Bulk Food Ingredients Market Size, Share, Trends, & Industry Analysis Report

By Type (Primary Processed, Secondary Processed), By Application, By Distribution Channel, By Region -Market Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 112

- Format: PDF

- Report ID: PM2469

- Base Year: 2024

- Historical Data: 2020-2023

Overview

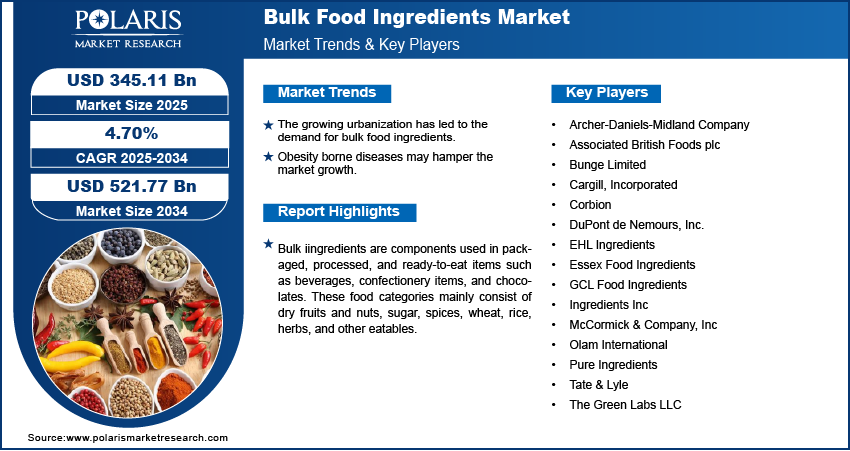

The global bulk food ingredients market size was valued at USD 330.25 billion in 2024. The market is projected to grow at a CAGR of 4.70% during 2025 to 2034. Key factors driving demand for bulk food ingredients include a growing global population and increasing urbanization.

Key Insights

- Herbs and spices segment is projected to grow at a robust pace in the coming years, owing to their high usage for preparing sauces, salad dressings, and condiments.

- The offline segment held the largest revenue share in 2024 due to its ability to offer competitive pricing, product substitutes, and innovative sales strategies.

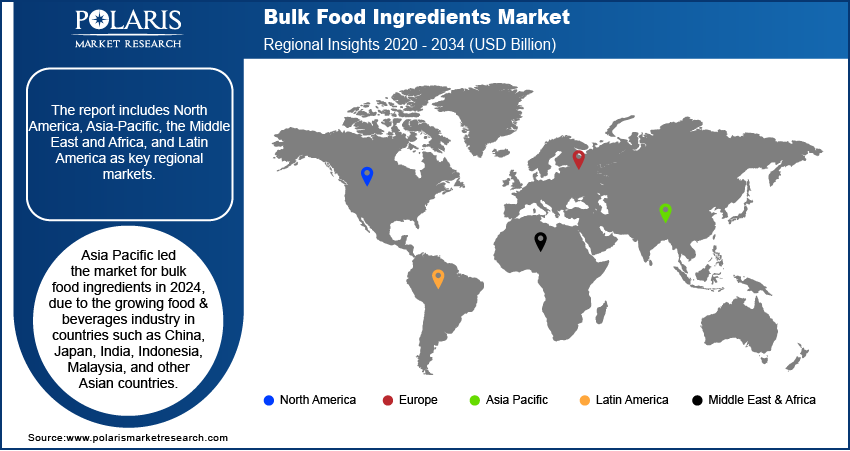

- Asia Pacific led the market for bulk food ingredients in 2024, due to the growing food & beverages industry in countries such as China, Japan, India, Indonesia, Malaysia, and other Asian countries.

Industry Dynamics

- The market is propelled due to the increasing adoption of packaged food & beverage products.

- The growing urbanization has led to the demand for bulk food ingredients.

- The increasing number of cloud kitchens and quick service restaurants across the globe is creating a lucrative market opportunity.

