Chicken Coop Market Share, Size, Trends, Industry Analysis Report

By Product Type (Wooden Coops and Wire Mesh Coops); By Sales Channel; By Region; Segment Forecast, 2023- 2032

- Published Date:Jul-2023

- Pages: 115

- Format: PDF

- Report ID: PM3628

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

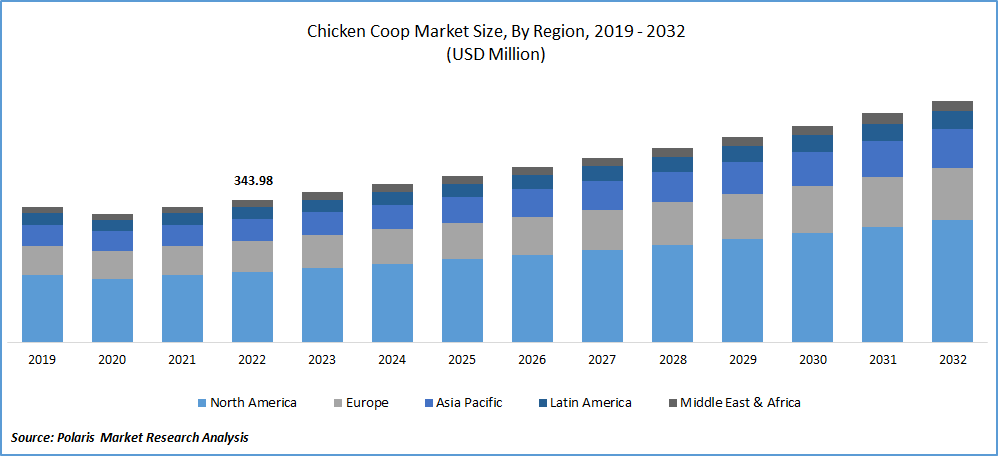

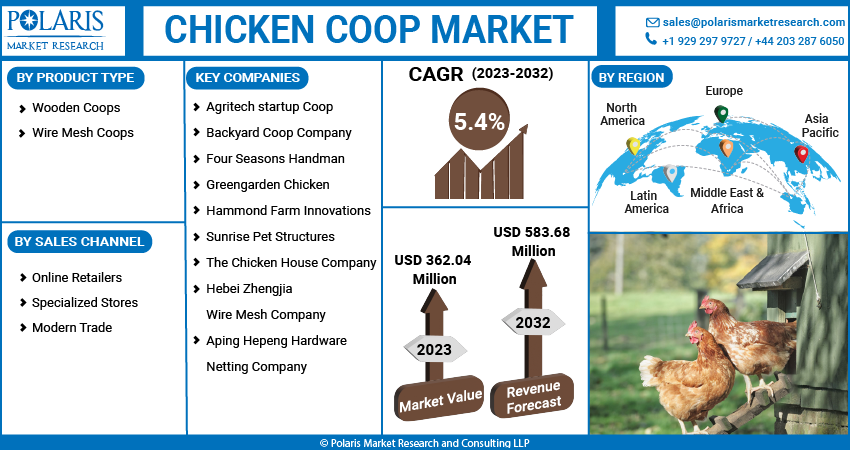

The global chicken coop market was valued at USD 343.98 million in 2022 and is expected to grow at a CAGR of 5.4% during the forecast period. A chicken coop is designed to house and safeguard hens from danger and severe weather.

The chicken coop's main functions are to prevent poultry deaths and provide minimal heat supply and ventilation. A nest box for laying eggs within the hen house and perches for sleeping make up a chicken coop. A chicken house effectively reduces disease-causing infections and keeps predators away from the birds. The chicken coop industry has soared the cost of keeping hens in the home. As a result, there is a greater need for chicken coops. A chicken coop is necessary because it protects female chickens from skin illnesses and health concerns.

