Cell & Gene Therapy Contract Research Organizations Market Size, Share, Industry Analysis Report

By Type of Therapy (Gene Therapy, Cell Therapy), By Type of Manufacturing Service, By Cell and Gene Therapy Modality, By Therapeutic Area, and By End-User, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6220

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

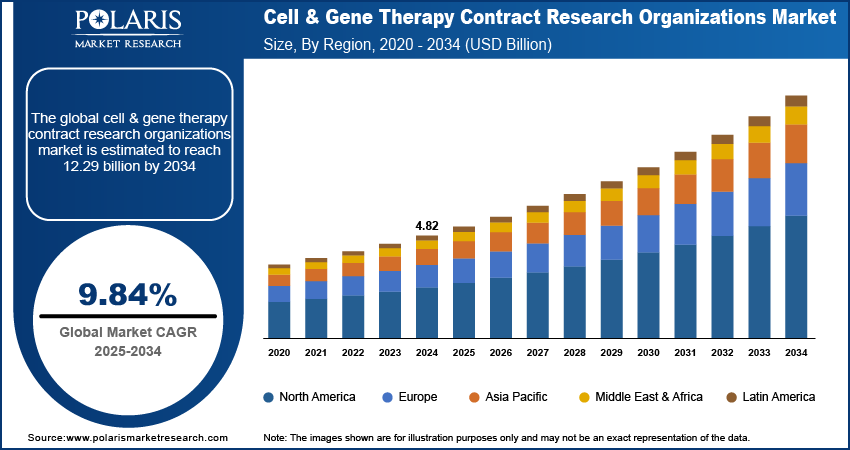

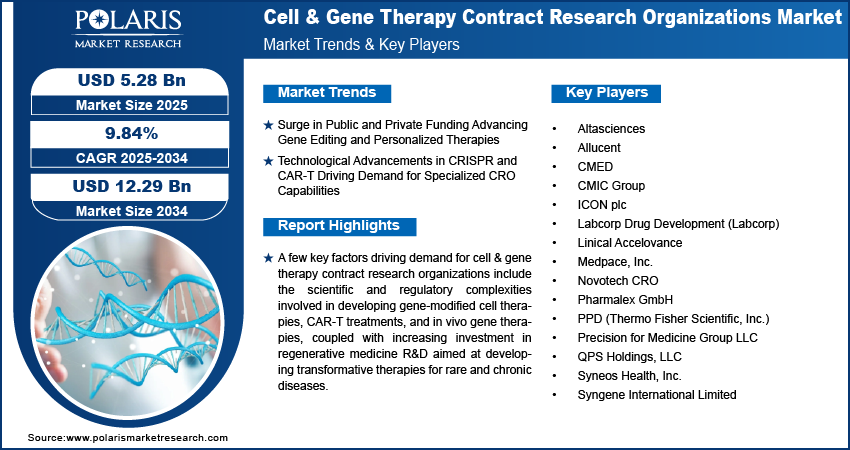

The global cell & gene therapy contract research organizations market size was valued at USD 4.82 billion in 2024, growing at a CAGR of 9.84% from 2025 to 2034. Key factors driving demand for cell & gene therapy contract research organizations include a surge in public and private funding, advancing gene editing and personalized therapies, coupled with technological advancements in CRISPR and CAR-T, driving demand for specialized CRO capabilities.

Key Insights

- The cell therapy segment held the largest market share in 2024, driven by the rising number of commercialized products, a steadily expanding clinical pipeline, and growing adoption of autologous and allogeneic therapeutic approaches.

- The viral vectors segment accounted for the highest share in 2024, attributed to the well-established role as delivery systems for both gene therapies and genetically modified cell therapies.

