Carbon and Graphite Felt Market Share, Size, Trends, Industry Analysis Report

By Raw Material Type (PAN, Pitch and Rayon); By Product Type; By Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4634

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

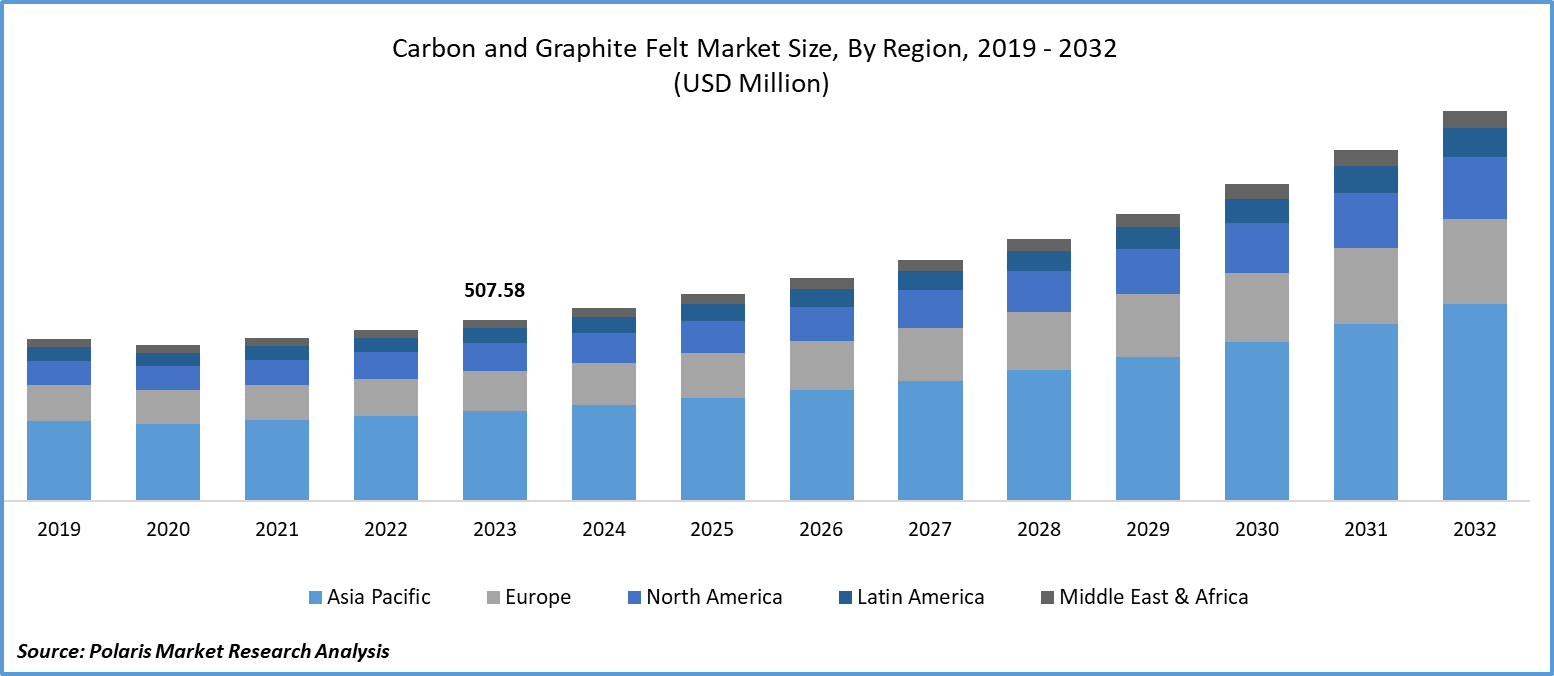

Carbon and Graphite Felt Market size was valued at USD 507.58 million in 2023. The market is anticipated to grow from USD 540.17 million in 2024 to USD 1092.29 million by 2032, exhibiting the CAGR of 9.2% during the forecast period

The research report offers a quantitative and qualitative analysis of the Carbon and Graphite Felt Market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Carbon and Graphite Felt Market Overview

The global market for carbon and graphite felt is expected to experience significant growth, over the study period driven by increased demand from furnaces, filters, batteries, and other high-temperature applications. These felts find extensive use in high-temperature furnaces and batteries. The global market growth for carbon and graphite felt in high-performance batteries is attributed to the requirement for materials with high conductivity, extended lifespans, good electrochemical stability, and lower fire risk.

- For instance, In October 2023, Toray Industries Inc. declared today that it has chosen to increase the production of normal tow* medium- and high-modulus carbon fibers at its French subsidiary Toray Carbon Fibers Europe S.A. With this change, the Abidos factory in South-West France will have an annual capacity of 6,000 metric tons instead of 5,000 metric tons. 2025 is when production is anticipated to begin.

Moreover, the increased effectiveness of carbon fiber in high-temperature environments has significantly contributed to carbon and graphite felt market expansion. Additionally, the growing demand for high-performance batteries is a crucial factor driving the carbon and graphite felt market growth from 2024 to 2032. Moreover, the extensive use of carbon and graphite felts in high-performance batteries, thanks to their wide operational range, exceptional thermal insulation, chemical stability, and lightweight properties, is further propelling the market forward.

To Understand More About this Research: Request a Free Sample Report

The Russia-Ukraine Conflict, the Cumulative Impact of COVID-19, and High Inflation are anticipated to have a major long-term impact on the global carbon felt & graphite felt market development. Research is still being conducted on how the pandemic has affected supply chains, government initiatives, and consumer behavior. In a similar vein, the research examines the ongoing political and economic unrest in Eastern Europe brought on by the conflict between Russia and Ukraine and its possible effects on import/export, pricing variations, and demand-supply balances.

