Carnauba Wax Market Share, Size, Trends, Industry Analysis Report

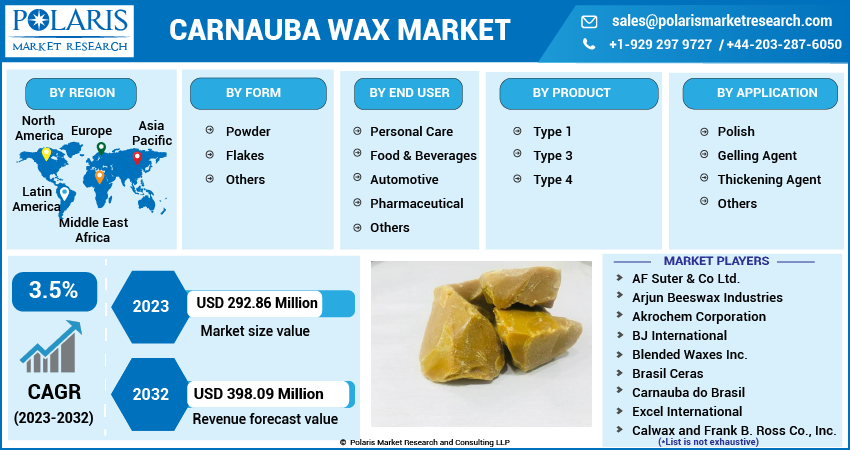

By Form (Powder, Flakes, and Others); By Product (Type 1, Type 3, Type 4); By Application; By End-User; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3488

- Base Year: 2022

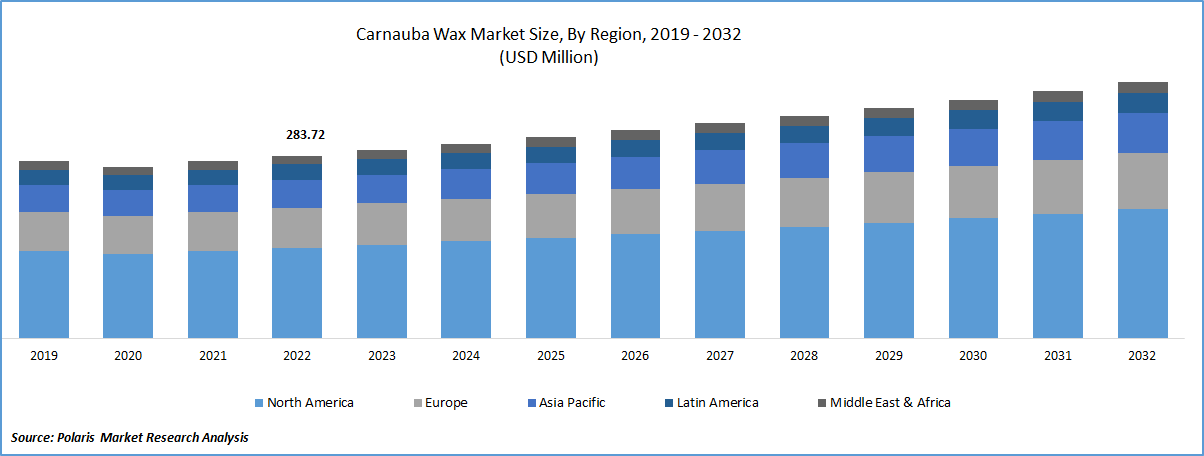

- Historical Data: 2019-2021

Report Outlook

The global Carnauba Wax market was valued at USD 287.6 million in 2022 and is expected to grow at a CAGR of 3.7% during the forecast period. As the food, pharmaceutical, and automotive industries grow, so is the demand for carnauba wax. Using a variety of distribution channels made up of suppliers, wholesalers, and distributors, the wax manufactured by the enterprises was then provided and exported to the international markets. Due to the rise in disposable income and the swift expansion of the global economy, market growth is also defined by a wide range of opportunities for market participants. Also, the surge in popularity of sweets like sugar-coated candy is a significant element boosting the market for carnauba wax. It also functions as a mound-releasing agent.

