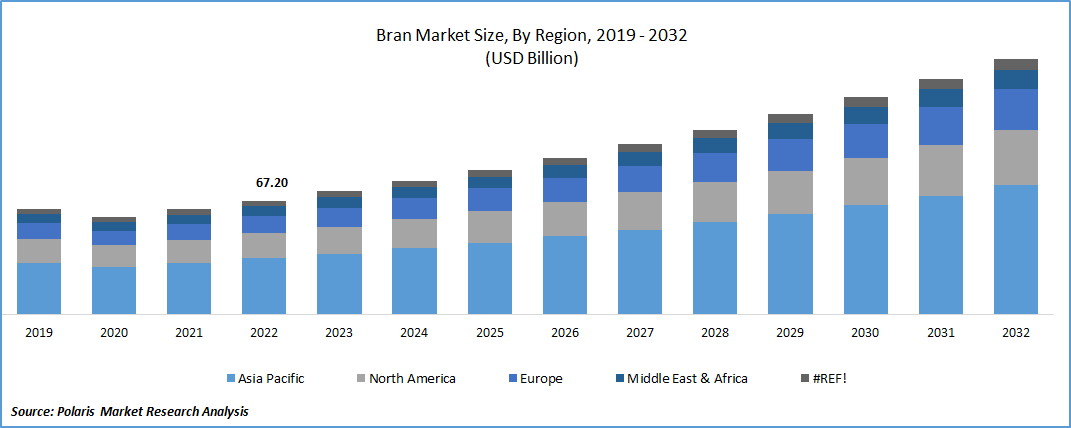

The global bran market was valued at USD 78.83 billion in 2023 and is expected to grow at a CAGR of 8.50% during the forecast period.

To Understand More About this Research: Request a Free Sample Report

The increasing popularity of nutritious extruded snacks in the food and beverage industry is driving the demand for bran. Incorporating bran into the production of extruded snacks offers several benefits, including an improved nutrient composition with increased levels of bioactive compounds, fiber, and protein. An example of this is Kellogg's introduction of an all-bran cereal with prebiotic fiber in March 2020. The cereal is available in various flavors, including pumpkin seeds, almonds, and original flavor.

Moreover, there is a growing focus on digestive health, leading to an increased demand for food products rich in dietary & prebiotic fiber. Bran, known for its high content of prebiotic fiber, is being incorporated into various applications such as supplements, cereals, bread, & snacks. A noteworthy instance is the recent introduction by Puratos, of a new ingredient that utilizes fermented AXOS sourced from bran derived from barley, wheat, & rye. This fermented fiber, which undergoes the fermentation process with the lactic acid, is known for its prebiotic benefits.

Increasing prevalence of the gluten intolerance has resulted in a growing demand for the bran derived from the gluten-free grains. In the United States alone, it is estimated that nearly 2 million people suffer from celiac disease, as per the National Institute of Health (NIH). This rising incidence of gluten intolerance has prompted companies to seek out gluten-free alternatives for food and bakery applications.

- For instance, researchers at the U.S. Department of Agriculture Research Service (ARS) have found that sorghum bran, which is derived from a gluten-free grain, can provide a nutritional boost to breads and other bakery products while maintaining their flavor.

Industry Dynamics

Growth Drivers

Rising Health Concerns

Increasing recognition among consumers regarding the significance of maintaining a healthy lifestyle and consuming natural, whole foods has led to a surge in the demand for the bran. It is highly valued for its abundance of anti-oxidants, minerals, dietary fiber, & vitamins, which contribute to overall well-being & digestive health. Moreover, as consumers become more aware of the benefits associated with a high-fiber diet, many companies have responded by incorporating fiber-rich ingredients into their products. This trend highlights the growing importance placed on dietary fiber as a key component of a healthy diet.

The growing awareness of the potential health risks associated with the consumption of processed foods, such as diabetes, heart diseases, and hypertension, has resulted in an increased demand for various types of bran, including corn, rice, wheat, and barley. Incorporating bran into cereal-based products, such as bran flakes, pasta, noodles, and biscuits, can enhance water absorption and reduce loaf volume, improving the quality of these food applications.

Report Segmentation

The market is primarily segmented based on source, application, distribution channel, and region.

|

By Source |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Segment Analysis

Wheat bran segment accounted for the largest market share in 2022

The demand for the fiber-rich wheat-based bran products is driven by shifting dietary patterns and lifestyle changes. Furthermore, advancements in milling technology & machinery have contributed to the growth of this segment. For instance, Choyal Group, offers customized grinding tools using patented technology, making flour easily accessible for businesses.

