CAR-T Cell Therapy Market Size, Share, & Industry Analysis Report

By Indication (DLBCL, ALL, CLL, MM, FL, Mastozytosis, Myeloid Fibrosis, MLL), By Target Antigen, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 116

- Format: PDF

- Report ID: PM1389

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

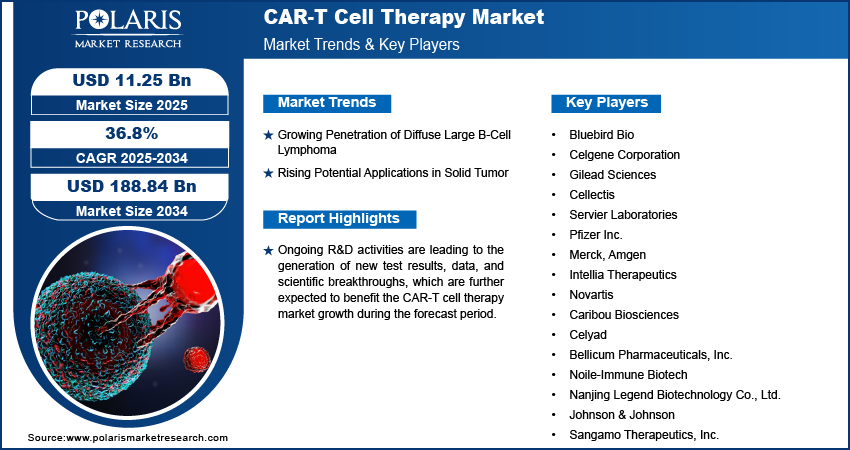

The CAR-T cell therapy market size was valued at USD 7.31 billion in 2024 and is projected to register a CAGR of 36.8% from 2025 to 2034. The market is driven by rising cancer prevalence and strong clinical efficacy in hematologic malignancies. Also, increasing FDA approvals and advancements in cell engineering propel the industry expansion. Further, growing demand for personalized immunotherapy solutions across developed and emerging healthcare markets is expected to drive the market growth during the forecast period.

Key Insights

- The DLBCL segment reached USD 1.41 billion and accounted for a major market share in 2024. The availability of approved cellular immunotherapies specifically targeting DLBCL fueled the dominance.

- The follicular lymphoma (FL) segment is expected to grow at the fastest pace, with a CAGR of 43.2% during the forecast period. The rising prevalence of refractory and high-risk cancer propels the growth.

- The CD19/CD22 antigen segment held the largest share in 2024. The dominance is driven by its established role in treating B-cell malignancies.

- North America dominated the market in 2024, holding about 47% revenue share. The dominance is driven by the presence of advanced healthcare infrastructure and significant research and development investments.

- The Europe CAR-T cell therapy industry is expected to witness a CAGR of 33.2% during the forecast period. The demand for this cell therapy is fueled by increased focus on expanding access to advanced therapies, coupled with the rising prevalence of relapsed or refractory hematologic cancers.

Industry Dynamics

- Rising demand for CAR-T cell therapy is fueled by increasing incidence of hematologic cancers, advancements in cell engineering, and the growing need for personalized, targeted cancer treatment options.

- Expanding application in relapsed or refractory cancers supports growth, driven by clinical success, FDA approvals, and adoption across hospitals and oncology centers seeking breakthrough immunotherapy solutions.

- High treatment costs, manufacturing complexity, and limited accessibility in emerging regions pose challenges, highlighting the need for cost-effective, scalable, and widely available CAR-T therapy models.

- Innovations in allogeneic CAR-T, automation, and combination therapies are accelerating development, improving safety profiles, reducing production time, and expanding potential for solid tumor treatment.

Market Statistics

- 2024 Market Size: USD 7.31 billion

- 2034 Projected Market Size: USD 188.84 billion

- CAGR (2025-2034): 36.8%

- North America: Largest market in 2024

AI Impact on CAR-T Cell Therapy Market

- AI analyzes genomic data to identify optimal CAR targets and tumor-specific antigens missed by traditional methods.