Carbon and Graphite Felt Market Dynamics

Market Drivers

Enhanced performance of carbon fiber in a range of high-temperature applications.

Carbon fiber is renowned for its exceptional qualities, including high strength, flexibility, lightweight nature, and superior corrosion resistance. These attributes make carbon fiber a preferred material for manufacturing carbon and graphite felts. Carbon fiber exhibits enhanced performance in high-temperature environments, making it a versatile choice. Unlike carbon fiber, other materials like glass fiber and ceramic fiber, which are also used for heat insulation, cannot match its performance. As a result, felts made from carbon fiber are utilized in applications requiring high insulation properties.

Market Restraints

The production cost of carbon and graphite felts is high.

Carbon and graphite felt are made from carbon fiber because of their exceptional properties, including enhanced corrosion resistance, lightweight nature, and high strength. Producing these materials requires advanced machinery and extensive technical expertise. The manufacturing process involves several steps such as carbonizing, graphitizing, pressing, curing, and others, which are mostly costly, leading to a high production cost for carbon and graphite felt.

Report Segmentation

The market is primarily segmented based on raw material type, product type, type, application and region.

|

By Raw Material Type |

By Product Type |

By Type |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Carbon and Graphite Felt Market Segmental Analysis

By Raw Material Type Analysis

- The PAN segment is projected to grow at a CAGR over the forecast period, mainly driven by its outstanding mechanical qualities, including a high modulus and tensile strength, which make them perfect for uses requiring durability and strength for the next five years. PAN-based carbon and graphite felt show a high carbon yield during the carbonization process, indicating that a greater proportion of the precursor is changed into carbon. This makes it a more economical option because it increases production efficiency and decreases waste.

By Product Type Analysis

- The soft felt segment accounted for the largest market share in 2023 and is likely to retain its position throughout the carbon and graphite felt market forecast period. The ease of processing carbon and graphite felts makes them highly convenient for both manufacturers and end users. This characteristic enables customization to meet specific needs while minimizing waste. These felts, being soft, can be easily cut, shaped, and molded into various forms as required. This flexibility in processing adds to their appeal, as it allows for precise tailoring to fit specific dimensions and applications, reducing the amount of material wasted during fabrication.

By Application Analysis

- Based on application analysis, the market has been segmented on the basis of batteries, filters, and furnaces. The furnace segment held a significant market share in revenue share in 2023. Felt made of carbon and graphite is widely utilized in many different applications, including nuclear reactors, batteries, furnaces, filters, and semiconductors. The majority of applications for these felts are in furnaces, mostly for insulation. However, as more renewable energy installations are added in emerging nations like China, India, and Brazil, there is currently a growing need for these felt items in the batteries sector.

Carbon and Graphite Felt Market Market Regional Insights

The Asia Pacific region dominated the global market with the largest market share in 2023

The Asia Pacific region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. The market demand is growing due to increased use in various applications like filters, batteries, and furnaces, supported by a mix of organized and unorganized felt manufacturers. China leads globally in both consuming and producing industrial furnaces and heating systems. The market development for carbon and graphite felt materials is being driven primarily by investments in energy storage solutions and electric vehicle (EV) technologies. The luxury uses of carbon and graphite felt in the automobile, electronics, and energy storage industries define the Japanese market for these materials. India is a developing market for carbon and graphite felt, with potential fueled by the country's rising industrial sector and policies supporting renewable energy. In order to meet the demands of major industries as well as small and medium-sized organizations (SMEs), the emphasis is on accessibility and affordability.

The North America region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to substantial investments in aerospace, defense, and energy storage infrastructure increasing the demand for carbon and graphite felt. The need for high-performance materials in lithium-ion battery manufacturing and thermal insulation for aerospace applications is strong. Significant research and development efforts are underway to improve material efficiency and environmental sustainability, involving both companies and government entities.

Competitive Landscape

The carbon and graphite felt market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Beijing Great Wall Co., Ltd

- Chemshine Carbon Co., Ltd

- CM Carbon

- Kureha Corporation

- Mersen

- Morgan Advanced Materials

- Nippon Carbon CO., Ltd

- SGL Carbon

- Sinotek Materials

- Toray Industries Inc

Recent Developments

- In August 2022, SGL Carbon revealed plans to expand the capacity of its locations in Meitingen, Germany, Shanghai, China, and St. Marys, USA, for graphite materials used in the semiconductor sector.

Report Coverage

The carbon and graphite felt market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, raw material type, product type, type, application and their futuristic growth opportunities.

Carbon and Graphite Felt Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 540.17 million |

|

Revenue forecast in 2032 |

USD 1092.29 million |

|

CAGR |

9.2% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Raw Material Type, By Product Type, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Seeking a more personalized report that meets your specific business needs? At Polaris Market Research, we’ll customize the research report for you. Our custom research will comprehensively cover business data and information you need to make strategic decisions and stay ahead of the curve.

FAQ's

The Carbon and Graphite Felt Market report covering key segments are raw material type, product type, type, application and region.

Carbon and Graphite Felt Market Size Worth $ 1092.29 Million By 2032

Carbon and Graphite Felt Market exhibiting the CAGR of 9.2% during the forecast period

Asia Pacific is leading the global market

key driving factors in Carbon and Graphite Felt Market are Growing need for high-performance batteries will increase demand for the worldwide market of carbon and graphite felt