Canada Liquid Waste Management Market Size, Share, Trends, & Industry Analysis Report

By Source (Residential, Commercial, Industrial), By Industry, By Service – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5822

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

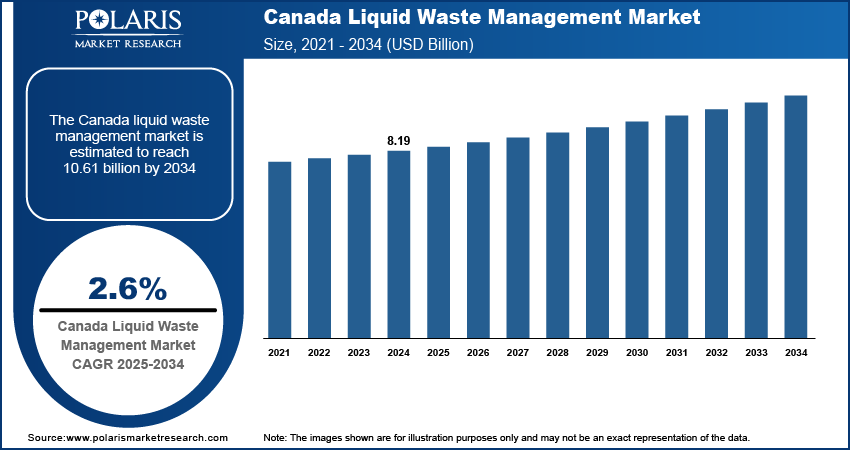

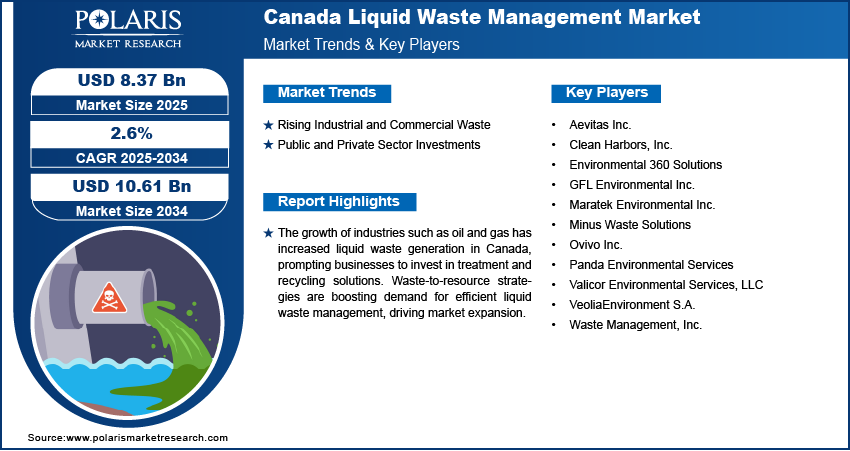

The Canada liquid waste management market was valued at USD 8.19 billion in 2024 and is expected to register a CAGR of 2.6% during the forecast period. The growth is driven by rising industrial and commercial waste and public and private sector investment.

The Canada liquid waste management market is a crucial component of the country's environmental sustainability efforts. The need for effective waste management solutions has become more crucial as urbanization and industrialization continue to grow. Liquid waste, which includes sewage, industrial effluents, and hazardous chemical byproducts, poses significant environmental and health risks if not managed properly. The Canadian government, along with private enterprises, is investing in advanced waste treatment technologies to ensure compliance with environmental regulations and sustainability goals.

The demand for liquid waste management in Canada is driven by stringent environmental laws and policies aimed at reducing pollution and promoting resource recovery. Regulatory frameworks such as the Canadian Environmental Protection Act (CEPA) and provincial regulations set strict guidelines for industries to manage their waste responsibly. Compliance with these regulations has led to the adoption of advanced water & wastewater treatment equipment and processes, including biological treatment, chemical treatment, and membrane filtration systems. These measures are essential for reducing adverse environmental impact and maintaining the health and safety of communities.

To Understand More About this Research: Request a Free Sample Report

Technological advancements are shaping the strategic investment landscape, with a growing emphasis on automation, digitization, and data-driven waste management solutions. Companies are investing in IoT technology-based sensors, remote monitoring systems, and AI-powered analytics to optimize wastewater treatment processes and improve regulatory compliance. These digital innovations improve efficiency and reduce operational costs, making waste management more cost-effective for industries and municipalities. Additionally, the development of decentralized wastewater treatment solutions is opening new investment avenues, particularly in remote and rural areas where centralized infrastructure is not feasible. Companies provide cost-effective and sustainable waste management solutions to underserved regions by investing in localized and modular treatment systems, thereby driving the Canada liquid waste management market growth.