- Obesity borne diseases may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 330.25 Billion

- 2034 Projected Market Size: USD 521.77 Billion

- CAGR (2025-2034): 4.70%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Bulk iingredients are components used in packaged, processed, and ready-to-eat items such as beverages, confectionery items, and chocolates. These food categories mainly consist of dry fruits and nuts, sugar, spices, wheat, rice, herbs, and other eatables. The market for bulk ingredients is growing immensely due to increased spending on packaged and processed consumables. Additionally, drastic lifestyle changes in developing economies have resulted in enhanced demand for ready-to-eat and processed food items. Further, the change in customers' preference from synthetic and pre-packaged consumables to organic, raw, and clean food items, specifically in developed nations, is estimated to impact the market positively. These consumables are also final products, including flours and oils. They are acquired bulk from the wholesalers and sold to various retail shops, supermarkets, hypermarkets, and others.

The outbreak of the COVID-19 pandemic has adversely impacted the growth of the market for bulk ingredients. Due to the lockdown worldwide, there was a significant surge in the prices of such raw materials due to trade barriers, inadequate distribution channels, and interruptions in the supply of raw materials. The increased fees, non-accessibility of bulk ingredients items, and manufacturing costs are restraining the growth of the global bulk ingredients market. Moreover, supply chain security has become a priority worldwide, owing to the shutdown of factories mainly in vegetable oil production in Malaysia and Indonesia, causing a limited availability of palm oil. Likewise, European manufacturers cannot import pepper from India due to the lockdown during COVID-19.

Industry Dynamics

Growth Drivers

The market is propelled due to the increasing adoption of packaged food & beverage items. This is due to the improved lifestyles and increasing standard of living. Moreover, the increase in urbanization, disposable income, and enhanced lifestyles encouraged the growth of the packaged bulk items market worldwide. Additionally, due to hectic lifestyles, people are shifting their preference from negligible cooking to consuming packed eatables, which are convenient to prepare and satisfy the consumer's taste buds. The companies manufacturing such packaged items are gaining equal revenues worldwide, both from developing and developed economies. For instance, based on a recent survey conducted by the Associated Chambers of Commerce and Industry of India (ASSOCHAM), the purchasing power for packaged items has increased drastically due to the increase in prices of vegetables, leading to the rise in sales of such products by to 20%–25%.

The demand for junk consumables or ready-to-eat items has increased steadily over the years due to the changing lifestyle of people, resulting in the consumption of bakery items, junk food, and desserts. The demand for convenience meals is more noticeable in developing countries, where per capita eatable expenditure rises with income.

Report Segmentation

The market is primarily segmented based on type, application, distribution channel, and region.

|

By Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

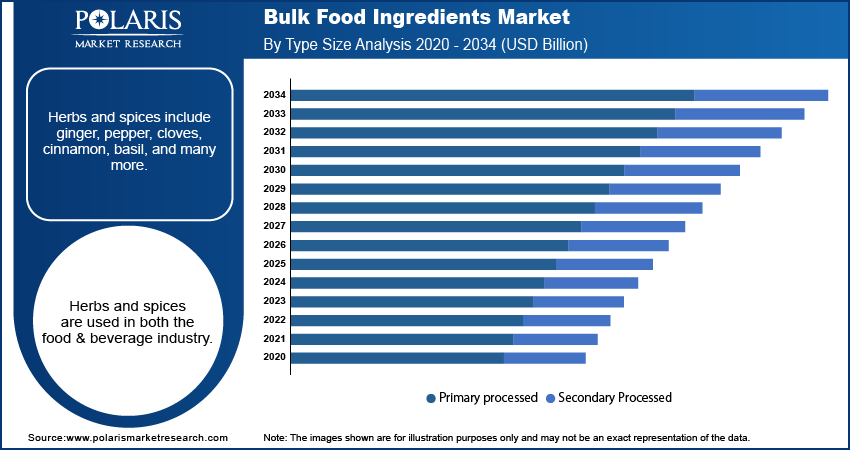

Herbs and Spices is the Most Lucrative Segment

Herbs and spices include ginger, pepper, cloves, cinnamon, basil, and many more. Herbs and spices are used in both the food & beverage industry. Such processed food items have increased for preparing sauces, salad dressings, and condiments, resulting in the demand for herbs and spices

