Busbar Market Share, Size, Trends, Industry Analysis Report

By Product Type (Copper, Aluminium); By Rating; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3125

- Base Year: 2023

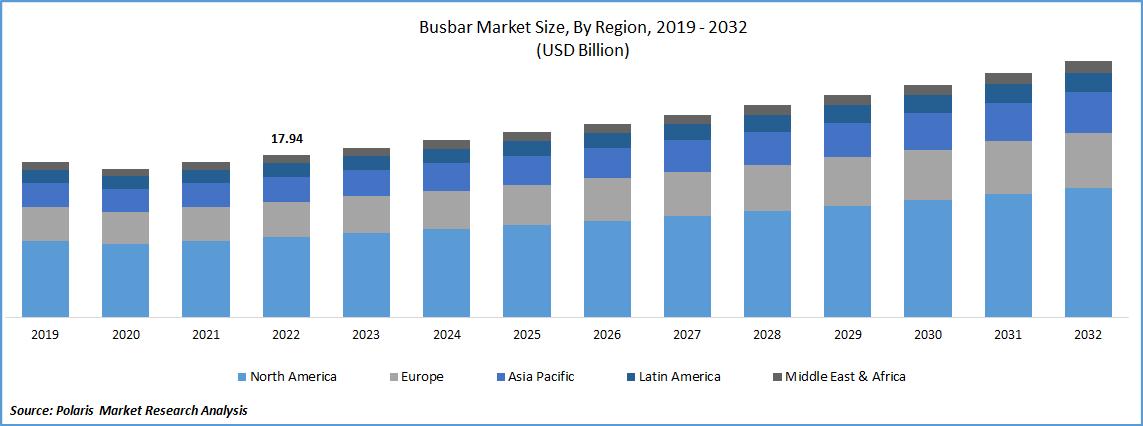

- Historical Data: 2019-2022

Report Outlook

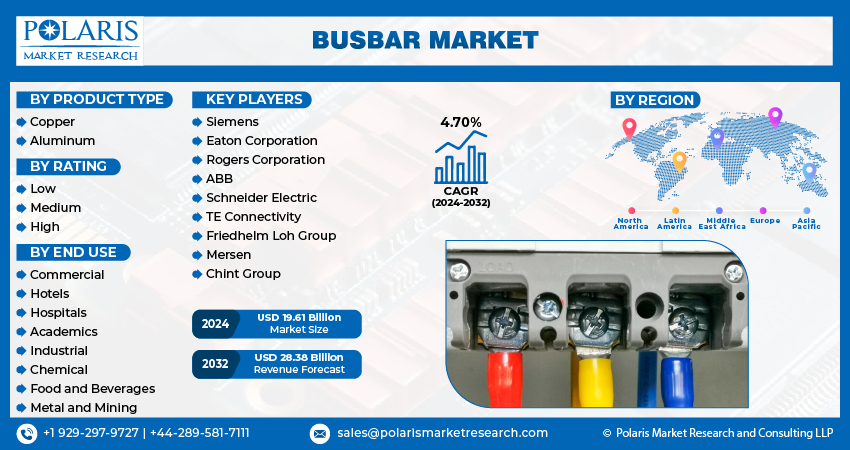

The global busbar market was valued at USD 18.75 billion in 2023 and is expected to grow at a CAGR of 4.70% during the forecast period. Busbar is in more demand due to the business environment's rapid commercialization and urbanization, which will also drive-up electricity demand in these industries. Through modernized, technology-driven urban planning, programs like the Revolutionary Smart City Mission (goal 100 communities) are projected to improve the quality of life in India. This will provide new opportunities for growth and demand for the busbar market in the upcoming years.

Know more about this report: Request for sample pages

The demand for busbars, a crucial aspect of building electrical systems, is driven by the expanding construction industry, notably in the residential and commercial sectors. According to Invest India, A Technology Sub-Mission of PMAY-U identified 54 novel construction technologies worldwide to usher in a new age in the Indian construction technology sector. This, in turn, fuels the growth of the busbar industry in the coming years.

Busbars of highly conductive metal have replaced conventional power distribution techniques because they provide a more efficient conductor and reduce energy loss during transmission. Additionally, the busbar industry is expanding as a result of the fact that they largely lower installation costs by replacing wires and other related components. Additionally, the fact that busbars are secure, dependable, and eco-friendly helps the busbar industry expand. Busbar installation is comparatively more economical, and electrical professionals don't need to pay for outside work. They don't require frequent upkeep and cost less to develop or renovate. Without any downtime, busbars are placed quickly and effectively. Busbar is used in various situations, including businesses, hospitals, power plants, data centers, laboratories, residences, shops, universities, transit systems, and railroads. This will further propel the demand for a busbar in upcoming years.

Industry Dynamics

Growth Drivers

The increasing demand for electrical energy, particularly in the residential and commercial sectors, is driving the demand for busbars, essential electrical system components. The growing industrialization in many countries is driving the demand for electrical energy and busbars. The growing construction industry, particularly in the residential and commercial sectors, is driving the demand for busbars, an essential component of building electrical systems. Technological advancements, such as the increasing use of automation and electrification, drive the demand for busbars.