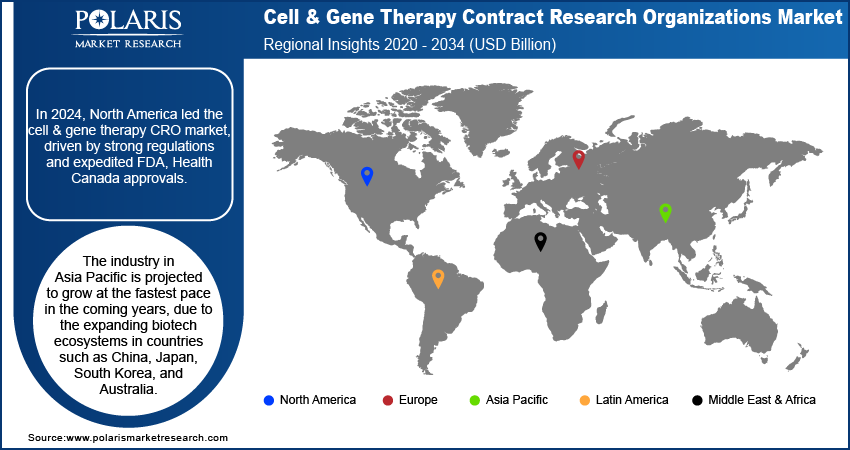

- The North America cell & gene therapy contract research organizations market dominated the market in 2024. This dominance is attributed to the robust regulatory frameworks and expedited approval pathways from government agencies.

- The U.S. held the largest revenue share in the North America cell & gene therapy contract research organizations landscape in 2024, driven by the growing cancer burden and increasing adoption of advanced cell-based treatments for oncology.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, due to the expanding biotech ecosystems in countries such as China, Japan, South Korea, and Australia.

- In India, the market is growing due to the rising investments in regenerative medicine, stem cell research, and gene-modified therapies.

Industry Dynamics

- Increasing public and private funding is accelerating advancements in gene editing and personalized therapies, creating a robust demand for specialized CRO services.

- Rapid technological progress in CRISPR, CAR-T, and other advanced modalities is boosting the need for CROs with niche expertise in complex trial design, regulatory compliance, and manufacturing support.

- AI-driven clinical trial optimization presents a lucrative opportunity for improving trial efficiency, patient recruitment, and data accuracy.

- High operational costs and complex regulatory protocols continue to pose significant challenges, particularly for smaller CROs and emerging market entrants.

Market Statistics

- 2024 Market Size: USD 4.82 Billion

- 2034 Projected Market Size: USD 12.29 Billion

- CAGR (2025–2034): 9.84%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Cell & Gene Therapy Contract Research Organizations Market

- AI accelerates drug discovery by analyzing genetic data to identify promising therapy patients faster, reducing preclinical development timelines.

- Machine learning optimizes manufacturing processes for personalized therapies, improving yield and consistency while lowering production costs.

- Predictive analytics enhance clinical trial design by identifying ideal patient populations, boosting success rates and speeding approvals.

- AI-powered quality control detects deviations in real-time during cell therapy production, ensuring safer and more reliable treatments.

The cell & gene therapy contract research organizations (CROs) market is emerging as a key component in the biopharmaceutical R&D ecosystem, offering specialized services to support the complex development needs of advanced therapies. These CROs provide end-to-end solutions, ranging from early-stage discovery and preclinical development to clinical trial execution and regulatory support. The growing need to streamline development timelines, reduce costs, and access global expertise is driving the outsourcing of research functions to CROs with deep technical capabilities in cell and gene therapy modalities.

The demand for specialized contract research organizations (CRO) services in this space is increasing due to the scientific and regulatory complexities involved in developing gene-modified cell therapies, CAR-T cell therapy, and in vivo gene therapies. Cell and gene therapy sponsors are collaborating with CROs to gain access to disease-specific models, biomarkers strategies, and real-world evidence frameworks that accelerate the path from bench to bedside. CROs are also enhancing their infrastructure by investing in GMP-compliant facilities, vector production capabilities, and decentralized trial platforms, catering to the evolving demands of personalized and rare disease therapies.