- Integration of AI supports early relapse prediction, treatment monitoring, and personalized CAR-T therapy adjustments.

- AI-powered tools interpret complex biomarkers and immune profiles to enhance patient selection and therapy effectiveness.

- AI automates cell processing workflows, improving manufacturing efficiency and reducing turnaround time for CAR-T production.

To Understand More About this Research: Request a Free Sample Report

CAR-T cell therapy, or chimeric antigen receptor T-cell therapy, represents a revolutionary advancement in the field of cancer treatment, particularly for hematological malignancies such as leukemias and lymphomas. This innovative approach harnesses the power of the patient’s immune system by modifying T cells to recognize better and attack cancer cells.

The process involves the extraction of white blood cells from the body of a cancer patient, reengineering these cells to enable them to fight malignant cells, and then re-injecting them again into the patient’s body.

The current focus of the CAR-T cell therapy market is still on blood cancers and solid tumors. The industry witnessed the first approval of CAR-T products in 2017, having specific applications in the leukemia therapeutic. With the advent of more research data in 2018 and 2019, the market witnessed a broadening of the overall application portfolio of the CART-Cell therapy, with the market witnessing robust growth in other indications as well. Diffuse large B-cell lymphoma (DLBCL), a form of lymphoma, and Acute Lymphoblastic Leukemia (ALL) were the only two types occupying market share in 2017, 2018, and 2019. Another type of indication, Multiple Myeloma (MM), entered the market in 2020 and is expected to witness robust growth during the forecast period.

Ongoing R&D activities are leading to the generation of new test results, data, and scientific breakthroughs, which are further expected to benefit the industry growth. The market is characterized by market participants striving to secure commercial access in various regional markets and gain access to treatment centers, thereby boosting adoption and demand.

Market Dynamics

Growing Penetration of Diffuse Large B-Cell Lymphoma

Diffuse large B-cell lymphoma (DLBCL) often resists standard treatments such as chemotherapy and monoclonal antibody therapies, leaving many patients with limited options, particularly those with relapsed or refractory disease. CAR-T cell therapy, which involves engineering a patient’s T cells to target and destroy cancer cells specifically, has shown remarkable efficacy in such cases. The therapy's ability to achieve durable remission in some patients with advanced DLBCL has positioned it as a breakthrough treatment. Additionally, the rising prevalence of DLBCL and growing awareness of advanced immunotherapies have further boosted demand for CAR-T therapies. Therefore, the growing penetration of diffuse large B-cell lymphoma (DLBCL) is projected to propel the market expansion during the forecast period.

Rising Potential Applications in Solid Tumor

Solid tumors, such as glioblastoma, pancreatic cancer, and lung cancer, account for the majority of cancer cases globally and have limited treatment options, particularly in advanced stages. Advances in CAR-T cells to overcome challenges such as tumor heterogeneity, the immunosuppressive tumor microenvironment, and limited antigen specificity have shown promising preclinical and clinical results. Innovations such as dual-targeting CARs, armored cars, and local delivery methods further enhance efficacy and safety profiles in solid tumors. This growing body of evidence, coupled with high patient demand for novel therapies, has led to increased investments and research in this area, driving the development of next-generation CAR-T therapies and expanding their application for solid tumors.

Segment Analysis

By Indication

Based on indication, the market is categorized into DLBCL, ALL, CLL, MM, FL, mastozytosis, myeloid fibrosis, MLL, Thymic Cancer, glioblastoma, AML, and others. The DLBCL segment reached USD 1.41 billion and accounted for a major market share in 2024. The segment growth is attributed to the high prevalence of DLBCL as the most common subtype of non-Hodgkin lymphoma and its aggressive nature, which often renders it resistant to standard treatment protocols such as chemotherapy and radiation. The availability of approved cellular immunotherapies specifically targeting DLBCL, such as axicabtagene, ciloleucel, and tisagenlecleucel, further fueled its industry dominance. These therapies demonstrated remarkable efficacy, particularly in patients with relapsed or refractory cases, driving widespread adoption. Additionally, an increasing focus on precision medicine and supportive regulatory frameworks facilitated rapid advancements and approvals, strengthening the segment's position.

