Cell Therapy Manufacturing Market Size, Share, Trends, & Industry Analysis Report

By Source, By Cell Type, By Indication, By Scale of Operation, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6118

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

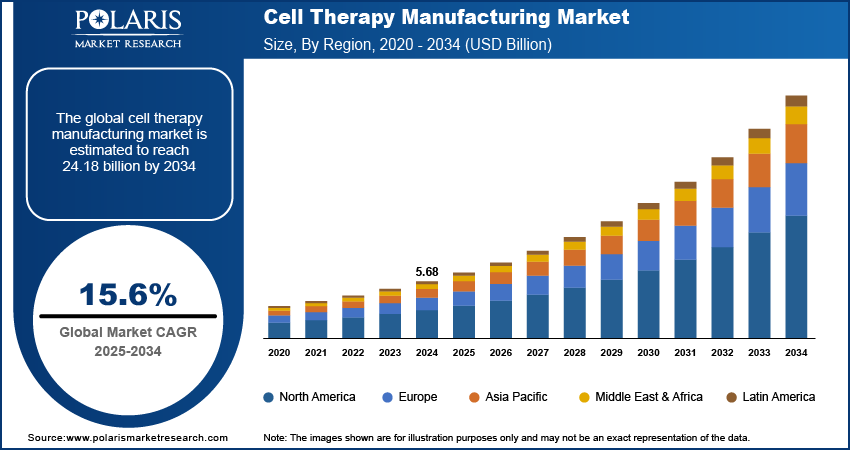

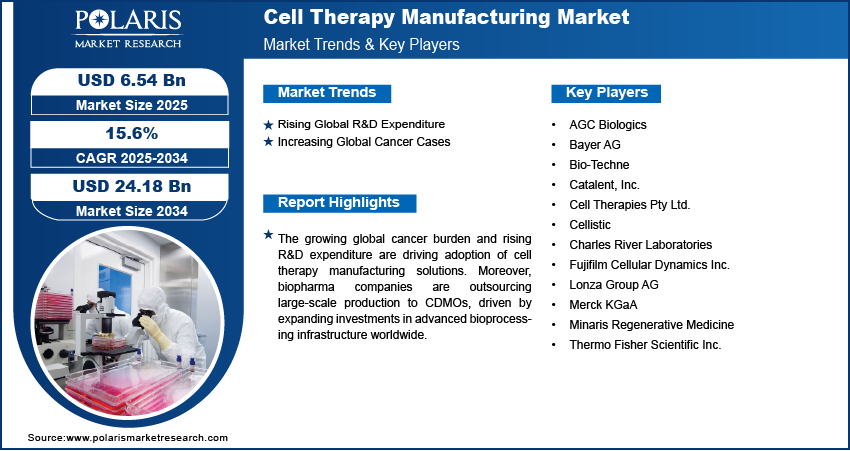

The global cell therapy manufacturing market size was valued at USD 5.68 billion in 2024, growing at a CAGR of 15.6% during 2025–2034. Rising global R&D expenditures and increasing cancer burden are fueling the growth of the cell therapy manufacturing market.

Key Insights

- The autologous cell therapy segment dominated the market share in 2024.

- The NK cell segment is projected to grow at a rapid pace in the coming years, driven by its increasing application in cancer immunotherapy and ability to provide targeted cytotoxic activity with minimal adverse effects.

- The North America cell therapy manufacturing market dominated the global market share in 2024.

- The US cell therapy manufacturing market is growing due to rising cancer burden and robust biopharmaceutical development pipelines.

- The Asia Pacific market is projected to grow at the highest CAGR from 2025–2034, fueled by rapid advancements in biotechnology and significant expansion of the regional biotech sector.

- Countries such as China and Japan are contributing significantly to regional growth, owing to expanding biomanufacturing infrastructure and increasing strategic collaborations with global pharmaceutical companies.

Industry Dynamics

- The rising global R&D expenditures is fueling market growth due to accelerated innovations in cell therapy manufacturing and advancements in process optimization.

