Browning Solution Market Share, Size, Trends, Industry Analysis Report

By Process (Tumbling, Glazing, Spraying); By Source; By End-Use; By Distribution Channel; By Region; Segment Forecast, 2023 – 2032

- Published Date:Jul-2023

- Pages: 118

- Format: PDF

- Report ID: PM3508

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

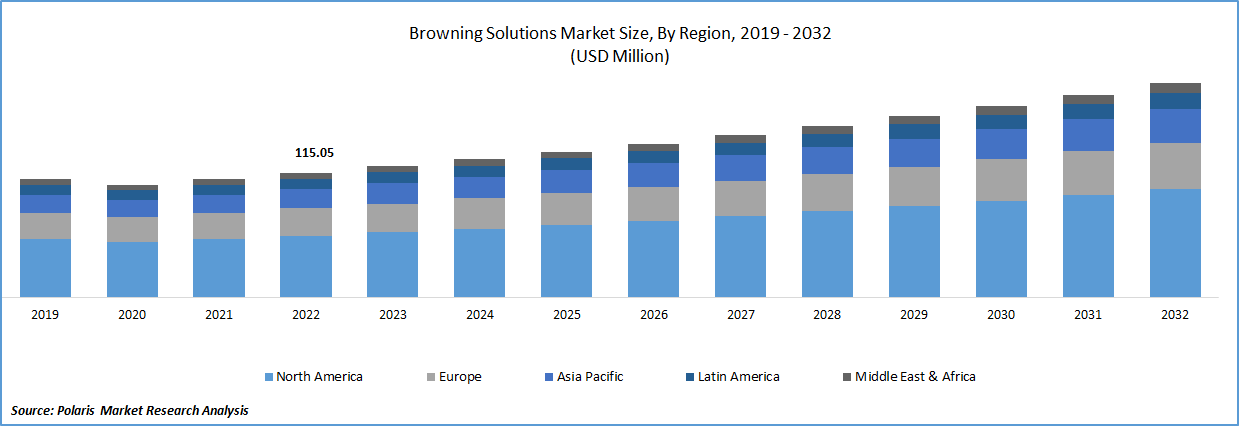

The global browning solution market was valued at USD 115.05 million in 2022 and is expected to grow at a CAGR of 5.6% during the forecast period. Key factors include the increasing demand for processed and convenience foods, the rise in the number of food service establishments, and the growing trend of home cooking. Additionally, the development of new browning solutions that are natural and free from harmful chemicals is also contributing to the growth of the market. Browning solutions are used to give foods such as baked goods, meats, and vegetables a brown colour, which can enhance their appearance and flavor. Growth of the market is attributed to rising consumer demand for natural and organic products, advancements in technology, and increasing demand for processed food products and meat products.

To Understand More About this Research: Request a Free Sample Report

It improves the texture and look of a wide range of culinary and confectionery products. It also offers a range of solutions and services designed to address the issue of browning or discoloration in fruits and vegetables. Browning is a natural process that occurs due to enzymatic and non-enzymatic reactions that cause the product to turn brown and lose its appeal.

Industry Dynamics

Growth Drivers

Demand for processed and convenience foods is increasing globally due to the growing population, changing lifestyles, and rising disposable incomes. Browning solutions are widely used in the production of processed and convenience food to enhance the visual appeal and flavor of the food. For example, in 2019, Kerry Group introduced range of browning solutions for use in meat products, ready meals, and snack foods. The number of food service establishments, such as restaurants, cafes, and fast-food outlets, is increasing worldwide due to the growing demand for eating out. Browning solutions are used by these establishments to enhance the presentation and taste of their food offerings. For instance, in 2020, Tate & Lyle PLC launched a range of browning solutions for use in food service applications, such as sauces, gravies, and soups.

The COVID-19 pandemic has led to an increase in the number of people cooking at home. As a result, there is a growing demand for ingredients and additives that helped home cooks to achieve professional-looking and tasty dishes. Browning solutions are used by home cooks to add colour and flavor to their cooking. For example, in 2020, McCormick & Company, introduced a range of browning and caramelizing solutions for home cooks. Consumers are increasingly looking for natural and clean-label food products. To meet this demand, several companies are developing natural browning solutions that are free from artificial colours and flavor.

For Specific Research Requirements, Request for a Customized Report

Report Segmentation

The browning solution market is segmented based on process, source, end-use, distribution channel, and region.

|

By Process |

By Source |

By End Use |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The tumbling segment led the industry in 2022

The tumbling segment is growing in the meat industry, particularly for processed meat products such as sausages, bacon, and ham. The tumbling process helps to improve the texture, flavor, and color of the meat. Additionally, it can reduce the processing time and increase the yield of the finished product. The glazing segment is growing in the bakery industry, particularly for baked goods such as cakes, cookies, and bread. Glazing helps to enhance the visual appeal of the product by providing a glossy finish, while also improving the texture and extending the shelf life.

