Chillers Market Share, Size, Trends, Industry Analysis Report

By Product, By Application, By Compressor Type (Screw Chillers, Centrifugal Chillers, Absorption Chillers, Scroll Chillers, Reciprocating Chillers), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4794

- Base Year: 2023

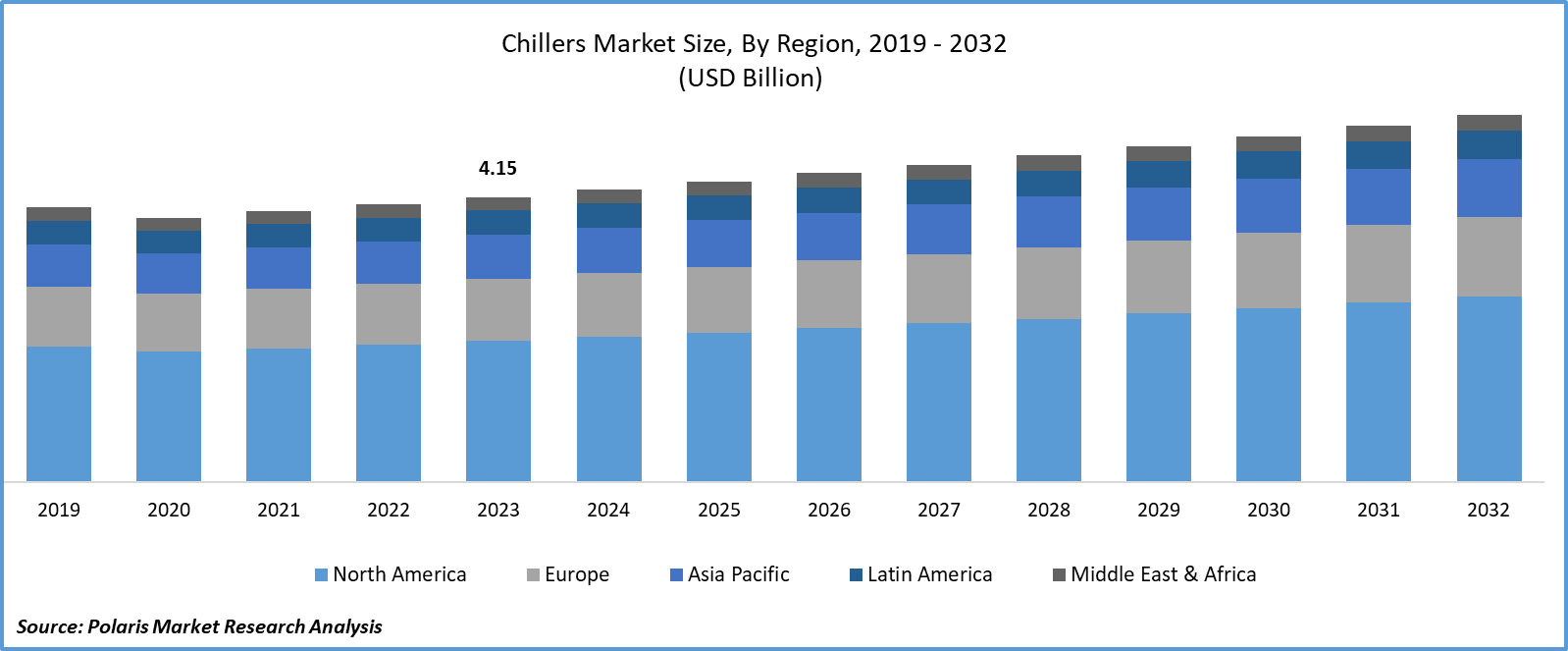

- Historical Data: 2019-2022

Report Outlook

Overview

The global chillers market size was valued at USD 10.28 billion in 2024, growing at a CAGR of 4.4% from 2025 to 2034. The exponential rise in global data traffic and cloud computing services is increasing demand for chillers to ensure thermal management of high-density servers, driving the adoption of energy-efficient cooling systems in hyperscale and enterprise data centers.