- Increasing global cancer burden is driving demand for cell therapy manufacturing due to growing adoption of cell-based immunotherapies for oncology treatments.

- The adoption of automation and AI-driven manufacturing is creating significant opportunities to enhance production efficiency, improve process consistency, and reduce operational timelines in the cell therapy manufacturing market.

- The high manufacturing costs limit the scalability of production and restrict adoption among smaller biotech firms, posing a challenge to the overall growth of the cell therapy manufacturing market.

Market Statistics

- 2024 Market Size: USD 5.68 billion

- 2034 Projected Market Size: USD 24.18 billion

- CAGR (2025-2034): 15.6%

- North America: Largest market in 2024

Cell therapy manufacturing refers to the production of therapeutic cell-based products used to repair, replace, or regenerate damaged tissues and treat various diseases. These therapies include autologous and allogeneic cell treatments applied in oncology, cardiovascular disorders, orthopedic injuries, and autoimmune diseases. The manufacturing process involves cell isolation, genetic modification, expansion, and cryopreservation to produce clinically viable and functional cells that meet therapeutic standards. Cell therapy products are delivered through hospitals, specialized clinics, and research centers under carefully monitored clinical protocols to ensure patient safety and treatment effectiveness. The market is expanding as healthcare providers and biopharmaceutical companies increase investments in personalized and regenerative therapies to address unmet medical needs across multiple therapeutic areas.

The global rise in chronic illnesses is driving the cell therapy manufacturing market due to increasing demand for advanced cell-based therapies and biologics to manage complex diseases. Growing cases of autoimmune disorders and cardiovascular conditions are pushing pharmaceutical and biotechnology companies to expand manufacturing capabilities for regenerative and immunotherapy-based treatments. According to the US Department of Health and Human Services, around 129 million people in the US live with at least one major chronic disease, while Eurostat 2023 reports that 50.6% of Finland’s and 43.2% of Germany’s populations suffer from chronic illnesses. This growing patient pool is driving investment in optimized manufacturing platforms to ensure reliable supply of innovative therapies.

Technological advancements in cell processing and bioprocessing are driving the cell therapy manufacturing market due to improved production efficiency, higher cell viability, and reduced manufacturing costs. Automation, closed-system bioreactors, and real-time monitoring tools are enabling large-scale production of CAR T-cell therapies and other advanced cell-based treatments. These innovations are helping pharmaceutical and biotechnology companies shorten production timelines, enhance product consistency, and accelerate commercialization of next-generation therapies, boosting market growth.

Drivers & Opportunities

Rising Global R&D Spending: The increase in global R&D spending is boosting the cell therapy manufacturing market due to growing investment in regenerative medicine, CAR T-cell therapies, and gene-modified treatments. Higher funding for clinical trials and process innovation is enabling the pharmaceutical and biotechnology companies to expand scalable and automated manufacturing systems to meet rising therapeutic demand. According to the World Intellectual Property Organization (WIPO), global R&D expenditure rose from 2.39% of GDP in 2020 to 2.75% in 2023, highlighting a strong push toward advanced therapy development and commercial-scale production.

Increasing Global Cancer Cases: The surge in global cancer cases is driving demand in the cell therapy manufacturing market due to the growing shift toward advanced cell-based treatments, including CAR T-cell and gene-modified therapies. According to the World Health Organization (WHO), about 20 million new cancer cases and 9.7 million deaths were reported in 2022, with new cases projected to exceed 35 million by 2050, a 77% increase from 2022. This growing cancer burden is accelerating investment in scalable manufacturing technologies to meet rising therapeutic demand and support faster commercialization of innovative oncology treatments.

