Certificate Authority Market Share, Size, Trends, Industry Analysis Report

By Vertical (BFSI, Retail & eCommerce, Government & Defense, Healthcare & Life Sciences, IT & Telecom, Travel & Hospitality, Education, Others); By Certificate; By Services; By Organization Size; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 115

- Format: PDF

- Report ID: PM2328

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

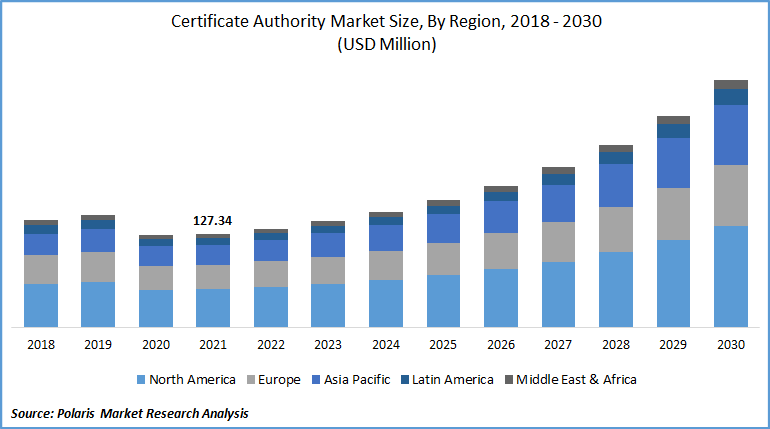

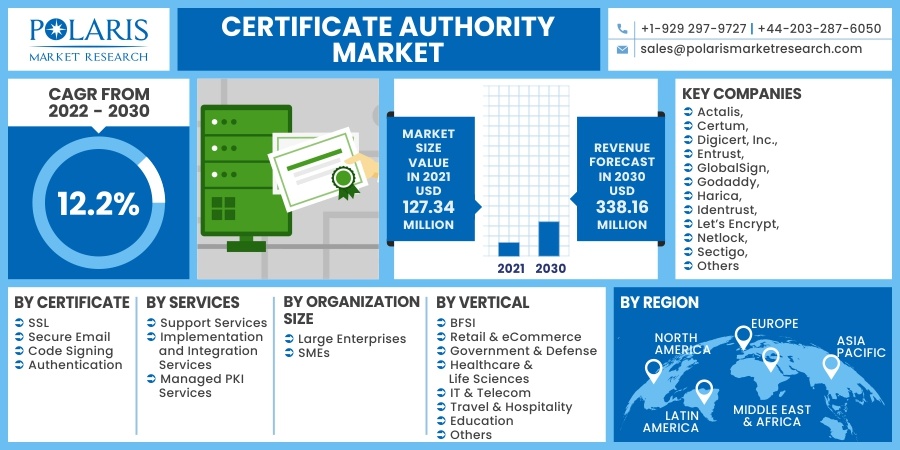

The global certificate authority market was valued at USD 127.34 million in 2021 and is expected to grow at a CAGR of 12.2% during the forecast period. The growing awareness among internet consumers regarding secure web access, the rise in adoption of IoT trends across various verticals, and the rising trust among the growing online consumer base are the most important aspects driving the certificate authority market's global expansion.

Know more about this report: request for sample pages

Other factors driving the certification authority market growth include expanding e-commerce enterprises, rising digitalization rates in the banking, financial services, and insurance (BFSI) industry, increased use of online documents, and rising security requirements. Also, in September 2021, Sectigo has signed a collaboration with Thomas Peer, an Australia and New Zealand (ANZ)-based IT services and management consulting organization. Sectigo's chosen ANZ partner is the Melbourne-based service.

Sectigo's authentication system and automated certification product lifecycle solution, Sectigo Certificate Manager, will be included in the array of solutions offered to Thomas Peers clients due to this new collaboration. Thus, these types of initiatives boost certification authority market growth during the forecast period. Moreover, the rapid rise in the adoption of IoT trends across various verticals boosts market growth during the forecast period. Global enterprises are paying closer attention to the influence of new applications, such as IoT, on digital certifications. Almost every industrial segment has benefited from the Internet of Things.

Businesses are more preoccupied with the timely release of new items to the market than properly implementing security procedures. It raises cyber threats to the overall security of IoT devices. More breaches are occurring than ever before, and attackers employ advanced tactics to carry them out. IoT devices are primarily utilized in Distributed Denial of Service (DDoS) attacks since they are network-connected and pose additional vulnerabilities due to poor password-only requirements.

