Choline Chloride Market Share, Size, Trends, Industry Analysis Report

By Application (Animal Feed, Oil & Gas, Human Nutrition, Personal Care, Pharmaceuticals, and Others); By Form; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3176

- Base Year: 2023

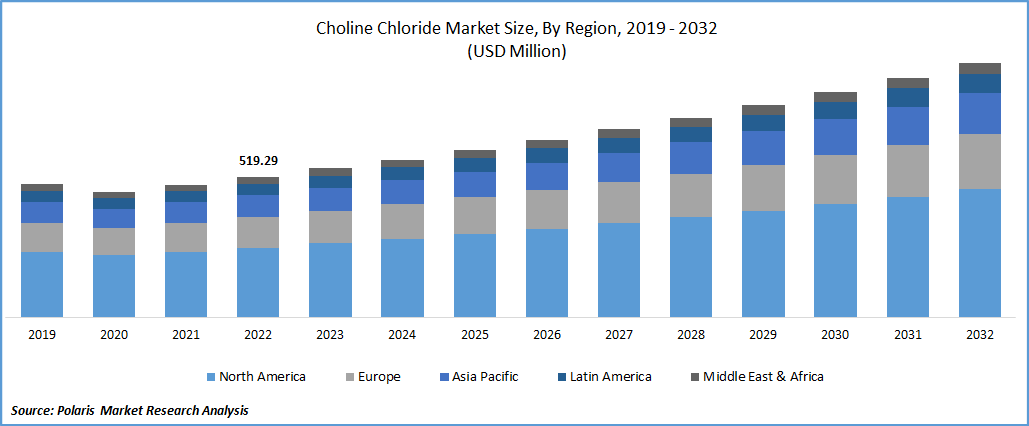

- Historical Data: 2019-2022

Report Outlook

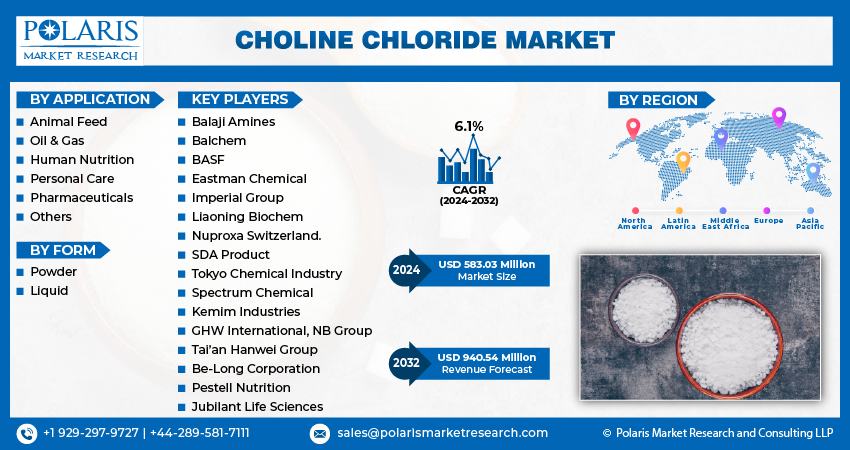

The global choline chloride market was valued at USD 550.13 million in 2023 and is expected to grow at a CAGR of 6.1% during the forecast period. The rapid growth in the oil & gas industry and continuously surging investments by various key market companies to expand their product portfolio by introducing new and more effective products and developing eco-friendly solutions are key factors expected to fuel the demand and growth of the market. Increasing utilization of pure choline chloride to prepare a variety of pharmaceutical preparations targeting neurological health and the growing need for natural ingredients worldwide are further expected to create huge growth opportunities in the near future. For instance, in March 2022, PurerVita UK Limited announced the launch of its new PurerMama range, which includes the Choline Capsule, Essence Capsule, Pregnancy Collagen, and Purer Rage Superfood Collagen, among others. The products are developed and formulated for pregnancy, breastfeeding, and postnatal recovery.

Know more about this report: Request for sample pages

Moreover, the growing vitality of choline chloride for the effective and healthy functioning of the liver, muscle development, better metabolism, healthy nervous system, and complete brain development has gained significant traction as an important supplement in the human nutrition sector.

The outbreak of the COVID-19 pandemic has significantly impacted the market's growth. The rapid emergence of the deadly coronavirus across the globe has driven substantial consumer attention toward preventive health and fitness products. Hence, consumer spending on various healthcare and pharmaceutical products has fueled the demand for choline chloride at a rapid pace. However, various stringent regulations and supply chain disruptions have slightly declined the manufacturing and supply capacities during the pandemic.

Industry Dynamics

Growth Drivers

Increasing applications of choline chloride across various end-use industries and mainly in the agriculture industry, involving fish farming, crustaceans, molluscs, aquatic plants, and many other organisms, as it helps to produce good quality food products, rebuild the marine population, and replenish the wild stock, are major factors expected to drive the global choline chloride market growth over the study period. Furthermore, the exponential growth in the need and demand for high-quality red & white meat products, coupled with the changing perception of animal nutrition across the globe, is further anticipated to boost product demand and growth. Choline chloride solutions are widely used in various feed products as it improves the quality & quantity of animal-derived products while maintaining operational cost control.