The follicular lymphoma (FL) segment is expected to grow at the fastest pace, with a CAGR of 43.2% during the forecast period due to the rising prevalence of refractory and high-risk cancer. Ongoing clinical trials and advancements in next-generation cellular immunotherapy products specifically tailored for FL have fueled this segment’s potential. Improved patient outcomes, coupled with expanding indications for newly developed therapies, have positioned FL as a growing focus for researchers and pharmaceutical companies. Enhanced funding for research and increasing awareness of these novel approaches are further expected to drive sustained growth of the follicular lymphoma (FL) segment during 2025–2034.

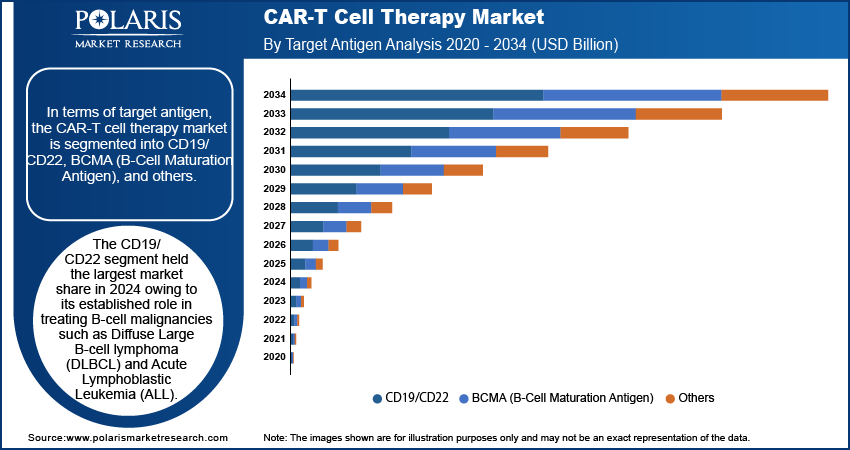

By Target Antigen

In terms of target antigen, the market is segmented into CD19/CD22, BCMA (B-Cell Maturation Antigen), and others. The CD19/CD22 antigen segment held the largest market share owing to its established role in treating B-cell malignancies such as Diffuse Large B-cell lymphoma (DLBCL) and Acute Lymphoblastic Leukemia (ALL). Therapies targeting CD19, such as axicabtagene ciloleucel and tisagenlecleucel, demonstrated high efficacy in patients suffering from relapsed or refractory disease, driving widespread adoption. The dual-targeting approach involving CD19/CD22 gained traction as it addressed antigen escape, a key mechanism of treatment resistance. Access to strong clinical data, regulatory approvals, and the expanding availability of products targeting these antigens contributed to the segment's industry dominance. Additionally, robust investments in research and development further strengthened the focus on the CD19/CD22 antigen class.