The growth of the cell & gene therapy CROs market is driven by the increasing investment in regenerative medicine R&D aimed at developing transformative therapies for rare and chronic diseases. The National Institute of Dental and Craniofacial Research (NIDCR) allocated more than USD 73 million toward basic, translational, and clinical research in regenerative medicine during fiscal year 2024. The drive among biopharmaceutical companies to deliver first-in-class treatments is fueling a rising demand for specialized external expertise in clinical development, regulatory strategy, and trial execution. Contract research organizations are becoming integral partners in this process, offering technical and operational capabilities tailored to the complex nature of gene-modified cell therapies, in vivo gene therapies, and autologous treatments.

Drivers & Opportunities

Surge in Public and Private Funding Advancing Gene Editing and Personalized Therapies: Government and private sector funding in high-impact areas such as gene editing, immunotherapies, and personalized medicine is expanding globally. For example, in March 2025, Arbor Biotechnologies closed a USD 73.9 million Series C financing round to advance its next-generation gene editing therapeutics. The funds aim to support the clinical development of the lead candidate ABO-101 for primary hyperoxaluria type 1 (PH1), along with other programs targeting liver and CNS diseases, including reverse transcriptase-based editing platforms. This influx of capital is enabling the launch of new development programs, particularly in oncology, rare genetic disorders, and autoimmune conditions. Thus, sponsors are increasingly outsourcing to CROs that provide comprehensive services ranging from biomarker-led trial designs to regulatory submissions and decentralized trial management streamlining the development pathway of advanced therapies.

Technological Advancements in CRISPR and CAR-T Driving Demand for Specialized CRO Capabilities: The rapid pace of innovation in enabling technologies such as CRISPR-Cas9 gene editing, viral vector engineering, and CAR-T cell therapies is accelerating the demand for CROs with domain-specific expertise. The intricate scientific, manufacturing, and regulatory requirements of these therapies necessitate partners with deep technical know-how, access to GMP-compliant environments, and a strong understanding of evolving regulatory frameworks. CROs that offer customized solutions aligned with these needs are expediting clinical progress while ensuring safety, efficacy, and compliance across diverse therapy platforms.

Segmental Insights

Type of Therapy Analysis

Based on type of therapy, the segmentation includes gene therapy, cell therapy, stem cell therapy, CAR-T therapy, and other cell therapies. Cell therapy accounted for the largest revenue share in 2024, driven by the rising number of commercialized products, a steadily expanding clinical pipeline, and growing adoption of autologous and allogeneic therapeutic approaches. Increasing investment from large biopharmaceutical companies, coupled with improved manufacturing scalability, is sustaining the segment’s dominance. The application of cell therapies in oncology, regenerative medicine, and rare genetic disorders continues to expand, further solidifying its position in the global market.

CAR-T therapy is projected to grow at the fastest pace during the forecast period, fueled by robust clinical research aimed at extending its use beyond hematologic malignancies into complex solid tumor indications. Advancements in CAR-T engineering, including enhanced persistence, reduced toxicity, and point-of-care manufacturing models, are accelerating development timelines. The increase in regulatory approvals and growing collaborations between CROs and therapy developers are expected to further strengthen this growth trajectory.

Type of Manufacturing Service Analysis

Based on type of manufacturing service, the segmentation includes development services, production services, and other services. Production services dominated the market in 2024 due to the intricate processes and specialized infrastructure required for the large-scale production of viral vectors, engineered cells, and other advanced therapeutic materials under GMP conditions. Many sponsors prefer outsourcing to CROs with established quality management systems, bioreactor capacity, and expertise in scale-up manufacturing to reduce capital investment and operational risks. The consistent rise in late-stage cell and gene therapy candidates has further intensified demand for manufacturing partnerships.

Development services are anticipated to post the fastest CAGR during the forecast period, as therapy developers increasingly seek CRO expertise in preclinical research, process optimization, assay development, and regulatory strategy formulation. These services are essential for shortening the time to clinical trial initiation and improving the success rates of early-stage programs. The growing complexity of novel modalities and delivery platforms is further enhancing the value proposition of CROs offering integrated development capabilities.

