Cell Culture Supplements Market Size, Share, Trends, Industry Analysis Report

By Product, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM6069

- Base Year: 2024

- Historical Data: 2020-2023

Overview

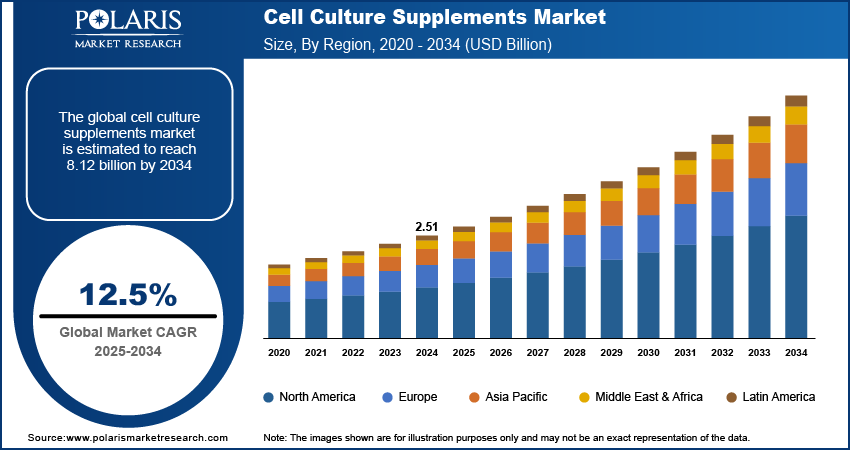

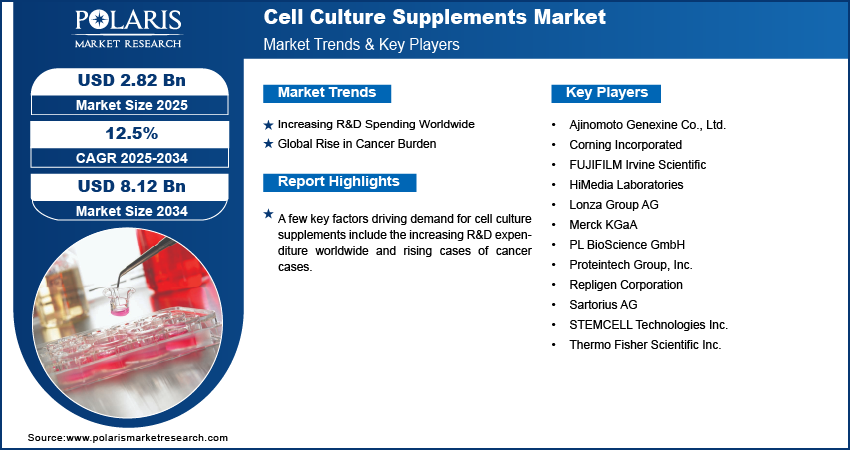

The global cell culture supplements market size was valued at USD 2.51 billion in 2024, growing at a CAGR of 12.5% from 2025 to 2034. Key factors driving demand for cell culture supplements include the increasing R&D expenditure worldwide coupled with rising cases of cancer worldwide.

Key Insights

- The segment of serum-based supplements dominated the market in 2024.

- The cell & gene therapy segment is expected to expand at a fast rate in the years to come with the growth of regenerative medicine and personalized medicines.

- The North America cell culture supplements market held the largest share in 2024.

- The U.S. cell culture supplements market is driven by robust biomedical research funding and commercialization of advanced therapies.

- The market in Asia Pacific is projected to grow at a fast pace from 2025-2034, driven by government backing, huge patient bases, and research activity.

- China and Japan lead regional growth with robust manufacturing, growing pharma pipelines, and biologics uptake.

Industry Dynamics

- Rising global R&D spending boosts biologics, advanced therapies, and drug development.

- Increasing cancer cases raise demand for cell culture supplements in biologics and immunotherapy research.

- AI and automation integration in cell culture expected to create new opportunities during the forecast period.

- The ethical concerns with animal-derived products is anticipated to limit market growth.

