Ceiling Tiles Market Size, Share, Trends, & Industry Analysis Report

By Material Type (Mineral Fiber, Metal, Gypsum, and Others), By Property Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6048

- Base Year: 2024

- Historical Data: 2020-2023

Overview

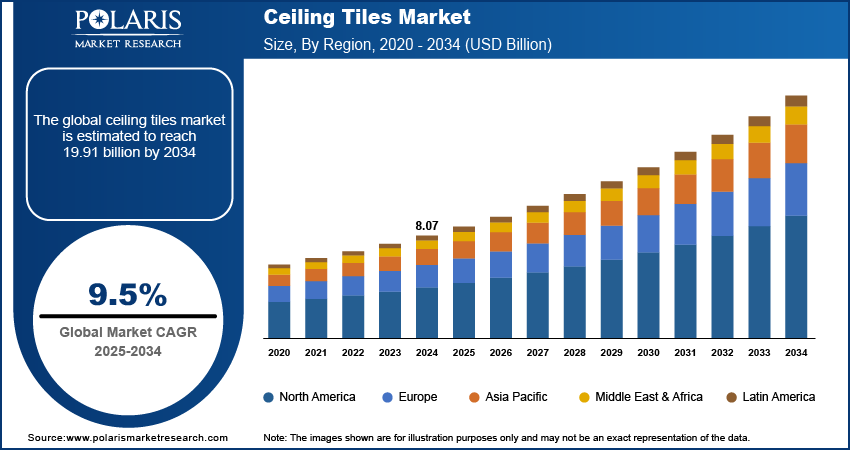

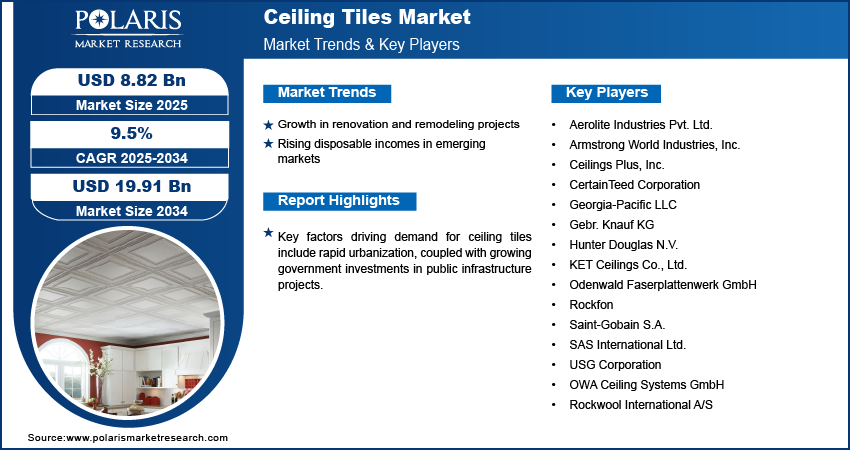

The global ceiling tiles market size was valued at USD 8.07 billion in 2024, growing at a CAGR of 9.5% from 2025–2034. Growth in renovation and remodeling projects coupled with rising disposable incomes in developing economies is propelling the demand for ceiling tiles worldwide.

Key Insights

- The mineral fiber segment accounted for largest revenue share in 2024, due to the rising adoption in commercial buildings, educational institutions, and healthcare facilities.

- The acoustic segment held the largest revenue share in 2024, owing to the growing demand for sound-absorbing materials in commercial spaces, such as corporate offices, schools, and hospitals.