Key Insights

- The water-cooled chillers segment captured ~60% of the market share in 2024, driven by high energy efficiency, superior cooling performance, and long service life.

- The commercial segment held ~50% of the revenue share in 2024, due to widespread use in offices, malls, airports, and hospitality facilities.

- The market in North America is projected to grow significantly from 2025 to 2034, fueled by infrastructure upgrades in commercial buildings, hospitals, and data centers.

- The U.S. market is expected to register a CAGR of 5.0% from 2025 to 2034, driven by urban redevelopment and strict federal and state energy efficiency regulations.

- Asia Pacific held the largest share of ~46% in 2024, supported by rapid industrialization and infrastructure expansion in China, India, and Southeast Asia.

- The industry in China is expected to grow strongly from 2025 to 2034, driven by rising demand in electronics, chemicals, and automotive manufacturing.

- The Europe industry is growing steadily due to strict regulations promoting energy efficiency and carbon neutrality in the industrial and building sectors.

Industry Dynamics

- Rising demand for climate control in commercial buildings and data centers is driving the adoption of energy-efficient chiller systems worldwide.

- Stringent global regulations on refrigerants and energy efficiency are accelerating the shift toward low-GWP and high-performance chiller technologies.

- Integration of smart controls and IoT enables predictive maintenance and optimized cooling performance across industrial and commercial applications.

- High upfront costs and complexitly of retrofitting legacy systems limit faster adoption, especially in price-sensitive and developing markets.

Market Statistics

- 2024 Market Size: USD 10.28 billion

- 2034 Projected Market Size: USD 15.79 billion

- CAGR (2025–2034): 4.4%

- Asia Pacific: Largest market in 2024

AI Impact on Chillers Market

- AI algorithms help analyze IoT sensor data (temperature, pressure, and vibration) for the prediction of component failures in compressors, pumps, and heat exchangers. It reduces downtime, extends equipment lifespan, and lowers maintenance costs.

- AI systems adjust flow rates, chiller load, and operating parameters to reduce energy consumption.

- AI-enabled smart chillers can achieve higher energy efficiency than conventional systems.

- AI is used to integrate chillers with renewable energy sources and optimize refrigerant use, which aligns with carbon neutrality targets.

The chillers market refers to the industry focused on the design, production, and sale of cooling systems used to remove heat from a liquid via a vapor-compression or absorption refrigeration cycle. These systems are widely deployed in industrial operations, commercial buildings, healthcare, and data centers for process cooling, HVAC systems, and environmental control. Chillers are critical for maintaining temperature-sensitive environments and improving energy efficiency in infrastructure and manufacturing facilities. Growth in office buildings, shopping malls, hotels, and airports is driving large-scale adoption of centralized HVAC systems, propelling the demand for chillers to deliver consistent and reliable cooling in high-occupancy environments.

Implementation of global and national policies promoting energy conservation is prompting end users to replace legacy cooling systems with high-efficiency chillers that comply with green building codes and energy performance standards. Moreover, innovation in variable-speed drives, magnetic bearing compressors, and low-GWP refrigerants is boosting the performance and sustainability of chillers, making them more attractive for end users seeking cost-effective, future-ready cooling solutions.

Drivers & Opportunities

Rising Urbanization and Smart City Development: Rising urbanization is transforming how buildings and infrastructure are designed and managed. Growing smart city development projects are leading to increased demand for intelligent HVAC systems that adapt to changing loads and environmental conditions. In September 2023, the Department of Commerce, in conjunction with NOAA, allocated USD 12.7 million to propel the Climate-Smart Communities Initiative forward. Chillers play a crucial role in maintaining thermal comfort across commercial buildings, airports, shopping centers, and industrial facilities. The integration of IoT-enabled chillers into building automation systems allows real-time monitoring, predictive maintenance, and energy optimization, which supports sustainability goals and cost reduction. Smart cities require cooling systems that not only provide reliable performance but also align with digital infrastructure and energy management strategies, making advanced chillers a preferred choice.

