Caprolactam Market Share, Size, Trends, & Industry Analysis Report

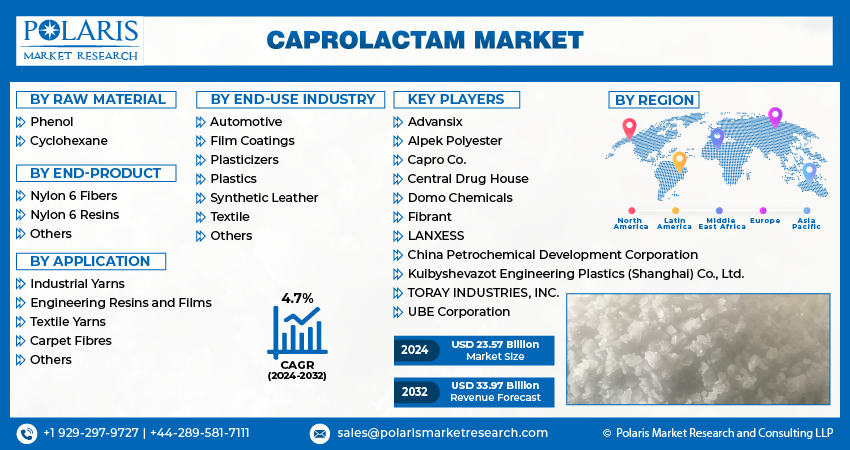

By Raw Material (Phenol, Cyclohexane); By End-Product; By Application; By End-Use Industry; By Region; Segment Forecast, 2025 - 2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM1434

- Base Year: 2024

- Historical Data: 2020-2023

The global caprolactam market was valued at USD 16.8 billion in 2024 and is projected to grow at a CAGR of 4.30% from 2025 to 2034. Market growth is supported by rising demand for nylon-based products in textiles, automotive, and industrial sectors.

Industry Trends

Caprolactam is a crucial chemical compound used primarily in the production of nylon 6, a versatile polymer with widespread applications in various industries. Chemically, caprolactam is a cyclic amide consisting of six carbon atoms, known for its clear, colorless appearance and distinctive odor. It serves as the building block for the synthesis of nylon 6 through a polymerization process, wherein caprolactam molecules undergo ring-opening polymerization to form long chains of polyamide.

The caprolactam market is experiencing significant growth, driven by several factors, including the increasing demand for nylon 6, a major derivative of caprolactam, across various end-use industries such as automotive, textiles, and electronics. Due to its excellent mechanical properties, durability, and chemical resistance, nylon 6 is extensively used in the production of fibers, resins, and engineering plastics.

To Understand More About this Research:Request a Free Sample Report

Along with this, technological advancements in caprolactam production processes, such as the development of eco-friendly and cost-effective manufacturing methods, are driving market growth. Manufacturers are increasingly adopting sustainable practices and investing in research and development to improve process efficiencies, reduce environmental impact, and enhance product quality. Also, the growing focus on lightweight and fuel-efficient materials in the automotive and aerospace sectors is driving the adoption of nylon 6-based composites, further boosting the demand for caprolactam.

The market trends, such as increasing investments in bio-based caprolactam production technologies, are driven by growing environmental concerns and the pursuit of sustainable alternatives to traditional petrochemical-based processes. However, the market also faces several restraining factors, including fluctuations in raw material prices, particularly benzene and cyclohexane, which are key feedstocks for caprolactam production.