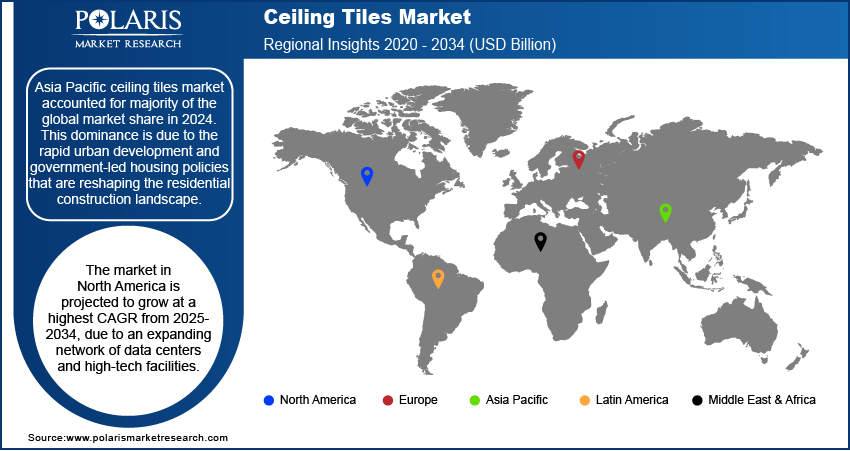

- Asia Pacific ceiling tiles market accounted for majority of the global market share in 2024. This dominance is due to the rapid urban development and government-led housing policies that are reshaping the residential construction landscape.

- The market in North America is projected to grow at a highest CAGR from 2025-2034, due to an expanding network of data centers and high-tech facilities.

- The market in the US is expanding due to the rising investment in high-end residential construction and a strong focus on heritage preservation.

Industry Dynamics

- Growth in renovation and remodeling projects is driving increased demand for ceiling tiles, particularly in aging commercial and residential buildings where interior upgrades are being made to enhance both aesthetics and functional performance.

- Rising disposable incomes in developing economies are boosting spending on home improvement and interior design, increasing the adoption of decorative and functional ceiling tile solutions.

- High installation and maintenance costs associated with suspended ceiling systems and specialized acoustic tiles are limiting their adoption in cost-sensitive construction projects.

- 3D printed ceiling panels are creating new opportunities in the market by offering customizable textures, reduced material waste, and innovative design patterns for commercial interiors and retail applications.

Market Statistics:

- 2024 Market Size: USD 8.07 Billion

- 2034 Projected Market Size: USD 19.91 Billion

- CAGR (2025-2034): 9.5%

- Asia Pacific: Largest market in 2024

Ceiling tiles are widely used in commercial offices, educational institutions, retail spaces, and healthcare facilities due to their ability to enhance acoustic performance, improve indoor air quality, and meet stringent building safety requirements. Increasing refurbishment activities in developed countries and new building projects in emerging markets are prompting manufacturers to expand product ranges to include lightweight, durable, and easy-to-install solutions. The market is witnessing rising demand for eco-friendly ceiling materials that contribute to green building certifications such as Energy and Environmental Design (LEED) and Building Research Establishment Environmental Assessment Method (BREEAM), boosting innovation in material sourcing and recycling technologies.

In addition, rapid global urbanization is increasing the demand for residential units, commercial complexes, and multi-functional urban spaces, thereby propelling the market growth. According to the 2024 report by Our World in Data, around 58% of the global population lived in urban areas as of 2023, with most high-income nations surpassing an urbanization rate of 80%. The report forecasts that by 2050, nearly 68% of the world’s population will reside in urban areas. Modern urban construction increasingly incorporates modular ceiling systems that enhance both functionality and aesthetics, particularly in densely populated areas where regulations prioritize acoustic insulation and thermal efficiency. As a result, the rising urban population is driving demand for ceiling tiles in sustainable building designs aimed at improving indoor comfort and overall quality of life.

Furthermore, rising government investments in public infrastructure are driving the growth of the ceiling tiles market. Facilities such as airports, transport terminals, public hospitals, and educational institutions are increasingly adopting advanced ceiling systems that comply with stringent standards for acoustic performance, fire safety, and hygiene. This has created sustained demand for high-performance ceiling tiles with features like high Noise Reduction Coefficient (NRC) ratings, antimicrobial surfaces, and low-maintenance requirements. As infrastructure funding continues to rise across North America, Asia Pacific, and the Middle East, the demand for ceiling tiles is expected to grow substantially.

Drivers & Opportunities

Growth in Renovation and Remodeling Projects

Increasing focus on interior upgrades and space optimization in older buildings is increasing the demand for modern ceiling tile solutions. In developed economies such as the US, the UK, and parts of Western Europe, commercial offices and institutional facilities are undergoing frequent renovation programs to improve acoustic performance, integrate modern lighting systems, and overall aesthetic appeal. According to the Home Improvement Research Institute, the total home improvement industry in the US grew by 3.7% to reach USD 574.3 billion in 2024 and is expected to expand by an additional 3.4% in 2025. Ceiling tiles are increasingly adopted as replacements for conventional ceiling systems due to ease of installation, modularity, and variety in design options. Growing preference among architects, facility managers, and building owners for energy-efficient buildings with optimized indoor environments is further boosting the integration of functional ceiling materials during renovation projects.

