Calibration Services Market Share, Size, Trends, Industry Analysis Report

By Service Type (Mechanical, Electrical, Dimensional, and Thermodynamics); By Proofreading; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3841

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

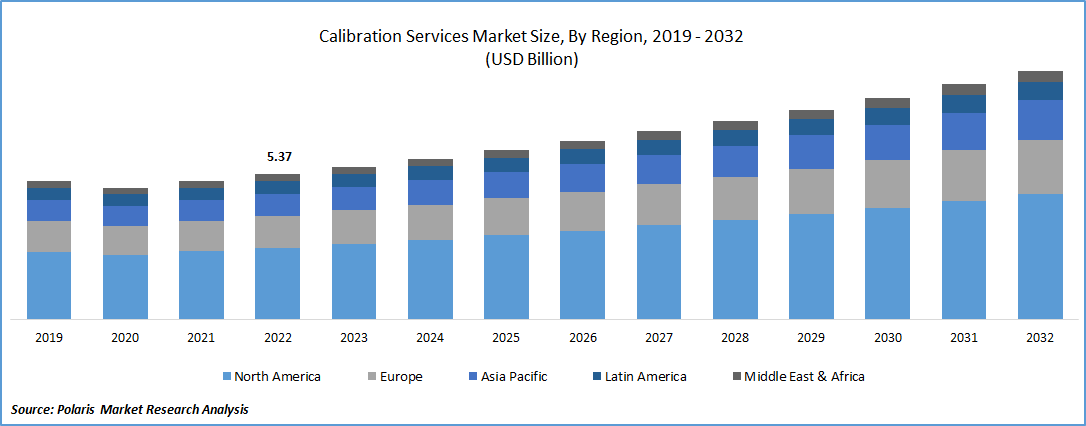

The global calibration services market was valued at USD 5.65 billion in 2023 and is expected to grow at a CAGR of 5.60% during the forecast period.

The advantages offered by the calibration services providers to the users, as well as rising public awareness among the companies for on-time calibration services, are boosting the market growth over the forecast period. Some of the important reasons driving the market include rising industrialization and technological developments. The technology adoption, such as 3D, AI, and 5G technology in calibration instruments, is the major factor that is driving the growth of the market over the forecast period.

To Understand More About this Research: Request a Free Sample Report

A calibration service detects the inaccuracy and unpredictability of an instrument for measurement or a piece of equipment. Calibration involves comparing the device under test (DUT) to a specified reference value to identify the measurement's divergence from the true value. The various documents are prepared for calibration services across the manufacturing companies. In the documents for calibration, it must be written the last calibration and next calibration date as well, as all the specifications of the instruments must be as per the requirement. A calibration certificate is also issued by the companies, which shows the accuracy and all the valuable information of the instrument.

Also, there are various benefits offered by the calibration services. They are used to identify deviations and inaccuracies in various instruments such as micrometers, analog multimeters, chart recorders, dial indicators, calipers, data loggers, clamp-on ammeters, digital multimeters, force gauges, and oscilloscopes. The basic importance of calibration is that it preserves measurement precision, standardization, and repeatability, ensuring dependable benchmarks and results. Equipment that is not calibrated regularly might fall out of specification, offer erroneous measurements, and endanger quality, safety, and equipment longevity.

Furthermore, they aid in the management, procurement, and repair of instruments, as well as the rental of measurement equipment and guidance on the purchase of new equipment. They ensure that the equipment produces high-quality, consistent results. Calibration services are in high demand around the world because they assist in eliminating the requirement for reactive maintenance in between regular maintenance and calibration inspections. Therefore, these advantages offered are the major factor bolstering the growth of the market over the forecast period.

Industry Dynamics

Growth Drivers

Rising need for calibration services

The increasing need for calibration services to guarantee patient safety is providing a positive market outlook. In June 2023, Viavi Solutions. introduced the TM500 Cloud. It is to monitor and manage any risks connected with the Quality of Service (QoS) for end users as operators progressively deploy core network infrastructure in the cloud via hyper scalers alongside additional cloud service providers. By this, increased corporate investments and rising demand for reconditioned medical equipment are bolstering market growth.

Also, in December 2020, TekDrive, the 1st oscilloscope-to-cloud software solution to promote worldwide data sharing directly on an oscilloscope, PC, phone, or tablet, was released by Tektronix. An oscilloscope can measure brain activity, muscular activity, and heart rate.