Key Takeaways

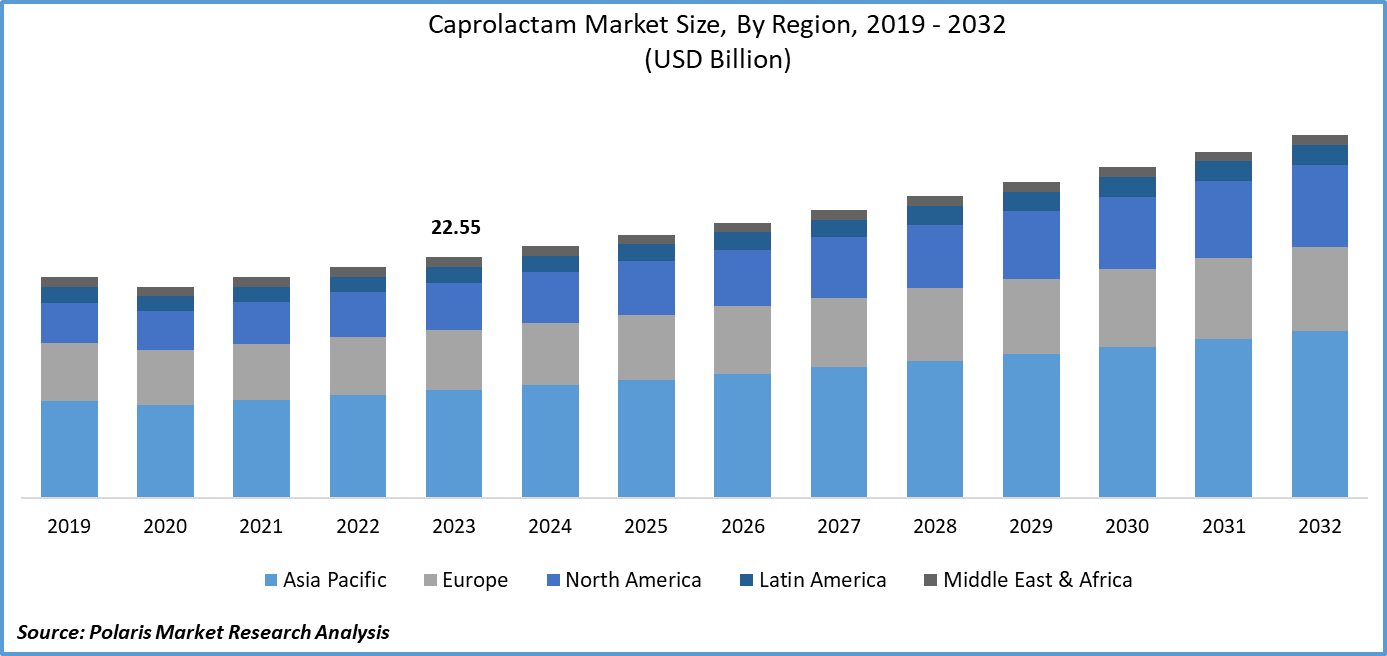

- Asia Pacific dominated the market and contributed to over 39% market share of the caprolactam market size in 2023.

- By end-product category, the nylon 6 resins segment is projected to grow with a significant CAGR over the forecast period.

- By application category, the textile yarns segment dominated the global caprolactam market size in 2024.

What are the Key Drivers Driving the Market Demand?

The Ongoing Technological Advancements are Driving Caprolactam Market Growth

Ongoing technological advancements are playing a significant role in driving the growth of the caprolactam market. These advancements encompass various aspects of caprolactam production processes, including innovative manufacturing techniques, catalyst development, and process optimization. Advancements in catalytic processes have led to the development of more efficient and environmentally friendly methods for caprolactam synthesis, reducing energy consumption and minimizing waste generation.

Also, breakthroughs in raw material sourcing and purification technologies have enhanced the quality and consistency of feedstocks used in caprolactam production, ensuring higher yields and product purity. Similarly, advancements in polymerization techniques and polymer engineering have enabled the development of novel applications for nylon 6, driving demand for caprolactam as a key precursor. Overall, ongoing technological advancements are driving efficiency improvements, cost reductions, and product innovations in the caprolactam market, thereby fueling its growth.

Which Factor is Restraining the Demand for Caprolactam?

The Competition from Bio-Based Alternatives Is Hindering the Caprolactam Market Growth

The caprolactam market is facing a significant challenge from the rising competition posed by bio-based alternatives. These alternatives, derived from renewable resources such as biomass and plant-based feedstocks, are gaining popularity due to their lower carbon footprint and reduced dependence on fossil fuels. This trend aligns with the sustainability goals of many industries and consumers.

Also, advancements in bio-based technologies have led to the development of cost-effective and scalable production processes for bio-based caprolactam substitutes, further intensifying competition. Consequently, manufacturers of traditional caprolactam are under pressure to innovate and adapt their production processes to remain competitive in a rapidly evolving market landscape dominated by sustainability-driven preferences. This competition from bio-based alternatives is creating hindrances to the growth prospects of the caprolactam market, and industry stakeholders are compelled to explore strategies for sustainability and technological innovation to maintain relevance in the market.

Report Segmentation

The market is primarily segmented based on raw material, end-product, application, end-use industry, and region.

|

By Raw Material |

By End-Product |

By Application |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By End-Product Insights

Based on end-product category analysis, the market has been segmented on the basis of nylon 6 fibers, nylon 6 resins, and others. The nylon 6 resins segment is poised for significant growth over the forecast period due to its wide usage across diverse industries such as automotive, textiles, electronics, and packaging. This is because of the superior mechanical properties, durability, and chemical resistance. As demand for lightweight, high-performance materials continues to rise, particularly in sectors like automotive manufacturing and consumer electronics, the adoption of nylon 6 resins as a preferred material choice is expected to surge.