Rising Disposable Incomes in Emerging Markets

Improving living standards across developing countries is generating consumer interest in premium interior materials, including decorative ceiling tiles. Moreover, middle-income households in countries such as India, Indonesia, and Vietnam are increasingly investing in home improvement products that elevate aesthetics and comfort. In 2024, real household income per capita across OECD countries rose by 1.8%, highlighting an improvement over the 1.7% growth recorded in 2023. This growth reflects an increasing household purchasing power across its member nations. The expansion of the retail and hospitality industries is driving increased demand for decorative and acoustically optimized ceiling systems, particularly in dynamic commercial settings such as shopping malls, hotels, and entertainment venues where both aesthetics and sound management are essential. Increasing demand for customized interior solutions is prompting ceiling tile manufacturers to introduce design-oriented products that align with the evolving preferences of urban consumers.

Segmental Insights

Material Type Analysis

Based on material type, the segmentation includes mineral fiber, metal, gypsum, and others. The mineral fiber segment accounted for largest revenue share in 2024, due to the rising adoption in commercial buildings, educational institutions, and healthcare facilities. Compatibility of mineral fibers with a wide range of grid systems and finishes makes them a preferred material in large-scale construction and renovation projects. Contractors also benefit from the ease of installation and replacement, further fueling the growth of mineral fiber ceiling tiles across developed and emerging economies.

The metal segment is projected to register the fastest growth over the forecast period. Demand for metal ceiling tiles is increasing in high-end office spaces, transportation terminals, and airports due to modern aesthetics, durability, and low maintenance. Architects increasingly select metal panels to achieve sleek finishes and incorporate perforated patterns that enhance acoustic performance. The rising adoption of modular metal ceilings in premium commercial interiors and the growth of infrastructure investments in urban centers are driving this segment’s expansion.

Property Type Analysis

By property type, the market includes acoustic and non-acoustic. The acoustic segment held the largest revenue share in 2024, owing to the growing demand for sound-absorbing materials in commercial spaces, such as corporate offices, schools, and hospitals. Ceiling tiles with high noise reduction coefficients (NRC) improve indoor sound quality and speech intelligibility in shared environments. Organizations are increasingly emphasizing employee comfort and productivity, contributing to the demand for acoustic ceiling systems in workspaces and learning environments.

The non-acoustic segment is projected to register the highest growth rate during the forecast period. These tiles are used in areas where aesthetics, fire safety, or humidity resistance take precedence over sound absorption, including retail outlets, kitchens, and corridors. Builders and interior designers are integrating non-acoustic ceiling panels in modular designs, for visual appeal and durability. The growing demand for customizable ceiling surfaces in hospitality and retail interior installations is accelerating the market growth.

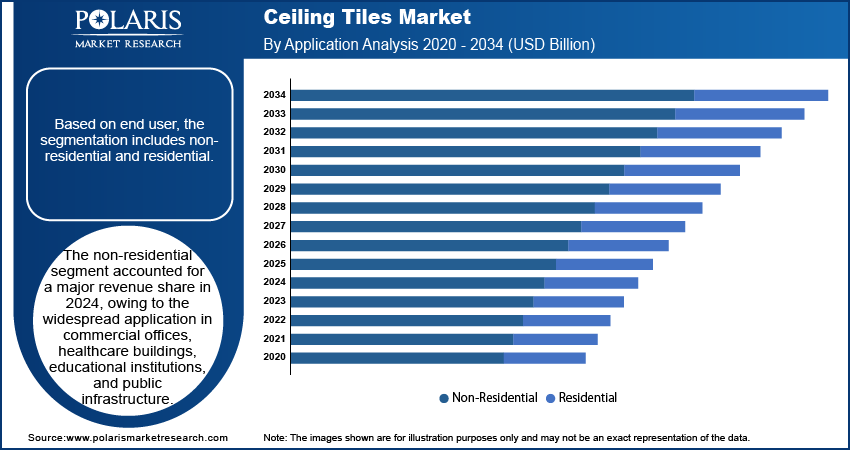

End User Analysis

By end user, the market includes non-residential and residential. The non-residential segment held the largest revenue share in 2024, owing to the widespread application in commercial offices, healthcare buildings, educational institutions, and public infrastructure. In these environments, ceiling tiles are integrated for performance benefits, including acoustic insulation, fire resistance, and ease of maintenance. Expansion of commercial real estate and institutional infrastructure by governments and private investors is increasing the demand for high-performance ceiling systems in the non-residential segment.