Cell and Gene Therapy Modality Analysis

Based on cell and gene therapy modality, the segmentation includes viral vectors, non-viral vectors, and CRISPR/Cas9 and other gene editing tools. Viral vectors held the largest share of the market in 2024, attributed to the well-established role as delivery systems for gene therapies and genetically modified cell therapies. Adeno-associated viruses (AAV), lentiviruses, and retroviruses are the most widely used due to high transduction efficiency, stable gene expression, and favorable safety profiles. The proven clinical performance of viral vectors in approved therapies created strong market demand, while continuous improvements in vector yield and purification processes are supporting cost efficiency and scalability.

CRISPR/Cas9 and other gene editing tools are projected to register the fastest growth during the forecast period, propelled by the unmatched precision, ability to perform in vivo editing, and potential to target a wide range of genetic diseases. The increasing adoption of base editing, prime editing, and next-generation CRISPR systems is expanding therapeutic possibilities. CROs are actively building expertise and infrastructure to support preclinical and clinical programs in this area, positioning themselves to capture emerging opportunities in advanced genome engineering.

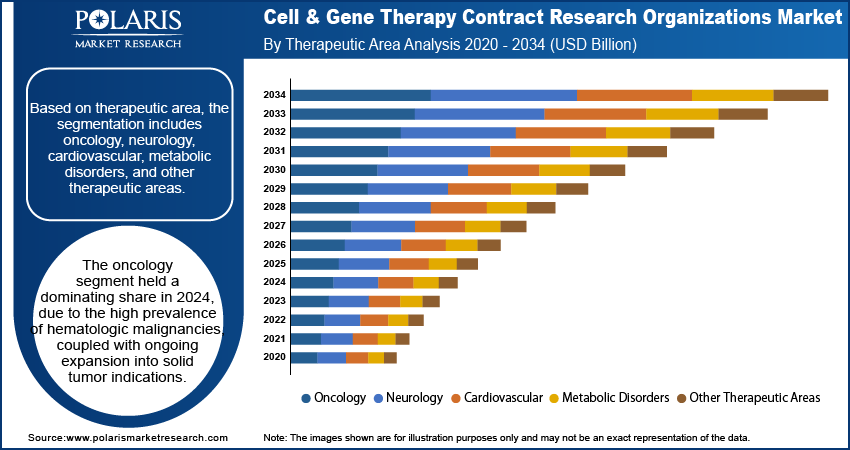

Therapeutic Area Analysis

Based on therapeutic area, the segmentation includes oncology, neurology, cardiovascular, metabolic disorders, and other therapeutic areas. Oncology emerged as the largest therapeutic segment in 2024, reflecting the concentration of global cell and gene therapy research efforts in cancer treatment. The high prevalence of hematologic malignancies, coupled with ongoing expansion into solid tumor indications, continues to drive segment growth. Regulatory agencies have shown strong support for innovative oncology products, granting designations such as RMAT and Breakthrough Therapy status, which further accelerate commercialization timelines and adoption rates.

Neurology is forecast to grow at the fastest rate over the coming years, driven by increasing innovation in targeting neurodegenerative and rare central nervous system (CNS) disorders. The development of novel delivery systems capable of crossing the blood–brain barrier, along with the expanding clinical application of gene editing technologies, is fueling research activity. Partnerships between CROs, biotech firms, and academic centers are further strengthening the neurological pipeline, paving the way for commercial breakthroughs in the next decade.

End-User Analysis

Based on end-user, the segmentation includes biopharmaceutical companies, academic and research institutions, and contract development & manufacturing organizations (CDMOs). Biopharmaceutical companies represented the largest end-user category in 2024, as the majority of therapy developers outsource specialized services to CROs to access advanced technical infrastructure, regulatory expertise, and scalable manufacturing capacity. Outsourcing also enables these companies to focus internal resources on strategic functions such as discovery and commercialization while reducing operational risks associated with in-house production. The increasing number of clinical trials reaching late-stage development is further amplifying demand for full-service CRO partnerships.