To Understand More About this Research: Request a Free Sample Report

Carnauba wax is a type of natural wax made up of polyesters, mono- and di-hydroxyl fatty solvents, and hydroxyl acids. Carnauba wax is used as a food-grade polish and as a stiffening or gelling agent in many applications. It is recognized among natural waxes for its hardness and high melting point. In Brazil, wax is made, and depending on need, it is shipped elsewhere in the world.

The rising adoption of carnauba wax across the various end-users is the major factor boosting the growth of the Carnauba wax market over the forecast period. Several kinds of wax can be used on products for coatings, adhesive purposes, and other functions. Carnauba wax is lustrous, making it ideal for giving various products a glossy appearance. When applied to specific goods, it provides waterproofing properties as well.

Emulsions are stable mixes of one or even more waxes in water, and one common wax used in them is carnauba wax. This wax emulsion is frequently used to thicken lotions and ointments. Shiny carnauba wax is frequently used in polishes, such as car, shoe, and flooring polish. Produce like apples and cucumbers are coated with it to make them glossy. More than merely improving the appearance of the floor or fruit, the beautiful wax covering also gives a layer of protection.

Apart from it, for a variety of uses and industries, carnauba wax has advantages for automobiles, cosmetics, pharmaceuticals, and leather, among others. Carnauba wax is suitable for use in cosmetics in addition to polishes and emulsions. The most common goods made with carnauba wax are eyeliners, lipsticks, foundations, skincare items, deodorants, and eyeshadow. Also, the substance is hypoallergenic, which is a fantastic quality for many cosmetic items.

Also, a variety of prescription pills and tablets are coated with carnauba wax. Carnauba wax is also useful for shielding leather goods from water damage. The material is insoluble in water and hydrophobic. Carnauba wax enhances the appearance and protection of customers' vehicles. The wax can shield customers' cars from the sun's UV rays, brighten cars' mirrors, and shield the paint from numerous factors outside. Therefore, the expanding adoption of carnauba wax due to its various uses as well as benefits for the products is boosting the growth of the market over the forecast period. However, the availability of substitutes and the low acceptance rate are two of the main factors impeding market growth over the forecast period.

The COVID-19 epidemic has had a significant negative influence on the world market. It is anticipated that the pandemic's impact on the transportation, leather, wood, and polymer industries will impede the market's expansion. Many market sectors have been forced by the epidemic to almost completely cease operations to adhere to laws like social segregation. Hence, it is projected that a lack of raw material supply will have an even greater impact on the rate of production of carnauba wax.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The rising consumption by young people is expected to expand along with the rising demand for chewy confectionery in the Asia Pacific, which is expected to drive market expansion over the next years. As a popular beeswax substitute, carnauba wax is utilized in products like gummy bears to make them more appealing to vegans. Moreover, the wax has the benefit of preventing chewing gum or gummy animals from sticking together when used as a coating agent.

Further, the top market participants new products with the increased capabilities. It is specifically designed for the automobiles and capable of cleaning alloys without having any corrosive consequences. For instance, in October 2022, at the SEMA Automotive Aftermarket Exhibition 2022, Proje Premium Car Care introduced a new spray wax for vehicles that are based on carnauba. The new "Express Spray Wax" is a specifically formulated carnauba-based spray wax with premium polymers intended to boost the depth of one's vehicle. As a result, the market for carnauba wax is growing rapidly.

Report Segmentation

The market is primarily segmented based on form, product, application, end-user, and region.

|

By Form |

By End-User |

By Product |

By Application |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Automotive segment is expected to witness the fastest growth over the forecast period

The demand for carnauba wax in the automotive sector is boosting rapidly for its benefits. Its properties to modify viscosity and increase hardness make it a popular polish wax in the automotive sector. There will likely be an increase in demand for carnauba wax due to growing worries about car maintenance and an increase in the need for automotive care waxes. Due to its wide range of uses, carnauba wax is becoming more popular with customers compared to bee wax, which is boosting its sales.

Over the study period, there is a increase in the demand for these products due to rising disposable income and a growing preference for expensive, wax-treated foods. Due to the rising demand of premium shine wax, its application in the automobile sector makes it necessary to chemically combine carnauba wax with a solvent to use it in cosmetics and food items. Customers are switching to healthier substitutes as they become more aware of the harmful health impacts of the chemicals added to the carnauba wax.