The residential segment is projected to grow at the fastest pace during the forecast period. Rising consumer preference for premium and functional interior designs is fueling demand for ceiling tiles in modern homes and apartments. In urban and suburban regions, homeowners are adopting decorative and acoustic ceilings to improve indoor ambiance and thermal performance. Growth in the middle-class population, home improvement activities, and new housing development is contributing to the expanding use of ceiling tiles in residential spaces.

Regional Analysis

Asia Pacific ceiling tiles market accounted for majority of the global market share in 2024. This dominance is due to the rapid urban development and government-led housing policies that are reshaping the residential construction landscape. Affordable housing programs and real estate reforms in India, China, and Indonesia are boosting the demand for cost-effective, easy-to-install ceiling systems in residential construction. The demand for ceiling tiles is increasing significantly in mass housing and institutional projects due to their aesthetic appeal, acoustic insulation, and fire-resistant properties. In addition, stricter building performance standards and growing awareness of indoor air purification are further propelling the growth of the market in the region.

China Ceiling Tiles Market Insight

China held significant market share in the Asia Pacific ceiling tiles landscape in 2024, driven by the large-scale infrastructure investments and government-backed urbanization projects. Initiatives supporting transport infrastructure, public service facilities, and mixed-use commercial developments are boosting the demand for modular and durable ceiling solutions. According to the Green Finance & Development Center, China's participation in the Belt and Road Initiative reached a record in 2024, with construction contracts totaling USD 70.7 billion and direct investments of around USD 51 billion. This surge in investment in infrastructure is creating substantial demand for ceiling tile manufacturers, particularly in public buildings requiring effective acoustic and thermal performance. Additionally, the growing adoption of pre-fabricated and smart construction systems is accelerating the use of ceiling tiles engineered for easy integration, durability, and low maintenance.

North America Ceiling Tiles Market

The market in North America is projected to grow at a highest CAGR from 2025-2034, due to an expanding network of data centers and high-tech facilities. This growth is increasing the need for specialized ceiling systems designed to support HVAC integration, acoustic control, and modular configurations. Additionally, robust public sector infrastructure funding is boosting the market growth. Government-led modernization of transportation hubs, courthouses, community centers, and other public buildings is driving the need for durable, fire-resistant, and easy-to-maintain ceiling systems. These development projects are creating significant demand for ceiling tiles that meet functional and design requirements in large-scale public infrastructure.

The US Ceiling Tiles Market Overview

The market in the US is expanding due to the rising investment in high-end residential construction and a strong focus on heritage preservation. For instance, in May 2025, the US Congress allocated USD 225 million to the Historic Preservation Fund (HPF) for fiscal year 2025. These funds are boosting the adoption of ceiling tiles in historical and public buildings, to replicate traditional interiors while meeting modern acoustic and fire safety regulations.

Europe Ceiling Tiles Market

The ceiling tiles landscape in Europe is projected to hold a substantial share in 2034, driven by growing renovation activity across the region coupled with rising demand for energy-efficient building upgrades. The European Commission's Renovation Wave initiative aims to double the renovation rate of existing buildings by 2030 and upgrade up to 35 million structures across the EU. These initiatives are fueling demand for modern ceiling systems in public infrastructure, social housing, educational institutions, and healthcare facilities. Countries such as Germany, France, and the UK are prioritizing the refurbishment of aging infrastructure to improve energy performance, indoor comfort, and functionality. Ceiling tiles are increasingly used in renovation projects across this country for their modular design, compatibility with modern lighting and HVAC systems, and ease of installation and maintenance.