Rice bran segment is projected to gain substantial growth rate. Rice bran is known for its high caloric content, protein, essential fatty acids, and minerals, making it a valuable nutritional source. It provides sufficient nutrients to support animal growth, development, and overall health. The increasing number of research studies and initiatives focusing on the use of rice bran in animal health have positively influenced the growth of this segment. For instance, a study conducted by the North Carolina State University revealed that incorporating stabilized rice bran into the diet of piglets can improve the growth-to-feed ratio and enhance the overall benefits without the need for antibiotics.

By Application Segment Analysis

Food segment held the significant market share in 2022

Food segment held the maximum market share. There is a growing trend of incorporating fiber-rich grains, such as bran, in baked goods, which is driving the demand for bran in the food industry. By adding bran to baked goods, manufacturers can enhance the fiber content of the products, appealing to consumers who are seeking to increase their fiber intake. This allows the bakery industry to offer products that contribute to a healthy diet and meet the demands of consumers who prioritize fiber consumption. For instance, in May 2023, Kirin Holdings collaborated with Kellogg's Japan to introduce a functional food product as part of their All-bran portfolio.

Breakfast cereals segment is anticipated to grow at fastest growth rate. This growth is attributed to the increasing consumer awareness regarding the nutritional advantages provided by breakfast cereals, as well as the availability of a wide range of flavors and the convenience they offer in meal preparation. For instance, in May 2023, Kellogg's introduced a maple-flavored cereal that contains vitamins, 16 grams of whole grain, and fiber. Furthermore, extensive marketing efforts by industry players are also contributing to consumer awareness, associating bran-based products with health and wellness.

By Distribution Channel Segment Analysis

B2C segment is projected to witness highest growth over the forecast period

B2C segment is expected to grow at highest growth rate. The increasing popularity of online channels can be attributed to the availability of a wide range of bran products from different brands and suppliers. Consumers can conveniently compare prices, access reviews, and choose from a diverse selection of bran options, including varieties like wheat bran or oat bran. The convenience and variety offered by online channels play a crucial role in driving the demand for bran products.

B2B segment held the largest share. The increasing consumer demand for healthier food options has prompted manufacturers in the industry to seek out bran as an ingredient to enhance the nutritional value of their products. Bran's versatility and ease of incorporation into a wide range of food products, including snacks, cereals, animal feed, and baked goods, have contributed to its growing demand. Food manufacturers catering to specific dietary needs also utilize bran to meet the requirements of these consumer segments.

Regional insights

Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global bran market. The region benefits from its significant production capacity of various grains and favorable farming conditions, particularly for crops like wheat, rice, and others. Moreover, the region's growing population and evolving dietary preferences have contributed to the increasing demand for bran derivatives. In India, the demand for rice bran oil has witnessed a surge, driven by disruptions in oil storage and supply chains.

Europe is projected to be the fastest emerging region. The region is witnessing an increased consumption of breakfast cereals, fueled by growing awareness of sustainably sourced ingredients. This trend has led to a heightened demand for bran in the region. Manufacturers are introducing new flavors, textures, and blends of breakfast cereals to cater to the evolving preferences of consumers, aiming to attract and retain their interest.

Key market players & Competitive Insight

Manufacturers of bran are focusing extensively on research and development (R&D) activities and technological advancements to develop innovative products that align with market trends, particularly the growing preference for non-GMO and organic options. Their objective is to provide cost-effective and high-quality bran products that meet the evolving demands of consumers.

Some of the major players operating in the global market include

- Archer Daniels Midland

- Ardent Mills

- Astra Alliance

- Didion

- Grain Millers

- Grain Processing Corporation

- Hindustan Animal Feeds

- Riceland Foods

- Siemer Milling Company

- Wilmar International

Recent Developments

- In March 2022, Ardent Mills recently unveiled its advanced facility in Florida, which is equipped to manufacture various products including whole wheat, bread flour, and high-gluten cake flour. The facility utilizes state-of-the-art technology to ensure the production of high-quality flours for different baking applications.

Bran Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 78.83 billion |

|

Revenue forecast in 2032 |

USD 151.02 billion |

|

CAGR |

8.50% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Source, By application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Bran Market report covering key segments are source, application, distribution channel, and region.