Market Statistics

- 2024 Market Size: USD 2.51 Billion

- 2034 Projected Market Size: USD 8.12 Billion

- CAGR (2025–2034): 12.5%

- North America: Largest Market Share

Cell culture supplements are additives that are used to optimize cell growth, viability, and productivity in culture media. They contain essential nutrients such as amino acids, vitamins, and growth factors. These supplements find extensive applications in drug development, vaccines, regenerative medicine, and research. The market is increasing as they contribute significantly toward developing new therapies and scientific advancement.

The growing number of chronic diseases is boosting the cell culture supplements market. These supplements enable disease modeling, drug testing, and development of new therapies. Based on the United States Department of Health and Human Services, an estimated 129 million Americans are residing with a minimum of one important chronic condition. Eurostat 2023 gives that 50.6% of Finland's and 43.2% of Germany's populations have chronic diseases. The boost the dependency on cell culture technologies to speed up biomedical research and innovative healthcare solutions.

Advancements in serum-free and chemically defined supplements are propelling the cell culture market by enhancing safety, consistency, and scalability in biomanufacturing. These formulations reduce variability from animal-derived components and meet regulatory standards, increasing their use in pharmaceutical, biotech, and research applications.

Drivers & Opportunities

Increasing R&D Spending Worldwide: Rising R&D spending is boosting the cell culture supplements market as pharma and biotechnology firms advance therapeutics, vaccines, and regenerative medicine that improve cell growth efficiency critical for applications in stem cell research, cancer biology, and biopharmaceutical production. The World Intellectual Property Organization states that global R&D spending increased from 2.39% of GDP in 2020 to 2.75% in 2023, fueling demand for stem cell research, cancer research, and biopharmaceutical manufacturing in high-quality supplements.

Increasing Global Cancer Incidence: The increasing global cancer incidence is propelling demand for cell culture supplements, which are necessary for in-vitro models, cancer research, and the development of targeted therapies. In 2022, WHO recorded 20 million new cases and 9.7 million deaths, with cases predicted to reach over 35 million by 2050, a 77% upsurge from 2022. This trend generates constant use of high-quality supplements in drug development and oncology research propelling market growth.

Segmental Insights

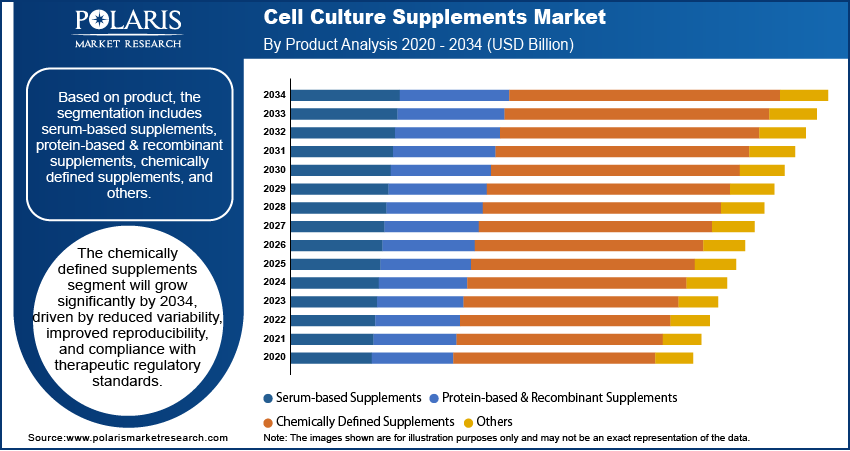

Product Analysis

By product, the market is divided into serum-based supplements, protein-based & recombinant supplements, chemically defined supplements, and others. The serum-based supplements segment held the maximum market share during 2024 due to maintaining cell growth, viability, and culture stability in production and research. For instance, in July 2025, Vegamour launched GRO+ hair growth supplements addressing hormones, stress, inflammation, and nutrition, depicting the interest of the industry in latest bioactive solutions.