To Understand More About this Research: Request a Free Sample Report

The market offers a huge range of goods, and the demand for these goods is rising globally, significantly boosting the industry. This business is also driven by social media, which promotes the idea of smaller poultry farms, pushing the chicken coop market. Chicken coops are affordable and accessible to poultry farm owners owing to various sales channels. The need for chicken coops is expanding as a result of the fact that chicken coop products are becoming more popular in both developed and developing countries.

Furthermore, the rising adoption of advanced technology, such as IoT in chicken coops, provides various benefits for the chicken, driving the market's growth over the forecast period. Keeping the temperature in the coops where the chickens live requires frequent visits, but as technology advances, many are turning to the Internet of Things (IoT) system. The Internet of Things (IoT) allows specific objects to transfer data over a network without human intervention. IoT is used in a harmful gas monitoring system in chicken coops. The environment and air quality have a big impact on chicken health.

In addition, ammonia produced by chicken dung is the main contaminant of the air in the chicken coop. Temperature and humidity are other environmental factors that impact chicken health. The issue small-scale chicken producers face is the deteriorating health of hens, which results in death from poor air and environmental quality. Therefore, adopting advanced technology in chicken coops is driving the market's growth over the forecast period. However, the only obstacle to the chicken coop market's expansion is the need for more products in some places, which could present some challenges to the market's growth.

Manufacturers and retailers of chicken-related goods reported record sales during the Covid-19 outbreak. There may be several causes, including concerns about supply chain problems. Additionally, there were periodic shortages of certain foods and personal necessities during the pandemic. Naturally, some individuals tried to increase their independence.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Proprietors of poultry farms want higher-quality aviary facilities for housing their birds. The international market has a growing demand for this small chicken shelter trend to produce the most eggs. The market is anticipated to grow in the future years as the number of small poultry farms increases globally.

According to the Indian government data published, the 20th Livestock Census estimates that India has 851.8 million poultry birds. 'Backyard poultry' account for about 30% (or 250 million) of this total. The 19th Livestock Census estimates around 30 million such producers worldwide. Poultry farms raise chickens, ducks, geese, and other animals for their meat & eggs. 'Laying hens' or 'layers' are the names of chickens raised solely for their eggs. "Broilers" are those raised for meat.

Also, Tamil Nadu (120 Mn), Telangana (79 Mn), Maharashtra (74 Mn), Karnataka (59 Mn), Andhra Pradesh (107 Mn), West Bengal (77 Mn), Assam (46 Mn), and Kerala (29 Mn) have the highest poultry populations, as per the 20th Livestock Census in 2020. In addition, small- and medium-sized chicken farm owners will need to make arrangements for manure. Water from a chicken farm must be collected in a tank after usage. The recommendations advise applying it to horticulture. Therefore, the rising demand for smaller poultry and guidance for this is driving the chicken coop market growth over the forecast period.

Report Segmentation

The market is primarily segmented based on product type, sales channel, and region.

|

By Product Type |

By Sales Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Online retailers segment is expected to witness the fastest growth during forecast period

Online shopping is taking a large share across the World. People are mostly habitual in purchasing everything online, and nowadays, they also buy chicken coops online due to the benefits offered by online channels. A person may save a lot of time and money by purchasing a chicken coop online. They can contrast several chicken coops and read reviews left by previous customers. Over 1,000 merchants and businesses sell chicken coops of every size and shape online. People want to study carefully because some require assembly, and some arrive pre-built. Individuals can find out if a seller or business is legitimate by reading customer reviews and researching them to see if they need to be aware of any red flags.

Also, the rising internet usage has increased the purchasing of everything online. Return and refund policies are also offered by the websites, making buying products easy. Discounts offered by online merchants compared to offline channels are higher, which is the major benefit of people purchasing chicken coops online. Various benefits bolster online shopping as the major factor boosting segmental growth.