Academic and research institutions are projected to grow at the highest CAGR, supported by rising government and philanthropic funding for translational research and early-stage therapy development. Universities and research hospitals are increasingly partnering with CROs to bridge the gap between discovery and commercialization, leveraging expertise in protocol design, preclinical modeling, and regulatory submissions. This collaboration model is crucial in expanding the scope of novel therapies entering the clinical pipeline.

Regional Analysis

The North America cell & gene therapy contract research organizations market held the dominating market share in 2024. This dominance is attributed to the robust regulatory frameworks and expedited approval pathways from agencies such as the US Food and Drug Administration (FDA) and Health Canada for innovative therapies. The region benefits from substantial public and private funding for clinical trials, particularly in rare diseases and oncology applications. The well-established research infrastructure, coupled with the presence of leading biotechnology hubs, further boosts the market growth in the region.

U.S. Cell & Gene Therapy Contract Research Organizations Market Insights

The U.S. held the largest revenue share in the North America cell & gene therapy contract research organizations landscape in 2024, driven by the growing cancer burden and increasing adoption of advanced cell-based treatments for oncology. Rising clinical activity and partnerships between biotechnology companies and CROs are enhancing trial execution efficiency and accelerating commercialization timelines. According to the American Cancer Society (ACS), a total of 2.04 million new cancer cases are expected in 2025, while cancer-related deaths are projected to reach 0.61 million in the country. This surge underscores the urgent need for novel therapeutics and specialized CRO capabilities to manage complex oncology trials.

Asia Pacific Cell & Gene Therapy Contract Research Organizations Market Trends

The market in Asia Pacific is projected to hold a substantial revenue share in 2034 due to the expanding biotech ecosystems in countries such as China, Japan, South Korea, and Australia. Government-backed initiatives and favorable regulatory frameworks are promoting advanced therapy research and development. Also, increasing investments in infrastructure and the emergence of regionally based CROs with global-standard capabilities are further boosting market growth.

India Cell & Gene Therapy Contract Research Organizations Market Overview

India is a key market for cell & gene therapy contract research organizations, driven by the rising investments in regenerative medicine, stem cell research, and gene-modified therapies. Biotechnology companies are focusing on innovative manufacturing technologies and automated platforms to improve scalability, reduce production costs, and meet the growing clinical requirements. According to the Department of Biotechnology–Biotechnology Industry Research Assistance Council (DBT-BIRAC), the biotechnology industry in India was valued at USD 44 billion in 2017 and is projected to reach USD 300 billion by 2030, reflecting a CAGR of over 15.8%. This rapid expansion is significantly increasing the demand for CRO services specializing in advanced therapies.

Europe Cell & Gene Therapy Contract Research Organizations Market Assessments

The industry in Europe is projected to grow at the fastest pace in the coming years, owing to the strong regulatory guidance under the European Medicines Agency’s (EMA) advanced therapy medicinal product (ATMP) framework. Increasing R&D expenditure across the region is accelerating innovation in regenerative medicine, gene-modified cell therapies, and advanced therapeutic platforms. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), R&D spending in Europe rose from USD 20.4 million in 2020 to USD 54.1 million in 2023, indicating a robust commitment to innovation. Pharmaceutical and biotechnology companies are actively investing in advanced manufacturing technologies to improve production efficiency and scale up clinical and commercial supply.

Key Players & Competitive Analysis

The global cell & gene therapy contract research organizations (CROs) market is highly competitive, with key players such as Altasciences, ICON plc, Labcorp Drug Development (Labcorp), and Syneos Health, Inc. dominating due to deep therapeutic expertise, advanced clinical trial capabilities, and expansive global networks. ICON plc leads with a strong portfolio of end-to-end services, including cell and gene therapy-specific trial design, regulatory consulting, and advanced analytics solutions. Labcorp leverages its global laboratory infrastructure and bioanalytical expertise to support complex trial requirements from preclinical to post-marketing stages. Syneos Health stands out for its integrated biopharmaceutical solutions, combining clinical development and commercialization capabilities tailored to advanced therapies. Altasciences differentiates itself with agile, flexible service models, enabling rapid early-phase development for novel cell and gene therapies.