Also, advancements in processing technologies and polymer engineering techniques are enhancing the versatility and applicability of nylon 6 resins, driving their adoption in new and innovative applications. Similarly, the increasing focus on sustainability and environmental responsibility is driving demand for nylon 6 resins, as they are recycled and reused in various applications, aligning with circular economy principles. Overall, these factors are expected to fuel significant growth in the nylon 6 resins segment of the caprolactam market in the coming years.

By Application Insights

Based on application category analysis, the market has been segmented on the basis of industrial yarns, engineering resins and films, textile yarns, carpet fibers, and others. In 2023, the textile yarns segment asserted its dominance in the caprolactam market since it serves as a fundamental building block in the production of nylon 6 which is a polymer widely utilized in textile manufacturing due to its exceptional strength, durability, and versatility. Textile yarns made from nylon 6 fibers find extensive applications in the production of various textile products, including apparel, upholstery, carpets, and industrial fabrics.

The inherent properties of nylon 6, such as resistance to abrasion, moisture, and chemicals, make it an ideal choice for applications requiring high-performance and long-lasting materials. Also, advancements in textile manufacturing technologies, such as melt spinning and solution spinning, have facilitated the production of nylon 6 yarns with tailored properties to meet the specific requirements of different end-use applications.

Global Caprolactam Market, Segmental Coverage, 2020 - 2034 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Regional Insights

Asia Pacific

In 2023, the Asia Pacific region emerged as the dominant region in the global caprolactam market due to the presence of some of the world's largest economies, including China, Japan, South Korea, and India, which collectively drive significant demand for caprolactam-based products across various industries. Rapid industrialization, urbanization, and infrastructure development in these countries have spurred demand for nylon 6, a major derivative of caprolactam, in sectors such as automotive manufacturing, textiles, and electronics. Also, the Asia Pacific region benefits from a robust manufacturing base and extensive supply chain networks, enabling efficient production and distribution of caprolactam and its derivatives.

North America

The North American region is anticipated to experience substantial growth in the global market over the forecast period due to the region's strong manufacturing base and advanced technological capabilities, particularly in industries such as automotive, aerospace, and electronics, which are significant consumers of caprolactam-derived products. Also, increasing investments in infrastructure development, particularly in the construction sector, are expected to drive demand for nylon 6-based materials such as carpets, flooring, and insulation. Overall, these factors indicate a favorable market outlook for the North American region in the market over the forecast period.

GLOBAL CAPROLACTAM MARKET, REGIONAL COVERAGE, 2020 - 2034 (USD Billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Competitive Landscape

The caprolactam market is highly competitive, with key players competing for market share and dominance. Major chemical companies, including BASF SE, China Petrochemical Development Corporation, and AdvanSix Inc., dominate the market with their broad production capacities, global reach, and diverse product lines. To strengthen their position and gain a competitive advantage, these industry leaders focus on strategic initiatives such as mergers and acquisitions, research and development investments, and expanding into emerging markets. Additionally, many regional players and niche manufacturers contribute to the competition by offering specialized caprolactam products and serving specific market segments.

Some of the major players operating in the global market include:

- Advansix

- Alpek Polyester

- Capro Co.

- Central Drug House

- China Petrochemical Development Corporation

- Domo Chemicals

- Fibrant

- Kuibyshevazot Engineering Plastics (Shanghai) Co., Ltd.

- LANXESS

- TORAY INDUSTRIES, INC.

- UBE Corporation

Recent Developments

- In November 2024, Sumitomo Chemical transferred its caprolactam manufacturing technology using the vapor-phase Beckmann rearrangement process to HighChem, enabling HighChem to globally license the innovative, byproduct-free process for producing nylon 6 raw material. This rearrangement is aimed to expand the reach.

- In March 2021, DOMO Chemicals, a global provider of advanced material solutions and a vertically integrated manufacturer of PA6, achieved a significant milestone by delivering 5 million tonnes of caprolactam at its Leuna facility.

- In December 2023, NACAG, an organization in the chemical industry, took a significant step towards mitigating N2O emissions in caprolactam production. The company has embraced abetment technology, and the first measures have been taken in Thailand. NACAG has expanded its scope by offering technical cooperation and financial mechanisms to caprolactam production.

Report Coverage

The caprolactam market report emphasizes on key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, raw material, end-product, application, end-use industry, and their futuristic growth opportunities.

Caprolactam Market Report Scope

|

FAQ's

The Caprolactam Market report covering key segments are raw material, end-product, application, end-use industry, and region.

Caprolactam Market Size Worth USD 33.97 Billion by 2032

Caprolactam Market exhibiting the CAGR of 4.7% during the forecast period

Asia Pacific is leading the global market

key driving factors in Caprolactam Market are increasing demand for nylon 6