Wire Mesh Coops segment accounted for the largest market share in 2022

The wire mesh chicken coops hold the largest segment due to their various benefits. Its key benefits are the strength, flexibility, and corrosion resistance of the chicken with wired mesh. Everyone can use it to keep foxes out of their chicken coop and stop birds from fleeing. It is a cost-effective option for fencing in tiny spaces. Galvanized steel wires are often placed in a hexagonal grid in a criss-cross pattern to create chicken wire mesh. Several mesh sizes and wire gauges will be employed depending on the required purpose.

Also, the type of use determines the thickness of a chicken wire mesh; generally, the thicker the mesh, the more long-lasting and robust it is. A thinner mesh might be preferable for applications and loads that are not as demanding. For long-term durability and outdoor use, the chicken wire mesh's finish needs to be corrosion, abrasion, and wear-resistant. To prevent rusting and weathering, consider various materials such as zinc- or powder-coated finishes. Individuals' investments will be protected and last for many years. Therefore, these benefits offered by wire mesh chicken coops boost the market growth over the forecast period.

The demand in North America is expected to witness significant growth during forecast period

The demand for chicken coops is high all around the world. Due to North America's small number of chicken coop producers, the region is expected to experience significant expansion over the coming years. Sales have increased due to the care laws and regulations, which have ultimately helped the chicken coop market flourish. The market for small and medium-sized chicken coop makers is quite fragmented, and this region is home to many. But as the market for premium chicken coops expands, competition is likely to heat up, with bigger producers and dealers possibly gaining market share. The demand for organic and locally obtained eggs is expected to increase, and technological developments like automatic feeders and waterers are also anticipated to impact the market for chicken coops in North America.

Furthermore, the Asia-Pacific region's chicken coop market is expanding as interest in domestic poultry farming rises. People are becoming aware of the advantages of keeping their hens, including having access to fresh eggs, knowing how the chickens are reared, and having the chance to engage in the entertaining and informative hobby of backyard chicken farming. Backyard chicken farming can also be considered a means to produce food locally and minimize the distance it travels to customers as more people grow interested in sustainable living and minimizing their environmental effects.

Competitive Insight

Some of the major players operating in the global market include Agritech startup Coop, Aping Hepeng Hardware Netting Company, Backyard Coop Company, Four Seasons Handman, Greengarden Chicken, Hammond Farm Innovations, Sunrise pet Structures, The Chicken House Company, and Hebei Zhengjia Wire Mesh Company.

Recent Developments

- In March 2023, a start-up from Austin called COOP and Bould Design offered a contemporary approach to poultry farming. The Coop, which combines form and function in the classic home form, lies at the nexus of architectural statement and useful functionality that aims to satiate even the most discriminating hens' wants and sensibilities. Both owners and chickens benefit from the comfort and convenience the Coop provides. Each component has been designed and integrated for simplicity and convenience, from building to use and maintenance, including feeding, watering, waste collection, and ventilation.

Chicken Coop Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 362.04 million |

|

Revenue Forecast in 2032 |

USD 583.68 million |

|

CAGR |

5.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Product Type, By Sales Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Agritech startup Coop, Aping Hepeng Hardware Netting Company, Backyard Coop Company, Four Seasons Handman, Greengarden Chicken, Hammond Farm Innovations, Sunrise Pet Structures, The Chicken House Company, and Hebei Zhengjia Wire Mesh Company |

FAQ's

The global Chicken Coop market size is expected to reach USD 583.68 million by 2032

key players in the market are Aping Hepeng Hardware Netting Company, Backyard Coop Company, Four Seasons Handman, Greengarden Chicken, Hammond Farm Innovations, Sunrise pet Structures, The Chicken House Company, and Hebei Zhengjia Wire Mesh Company.

North America contribute notably towards the global chicken coop market

The global Chicken Coop market is expected to grow at a CAGR of 5.4% during the forecast period

The chicken coop market report covering key segments are product type, sales channel, and region