Carbon Black Market Size, Share, Trends, Industry Analysis Report

By Type (Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others); By Application; By Grade; By Region – Market Forecast 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1478

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

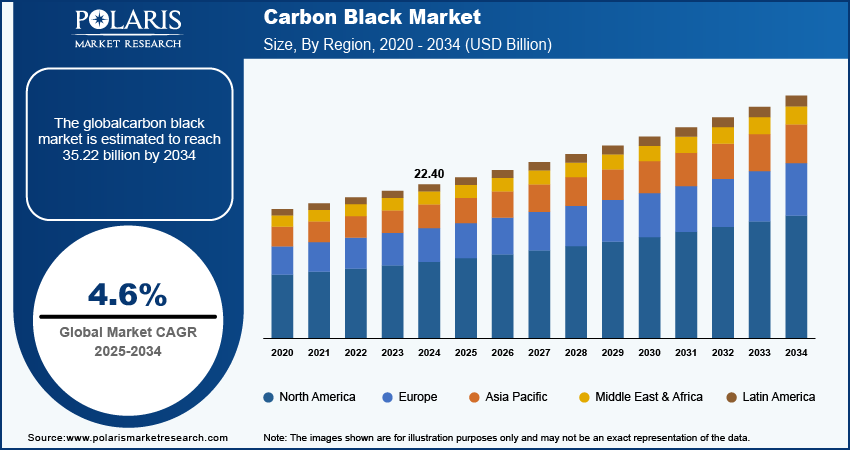

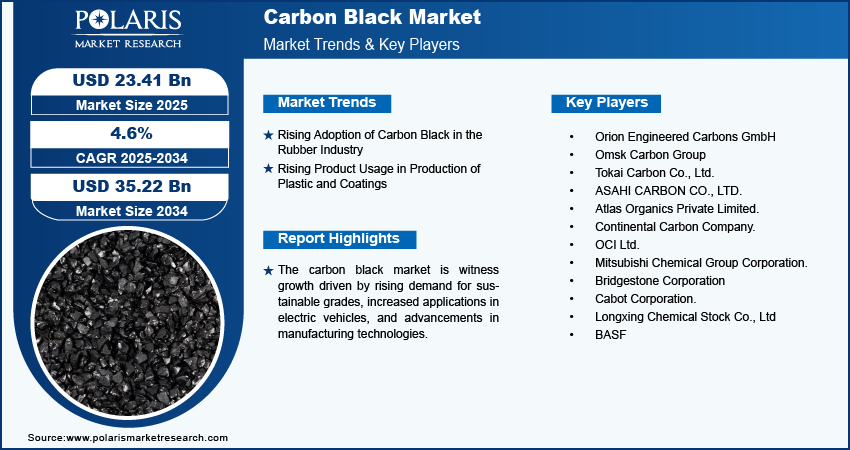

The carbon black market size was valued at USD 22.40 billion in 2024. The market is projected to register a CAGR of 4.6% from 2025 to 2034. The rising adoption of carbon black in the rubber, plastic, and coating production applications is emerging as an important trend supporting the market growth.

