Cellular Concrete Market Size, Share, Trends, & Industry Analysis Report

: By Product (Aerated Concrete and Foam Concrete), End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 120

- Format: PDF

- Report ID: PM5809

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

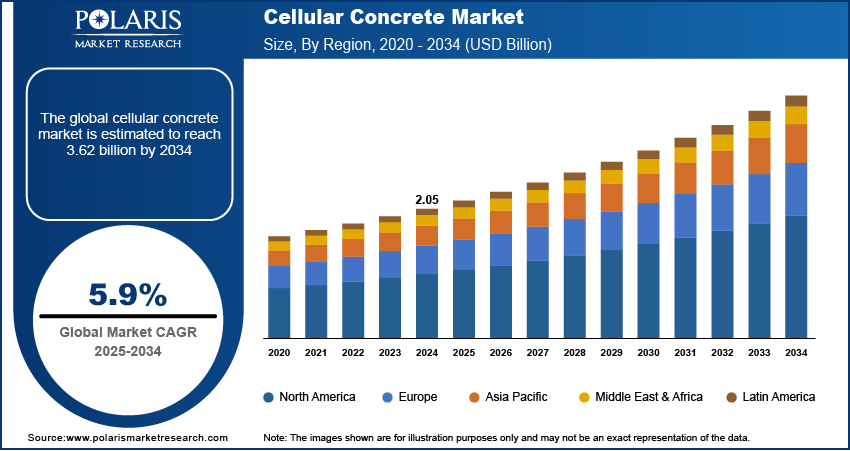

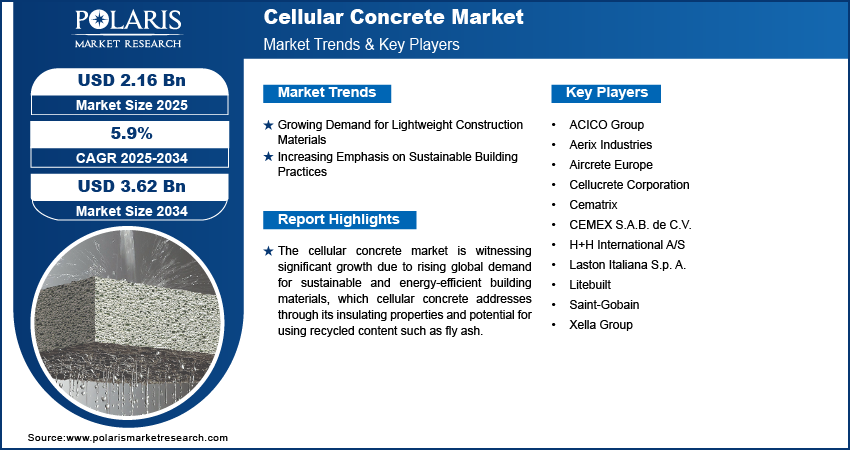

The global cellular concrete market size was valued at USD 2.05 billion in 2024 and is anticipated to register a CAGR of 5.9% from 2025 to 2034. The cellular concrete industry is mainly driven by the increasing global demand for lightweight construction materials, which reduce structural load and transportation costs.

The cellular concrete market focuses on producing and using a lightweight concrete mixture made from cement, water, and preformed foam. The mixture creates a material with stable air voids, resulting in a porous and lighter product upon curing, suitable for various construction and geotechnical applications.

The increasing focus on sustainable building practices propels the adoption of cellular concrete. As environmental concerns grow, there is a strong demand for construction materials that minimize ecological impact. Cellular concrete fits this need due to its energy-efficient properties and the ability to incorporate industrial byproducts such as fly ash, which supports circular economy initiatives. This sustainability aspect makes it a preferred choice for green building projects.

Another significant driver boosting the demand for cellular concrete is the rapid global urbanization and infrastructure development. As populations expand and cities grow, there is a constant need for efficient, durable, and cost-effective building solutions. Cellular concrete, being lightweight and easy to handle, significantly reduces dead loads on structures and can speed up construction, making it ideal for high-rise buildings, bridges, and void filling in large-scale infrastructure projects. For example, the World Health Organization (WHO) highlighted the critical need for resilient infrastructure in urban areas, often involving innovative materials that can withstand environmental stresses and facilitate rapid development. This emphasize the growing relevance of cellular concrete, known for its lightweight, durable, and thermally efficient properties, in modern construction practices.

Industry Dynamics

Growing Demand for Lightweight Construction Materials

The increasing global need for lightweight construction materials is a major factor driving the industry growth. As urban areas expand and construction projects become more complex, there is a rising demand for construction materials that can reduce structural weight, lower transportation costs, and facilitate faster construction. Cellular concrete offers significant advantages with its low density, allowing for lighter building structures and less demanding foundations. This makes it an attractive option for new builds and renovation projects, especially in high-rise constructions where reducing dead load is crucial for seismic performance and overall structural integrity.

A study published by the National Institute of Standards and Technology (NIST) titled "Lightweight Concrete Essentials" in 2025 found that the use of lightweight concrete in building construction can reduce structural loads by up to 30%. This significant weight reduction directly contributes to material savings, easier handling on job sites, and quicker project completion times. This widespread adoption of lightweight materials, including cellular concrete, directly drives the expansion of the cellular concrete market.