Surging Demand from Data Centers: Surging demand for data centers is significantly boosting the need for high-performance cooling solutions. The rise in cloud computing, artificial intelligence workloads, and video streaming is driving the expansion of hyperscale and colocation facilities, where temperature control is critical to maintain server uptime and operational efficiency. In January 2025, AWS announced a strategic investment of about USD 11 billion to expand its infrastructure in Georgia, aimed at enhancing cloud computing and AI capabilities. Chillers are essential in managing the thermal loads generated by densely packed server racks. Operators are prioritizing energy-efficient and scalable chiller systems that can adapt to fluctuating IT loads while minimizing power consumption and operating costs. Innovations in liquid cooling and modular chiller systems are further supporting their deployment in modern data centers.

Segmental Insights

Product Analysis

Based on product, the segmentation includes water-cooled and air-cooled. The water-cooled segment dominated the market with ~60% of the revenue share in 2024, due to their high energy efficiency, superior heat rejection capability, and longer operational lifespan. These systems are preferred in large-scale commercial and industrial facilities where continuous, heavy-duty cooling is essential. The ability to connect with cooling towers enables better temperature control and system optimization. Their low noise output and higher cooling capacity make them more suitable for sensitive environments such as hospitals, data centers, and high-rise buildings. Preference for long-term operational stability in mission-critical applications has reinforced the dominance of water-cooled chillers in the product category.

The air-cooled segment is expected to register highest CAGR from 2025 to 2034, driven by increasing demand for compact, easy-to-install systems in small to mid-sized buildings and retrofit projects. These systems eliminate the need for cooling towers, reducing water usage and maintenance complexity. Growing adoption in regions facing water scarcity, coupled with advancements in energy-efficient inverter technology and environmentally friendly refrigerants, is enhancing product viability. Rising investments in modular buildings and portable HVAC units fuel the deployment of air-cooled chillers. Cost advantages in initial installation and flexibility in operations are positioning air-cooled chillers as the preferred choice for emerging decentralized cooling applications.

Application Analysis

In terms of application, the segmentation includes commercial, industrial, and residential. The commercial segment held ~50% of the revenue share in 2024 due to the extensive deployment of chillers in office buildings, shopping malls, airports, and hospitality facilities. Increasing demand for reliable HVAC solutions to support occupant comfort, indoor air quality, and energy savings has driven product uptake. Frequent refurbishments and upgrades of building systems in the commercial sector support recurring purchases. Technological integration with smart building systems and energy management platforms also increases operational efficiency. Greater attention to ESG compliance and green building certifications in commercial real estate has contributed to sustained demand for high-efficiency chillers in this segment.

The industrial segment is growing due to expanding requirements for precise process cooling in manufacturing facilities, chemical plants, and food processing units. Chillers play a critical role in maintaining temperature-sensitive production environments to ensure product consistency and quality. Rising industrial automation and the integration of advanced machinery create additional thermal loads, increasing the need for efficient cooling. Market participants are focusing on chillers designed for high-capacity, continuous operation and harsh industrial environments. The increasing shift toward energy recovery and waste heat utilization in industries is also driving the adoption of chillers capable of supporting integrated thermal management systems.

Compressor Type Analysis

In terms of compressor type, the segmentation includes screw chillers, centrifugal chillers, absorption chillers, scroll chillers, and reciprocating chillers. Screw chillers segment held the largest revenue share of ~50% in 2024 due to their robust performance in medium- to large-capacity applications requiring continuous operation. These chillers offer superior energy efficiency, reduced maintenance, and excellent partial-load performance. They are widely adopted in manufacturing, large commercial buildings, and district cooling systems. Technological enhancements such as variable speed drives and smart control systems have improved operational flexibility and reduced lifecycle costs. Their capability to handle high-load variations while maintaining consistent performance has made them a preferred choice in projects that demand high reliability and long service life without compromising on efficiency.