Bakery and Confectionery Segment Accounted for the Largest Market Share in 2024

Based on application, the bulk food ingredient market is categorized into bakery and confectionery, snacks & spreads, ready-to-eat meals, beverages, and others. Increasing consumer consciousness about health and nutrition-related food items has encouraged bakery and confectionery manufacturers to produce goods such as probiotics, oats, quinoa, cereals, and other healthy food products. Thereby resulting in the procuring highest market share in the application segment. Moreover, the market for bakery & confectionery in Asia is mainly driven by the growing demand for processed bakery products, along with increasing awareness for clean labels and healthy bulk ingredients.

Offline Distribution Channel Segment Accounted for the Largest Market Share in 2024

The factors leading to the growth of this distribution channel are fluctuation in raw material prices, competitive pricing, product substitutes, and innovative sales strategies, among others. Moreover, various research and development for innovative products and solutions by manufacturers are projected to drive market growth for bulk ingredients.

The Asia Pacific Region Lead the Global Bulk Food Ingredients Market in 2024

Asia Pacific led the market for bulk food ingredients in 2024. There is an increased demand in the food & beverages industry in countries such as China, Japan, India, Indonesia, Malaysia, and other Asian countries, resulting in the market growth of bulk ingredients. Growing disposable income and improving living standards have resulted in greater demand for these bulk ingredients in the Asia Pacific. The economic growth in countries such as China, Japan, and India has strengthened the food & beverage industry, resulting in increased demand for bulk food ingredients. Global players are expanding into emerging countries to tap the market potential. Technological advancements and rising investments in R&D further supported the market growth. Moreover, processed and packaged food consumption is the highest in the Asia Pacific region due to its rising population and growing exposure to western lifestyles. This fueld the market domianance.

Competitive Insight

Some of the major players operating in the global market for bulk ingredients include Archer-Daniels-Midland Company, Associated British Foods plc, Bunge Limited, Cargill, Incorporated, Corbion, DuPont de Nemours, Inc., EHL Ingredients, Essex Food Ingredients, GCL Food Ingredients, Ingredients Inc, McCormick & Company, Inc, Olam International, Pure Ingredients, Tate & Lyle, and The Green Labs LLC. These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products to cater to the growing consumer demands for bulk ingredients.

Recent Developments

In July 2021, Tate & Lyle PLC unveiled a sustainable program to encourage stevia production in China. In January 2020, Archer-Daniels-Midland Company acquired Yerbalatina Phytoactives to expand its product offering of plant-based ingredients and initiated a manufacturing plant for organic food colors, organic powdered fruits, and functional health and nutrition ingredients.

Bulk Food Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 330.25 billion |

| Market size value in 2025 | USD 345.11 billion |

|

Revenue forecast in 2034 |

USD 521.77 billion |

|

CAGR |

4.70% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Archer-Daniels-Midland Company, Associated British Foods plc, Bunge Limited, Cargill, Incorporated, Corbion, DuPont de Nemours, Inc., EHL Ingredients, Essex Food Ingredients, GCL Food Ingredients, Ingredients Inc, McCormick & Company, Inc, Olam International, Pure Ingredients, Tate & Lyle, and The Green Labs LLC |

FAQ's

• The global market size was valued at USD 330.25 billion in 2024 and is projected to grow to USD 521.77 billion by 2034.

• The global market is projected to register a CAGR of 4.70% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market are Archer-Daniels-Midland Company, Associated British Foods plc, Bunge Limited, Cargill, Incorporated, Corbion, DuPont de Nemours, Inc., EHL Ingredients, Essex Food Ingredients, GCL Food Ingredients, Ingredients Inc, McCormick & Company, Inc, Olam International, Pure Ingredients, Tate & Lyle, and The Green Labs LLC.

• The offline segment dominated the market revenue share in 2024.