Industry Dynamics

Rising Industrial and Commercial Waste

The expansion of industries such as oil and gas, mining, food processing, and manufacturing has resulted in a sharp rise in liquid waste generation. According to the Canadian Energy Center, in 2021, 147,371 people were employed in the oil and gas sector in Canada. Industrial and commercial facilities produce both hazardous and non-hazardous liquid waste, requiring specialized handling and disposal methods. Businesses are increasingly investing in on-site wastewater treatment plants, chemical neutralization systems, and hazardous waste recycling solutions to manage their waste responsibly. The push toward waste-to-resource strategies, such as converting organic waste into biogas and recovering valuable chemicals, is further driving demand for efficient liquid waste management services, thereby driving the growth.

Public and Private Sector Investments

Investments in liquid waste management are rising as both government agencies and private enterprises recognize the need for improved infrastructure and innovative treatment solutions. Public sector funding is supporting municipal wastewater treatment upgrades, hazardous waste disposal programs, and research into next-generation waste technologies. Meanwhile, private sector players are investing in artificial intelligence (AI) driven waste tracking, decentralized treatment systems, and sustainable waste processing solutions to enhance efficiency and reduce costs. The availability of green financing, sustainability-linked loans, and government grants is further driving capital into the sector, ensuring continued growth and development.

Segmental Insights

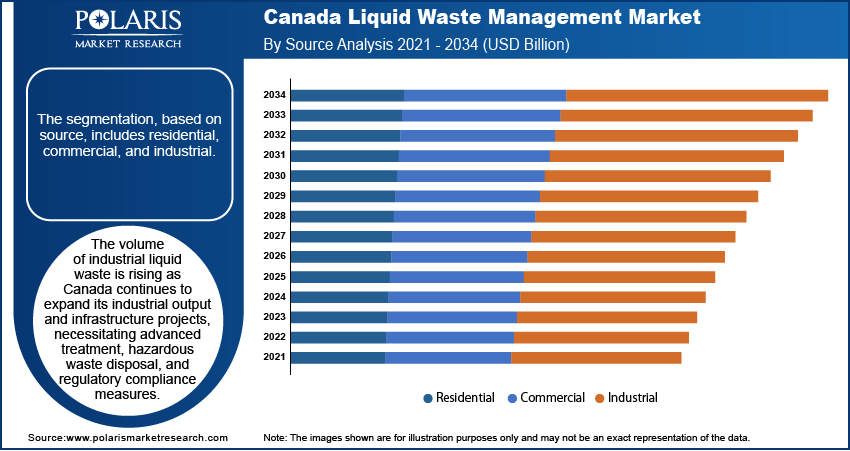

By Source Analysis

The Canada liquid waste management market segmentation, based on source, includes residential, commercial, and industrial. The industrial segment is expected to reach USD 5.16 billion by 2034. This sector includes waste generated from industries such as oil & gas, manufacturing, mining, chemicals, food processing, and pulp & paper production. The volume of industrial liquid waste is rising as Canada continues to expand its industrial output and infrastructure projects, necessitating advanced treatment, hazardous waste disposal, and regulatory compliance measures. The growing adoption of circular economy practices, water reuse technologies, and zero-liquid discharge (ZLD) systems is further driving demand for specialized liquid waste management services. Additionally, the imposition of stringent government policies on effluent treatment, toxic waste disposal, and industrial water conservation is pushing industries to adopt sustainable waste management solutions to meet environmental standards, thereby driving the segment growth.

The commercial segment accounted for USD 2.59 billion in revenue in 2024, driven by the expansion of urban centers, growth in the service sector, and increasing government regulations on proper waste disposal for businesses. The hospitality industry, including restaurants and hotels, contributes significantly to grease, oil, and food-related liquid waste, necessitating advanced treatment solutions such as grease traps and biological treatment systems. Additionally, hospitals and healthcare facilities generate medical liquid waste, requiring specialized handling and disposal due to its hazardous nature. The introduction of stricter wastewater discharge limits and sustainability-focused waste management solutions is expected to support the steady growth of this segment during the forecast period.

By Industry Analysis

The segmentation, based on industry, includes textile, paper, iron & steel, automotive, pharmaceutical, oil & gas, and others. The oil & gas segment accounted for a 27.93% share in 2024. The oil & gas industry is one of the largest generators of liquid waste in Canada, particularly in the form of produced water, drilling fluids, and contaminated runoff from extraction and refining processes. These liquid wastes often contain hydrocarbons, salts, heavy metals, and chemicals, making them difficult to treat and posing significant risks to the environment. The treatment of liquid waste in the oil & gas sector requires specialized processes, including oil-water separation, flocculation, and advanced filtration systems to remove harmful substances before discharge or disposal. In Canada, regulatory bodies such as the Canadian Environmental Assessment Agency (CEAA) enforce strict guidelines to ensure proper waste management in this high-risk industry.