Aside from that, the increasing demand for calibration services in numerous end-use sectors such as automotive, construction, aerospace, and defense is propelling the market forward. In June 2023, Keysight's application layer offering is expanded with simulation capabilities that are crucial for accelerating innovation in a variety of end sectors, including automotive. Customers can reduce their environmental footprint while accelerating time to market and lowering operational costs. Since these are the launches of calibration instruments for various end-users, as well as the adoption of calibration across the sectors, are driving the growth of the market over the forecast period.

Report Segmentation

The market is primarily segmented based on service type, proofreading, application, and region.

|

By Services Type |

By Proofreading |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Proofreading Analysis

Third-Party Vendor segment is expected to witness the fastest growth during forecast period

The demand for calibration services rising from the third-party vendor side is the major factor that is driving the segmental growth with the fastest CAGR. The growing number of third-party calibration suppliers for outsourced services provides significant growth potential for industry investors. For starters, because the calibration vendor has no inherent interest in selling certain equipment, it allows for impartiality and objectivity in the process. This ensures that the calibration results are objective and meet industry requirements. 3rd party calibration services are also well-known for their experience, technical competency, and adherence to recognized calibration methods.

Organizations commonly use calibration services to standardize in-house equipment and by original equipment manufacturers (OEM) to ensure the efficiency of their items. Outsourced calibration services have also given rise to a host of third-party calibration suppliers, supporting industry growth. Also, In-house refers to a technique in which a corporation decides to calibrate its equipment and devices. The company may have engineers with calibration expertise who can calibrate the necessary instruments.

By Application Analysis

Electronics segment accounted for the largest market share in 2022

The electronics segment holds the largest share of the market. The segment is holding the largest share due to high demand from clients and advanced technology adoptions. Electrical and its applications in the calibration services industry are used to provide stability, accuracy, and dependability of measurement systems. It also aids in reducing variation in measurements that are repeated. Electrical & Usage in Calibration Services uses advanced electronic equipment to evaluate the electrical properties of items under test, such as resistivity, inductance, and capacitance, among others, resulting in high precision levels.

Moreover, the demand for calibration instruments for the aerospace and defense sector is also high in demand, which is rising segmental growth. The precision of the instruments, such as avionics systems, radars, navigational tools, and weapons systems, is ensured by accurate calibration, which contributes to the overall performance, safety, and reliability of aerospace and defense systems. These cutting-edge technologies meet the demand for specialized calibration services, driven by the requirement to ensure rigorous compliance with industry regulations and optimal functionality in essential applications.

By Regional Analysis

The demand in Europe is expected to witness significant growth during forecast period

The Europe region holds the largest share of the market owing to various factors such as the rising demand for calibration instruments in the various manufacturing sectors as well as the investment by the major players for the development of calibration instruments. The accessibility and acceptance of novel innovations of enhanced transit infrastructure, rising public awareness about protective machinery, boosting utilization by organizations for in-house standardization of equipment, and other factors drove the European calibration services market.

The Asia-Pacific region holds the second-largest share in market growth due to various driving factors. Calibration instrument items or materials must be evaluated for deviations and accurate performance before being used for ultimate purposes, resulting in a high need for calibration services that test and assess the accuracy and ensure proper product operation. Additionally, in May 2022, WIKA Instruments released a Mobile Calibration Van for on-site maintenance and repair. These continuous efforts by the manufacturers in the regions are boosting the region's growth.

Competitive Insight

The Calibration Services market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- ABB

- Agilent

- Endress+Hauser

- Fluke Corporation

- General Electric

- Keysight Technologies.

- Micro Precision Calibration

- Optical Test and Calibration

- Rohde & Schwarz

- Siemens Aktiengesellschaft

- Simco Electronics.

- Sulzer

- Tradinco Instruments

- Transcat

- Trescal Holdings

Recent Developments

- In March 2023, Rohde & Schwarz, introduced the R&S EVSD1000 VHF/UHF nav/drone analyzer. The analyzer is a vital instrument for civil aviation since it offers precise & efficient drone examination of the terrestrial navigation & communication systems. It is intended to give one-of-a-kind testing and measurement capabilities to develop precise and dependable navigation systems to manage air traffic control to ensure public safety.

Calibration Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.95 billion |

|

Revenue Forecast in 2032 |

USD 9.20 billion |

|

CAGR |

5.60% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2024 - 2032 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Service Type, By Proofreading, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global Calibration Services market size is expected to reach USD 9.20 billion by 2032.

Key players in the market are ABB, Agilent, Endress+Hauser, Fluke Corporation, General Electric.

Europe contribute notably towards the global calibration services market.

The global calibration services market is expected to grow at a CAGR of 5.6% during the forecast period.

The calibration services market report covering key segments are service type, proofreading, application, and region.