PKI has shown to be a highly secure and adaptable solution for securing and managing the whole life cycle of connected devices in an IoT environment. However, running a private certification authority or using self-signed documents are restraining the certificate authority market growth during the forecast period.

Self-signed documents can provide the same level of encryption as certifications certified by a trustworthy authority. The document cannot be canceled like a trusted certification, and it may result in an attack on visitors' connection. If a user accepts a self-signed certification, a hacker could monitor all traffic or attempt to set up a fake server to elicit further information from the user.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The major players in the certificate authority market are developing different certificate types and launching various services for securely storing the digital document in the applications, propelling the certification authority market growth during the forecast period. For instance, in August 2021, the Google Cloud Certificate Authority Service (CAS) was a flexible service that automated the management and deployment of private documents and public key infrastructure (PKI). Google launched the company's general availability (GA).

In August that year, the business released a public preview of its cloud-based CAS, allowing users to create digital documents for existing access control. Since then, multiple users have been using the service for various purposes, including identity management and the creation of digital signature services. In addition, Keyfactor, Jetstack, and Small step have entered the CAS collaboration program, joining previous partners Venafi and AppViewx.

Further, in August 2021, Sectigo announced the Sectigo Secure Solution Storage SDK (SKS-SDK) expansion to its portfolio of market-leading services. Secure key management is a software-based repository that maintains, seals, and saves encryption keys, passwords, and other private information efficiently and cost-effectively. It eliminates the risk of disclosing the passwords of devices that lack hardware-based encryption password storage solutions, such as a Trusted Platform Module (TPM).

Also, in April 2021, DigiCert Automation Manager, a container-based corporate solution for on-premises, high-volume TLS certificate authority automation, was announced. DigiCert Automation Manager is designed with a cloud-native design in mind. The Automation Manager lays the path for secure and comprehensive document management while behind network and on-premises to supplement DigiCert's current cloud architecture. Additionally, in May 2021, DigiCert, Inc., the country's leading supplier of TLS/SSL, IoT, and other PKI technologies, disclosed that the Telecom Infra Project (TIP) had chosen it to provide global PKI-based security apparatus for TIP's OpenWiFi platform.

The DigiCert IoT Device Manager, based on the DigiCert ONE platform, would provide scalability completely automated digital certificate authority administration to help OpenWiFi achieve its aim of increasing next-generation Wi-Fi availability. Thus, the launches of cloud platforms and open wifi platforms for securing digital certificates properly and launches of security platforms are boosting the certification authority market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on certificate, services, organization size, vertical, and region.

|

By Certificate |

By Services |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Vertical

BFSI segment is expected to be the most significant revenue contributor in the global certification authority market. Since it deals with enormous amounts of confidential and valuable financial data, BFSI is the most developed relevant vertical. This business vertical's firms are looking for a certificate authority solution. Furthermore, the BFSI industry vertical is the most regulated, as it must meet numerous security criteria. There are stringent data security regulations because of the sensitive and confidential data that BFSI industries deal with.

Geographic Overview

North America had the largest share. The primary market growth drivers are important certificate authority traders, investments and developments, a stringent regulatory environment, and highly technological adoption rates. Europe and the United States have enacted rigorous security measures. The Australian government, which recently unveiled the Essential Eight Maturity Model, implies that they might follow suit immediately.

Until the laws are issued, security experts propose establishing security measures such as the National Institute of Standards and Technology (NIST) and ISO 27001, including public key infrastructure (PKI) and certificate authority management. North America is one of the country’s most vulnerable to cyberattacks, particularly identity theft. As a consequence, it has the most certificate authority, suppliers.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market in 2021. This would be mostly owing to an increase in the number of online enterprises, rapid digitalization, and widespread adoption of the internet of things (IoT). Chinese mobile providers are the world's leaders in integrating transformational IoT solutions. The Asia Pacific market is growing due to increased malware and file-based attacks, increased concerns about the loss of important data, a surge in the use of IoT and cloud trends, and stringent obligatory regulations and compliances.

Competitive Insight

Some of the major players operating in the global market include Actalis, Certum, Digicert, Inc., Entrust, GlobalSign, Godaddy, Harica, Identrust, Let’s Encrypt, Netlock, Sectigo, SSL.Com, SwissSign, Trustwave, and Wisekey.

Certificate Authority Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 127.34 million |

|

Revenue forecast in 2030 |

USD 338.16 million |

|

CAGR |

12.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Certificate, By Services, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Actalis, Certum, Digicert, Inc., Entrust, GlobalSign, Godaddy, Harica, Identrust, Let’s Encrypt, Netlock, Sectigo, SSL.Com, SwissSign, Trustwave, and Wisekey. |