The segment of chemically defined supplements is anticipated to develop the most rapidly up to 2034, providing stable composition, less variability, and regulatory approval. The supplements have reproducible results, which makes them critical for cell therapy and production of biopharmaceuticals, thereby transforming the market in the direction of uniform solutions.

Application Analysis

By application, the industry is divided into biopharmaceutical manufacturing, cell & gene therapy, drug discovery, and others. The segment of biopharmaceutical manufacturing dominated the market in 2024, owing to increased demand for monoclonal antibodies, vaccines, and recombinant proteins. Cell culture supplements increase yields, stability, and efficiency in large-scale production of biologics, with increasing investments cementing this segment on a worldwide scale.

The cell & gene therapy market is predicted to grow fastest fueled by progress in regenerative medicine and engineered treatments. Cell stability and function are assisted by stem cell and CAR T-cell supplements and growing clinical pipelines and FDA approvals creates significant opportunities for companies.

End User Analysis

Based on end user, the market is segmented into cell culture media manufacturers, biotechnology & pharmaceutical companies, CDMOs/CMOs & CROs, and research & academic institutes. Pharmaceutical and biotech companies led the market in 2024 as a result of high utilization of cell culture supplements in research, biologics, and personalized medicine. Strong investments and increasing pipelines of antibodies, vaccines, and regenerative treatments are fueling steady demand.

The CDMOs/CMOs & CROs segment is expected to grow the fastest until 2034 due to increased outsourcing of biopharmaceutical manufacturing and clinical studies. These entities provide scalable, cost-effective solutions to enable smaller companies to access sophisticated manufacturing and accelerate therapy development.

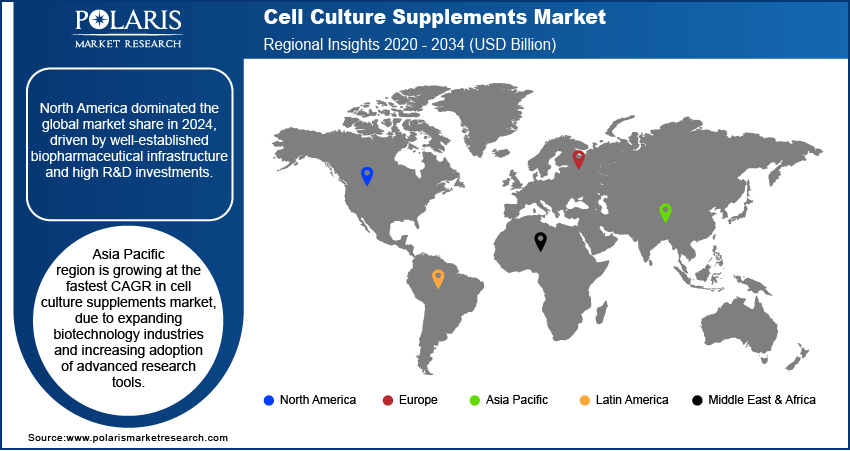

Regional Analysis

North America led the cell culture supplements market in 2024 due to strong biotech and pharmaceutical sectors, advanced healthcare infrastructure, and major investments in drug development. Leading research institutions and life sciences companies drive biologics, vaccines, and cell therapy research. Continuous funding boosts the use of supplements that enhance cell growth and productivity.

U.S. Cell Culture Supplements Market Insights

The cell culture supplements market in the U.S. is expanding as a result of increasing cancer incidences and greater adoption of cell-based advanced therapies. Increasing demand for personalized treatment, such as CAR T-cell and stem cell therapies, is fueling demand for quality supplements that support cell viability and growth. According to American Cancer Society, Inc., in 2025 America accounts for 2,041,910 new cases of cancer and 618,120 deaths due to cancer, which propels supplement consumption for research and therapy development.

Europe Cell Culture Supplements Market Assessments

Europe is expected to hold a large share of the market in 2034 on account of robust biopharmaceutical production, research superiority, and stringent quality regulations. Increasing need for supplements boosting cell culture conditions is fueling the efficiency of drug discovery and development of therapy in this area.