Key Insights

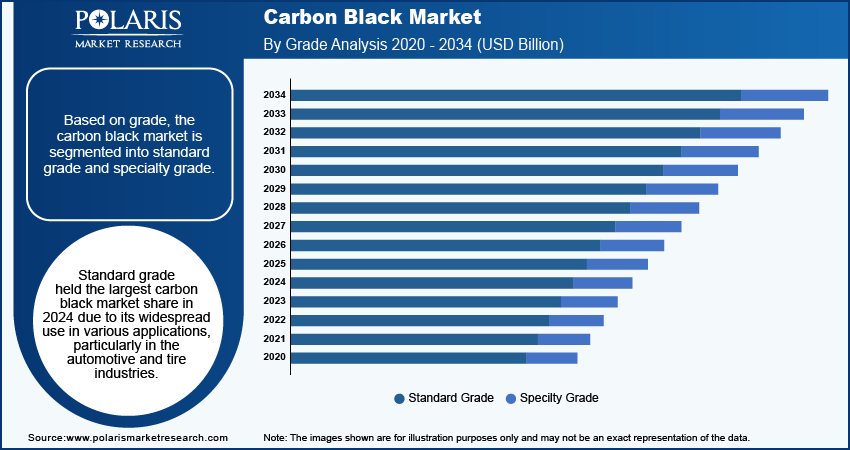

- Based on grade, the standard grade segment accounted for a larger carbon black market share. Standard-grade carbon black is known to enhance the strength, durability, and performance of tires and rubber products in a cost-effective way, which drives its use in tire manufacturing and other automotive applications.

- Among major applications, the plastics segment is expected to record the fastest CAGR from 2025 to 2034. Carbon black is increasingly used in plastic products designed for the automotive, packaging, and electronics industries.

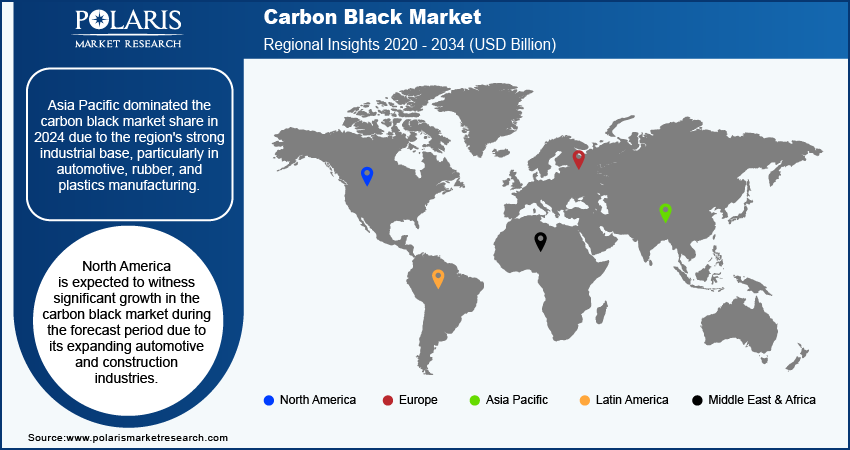

- Asia Pacific dominated the carbon black industry in 2024. Its dominance is largely due to the robust manufacturing base, including automotive, rubber, and plastics, in countries such as China, India, Japan, and South Korea.

- North America is projected to present the most significant demand for carbon black during the forecast period, primarily driven by a prime focus on sustainable and high-performance materials.

Industry Dynamics

- As demand for high-performance tires continues to rise in the automotive sector, the need for carbon black also continues to surge worldwide. Carbon black is used as an important reinforcement additive in rubber products, particularly tires, to enhance their durability, performance, and wear resistance.

- Flourishing plastic and coating industries drive the demand for carbon black. The material is used as a reinforcing and pigmentation agent in plastics, and a weather resistance additive in coatings.

- Owing to its versatility, carbon black applications extend beyond tire manufacturing, generating significant growth opportunities for businesses. It is used in the production of conveying equipment, belts, hoses, and gaskets for different industrial facilities.

- Hazardous gases emitted during carbon black production result in reluctance around its industrial use, particularly in regions with high regulatory pressures.

Market Statistics

2024 Market Size: USD 22.40 billion

2034 Projected Market Size: USD 35.22 billion

CAGR (2025–2034): 4.6%

Asia Pacific: Largest market in 2024

AI Impact on Carbon Black Market

- Amid manufacturers' focus on meeting net-zero goals, emerging technologies such as artificial intelligence (AI) present new opportunities to optimize production by reducing emissions.

- Key players such as Birla Carbon propose integrating generative AI and agentic AI into factories to enhance agility, efficiency, and responsiveness to customer demands.

- Concepts supported by AI, such as digital twins, are likely to aid in the proactive prediction and performance optimization through simulations.

- Automation unlocked by advanced sensor technologies will likely pave the way for environmentally friendly operations by enabling emission measurement, real-time monitoring, and instant corrective actions.