Segmental Insights

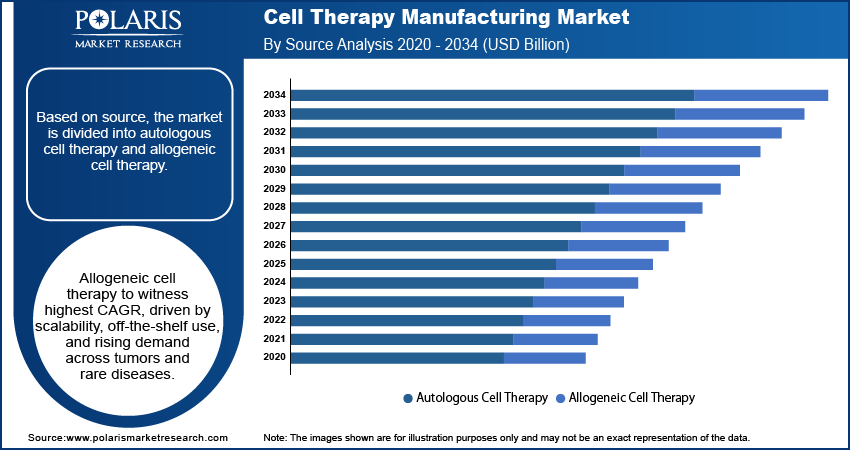

Source Analysis

Based on source, the segmentation includes autologous cell therapy and allogeneic cell therapy. The autologous cell therapy segment held the dominant market share in 2024, primarily due to its established use in CAR-T therapies and personalized oncology treatments. Patient-derived cells reduce the risk of immune rejection and remain the preferred approach in relapsed or refractory hematologic malignancies. Increasing approvals of autologous CAR-T products and expanding manufacturing capabilities are further consolidating the segment’s leadership.

The allogeneic cell therapy segment is projected to expand at the fastest CAGR through 2034, driven by its scalability and off-the-shelf availability. Allogeneic platforms are making progress for treating solid tumors, autoimmune disorders, and rare genetic diseases by enabling scalable off-the-shelf cell therapies that reduce manufacturing time and improve treatment accessibility. For instance, in June 2023, Allogene Therapeutics announced positive Phase II data for its ALLO-501A allogeneic CAR-T therapy in large B-cell lymphoma, demonstrating favorable safety and promising efficacy for off-the-shelf treatment candidates. Moreover, advancements in gene editing and cryopreservation technologies are expected to support large-scale commercial production over the coming years.

Cell Type Analysis

In terms of cell type, the segmentation includes T-cells, stem cells, natural killer (NK) cells, dendritic cells, and others. The T-cell segment dominated the market in 2024 due to the established clinical success of CAR-T therapies in treating hematologic cancers. T-cell-based therapies are backed by strong clinical pipelines, with multiple trials evaluating next-generation CAR constructs, armored T-cells, and T-cell receptor (TCR)-engineered therapies. The strategic collaborations between pharmaceutical companies and contract development and manufacturing organizations (CDMOs) are further boosting production capacity and process optimization for T-cell manufacturing.

The NK cell segment is anticipated to grow steadily through 2034, driven by its unique tumor-targeting capabilities and reduced risk of graft-versus-host disease. The development of engineered NK cells and combination regimens with monoclonal antibodies is broadening its applications in hematologic and solid tumors.

Indication Analysis

Based on indication, the segmentation includes oncology, cardiovascular diseases, neurological disorders, orthopedic & musculoskeletal disorders, autoimmune diseases, and others. The oncology segment held the largest market share in 2024, driven by the growing clinical adoption of CAR-T and tumor-infiltrating lymphocyte (TIL) therapies. These therapies demonstrate high efficacy in hematologic malignancies such as leukemia and lymphoma, and continuous trials are exploring its potential in solid tumors. The expanding regulatory approvals, coupled with favorable reimbursement policies in developed markets, are fueling broader patient access to oncology-focused cell therapies.

The neurological disorders segment is expected to expand at a notable pace through 2034, fueled by emerging research on stem cell therapies for neurodegenerative conditions such as parkinson’s and amyotrophic lateral sclerosis (ALS). Moreover, increasing investments in regenerative medicine and early clinical success in restoring neural function that is contributing to this growth.

Scale of Operation Analysis

In terms of scale of operation, the segmentation includes clinical, commercial, and pre-clinical. The clinical segment dominated the market in 2024, owing to the increasing demand for biologics, biosimilars, and advanced vaccines. Stable and high-yield cell lines are essential for large-scale manufacturing, with CHO and HEK293 cells serving as the primary production platforms. Continuous bioprocessing, coupled with advanced screening technologies, is further enhancing productivity and reducing development timelines for new biologics.