Key Players & Competitive Analysis Report

The ceiling tiles market is moderately consolidated, with competition primarily centered on product innovation, aesthetic design, and performance efficiency. Leading companies are actively investing in research and development to introduce lightweight, sustainable, and acoustically enhanced ceiling solutions that meet the evolving needs of modern infrastructure projects. Manufacturers are increasingly focusing on eco-friendly materials, fire-resistant formulations, and moisture-resistant coatings to comply with stringent building codes and environmental standards across global markets. Companies are expanding product portfolios with modular, customizable, and digitally integrated ceiling systems to cater to a wide range of applications in commercial offices, healthcare facilities, educational institutions, and public infrastructure. Strategic partnerships with construction firms, architects, and urban developers are leveraged to boost product visibility and drive adoption in large-scale projects. In addition, players are exploring digital design platforms and Building Information Modeling (BIM) compatibility to support architects and designers in project planning and installation efficiency.

Prominent players in the market include Aerolite Industries Pvt. Ltd., Armstrong World Industries, Inc., Ceilings Plus, Inc., CertainTeed Corporation, Georgia-Pacific LLC, Gebr. Knauf KG, Hunter Douglas N.V., KET Ceilings Co., Ltd., Odenwald Faserplattenwerk GmbH, Rockfon (a subsidiary of ROCKWOOL International A/S), Saint-Gobain S.A., SAS International Ltd., USG Corporation, OWA Ceiling Systems GmbH, and Rockwool International A/S.

Key Players

- Aerolite Industries Pvt. Ltd.

- Armstrong World Industries, Inc.

- Ceilings Plus, Inc.

- CertainTeed Corporation

- Georgia-Pacific LLC

- Gebr. Knauf KG

- Hunter Douglas N.V.

- KET Ceilings Co., Ltd.

- Odenwald Faserplattenwerk GmbH

- Rockfon (a subsidiary of ROCKWOOL International A/S)

- Saint-Gobain S.A.

- SAS International Ltd.

- USG Corporation

- OWA Ceiling Systems GmbH

- Rockwool International A/S

Industry Developments

- March 2025: Kirei launched three new acoustic ceiling tile packs Hatch ACT, Sidebar ACT, and Gather ACT crafted from 60% post-consumer recycled plastic, featuring color, texture, and customizable printing options. Their modular design allowed pattern rotation and flexibility within standard grid systems, making them ideal for creative commercial spaces.

- January 2025: ClearOne launched the BMA 360DX, an all‑in‑one ceiling tile integrating a beamforming microphone array, DSP with Dante, multi‑channel amplifier, and auto-config features into a standard ceiling tile form factor. The environmental design reduced rack usage, packaging, and shipping, aligning with sustainability trends in building materials.

Ceiling Tiles Market Segmentation

By Material Type Outlook (Revenue, USD Billion; Volume, Mn Sq. Mt.; 2020–2034)

- Mineral Fiber

- Metal

- Gypsum

- Others

By Property Type Outlook (Revenue, USD Billion; Volume, Mn Sq. Mt.; 2020–2034)

- Acoustic

- Non-Acoustic

By End User Vertical Outlook (Revenue, USD Billion; Volume, Mn Sq. Mt.; 2020–2034)

- Non-Residential

- Residential

By Regional Outlook (Revenue, USD Billion; Volume, Mn Sq. Mt.; 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ceiling Tiles Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.07 Billion |

|

Market Size in 2025 |

USD 8.82 Billion |

|

Revenue Forecast by 2034 |

USD 19.91 Billion |

|

CAGR |

9.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion, Volume in Mn Sq. Mt., CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.07 billion in 2024 and is projected to grow to USD 19.91 billion by 2034.

The global market is projected to register a CAGR of 9.5% during the forecast period.

Asia Pacific dominated the market in 2024.

A few of the key players in the market are Aerolite Industries Pvt. Ltd., Armstrong World Industries, Inc., Ceilings Plus, Inc., CertainTeed Corporation, Georgia-Pacific LLC, Gebr. Knauf KG, Hunter Douglas N.V., KET Ceilings Co., Ltd., Odenwald Faserplattenwerk GmbH, Rockfon (a subsidiary of ROCKWOOL International A/S), Saint-Gobain S.A., SAS International Ltd., USG Corporation, OWA Ceiling Systems GmbH, and Rockwool International A/S.

The mineral fiber segment dominated the market in 2024.

The non-acoustic segment is expected to witness the fastest growth during the forecast period.