To Understand More About this Research: Request a Free Sample Report

Carbon black is an inorganic compound derived from the incomplete combustion of heavy petroleum products. It plays a crucial role in the production of various industrial products such as tires, rubber, inks, and plastics. Carbon black is renowned for its versatility, and it serves as a reinforcing filler in tires and other rubber products, enhancing durability and performance.

The carbon black market has witnessed substantial growth, primarily driven by rising automotive sales and advancements in tire manufacturing technologies. Tire manufacturers are incorporating carbon black into rubber to improve padding and strengthen their products. Different forms of carbon black are tailored to meet specific performance requirements across various tire components, ensuring optimal functionality. For instance, in March 2024, Cabot Corporation launched PROPEL E8, an engineered reinforcing carbon black designed to boost tread durability and reduce rolling resistance in high-performance automotive tires, addressing the challenges of heavier electric vehicles (EVs) to enhance tire lifespan and efficiency.

Carbon black is widely used as a high performance pigment in inks, paints, and plastics, imparting color and improving material properties. The increasing demand for high-performance coatings in the aerospace and defense sectors is boosting market expansion. However, volatile raw material prices and strict environmental regulations imposed by governments worldwide act as effective constraints.

Market Dynamics

Rising Adoption of Carbon Black in Rubber Industry

The rising adoption of carbon black in the rubber industry is a major carbon black market driver. Carbon black acts as a crucial reinforcing filler in rubber products, particularly tires, to enhance their durability, performance, and wear resistance. The demand for high-performance tires continues to rise as the global automotive industry experiences growth, further fueling the need for carbon black. For instance, in May 2023, Monolith partnered with Goodyear Tire & Rubber Company to launch its sustainable carbon black into the ElectricDrive GT tire tread. Produced through a methane pyrolysis process, Monolith’s carbon black reduces emissions, marking a notable move toward zero-emissions tire manufacturing.

The versatility of carbon black extends to non-tire rubber applications, such as conveying equipmnents, belts, hoses, and gaskets, contributing to its widespread use. The increasing production of electric vehicles (EVs), which require specialized tire properties, has also accelerated the adoption of carbon black. Overall, the rising need for high-quality, durable rubber products across various industries, driven by automotive innovations, continues to expand the carbon black market growth.

Rising Product Usage in Production of Plastic and Coatings

The rising usage of carbon black in the production of plastics and coatings is driving of the carbon black market expansion. Carbon black is extensively used as a reinforcing agent and pigment in plastics, improving their strength, durability, and color. In coatings, it enhances properties such as weather resistance, UV stabilizer and protection, and electrical conductivity, making it indispensable in sectors such as automotive, construction, and electronics. The need for high-quality carbon black continues to increase as the demand for high-performance plastics and coatings grows, particularly in innovative and sustainable applications. For instance, in April 2023, Birla Carbon, a global leader in carbon black production, has partnered with Circtec to supply Sustainable Carbonaceous Materials (SCM). This collaboration focuses on providing eco-friendly carbon black alternatives for various applications, including plastics and coatings, aligning with the industry's shift toward sustainable materials. This trend is further supported by the growing automotive and electronics industries, which utilize carbon black in components and coatings for better functionality and aesthetics. Additionally, carbon black helps manufacturers meet environmental standards by improving the longevity and performance of products, driving further market growth.

Segment Analysis

Market Assessment by Grade Outlook

The global carbon black market segmentation, based on grade, includes standard grade and specialty grade. Standard grade held the largest carbon black market share in 2024 due to its widespread use in various applications, particularly in the automotive and tire industries. This grade is favored for its cost-effectiveness and ability to improve the strength, durability, and performance of products such as tires, rubber goods, and plastics. The growing demand for tires, driven by the automotive sector's expansion, also contributes to the high consumption of standard grade carbon black. Additionally, its use in coatings and inks, where performance and cost balance are critical, further boosts its demand. The standard grade's versatile properties and affordability make it a preferred choice for manufacturers seeking reliable performance at competitive prices, reinforcing its dominance in the market.