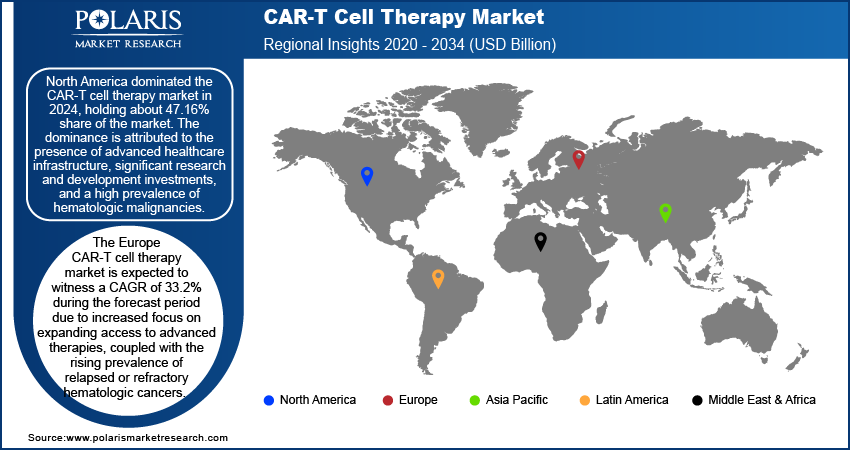

Regional Analysis

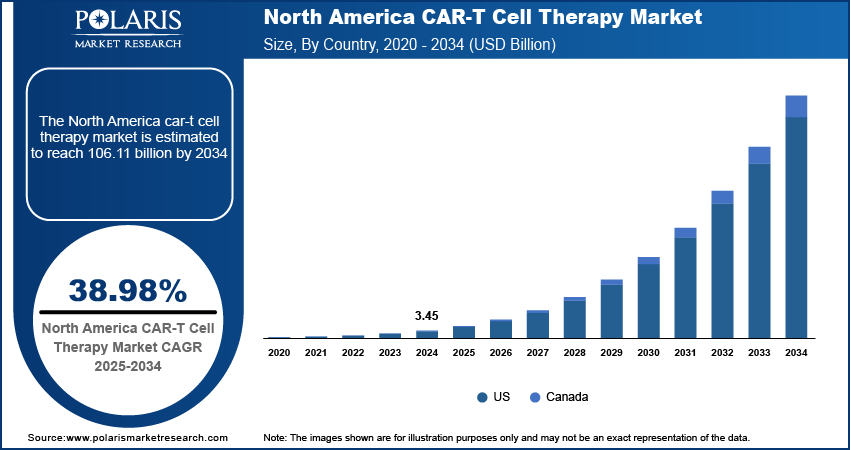

By region, the study provide insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the market in 2024, holding about 47% share of the market revenue. The dominance is attributed to the presence of advanced healthcare infrastructure, significant research and development investments, and a high prevalence of hematologic malignancies. The US emerged as the leading country within the region due to its robust biotechnology sector, early adoption of innovative therapies, and favorable regulatory environment. Approvals from the US Food and Drug Administration (FDA) for groundbreaking therapies targeting Diffuse Large B-cell lymphoma (DLBCL) and other cancers further contributed to North America's dominance. Additionally, well-established reimbursement frameworks and strong clinical trial networks played critical roles in accelerating patient access and boosting the region's market share.

The Europe CAR-T cell therapy market is expected to witness a CAGR of 33.2% during the forecast period due to increased focus on expanding access to advanced therapies, coupled with the rising prevalence of relapsed or refractory hematologic cancers. Countries such as Germany, the UK, and France lead the regional market, supported by government initiatives to foster innovation and streamline regulatory pathways for advanced therapies, including CAR-T cell therapy. Enhanced infrastructure for manufacturing and distribution, as well as growing collaboration between academic institutions and biotech firms, further contribute to the Europe CAR-T cell therapy market development.

Key Players and Competitive Analysis Report

Major industry players are investing heavily in research and development to expand their offerings, which will help to grow rapidly in the coming years. Industry participants are also undertaking a variety of strategic activities to expand their global footprint, with important developments including innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The market is fragmented, with the presence of numerous global and regional market players. A few major players in the industry are Bluebird Bio; Celgene Corporation; Gilead Sciences; Cellectis; Servier Laboratories; Pfizer Inc.; Merck; Amgen; Intellia Therapeutics; Novartis; Caribou Biosciences; Celyad; Bellicum Pharmaceuticals, Inc.; Noile-Immune Biotech; Nanjing Legend Biotechnology Co., Ltd.; Johnson & Johnson; and Sangamo Therapeutics, Inc.