The growth of the scroll chillers segment is fueled by increasing demand for compact and low-noise cooling solutions in commercial and residential buildings. These systems are ideal for smaller-scale applications that require space-saving designs and efficient part-load performance. Cost advantages and minimal maintenance requirements make scroll chillers attractive to end-users seeking reliable, plug-and-play systems. Widespread use in retail chains, educational institutions, and healthcare facilities is expanding their market share. Technological advancements such as enhanced scroll compression design and integration with IoT-based monitoring tools are making these chillers more appealing for applications focused on energy conservation and minimal environmental footprint.

Regional Analysis

The North America chillers market is expected to register a significant CAGR from 2025 to 2034 due to rising investments in infrastructure upgrades across commercial buildings, hospitals, and data centers. In December 2024, the U.S. Department of Energy (DOE) reported that data center energy loads have tripled over the past decade and are projected to double or triple by 2028. Growing focus on energy efficiency and sustainability standards is prompting businesses to replace older systems with advanced chillers offering better performance and lower emissions. Increasing demand for temperature-controlled environments in the food & beverage and pharmaceutical industries is also supporting adoption. Federal incentives for green buildings and smart HVAC installations are encouraging early adoption. Adoption of low-GWP refrigerants in response to environmental regulations is driving product replacements across multiple sectors.

U.S. Chillers Market Insights

The U.S. market is expected to register a significant CAGR of 5.0% from 2025 to 2034 due to rapid urban redevelopment projects and stringent energy-efficiency mandates at the federal and state levels. Expanding commercial real estate and growing cloud infrastructure are fueling demand for reliable cooling systems. High penetration of precision cooling applications in healthcare, life sciences, and data centers is influencing product innovation. Rising environmental awareness is pushing companies to adopt chillers with minimal carbon footprints. OEMs are also focusing on modular, intelligent chiller systems to meet the evolving needs of the U.S. industrial and commercial base.

Asia Pacific Chillers Market Trends

The market in Asia Pacific accounted for the largest revenue share of ~46% due to the rapid industrialization and infrastructure growth across key economies such as China, India, and Southeast Asia. Strong investments in manufacturing facilities, IT hubs, and commercial complexes is driving large-scale chiller deployment. The increasing adoption of HVAC systems in high-rise residential developments and growing emphasis on energy-efficient solutions are key contributors. Governments in the region are also supporting green building standards and incentivizing eco-friendly cooling technologies, which is pushing demand for next-generation chiller systems. Rising population and climatic conditions further reinforce the need for robust cooling infrastructure.

China Chillers Market Overview

The market in China is expected to grow significantly from 2025 to 2034 due to increasing industrial activity across electronics, chemicals, and automotive manufacturing sectors. Strong investments in commercial infrastructure such as office complexes, airports, and shopping malls are accelerating the adoption of centralized cooling systems. Supportive government policies promoting clean energy and building efficiency are encouraging the replacement of traditional systems with low-emission chillers. Urbanization trends are also creating sustained demand for high-capacity cooling across smart city developments. Local manufacturers are rapidly scaling up innovation to cater to the rising demand for technologically advanced and cost-efficient chiller systems across multiple sectors.

Europe Chillers Market Assessment

The market in Europe is growing significantly due to stringent regulatory mandates targeting carbon neutrality and energy efficiency across the construction and industrial sectors. Demand for eco-friendly chillers is rising due to government pressure on businesses to adopt sustainable cooling technologies. The ongoing modernization of district cooling networks and high reliance on advanced automation in building management systems are encouraging the deployment of intelligent chillers. Renovation of old commercial infrastructure and the increasing presence of data centers in countries such as Ireland, the Netherlands, and France are also contributing to growth. Rising focus on reducing operating costs and carbon emissions is accelerating adoption.

Germany Chillers Market Outlook

Germany held ~22% of the revenue share in European industry in 2024, due to strong investments in industrial automation and energy-efficient infrastructure. Manufacturing facilities, automotive plants, and R&D centers are adopting advanced chillers for process cooling and precise temperature control. Nationwide regulations promoting low-GWP refrigerants and the phase-out of older systems are encouraging upgrades. High standards in building efficiency and sustainability are pushing demand in the commercial sector. Presence of technologically mature OEMs and consistent innovation in smart cooling systems are supporting growth. Preference for hybrid and modular chillers is also rising, catering to customized applications in both industrial and commercial segments.