Type 1 segment accounted for the largest market share in 2022

Type 1 is the product's purest form and is in a growing market in specialized industries like food and medicine. The need for the product is anticipated to grow, particularly in fruit coatings. Type 3 is rising at a rapid rate. The expanding confectionery sector is anticipated to be the main driver of the demand for type 3 food-grade carnauba wax. The industry is projected to expand due to the rising demand for confectionery products including sugar-coated chocolate and sweets.

Moreover, due to rising demand for the product as a mold release agent, type 4 demand is anticipated to rise. Both are dark in color, type 3 and type 4 wax is used in industrial polishes, the leather tanning industry, and automotive applications. In the cosmetics sector, it is employed as a gloss-enhancing compound in a variety of goods, including nail polishes and lip colors.

The demand in North America is expected to witness significant growth

Regions in North America and Eastern Europe make significant investments in carnauba wax imports. The personal care and automotive industries are expected to support an upward growth graph during the forecast period. Rise in demand for the product is projected to due to exapansion in the automotive sector. The manufacturing of camauba wax is dominated by Latin American nations including Brazil, Indonesia, India, and China. Latin America is the market leader for carnauba wax and has the largest reserve of the substance, which will continue to fuel industry expansion.

Market expansion in this area is anticipated to be fueled by rising demand for food glazing agents in China's expanding food and confectionery sector. Additionally, it is anticipated that greater product usage in the vehicle sector will boost market expansion in the region. The rules and regulations adopted by the regional players are assisting the market in growth.

Manufacturers and distributors of the region must check the safety of their products as part of the FDA's requirements, label them before marketing them, and refrain from marketing products that are misbranded or adulterated. The economy of APAC is typically impacted by that of nations like China & India, however, this is changing as foreign direct investment in Southeast Asia is expanding quickly. There are various items created of carnauba wax, however, they fall primarily under the headings of polishes, food items, & cosmetics.

Competitive Insight

Some of the major players operating in the global market include AF Suter, Arjun Beeswax, Akrochem Corporation, BJ International, Blended Waxes, Brasil Ceras, Carnauba do Brasil, Excel International, Calwax and Frank, J. Allcock & Sons, Kahl GmbH, Micro Powders., Kerax Limited, Pontes industria, Strahl & Pitsch, TER HELL & CO, The International Group, and Tropical Ceras.

Recent Developments

In January 2023, Turtle Wax, Inc. announced a strategic relationship with Bosch Car Services (BCS), a network of autonomous multi-brand auto repair shops working with the well-known and dependable Bosch brand.

In October 2021, An acquisition of Bech Chem, LLC, by Akrochem Corporation was disclosed. Akrochem can enter the paint and coatings sector through the acquisition of Bech Chem, which also prepares the business for future expansion and improves support for Bech Chem's clients.

Carnauba Wax Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 292.86 million |

|

Revenue forecast in 2032 |

USD 398.09 million |

|

CAGR |

3.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Form, By End-User, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

AF Suter & Co Ltd., Arjun Beeswax Industries, Akrochem Corporation, BJ International, Blended Waxes Inc., Brasil Ceras, Carnauba do Brasil, Excel International, Calwax and Frank B. Ross Co., Inc., Foncepi comercial exportadora ltda, J. Allcock & Sons Ltd, Kahl GmbH & CO. KG, Micro Powders, Inc.., Kerax Limited, Pontes industria de Cera ltda., Strahl & Pitsch, Inc, TER HELL & CO. GMBH, The International Group, Inc, and Tropical Ceras do Brasil Ltda |

FAQ's

The global Carnauba Wax market size is expected to reach USD 398.09 million by 2032.

Top market players in the Carnauba Wax Market are AF Suter, Arjun Beeswax, Akrochem Corporation, BJ International, Blended Waxes, Brasil Ceras, Carnauba do Brasil.

North America contribute notably towards the global Carnauba Wax Market.

The global Carnauba Wax market expected to grow at a CAGR of 3.7% during the forecast period.

The Carnauba Wax Market report covering key are form, product, application, end-user, and region.