Increasing Emphasis on Sustainable Building Practices

Another significant driver is the growing global emphasis on sustainable building practices. Owing to the rising awareness of environmental impact and imposition of stringent regulations, there is a strong preference for construction materials that offer energy efficiency, reduce waste, and have a lower carbon footprint. Cellular concrete aligns well with these goals due to its thermal insulation properties, which can reduce energy consumption for building heating and cooling.

Ability of cellular concrete to incorporate industrial byproducts, such as fly ash, helps in waste utilization and promotes a circular economy. Thus, the material's strong thermal performance, directly contributing to energy savings and reduced building operational costs. Such environmental benefits and energy efficiency advantages continually boost the demand for cellular concrete.

Segmental Insights

By Product

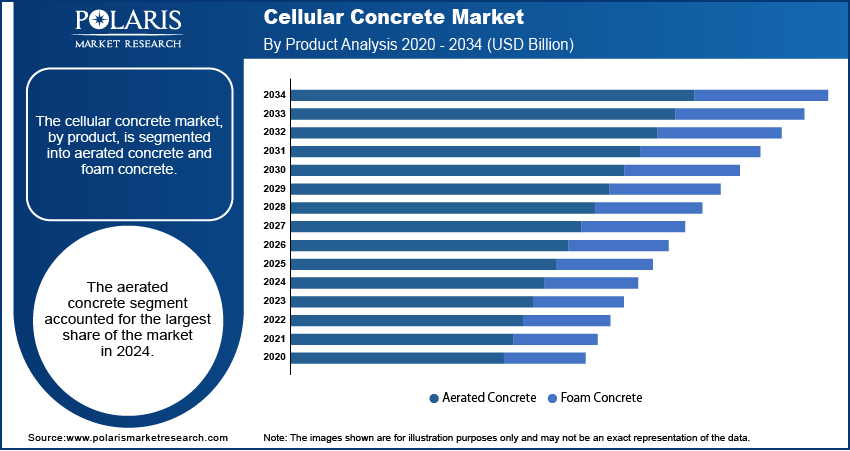

The aerated concrete segment held the largest market share in 2024. This dominance is largely attributed to its superior thermal insulation properties, lightweight nature, and energy efficiency, making it a highly preferred material for residential and commercial construction. Its manufacturing process often involves autoclaving, resulting in a consistent, high-quality product that meets stringent building codes. For instance, the National Institute of Standards and Technology (NIST) highlighted the use of aerated concrete in its ongoing research into high-performance building materials, noting its contribution to overall building energy savings. This widespread adoption across various building types significantly contributes to its leading position.

The foam concrete segment is anticipated to grow at the highest growth rate during the forecast period, primarily driven by its versatility and cost-effectiveness in diverse applications beyond traditional building blocks. Its ability to be produced on-site and poured into various forms makes it ideal for geotechnical applications such as void filling, trench backfilling, and road sub-bases. This adaptability, combined with its excellent flowability and self-leveling concrete properties, makes it highly suitable for large-scale infrastructure projects where speed and efficiency are crucial.

By End Use

The residential sector accounts for the largest share in 2024, due to the material's beneficial properties such as lightweight, thermal insulation, and soundproofing, which are highly valued in home construction. Cellular concrete blocks and panels contribute to energy-efficient homes by reducing heating and cooling costs, a significant factor for homeowners. The ongoing demand for affordable and sustainable housing solutions further solidifies the residential segment's leading position. For instance, the National Institutes of Health (NIH) has funded research into the health benefits of improved indoor environments, which can be supported by materials such as cellular concrete that offer better thermal and acoustic comfort.

The infrastructure segment is anticipated to register the highest growth rate during the forecast period. Extensive global investments in public infrastructure projects such as roads, bridges, tunnels, and large-scale void-filling operations drive this surge. Cellular concrete is highly favored in these applications due to its lightweight nature, which reduces ground pressure and simplifies handling on large construction sites. Its flowability and ability to efficiently fill irregular voids make it ideal for geotechnical stabilization.