Key Players & Competitive Analysis

The competitive landscape of the chillers market is marked by intense rivalry, driven by continuous product innovation and evolving application demands. Industry analysis indicates that key players are investing heavily in technology advancements to develop energy-efficient and low-GWP chillers in line with regulatory mandates. Market expansion strategies include joint ventures and strategic alliances aimed at increasing regional footprint and enhancing supply chain capabilities.

Mergers and acquisitions are shaping the market dynamics, allowing companies to integrate complementary product portfolios and accelerate innovation cycles. Post-merger integration efforts are focusing on optimizing operations and harmonizing technology platforms. Leading vendors are also strengthening their competitive edge by offering smart control systems and predictive maintenance features as differentiators. Product customization for sector-specific requirements remains a critical focus, supported by robust R&D investments. The market continues to evolve as participants explore sustainable refrigerants, smart connectivity, and modular systems to meet the rising demand for high-performance, eco-friendly chiller solutions.

Key Players

- Carrier

- ClimaCool Corp.

- Cold Shot Chillers

- Daikin Industries, Ltd.

- Drake Refrigeration, Inc.

- Fluid Chillers, Inc.

- FRIGEL FIRENZE S.p.A.

- General Air Products

- Honeywell International, Inc.

- Johnson Controls

- Midea

- Multistack International Limited

- Rite-Temp

- Tandem Chillers

- Trane

Chillers Industry Developments

January 2025: Midea expanded its manufacturing presence in Thailand by opening a new plant in Rayong, producing VRF systems and chillers with an annual capacity of 600,000 units, primarily for export.

December 2024: Vertiv Group Corp acquired key assets and technologies from BiXin Energy Technology, a China-based chiller manufacturer, to enhance its portfolio of water-cooled and air-cooled chillers, including high-capacity (up to 5.5 MW) and heat recovery systems for AI and high-performance computing applications.

Chillers Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Water-Cooled

- <50kW

- 51–100kW

- 101–500kW

- 501–1000kW

- 1001–1500kW

- >1501kW

- Air-Cooled

- <50kW

- 51–100kW

- 101–500kW

- 501–1000kW

- 1001–1500kW

- >1501kW

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Commercial

- Corporate Offices

- Data Centers

- Public Buildings

- Mercantile & Service

- Healthcare

- Others

- Industrial

- Chemicals & Pharmaceuticals

- Food & Beverage

- Metal Manufacturing & Machining

- Medical & Pharmaceutical

- Plastics

- Others

- Residential

By Compressor Type Outlook (Revenue, USD Billion, 2020–2034)

- Screw Chillers

- Centrifugal Chillers

- Absorption Chillers

- Scroll Chillers

- Reciprocating Chillers

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Chillers Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.28 billion |

|

Market Size in 2025 |

USD 10.72 billion |

|

Revenue Forecast by 2034 |

USD 15.79 billion |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.28 billion in 2024 and is projected to grow to USD 15.79 billion by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

Asia Pacific accounted for the largest revenue share of ~46% due to the rapid industrialization and infrastructure growth across key economies such as China, India, and Southeast Asia.

A few of the key players in the market are Carrier; ClimaCool Corp.; Cold Shot Chillers; Daikin Industries, Ltd.; Drake Refrigeration, Inc; Fluid Chillers, Inc.; FRIGEL FIRENZE S.p.A.; General Air Products; Honeywell International, Inc.; Johnson Controls; Midea; Multistack International Limited; Rite-Temp; Tandem Chillers; and Trane.

The water-cooled chillers segment dominated the market with ~60% of the revenue share in 2024 due to their high energy efficiency, superior heat rejection capability, and longer operational lifespan.

The commercial segment held ~50% of the revenue share in 2024 due to the extensive deployment of chillers in office buildings, shopping malls, airports, and hospitality facilities.