The growing focus on energy efficiency drives the demand for busbars, which play a key role in the efficient distribution of electrical energy. The rising living standards in many countries, particularly in the residential and commercial sectors, are driving the demand for electrical energy and, in turn, busbars. Government initiatives to promote renewable energy sources, such as wind and solar power, drive the need for high-rating busbars, essential components of high-capacity power transmission and distribution systems.

Report Segmentation

The market is primarily segmented based on product type, rating, end use and region.

|

By Product Type |

By Rating |

By End Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Copper Product Type is expected to witness fastest growth in 2022

Copper is a key material in producing busbars and plays a significant role in the growth of the busbar market. Copper has high electrical conductivity, making it a preferred material for electrical applications such as busbars. Copper is a durable material that can withstand high temperatures, making it suitable for use in high-temperature applications such as transformers and switchgear. Copper is cheaper than other materials with similar electrical conductivity, making it a cost-effective solution for electrical applications.

The demand for copper-based electrical products such as busbars is growing as electrical energy needs increase. This, in turn, is driving the growth of the busbar market. Copper is easy to process, making it a preferred material for busbars. The ability to process copper easily makes it possible to produce various sizes and shapes of busbars, which is essential for multiple electrical applications. Additionally, aluminum has a smaller energy loss during transmission compared to other materials, which raises the need for aluminum in the upcoming years.

Industries need a constant source of high energy, which necessitates the use of copper and other extremely high thermal and electrically conductive materials. Due to its advantages of increased security in short circuit conditions and exceptional flexibility at higher temperatures, it is more conductive than aluminum and preferred over other materials. Copper offers many applications, including low electrical and thermal resistance, improved mechanical strength, and higher resistance to fatigue failure. Due to its superior power distribution capabilities over busbars constructed of other materials, copper busbars are particularly desirable in renewable energy applications. This will fuel the growth of the market in the upcoming years.

High Rating segment accounted for the second-largest market share in 2022

High-rating busbars provide improved safety and reliability compared to low-rating busbars, making them an attractive solution for various electrical applications, such as transformers and switchgear. Technological advancements in the production of high-rating busbars have led to increased efficiency, reduced costs, and improved reliability, further contributing to the growth of the busbar market. The increasing demand for renewable energy sources, such as wind and solar power, drives the need for high-rating busbars, as these sources require high-capacity power transmission and distribution systems.

High-rating busbars can handle high levels of electrical power, making them suitable for use in applications such as power distribution and transmission. High-rating busbars improve performance and reliability compared to low-rating busbars, making them an attractive solution for various electrical applications. These factors will further fuel the growth of the market in the coming future.

Commercial segment is expected to hold the significant revenue share during forecast period

The commercial sectors are implementing busbars, including buildings, corporate offices, department stores, retail malls, offices, and banking. The increasing demand for electrical energy in commercial buildings, such as office buildings, shopping centers, and hotels, drives the market for busbars and essential electrical system components. The growing construction industry, particularly in the commercial sector, is driving the demand for busbars, an essential part of electrical systems in commercial buildings.

Technological advancements in the commercial sector, such as the increasing use of automation and electrification, drive the demand for busbars. The industrial segment dominated the market by controlling a substantial revenue market share. As a result of smart and green city concepts, the commercial category is anticipated to increase at a faster CAGR. Busbars are swiftly replacing traditional cables in the retail sector because they are simple to install and save space.

The demand in Asia Pacific is expected to witness significant growth in 2022

Asia-Pacific is projected to experience a higher growth rate in coming years due to rising busbar sector investments in emerging economies. India is the second-largest producer of busbars in the Asia-Pacific region after China. As a result of increasing market investments, India is anticipated to expand at the greatest rate in the area. The region is home to a large population, and this, combined with its growing industrialization, makes it a large market for electrical products such as busbars.

The Asia Pacific region is experiencing growing demand for renewable energy sources, such as wind and solar power, which require high-capacity power transmission and distribution systems. This drives the market for high-rating busbars as a region invests in developing its infrastructure, including its electrical infrastructure, which operates the demand for busbars. The governments of several countries in the region have implemented favorable policies to encourage the growth of their electrical industries, driving the demand for busbars.

Competitive Insight

Some of the major players operating in the global market include Siemens, Eaton Corporation, Rogers Corporation, ABB, Schneider Electric, TE Connectivity, Friedhelm Loh Group, Mersen, & Chint Group.

Recent Developments

- In January 2023, Eaton, a leader in intelligent power management, announced a partnership with Rewiring America, the top U.S. organization in the field of electrification, to increase electrification knowledge, awareness, and action.

- In November 2022, Siemens Limited established cutting-edge manufacturing in Aurangabad to meet the rising demand in India and worldwide. To fulfill an export order, the manufacturer will send over 200 bogies. Bogies are built using the tried-and-true “SF30 Combino Plus” global design concept from Siemens.

Busbar Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 19.61 billion |

|

Revenue forecast in 2032 |

USD 28.38 billion |

|

CAGR |

4.70% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product Type, By Rating, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Siemens, Eaton Corporation, Rogers Corporation, ABB, Schneider Electric, TE Connectivity, Friedhelm Loh Group, Mersen, & Chint Group |

FAQ's

The busbar market report covering key segments are product type, rating, end use and region.

Busbar Market Size Worth $28.38 Billion By 2032.

The global busbar market expected to grow at a CAGR of 4.7% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in the busbar market are green & smart city concepts and emerging switchgear and energy & power market.