The commercial segment is projected to grow at the fastest rate through 2034, driven by the increasing number of approved cell therapies and the need for large-scale production. The adoption of automated bioreactor systems, closed processing technologies, and advanced quality control analytics is enabling efficient large-batch manufacturing. Additionally, establishment of GMP-certified facilities and long-term manufacturing partnerships between biotech firms and CDMOs are further accelerating this shift toward commercial-scale operations.

End User Analysis

The end user segmentation includes hospitals & specialty clinics, pharmaceutical & biotechnology companies, and academic & research institutes. The pharmaceutical & biotechnology companies segment dominated the market in 2024 due to substantial investments in R&D and manufacturing infrastructure. The strategic alliances with CDMOs, technology licensing agreements, and acquisitions are helping the companies expand their cell therapy portfolios and accelerate commercialization timelines.

The academic & research institutes segment is projected to grow at the fastest rate through 2034, driven by increasing government funding for regenerative medicine research and collaborative programs focused on novel cell therapies. These institutes serve as innovation hubs, contributing to the development of next-generation autologous and allogeneic platforms.

Regional Analysis

The North America cell therapy manufacturing industry dominated the global market share in 2024, driven by the rising cancer burden and increasing adoption of cell-based oncology treatments. The continuous advancements in manufacturing protocols is enabling faster delivery to treatment centers and improving patient access to innovative oncology care across the region. Additionally, expanding investment in CAR T-cell and stem cell therapy manufacturing is boosting the region’s production capacity to meet clinical and commercial demand.

The US Cell Therapy Manufacturing Market Insight

The US cell therapy manufacturing market is driven by the growing cancer burden and increasing adoption of advanced cell-based treatments for oncology. Rising demand for personalized therapies, including CAR T-cell and stem cell-based treatments, is boosting pharmaceutical and biotechnology companies to invest in scalable and automated manufacturing platforms. According to the American Cancer Society (ACS), the total 2.04 million new cancer cases are reported in 2025, while cancer-related deaths are reaching 0.61 million in the US. This surge in cancer incidence is accelerating investment in specialized cell therapy manufacturing to ensure consistent supply and support faster commercialization of innovative therapies.

Asia Pacific Cell Therapy Manufacturing Market

Asia Pacific cell therapy manufacturing industry is projected to grow significantly by 2034. This is driven by the rapid growth of the biotechnology sector and increasing investment in regenerative medicine. Countries such as China, Japan, and South Korea are expanding stem cell research and gene-modified therapy programs, driving greater reliance on advanced manufacturing technologies to meet clinical and commercial requirements.

India Cell Therapy Manufacturing Market Insight

Growth of the biotechnology sector is driving the cell therapy manufacturing market by increasing investment in regenerative medicine, stem cell research, and gene-modified therapies. The biotech companies are investing in innovative manufacturing technologies and automated platforms to improve scalability, reduce production costs, and meet growing clinical requirements. According to the Department of Biotechnology–Biotechnology Industry Research Assistance Council (DBT-BIRAC) of India, the biotechnology industry was valued at USD 44 billion in 2017 and is projected to reach USD 300 billion by 2030, reflecting a CAGR of over 15.8%. This growth is boosting demand for efficient and large-scale cell therapy manufacturing capabilities to support commercial supply and accelerate therapy approvals.

Europe Cell Therapy Manufacturing Market Overview

Increasing R&D expenditure in Europe is driving the cell therapy manufacturing market by accelerating research in regenerative medicine, gene-modified cell therapies, and advanced therapeutic development. Pharmaceutical and biotechnology companies are investing in innovative manufacturing platforms to enhance production efficiency and scale up clinical and commercial supply. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), research and development (R&D) spending rose significantly from USD 20.4 million in 2020 to USD 54.1 million in 2023. This rise in investment is firming manufacturing infrastructure and boosting demand for specialized cell therapy production services across the region.