Asia Pacific Cell Culture Supplements Market Trends

Asia Pacific is expected to see the fastest growth due to accelerated biotechnology growth and government programs. Increased biosynthesis of biologics and vaccines raises demand for high-quality cell culture supplements. Moreover, ventures among international and regional companies as well as increasing contract research services are driving the regional market.

India Cell Culture Supplements Market Overview

The surging biotechnology industry is inducing the demand for cell culture supplements with high investment in research, therapeutics, and bulk bio manufacturing. According to the DBT-BIRAC, India’s biotech industry grew from USD 44 billion in 2017 to a projected USD 300 billion by 2030, showing over 15.8% CAGR. This results in a focus on precision medicine, regenerative treatments and vaccines creating the need for superior-quality supplements.

Key Players & Competitive Analysis

The market for cell culture supplements is moderately competitive with major players such as Thermo Fisher, Merck, Sartorius, and Lonza dominating the market. They develop high-purity contamination-free supplements for application in the biopharma, regenerative medicine, and research industries. Expansion is fueled by partnerships, acquisitions and capacity increase to meet rising global demand.

A few major companies operating in the cell culture supplements industry include Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, Lonza Group AG, Corning Incorporated, FUJIFILM Irvine Scientific, HiMedia Laboratories, STEMCELL Technologies Inc., Ajinomoto Genexine Co., Ltd., PL BioScience GmbH, Proteintech Group, Inc., and Repligen Corporation.

Key Players

-

- Ajinomoto Genexine Co., Ltd.

- Corning Incorporated

- FUJIFILM Irvine Scientific

- HiMedia Laboratories

- Lonza Group AG

- Merck KGaA

- PL BioScience GmbH

- Proteintech Group, Inc.

- Repligen Corporation

- Sartorius AG

- STEMCELL Technologies Inc.

- Thermo Fisher Scientific Inc.

Cell Culture Supplements Industry Developments

July 2025: PL BioScience increased capacity in its German facility to provide worldwide animal-free, GMP-grade human platelet lysate and build lab-grown HPL for CAR-T and other cell therapies.

December 2024: Merck acquired HUB Organoids to increase its 2D and 3D cell culture portfolio, offering organoids and cutting-edge supplements for drug discovery and intricate cell models.

December 2023: Ajinomoto Genexine introduced BASAL CHO MX under the CELLiST brand, utilizing CHO-M cells and custom amino acid mixtures for enhanced cell culture performance.

Cell Culture Supplements Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Serum-based Supplements

- Protein-based & Recombinant Supplements

- Chemically Defined Supplements

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Biopharmaceutical Manufacturing

- Cell & Gene Therapy

- Drug Discovery

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Cell Culture Media Manufacturers

- Pharmaceutical & Biotechnology Companies

- CDMOs/ CMOs & CROs

- Academic & Research Institutes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell Culture Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.51 Billion |

|

Market Size in 2025 |

USD 2.82 Billion |

|

Revenue Forecast by 2034 |

USD 8.12 Billion |

|

CAGR |

12.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.51 billion in 2024 and is projected to grow to USD 8.12 billion by 2034.

The global market is projected to register a CAGR of 12.5% during the forecast period.

North America dominated the market in 2024 driven by strong biopharmaceutical production capacity, significant investments in life sciences research, and the presence of major industry players.

A few of the key players in the market are Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, Lonza Group AG, Corning Incorporated, FUJIFILM Irvine Scientific, HiMedia Laboratories, STEMCELL Technologies Inc., Ajinomoto Genexine Co., Ltd., PL BioScience GmbH, Proteintech Group, Inc., and Repligen Corporation.

The biopharmaceutical manufacturing segment dominated the market revenue share in 2024 due to the rising demand for monoclonal antibodies, vaccines, and cell-based therapies requiring high-quality cell culture supplements.

The CDMOs/ CMOs & CROs segment is projected to witness the fastest growth during the forecast period due to increasing outsourcing of biologics development, scalability needs, and cost-efficient manufacturing solutions.