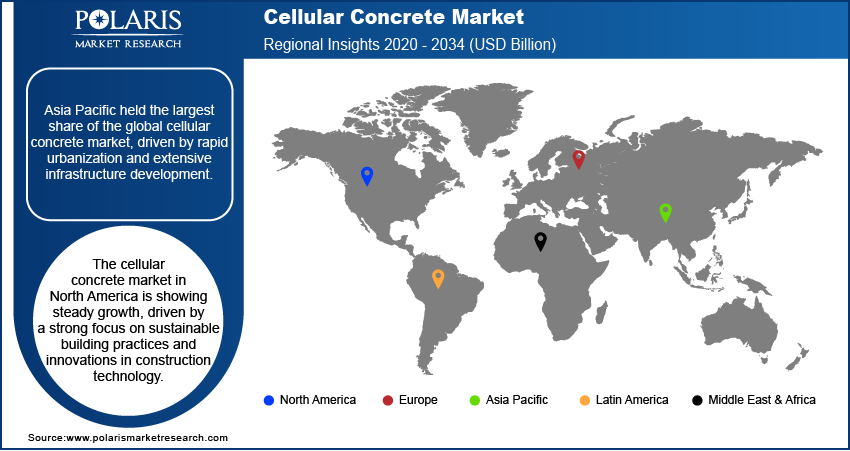

Regional Analysis

The Asia Pacific cellular concrete market held the largest share in 2024 and is experiencing significant expansion, primarily due to rapid urbanization, robust industrialization, and extensive infrastructure development across its diverse economies. Countries in this region are undertaking massive construction projects to accommodate growing populations and support economic growth, leading to a high demand for efficient and lightweight building materials. The increasing focus on modern construction techniques and the need for faster project completion times also contribute to the rising adoption of cellular concrete across the region. The China cellular concrete market held a major share in Asia Pacific in 2024, with its vast construction activities and a growing emphasis on green building solutions, pushing the use of cellular concrete in residential and large-scale public works.

North America Cellular Concrete Market Insight

The cellular concrete market in North America is showing steady growth, driven by a strong focus on sustainable building practices and innovations in construction technology. The region benefits from increasing investments in residential and infrastructure projects, where lightweight and insulating materials are highly valued. There is a growing awareness of the environmental benefits of cellular concrete, which aligns with various green building certifications and energy efficiency mandates across the continent. This shift toward more environmentally friendly construction methods is significantly influencing the demand trends in North America.

US Cellular Concrete Market Insight

The US is a prominent contributor to the cellular concrete market in North America. The country's demand is fueled by ongoing urban development, a push for resilient infrastructure, and a strong emphasis on energy conservation in building construction. Adopting advanced construction techniques, including prefabrication using cellular concrete panels, is becoming more widespread to improve efficiency and reduce construction timelines. Federal and state initiatives promoting energy-efficient homes and public works also play a crucial role in shaping the demand for cellular concrete across the US.

Europe Cellular Concrete Market

The imposition of stringent environmental regulations and a widespread commitment to sustainable development drive the Europe cellular concrete market expansion. Countries across the region are actively adopting low-carbon and energy-efficient materials for new builds and renovation projects. Government-backed energy efficiency mandates and a strong prevalence of green certification programs encourage the use of advanced, eco-friendly materials such as cellular concrete. The continuous need to renovate older urban infrastructure and historical buildings supports the consistent demand for cellular concrete solutions in Europe. The Germany cellular concrete market is showing notable development, largely due to its advanced construction sector and a proactive approach to sustainable building. Germany has implemented strict energy efficiency standards for buildings, favoring high-performance insulating materials such as cellular concrete. The country's strong research and development in construction materials also contributes to the continued innovation and adoption of cellular concrete in various applications, from residential housing to specialized infrastructure projects.

Key Players and Competitive Insights

The cellular concrete industry features a diverse, competitive landscape, with established players and newer entrants vying for market share. Companies in this space differentiate themselves through product innovation, production efficiency, and tailored solutions for specific applications. The focus is increasingly on developing sustainable, high-performance cellular concrete products to meet evolving construction demands and environmental regulations. Strategic partnerships and geographical expansion are common tactics to enhance market presence and capture emerging opportunities.

A few prominent companies in the industry include Xella Group, H+H International A/S, Saint-Gobain, CEMEX S.A.B. de C.V., Aerix Industries, Cematrix, Aircrete Europe, Litebuilt (Pan Pacific Management Resources Pty. Ltd.), ACICO Group, Cellucrete Corporation, and Laston Italiana S.p. A.

Key Players

- ACICO Group

- Aerix Industries

- Aircrete Europe

- Cellucrete Corporation

- Cematrix

- CEMEX S.A.B. de C.V.

- H+H International A/S

- Laston Italiana S.p. A.

- Litebuilt (Pan Pacific Management Resources Pty. Ltd.)

- Saint-Gobain

- Xella Group

Industry Development

April 2025: Aerix Industries launched Aerlite-iX 2.0, an updated foaming agent designed for making lightweight cellular concrete. This new version creates more stable bubbles, which means it can be mixed with more fly ash and is easier to work with across different consistencies, making it useful for many building projects.

Cellular Concrete Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Aerated Concrete

- Foam Concrete

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

- Infrastructure

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Cellular Concrete Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.05 billion |

|

Market Size in 2025 |

USD 2.16 billion |

|

Revenue Forecast by 2034 |

USD 3.62 billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your countries, regions, and segmentation requirements. |

FAQ's

The global market size was valued at USD 2.05 billion in 2024 and is projected to grow to USD 3.62 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Xella Group, H+H International A/S, Saint-Gobain, CEMEX S.A.B. de C.V., Aerix Industries, Cematrix, Aircrete Europe, Litebuilt (Pan Pacific Management Resources Pty. Ltd.), ACICO Group, Cellucrete Corporation, and Laston Italiana S.p. A.

The aerated concrete segment accounted for the largest share of the market in 2024.

The foam concrete segment is expected to grow fastest during the forecast period.