Market Evaluation by Application Outlook

The global carbon black market segmentation, based on application, includes tire, non-tire rubber, inks & coatings, plastics, cement, steel, buildings, batteries, and others. The plastics segment is expected to witness the fastest growth due to the increasing utilization of carbon black in the production of plastic products, particularly in the automotive, packaging, and electronics industries. Carbon black improves the durability, strength, and thermal stability of plastics, making them more suitable for high-performance applications. The rising demand for lightweight, high-strength materials and the sustainable packaging solutions in the automotive sector are driving the adoption of carbon black in plastic manufacturing. Moreover, the shift towards eco-friendly and long-lasting plastics, along with the expansion of the electronics market, further fuels the growth of this segment. Carbon black's role in plastics is becoming increasingly prominent as industries continue to prioritize innovation in materials.

Regional Insights

By region, the study provides carbon black market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market in 2024 due to the region's strong industrial base, particularly in automotive, rubber, and plastics manufacturing. Asia Pacific's dominance in the carbon black market can be seen in the strong growth of the tire and automotive sectors in China. For instance, a report published by IMD in January 2024 highlighted that China’s automotive production exceeded 30 million vehicles. Additionally, the rapid expansion of the packaging and electronics sectors in the region further boosted the demand for carbon black. The presence of leading carbon black manufacturers and a low-cost production environment has also supported market growth. Furthermore, the region's strong focus on infrastructure development, coupled with increasing urbanization, has driven demand for carbon black in construction and building materials. These factors collectively reinforce Asia Pacific's leading position in the market.

North America is expected to witness significant carbon black market growth during the forecast period due to its expanding automotive and construction industries. The region's strong focus on sustainable and high-performance materials has driven demand for carbon black in tire manufacturing, coatings, and plastics applications. Additionally, advancements in technology and manufacturing processes have enhanced the quality and efficiency of carbon black production in the region. The rise in infrastructure development projects and the growing need for lightweight materials in the automotive sector further contribute to this growth. Supportive government policies and increased investments in research and development are also key factors bolstering the carbon black market in North America.

Key Players and Competitive Analysis Report

The competitive landscape of the carbon black market is characterized by a mix of global leaders and regional players competing to gain market share through innovation, strategic partnerships, and geographic expansion. Prominent global players such as Birla Carbon, Cabot Corporation, Orion Engineered Carbons, and Mitsubishi Chemical Corporation leverage their strong R&D capabilities and extensive distribution networks to provide high-quality products across diverse applications, including tires, non-tire rubber, plastics, and coatings. Carbon Black market trends highlight the growing demand for specialty carbon black grades used in advanced applications such as conductive plastics, high-performance coatings, and battery technologies. The market is poised for growth, driven by increasing demand in the automotive, packaging, and electronics sectors, alongside expanding infrastructure activities. Regional players focus on meeting localized demands by offering cost-effective solutions, particularly in emerging markets such as Asia Pacific, which is anticipated to grow at the highest CAGR due to its robust industrial base and infrastructure development. Competitive strategies include mergers and acquisitions, collaborations with end user industries, and the development of innovative and sustainable carbon black products to cater to evolving customer preferences. These trends underscore the critical role of technological advancements, market agility, and regional investments in shaping the growth trajectory of the carbon black industry. A few key major players are Orion Engineered Carbons GmbH; Omsk Carbon Group; Tokai Carbon Co., Ltd.; ASAHI CARBON CO., LTD.; Atlas Organics Private Limited; Continental Carbon Company; OCI Ltd.; Mitsubishi Chemical Group Corporation; Bridgestone Corporation; Cabot Corporation; and Longxing Chemical Stock Co., Ltd., BASF