The market is experiencing a growing emphasis on decentralized and hybrid clinical trial models, driven by the unique logistics and patient recruitment challenges associated with advanced therapies. Companies are increasingly investing in specialized manufacturing support, real-world evidence generation, and regulatory navigation for accelerated approvals. Strategic collaborations, mergers, and acquisitions remain common approaches to expand service offerings and geographical reach, while competition intensifies in emerging markets where cell and gene therapy pipelines are rapidly expanding.

Prominent companies in the market include Allucent, CMED, CMIC Group, Linical Accelovance, Novotech CRO, Pharmalex GmbH, PPD (Thermo Fisher Scientific, Inc.), Precision for Medicine Group LLC, QPS Holdings, LLC, and Syngene International Limited.

Key Players

- Altasciences

- Allucent

- CMED

- CMIC Group

- ICON plc

- Labcorp Drug Development (Labcorp)

- Linical Accelovance

- Medpace, Inc.

- Novotech CRO

- Pharmalex GmbH

- PPD (Thermo Fisher Scientific, Inc.)

- Precision for Medicine Group LLC

- QPS Holdings, LLC

- Syneos Health, Inc.

- Syngene International Limited

Cell & Gene Therapy Contract Research Organizations Industry Developments

In April 2025, AGC Biologics launched a new cell and gene technologies division aimed at elevating its CDMO capabilities to support developers facing capacity and technical challenges in advanced therapies. This division is anchored by its Milan Cell and Gene Center of Excellence, an established site with 30 years of experience, nine commercial product approvals, and hundreds of GMP batches produced.

In November 2024, QPS Holdings, LLC launched a new cell therapy business unit at its Springfield, Missouri campus, opening a dedicated Leukopak collection and blood product processing center to support the surge in demand for raw materials essential to cell and gene therapy development.

Cell & Gene Therapy Contract Research Organizations Market Segmentation

By Type of Therapy Outlook (Revenue, USD Billion, 2020–2034)

- Gene Therapy

- Cell Therapy

- Stem Cell Therapy

- CAR-T Therapy

- Other Cell Therapies

By Type of Manufacturing Service Outlook (Revenue, USD Billion, 2020–2034)

- Development Services

- Production Services

- Other Services

By Cell and Gene Therapy Modality Outlook (Revenue, USD Billion, 2020–2034)

- Viral Vectors

- Adeno-associated Virus (AAV)

- Lentivirus

- Adenovirus

- Retrovirus

- Other Viral Vectors

- Non-Viral Vectors

- Plasmid DNA

- mRNA-based Therapies

- CRISPR/Cas9 and Other Gene Editing Tools

By Therapeutic Area Outlook (Revenue, USD Billion, 2020–2034)

- Oncology

- Neurology

- Cardiovascular

- Metabolic Disorders

- Other Therapeutic Areas

By End-User Outlook (Revenue, USD Billion, 2020–2034)

- Biopharmaceutical Companies

- Academic and Research Institutions

- Contract Development & Manufacturing Organizations (CDMOs)

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell & Gene Therapy Contract Research Organizations Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.82 Billion |

|

Market Size in 2025 |

USD 5.28 Billion |

|

Revenue Forecast by 2034 |

USD 12.29 Billion |

|

CAGR |

9.84% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.82 billion in 2024 and is projected to grow to USD 12.29 billion by 2034.

The global market is projected to register a CAGR of 9.84% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Allucent, CMED, CMIC Group, Linical Accelovance, Novotech CRO, Pharmalex GmbH, PPD (Thermo Fisher Scientific, Inc.), Precision for Medicine Group LLC, QPS Holdings, LLC, and Syngene International Limited

The cell therapy segment dominated the market revenue share in 2024.

The development services segment is projected to witness the fastest growth during the forecast period.