Key Players & Competitive Analysis Report

The cell therapy manufacturing market is highly competitive, with prominent players such as Lonza Group AG, Minaris Regenerative Medicine, Merck KGaA, Thermo Fisher Scientific Inc., Catalent, Inc., Charles River Laboratories, Fujifilm Cellular Dynamics Inc., and AGC Biologics. These companies focus on optimizing cell expansion, improving cryopreservation techniques, and adopting closed and automated systems to meet the rising demand for autologous and allogeneic cell therapies. The competitive dynamics are further influenced by strategic partnerships and long-term manufacturing agreements with biotech firms to accelerate clinical development and commercial supply.

Key companies in the industry include Lonza Group AG, Minaris Regenerative Medicine, Merck KGaA, Thermo Fisher Scientific Inc., Catalent, Inc., Charles River Laboratories, Cell Therapies Pty Ltd., Fujifilm Cellular Dynamics Inc., Bayer AG, AGC Biologics, Cellistic, and Bio-Techne.

Key Players

-

- AGC Biologics

- Bayer AG

- Bio-Techne

- Catalent, Inc.

- Cell Therapies Pty Ltd.

- Cellistic

- Charles River Laboratories

- Fujifilm Cellular Dynamics Inc.

- Lonza Group AG

- Merck KGaA

- Minaris Regenerative Medicine

- Thermo Fisher Scientific Inc.

Industry Developments

May 2025: Altaris acquired Minaris Regenerative Medicine and the US and U.K. operations of WuXi Advanced Therapies, merging them to establish Minaris Advanced Therapies, a global contract development and manufacturing organization (CDMO) and testing partner specializing in cell therapy.

December 2024: Thermo Fisher Scientific launched CTS Detachable Dynabeads CD4 and CTS Detachable Dynabeads CD8, expanding its next-generation platform for cell therapy development and manufacturing. These new products are designed to improve the isolation and activation of CD4+ and CD8+ T cells, helping achieve optimal cell quality and greater control over workflow for CAR-T and other cell therapies.

Cell Therapy Manufacturing Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Autologous Cell Therapy

- Allogeneic Cell Therapy

By Cell Type Outlook (Revenue, USD Billion, 2020–2034)

- T-Cells

- Stem Cells

- Natural Killer (NK) Cells

- Dendritic Cells

- Others

By Indication (Revenue, USD Billion, 2020–2034)

- Oncology

- Cardiovascular Diseases

- Neurological Disorders

- Orthopedic & Musculoskeletal Disorders

- Autoimmune Diseases

- Others

By Scale of Operation (Revenue, USD Billion, 2020–2034)

- Clinical

- Commercial

- Pre-clinical

By End User (Revenue, USD Billion, 2020–2034)

- Hospitals & Specialty Clinics

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cell Therapy Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.68 Billion |

|

Market Size in 2025 |

USD 6.54 Billion |

|

Revenue Forecast by 2034 |

USD 24.18 Billion |

|

CAGR |

15.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Cell Therapy Manufacturing Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.68 billion in 2024 and is projected to grow to USD 24.18 billion by 2034.

The global market is projected to register a CAGR of 15.6% during the forecast period.

North America dominated the market share in 2024 driven by the rising cancer burden, strong biopharmaceutical infrastructure, and increasing adoption of advanced cell therapy manufacturing technologies.

A few of the key players in the market are Lonza Group AG, Minaris Regenerative Medicine, Merck KGaA, Thermo Fisher Scientific Inc., Catalent, Inc., Charles River Laboratories, Cell Therapies Pty Ltd., Fujifilm Cellular Dynamics Inc., Bayer AG, AGC Biologics, Cellistic, and Bio-Techne.

The autologous cell therapy segment dominated the market share in 2024, due to its established use in CAR-T therapies and personalized oncology treatments, reducing the risk of immune rejection.

The NK cell segment is expected to witness the fastest growth during the forecast period, driven by its unique tumor-targeting capabilities, reduced graft-versus-host disease risk, and expanding applications in solid and hematologic cancers.