By Service Analysis

The segmentation, based on service, includes transportation, collection, and retreading. The transportation segment accounted for a 34.44% share in 2024. Transportation is a critical service in the liquid waste management market, ensuring that liquid waste is moved efficiently from its point of generation to treatment or disposal facilities. In Canada, this involves the use of specialized vehicles, such as vacuum trucks and tankers, designed to handle hazardous and non-hazardous liquid waste. The need for efficient transportation solutions will grow as the demand for liquid waste management services increases across various industries, including oil & gas, pharmaceuticals, and textiles. Companies are investing in technology that improves tracking and monitoring capabilities for waste transportation, using GPS systems and IoT sensors to ensure real-time visibility and secure waste handling. This enables compliance with environmental regulations and timely delivery to treatment facilities. In Canada, the adoption of sustainable transportation methods, such as using electric vehicles or low-emission trucks, will also play a crucial role in minimizing the carbon footprint of the liquid waste transportation process.

Key Players & Competitive Analysis Report

The Canada liquid waste management market is highly competitive, featuring a mix of multinational corporations and regional players. Global giants such as Veolia Environment S.A. and Waste Management, Inc. dominate with extensive infrastructure, advanced technologies, and broad service portfolios. GFL Environmental Inc. and Clean Harbors, Inc. are strong Canadian and North American leaders, offering hazardous and non-hazardous liquid waste solutions. Mid-sized firms such as Environmental 360 Solutions, Valicor, and Aevitas Inc. focus on tailored industrial and municipal services. Niche providers such as Maratek, Minus Waste Solutions, Ovivo, and Panda Environmental specialize in recycling, wastewater treatment, and sustainable solutions, contributing to a diversified market landscape.

Key Players

- Aevitas Inc.

- Clean Harbors, Inc.

- Environmental 360 Solutions

- GFL Environmental Inc.

- Maratek Environmental Inc.

- Minus Waste Solutions

- Ovivo Inc.

- Panda Environmental Services

- Valicor Environmental Services, LLC

- VeoliaEnvironment S.A.

- Waste Management, Inc.

Industry Developments

February 2024: Ovivo Inc., a global provider of water and wastewater treatment equipment, technologies, and systems, announced the acquisition of E2metrix Inc., a Sherbrooke, Quebec, Canada-based technology company that specializes in innovative and clean electro-technologies that are particularly effective to destroy perfluoroalkyl and polyfluoroalkyl substances (PFAS), commonly known as the forever chemicals, and other emerging contaminants present

November 2024: WM announced that it had completed the acquisition of Stericycle, Inc. The previously disclosed purchase price of USD 62.00 per share in cash corresponds to a total enterprise value of about USD 7.2 billion.

October 2023: Veolia North America, an integrated provider of environmental services in the US and Canada, announced that it had completed the acquisition of US Industrial Technologies, a Michigan-based provider of total waste and recycling services that has managed industrial waste streams for automakers, other large manufacturers, medium and small businesses, governments, and municipalities since 1996.

Canada Liquid Waste Management Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Toxic & Hazardous

- Organic & Non-hazardous

- Industrial

- Toxic & Hazardous

- Organic & Non-hazardous

By Industry Outlook (Revenue, USD Billion, 2020–2034)

- Textile

- Paper

- Iron & Steel

- Automotive

- Pharmaceutical

- Oil & Gas

- Others

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Transportation

- Collection

- Retreading

Canada Liquid Waste Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.19 Billion |

|

Market Size in 2025 |

USD 8.37 Billion |

|

Revenue Forecast by 2034 |

USD 10.61 Billion |

|

CAGR |

2.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 8.19 billion in 2024 and is projected to grow to USD 10.61 billion by 2034.

The market is projected to register a CAGR of 2.6% during the forecast period.

A few of the key players in the market are Aevitas Inc.; Clean Harbors, Inc.; Environmental 360 Solutions; GFL Environmental Inc.; Maratek Environmental Inc.; Minus Waste Solutions; Ovivo Inc.; Panda Environmental Services; Valicor Environmental Services, LLC; Veolia Environment S.A.; and Waste Management, Inc.

The industrial segment dominated the market share in 2024.

The transportation segment is expected to witness the fastest growth during the forecast period.