The spraying segment is growing in the beverage industry, particularly for alcoholic beverages such as whiskey, rum, and brandy. Spraying helps to impart a desired color and flavor to the product, while also reducing the aging time required for the product to develop its desired characteristics.

The wood-derived segment is fastest growing segment over the study period

The wood-derived segment is growing in the food industry, particularly for meat products such as bacon, ham, and sausages. The use of wood-derived browning solutions in the meat industry is gaining popularity due to the consumer demand for natural and organic products. the food industry to create a natural and authentic appearance in certain products, such as bread crusts, sauces, and gravies. Wood-derived browning solutions are also used in the beverage industry to add colour and flavor to products like whiskey and beer.

Dextrose-derived browning solutions, on the other hand, are made from a type of sugar called dextrose. These solutions are often used in the food industry to create a consistent and uniform colour in products like baked goods, snacks, and sauces. Dextrose-derived browning solutions are also used in the meat industry to create a desirable brown colour in processed meats.

The food & Beverage Industry holds a large market share in 2022

In the food and beverage industry, browning solutions are used to enhance the color and flavor of products like baked goods, meat products, and sauces. In the cosmetic industry, browning solutions are used in self-tanning products to create a natural-looking tan. The bakery and confectionery segment is a significant user of browning solutions, particularly for bread, cakes, and pastries. Browning solutions are used to improve the appearance, texture, and flavor of baked goods, and to create a desirable crust and colour.

The use of browning solutions in the vegetable industry is gaining popularity due to consumer demand for natural and organic products. Browning solutions are used to create a caramelized appearance and a sweet flavor in vegetables such as onions, carrots, and sweet potatoes. In the pharmaceutical industry, browning solutions are used as colorants and coatings for tablets and capsules.

The online channel segment is growing exponentially over the forecast period

Online channel is gaining popularity in the food industry, particularly for B2C sales of various food products, including browning solutions. Consumers prefer to shop online due to convenience, availability of a wider range of products, and the ability to compare prices. The B2B channel is used in various industries, including food and beverage, where manufacturers and suppliers sell their products to other businesses. B2B sales of browning solutions may occur through distributors, wholesalers, or directly to manufacturers who use them as ingredients in their products.

The B2C channel includes traditional retail stores, supermarkets, and other brick-and-mortar outlets where consumers purchase food and beverage products. Browning solutions may be sold through these channels, particularly in the bakery and confectionery industry, where consumers can buy packaged baked goods that contain browning solutions.

North America garnered the largest revenue share in 2022

The regional growth is increased owing to the rising demand for processed food products. The demand for processed food is increasing in the region due to busy lifestyles and changing dietary habits. For example, in 2019, Archer Daniels Midland introduced a new line of browning agents to enhance the appearance and taste of processed meat products.

Europe is expected to spur the browning solution market owing to the use of browning solutions in the food processing industry to enhance the color and flavor of food products. Browning solutions are used in the baking industry to create a desirable color and texture in baked goods. For example, in 2018, DuPont Nutrition & Health launched a new range of browning solutions for baked goods to enhance their flavor, appearance, and texture.

Competitive Insight

Some of the major players operating in the global market include Cargill, Archer Daniels Midland, Kerry Group, Royal DSM, and Tate & Lyle.

Recent Developments

- In 2020, Cargill, Inc launched a new line of de-oiled lecithin products, which are used as an emulsifier in browning solutions. The de-oiled lecithin products are made from non-GMO soybeans and are designed to improve the performance of browning solutions in various food applications.

- In 2019, Kerry Group plc launched a new range of browning solutions for use in meat products, ready meals, and snack foods. The solutions are designed to enhance the appearance, flavor, and texture of food products, while also providing cost savings to manufacturers.

- In 2020, Royal DSM N.V. launched a new range of natural browning solutions made from fermentation-derived ingredients. The solutions are designed to provide a natural browning effect in food products, while also addressing consumer demand for clean labels and sustainable ingredients.

Browning Solution Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 121.20 million |

|

Revenue forecast in 2032 |

USD 197.92 million |

|

CAGR |

5.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Process, By Source, By End Use, By Distribution Channel, By Region |

|

Regional scope |

North America, Latin America, Europe, Middle East & Africa, Asia Pacific |

|

Key companies |

Cargill, Inc., Archer Daniels Midland Company, Kerry Group plc, Koninklijke DSM N.V., and Tate & Lyle PLC. |

FAQ's

key companies in Browning Solution Market are Cargill, Archer Daniels Midland, Kerry Group, Royal DSM, and Tate & Lyle PLC.

The global browning solution market is expected to grow at a CAGR of 5.6% during the forecast period.

The Browning Solution Market report covering key segments are process, source, end-use, distribution channel, and region.

key driving factors in Browning Solution Market are consumers are increasingly looking for natural and clean-label food products.

The global browning solution market size is expected to reach USD 197.92 million by 2032.