Bluebird Bio is a US based company focusing on gene therapy. The company is particularly researching cancer and genetic diseases. The company operates in over 1,100 locations across America and Europe. It is equipped with multiple labs, drug manufacturing facilities, and lentiviral vector production. Bluebird Bio has four focus areas—transfusion-dependent beta-thalassemia, sickle cell disease, multiple myeloma, and cerebral adrenoleukodystrophy. The company was incorporated in 1992 in Delaware as Genetix Pharmaceuticals, Inc., and in September 2010, it changed its name to Bluebird Bio, Inc. In April 2021, PsiOxus and Bluebird Bio presented novel data combining the PsiOxus T-SIGn Platform with CAR-T therapy to clear primary tumors and metastases.

Gilead Science is a US-based company catering to the pharmaceutical industry. The company produces, markets, and sells drugs and innovative medicines. Most of the company’s locations are concentrated in the US. The company is mainly focusing on fighting deadly diseases such as cancer and HIV. Gilead Sciences Inc. offers mainly four main products for HIV, HCV, Yescarta, and others. The sales of the company are mainly concentrated in the US. The company has plans to boost its cell therapy platform in accordance to develop new therapies and drive long term growth. In December 2022, Gilead Sciences announced its plans to acquire Tmunity Therapeutics, a private biotechnology company trying to develop newer, better CAR-T treatments.

List Of Key Companies

- Bluebird Bio

- Celgene Corporation

- Gilead Sciences

- Cellectis

- Servier Laboratories

- Pfizer Inc.

- Merck

- Amgen

- Intellia Therapeutics

- Novartis

- Caribou Biosciences

- Celyad

- Bellicum Pharmaceuticals, Inc.

- Noile-Immune Biotech

- Nanjing Legend Biotechnology Co., Ltd.

- Johnson & Johnson

- Sangamo Therapeutics, Inc.

Industry Developments

April 2025: Johnson & Johnson announced the European Commission approved a new use for its drug DARZALEX. The approval allows the drug to be used as a first treatment for adults who have just been diagnosed with multiple myeloma. In this treatment, DARZALEX will be used together with three other medicines: bortezomib, lenalidomide, and dexamethasone.

March 2025: Bristol Myers Squibb (BMS) announced the acquisition of 2seventy bio. The company stated that the partnership will focus on Abecma, a CAR T-cell therapy for multiple myeloma.

Market Segmentation

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- DLBCL (Diffuse large B-cell lymphoma)

- ALL (Acute Lymphoblastic Leukemia)

- CLL (Chronic Lymphocytic Leukemia)

- MM (Multiple Myeloma)

- FL (Follicular Lymphoma)

- Mastozytosis

- Myeloid Fibrosis

- MLL (Mixed Lineage Leukemia)

- Thymic Cancer

- Glioblastoma

- AML (Acute Myeloid Leukemia)

- Other

By Target Antigen Outlook (Revenue, USD Billion, 2020–2034)

- CD19/CD22

- BCMA (B-Cell Maturation Antigen)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

CAR-T Cell Therapy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.31 billion |

|

Market Size Value in 2025 |

USD 11.25 billion |

|

Revenue Forecast by 2034 |

USD 188.84 billion |

|

CAGR |

36.8 % from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global CAR-T cell therapy market size was valued at USD 7.31 billion in 2024 and is projected to grow to USD 188.84 billion by 2034

The global market is projected to register a CAGR of 36.8% during the forecast period.

North America held the largest share of the global market in 2024.

A few of the key players in the market are Bluebird Bio; Celgene Corporation; Gilead Sciences; Cellectis; Servier Laboratories; Pfizer Inc.; Merck; Amgen; Intellia Therapeutics; Novartis; Caribou Biosciences; Celyad; Bellicum Pharmaceuticals, Inc.; Noile-Immune Biotech; Nanjing Legend Biotechnology Co., Ltd.; Johnson & Johnson; and Sangamo Therapeutics, Inc.

The FL segment is projected for significant growth in the global market during the forecast period.

The CD19/CD22 segment dominated the CAR-T cell therapy market in 2024.