Mitsubishi Chemical Group Corporation is a chemical manufacturing company. The company works in five segments: Health Care, Specialty Materials, Industrial Gases, MMA, and Basic Materials. The industrial gases segment supplies various industrial gases, while the health care segment concentrates on delivering ethical pharmaceuticals. The specialty materials segment offers a wide range of products, including performance polymers, engineering plastics, sustainable polymers, and composite materials. The MMA segment specializes in providing polymethyl methacrylate and methyl methacrylate. The basic materials component offers polyolefins, basic petrochemicals, and carbon products. Additionally, the company provides engineering, transportation, and warehousing services. Mitsubishi Chemical Group Corporation offers high-quality carbon black products for applications in tires, rubber, plastics, coatings, and conductive materials, ensuring durability, UV resistance, and enhanced performance across various industries.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments including chemicals, industrial solutions, materials, surface technologies, nutrition & care, and agricultural solutions, and others. Petrochemicals and intermediates are provided in the chemicals section. Advanced materials and their precursors for applications such as isocyanates and polyamides are available through the Materials section, as well as inorganic basic products and specialties for the plastic and plastic processing industries. Polymer dispersions, resins, electronic materials, pigments, antioxidants, light stabilizers, oilfield chemicals, mineral processing, and hydrometallurgical chemicals are among the ingredients and additives developed and sold by the industrial solutions sector. Surface Technologies provide chemical solutions and automotive OEM services to the automotive and chemical sectors, including refinishing coatings, surface treatment, catalysts, battery materials, and base metal services. BASF SEoffers carbon black as part of its Aurasperse line, including products like Aurasperse Carbon Black W-7017 and Aurasperse II Carbon Black W-7016, used as black pigments.

Key Companies

- Orion Engineered Carbons GmbH

- Omsk Carbon Group

- Tokai Carbon Co., Ltd.

- ASAHI CARBON CO., LTD.

- Atlas Organics Private Limited.

- Continental Carbon Company.

- OCI Ltd.

- Mitsubishi Chemical Group Corporation.

- Bridgestone Corporation

- Cabot Corporation.

- Longxing Chemical Stock Co., Ltd

- BASF

Carbon Black Industry Developments

November 2024: Evonik launched its latest innovations at Formnext 2024, including flame-retardant PA12 and carbon black-embedded 3D-printable powders under the INFINAM brand. Developed in collaboration with HP Inc., the halogen-free flame retardant material offers 50% reusability, and the carbon black encapsulated INFINAM powders will be directly available from Evonik.

November 2024: Birla Carbon launched its first Asia Post-Treatment (APT) Plant at its Patalganga facility in Maharashtra, India, to transform the carbon black industry by enhancing flexibility, efficiency, and precision.

June 2023: Bridgestone Corporation began producing tire-derived oil and recovering carbon black through pyrolysis at its Innovation Park in Tokyo. This was part of a chemical recycling initiative under Japan's NEDO Green Innovation Fund. The project, in collaboration with ENEOS Corporation, aims to develop technologies for high-yield production of chemical products like butadiene by 2030.

Carbon Black Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Tire

- Non-Tire Rubber

- Inks & Coatings

- Plastics

- Cement

- Steel

- Buildings

- Batteries

- Others

By Grade Outlook (Revenue, USD Billion, 2020–2034)

- Standard Grade

- Specialty Grade

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon Black Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.40 billion |

|

Market Size Value in 2025 |

USD 23.41 billion |

|

Revenue Forecast by 2034 |

USD 35.22 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global carbon black market size was valued at USD 22.40 billion in 2024 and is projected to grow to USD 35.22 billion by 2034.

• The global market is projected to register a CAGR of 4.6% during the forecast period.

• Asia Pacific dominated the carbon black market share in 2024 due to the region's strong industrial base, particularly in automotive, rubber, and plastics manufacturing.

• A few key players in the market are Orion Engineered Carbons GmbH; Omsk Carbon Group; Tokai Carbon Co., Ltd.; ASAHI CARBON CO., LTD.; Atlas Organics Private Limited; Continental Carbon Company; OCI Ltd.; Mitsubishi Chemical Group Corporation; Bridgestone Corporation; Cabot Corporation; Longxing Chemical Stock Co., Ltd., BASF.

• Standard grade held the largest carbon black market share in 2024.

• Plastics segment is expected to witness fastest carbon black market growth.