Report Segmentation

The market is primarily segmented based on application, form, and region.

|

By Application |

By Form |

By Region |

|

|

|

Know more about this report: Request for sample pages

Animal feed segment accounted for the largest market share in 2022

The animal feed segment accounted for the largest market share in 2022. Growth is driven by the extensively growing usage of choline chloride as an effective vitamin substitute or supplement in various animal feed additives for poultry, fish farming, and swine feed. Poultry animals are highly vulnerable to multiple contagious diseases and tend to lack choline content. Thus integration of choline content in animal feed additives is essential as it supports faster growth and helps them overcome perosis.

Choline chloride is also widely used for building and maintaining cell structures, formulating the essential acetylcholine, and as a methyl-group donor through betaine. Moreover, the continuous rise in the incidences of several animal diseases across both developed and developing regions around the world has rapidly increased choline chloride usage.

The oil & gas segment registered the highest CAGR during the study period because of its various beneficial characteristics and features, including good clay stabilizer, ensuring cost-effectiveness, and increasing the overall production rates in the oil & gas industry. Choline chloride mainly aids in the resolution of numerous types of tissues that develop during the oil drilling processes, including fine migration, reduction of permeability, and wellborn instability, as it is a biodegradable and more environment friendly alternative to the conventional clay stabilizers.

Powder form segment dominated the global market in 2022

The powder form segment dominated the global market for choline chloride in 2022, with a holding of healthy market share. Increasing use of choline chloride powder in the medical end-use industry owing to its easy water solubility and the continuous rise in the demand for animal feed products. In addition, the market and need for these powders are likely to gain significant traction on account of the rapid increase in the popularity of various supplementary diet products across the globe and especially the increasing demand for meats across the APAC region, which are likely to boost the segment market growth over the next coming years.

The liquid form segment is expected to grow substantially and will likely account for a significant market share during the study period. The growing adoption of liquid choline chloride as a precursor of phospholipids plays a crucial role in cell membranes' structural integrity and fluidity.

The demand in Asia Pacific is expected to witness fastest growth rate over forecasted period

The Asia Pacific region is expected to emerge at the fastest growth rate throughout the projected period. The regional market growth is highly attributable to increased research & development activities to emphasize the use of advanced choline chloride products in the animal feed industry and the rise in the demand for poultry, meat, and egg industry along with the increased penetration for choline chloride among various end-use industries such as personal care, pharmaceuticals, and human nutrition. In addition, China’s livestock sector has grown significantly in the last few years, as consumers are continuously shifting towards a healthy diet and more animal proteins, which is likely to fuel the demand and growth of the market in the region.

For instance, according to our findings, the average meat consumption in China has increased drastically. By 2021, Chinese people, on average, have around 63 KGs meat per year, and its overall meat consumption accounts for nearly 30% of the total world consumption.

The Europe region held the largest market share in the choline chloride market in 2022 and is expected to maintain its dominance throughout the anticipated period, owing to the increased consumer awareness regarding their well-being and rising consumer disposable income along with the introduction to a variety of innovative and more beneficial products by large market players operating in the market. Additionally, a rapid increase in the number of people living with liver health problems in countries like the UK, France, and Germany is likely to boost the adoption and growth of the market.

Competitive Insight

Some of the major players operating in the global choline chloride market include Balaji Amines, Balchem, BASF, Eastman Chemical, Imperial Group, Liaoning Biochem, Nuproxa Switzerland., SDA Product, Tokyo Chemical Industry, Spectrum Chemical, Kemim Industries, GHW International, NB Group, Tai’an Hanwei Group, Be-Long Corporation, Pestell Nutrition, & Jubilant Life Sciences.

Recent Developments

- In May 2022, Adroit Biomed., a leading healthcare and pharmaceutical company, announced the launch of its new Fortisil range of products that offer innovative and smart skincare with a deep focus on the projection and rejuvenation of human skin and others. The newly developed range of products is available in three different varieties of sunscreens and capsules.

- In January 2021, Balchem, a leading global manufacturer of choline products for human and animal nutrition, unveiled its new line of choline chloride products launched in Asia Pacific, Europe, and The Middle East. The company has refined its manufacturing process and continuously leverages the latest production technologies while improving its products' reliability, purity, and consistency.

Choline Chloride Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 583.03 million |

|

Revenue forecast in 2032 |

USD 940.54 million |

|

CAGR |

6.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Balaji Amines Ltd., Balchem Inc., BASF SE, Eastman Chemical Company, Imperial Group Limited, Liaoning Biochem Co. Ltd., Nuproxa Switzerland Ltd., SDA Product, Tokyo Chemical Industry, Spectrum Chemical, Kemim Industries Inc., Merck KGaA, GHW International, NB Group Co. Ltd., Tai’an Hanwei Group, Be-Long Corporation, Pestell Nutrition Inc., and Jubilant Life Sciences Ltd. |

FAQ's

The choline chloride market report covering key segments are application, form, and region.

Choline Chloride Market Size Worth $940.54 Million By 2032.

The global choline chloride market expected to grow at a CAGR of 6.1% during the forecast period.

Asia Pacific is leading the global market.

Key driving factors in choline chloride market are growth in the oil & gas industry and continuously surging investments.