Cigarette Paper Market Share, Size, Trends, Industry Analysis Report

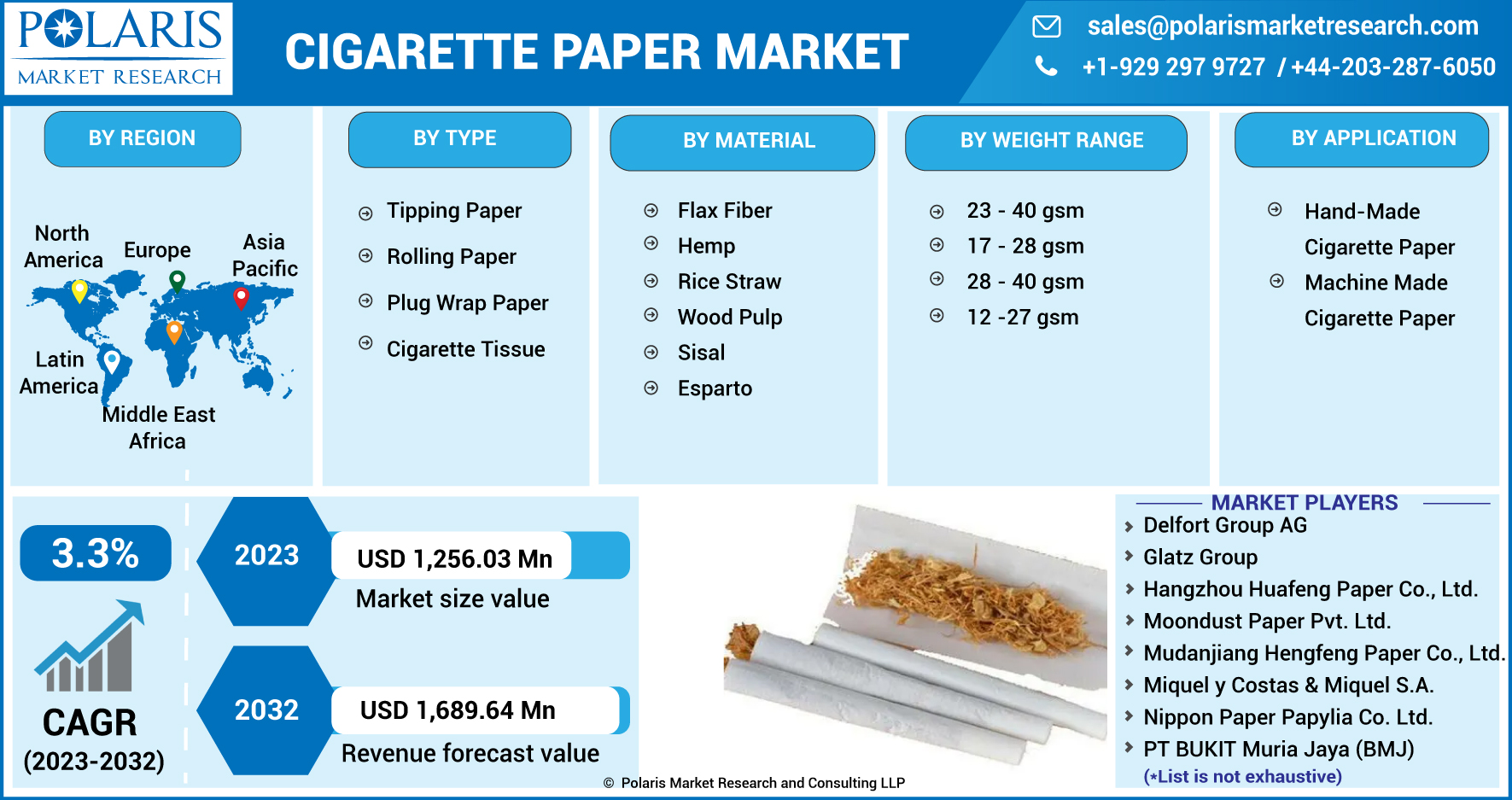

By Type (Tipping Paper, Rolling Paper, Plug Wrap Paper, and Cigarette Tissue); By Material; By Weight Range; By Application; By Region; Segment Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM3001

- Base Year: 2024

- Historical Data: 2020-2023

The global cigarette paper market was valued at USD 1.36 billion in 2024 and is expected to grow at a CAGR of 3.5% during the forecast period. Cigarette smoking has been a common habit worldwide for a very long time. Additional tobacco products include waterpipe tobacco, roll-your-own tobacco, numerous smokeless tobacco options, cigars, cigarillos, pipe tobacco, bidis, and kreteks. The smoke exhaled by a smoker or released from the ends of a cigarette is known as secondhand tobacco smoke. There is no safe contact threshold with secondhand smoke because more than 4000 compounds have been found in tobacco smoke.

Key Insights

- By type, the tipping paper subsegment held the largest share. It is the most important component in the manufacture of both the classic and the increasingly popular heated tobacco products. The increased use of tipping paper in the tobacco industry for branding and customized products is considered a primary reason.

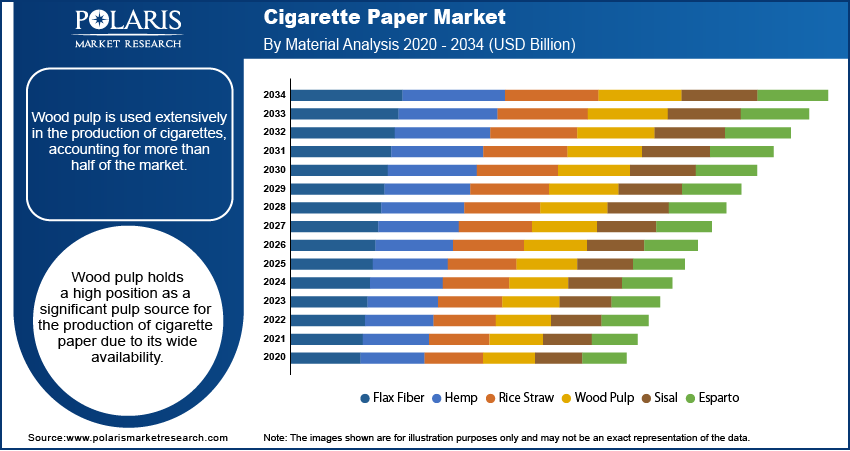

- By material, the wood pulp held the largest share due to the ready availability of wood and the endless utilization of paper and products derived from it. It is the most important subsegment in the supply chain for cigarette paper, because it is in abundant supply and inexpensive.

- By weight range, 12-27 gsm held the largest share. This is particularly due to its use for "roll-your-own" (RYO) cigarette paper. Within this segment, it is the most economical for the production of thin and ultra-thin rolling papers. The growing penchant for RYO cigarettes, which are, on average, cheaper than the pre-packaged alternatives, is also one of the contributing factors for the growth of this segment.

- By application, the machine-made cigarette paper sub-segment held the largest share. The primary reason for this is that the majority of cigarettes produced worldwide are made in factories using high-speed automated production processes.

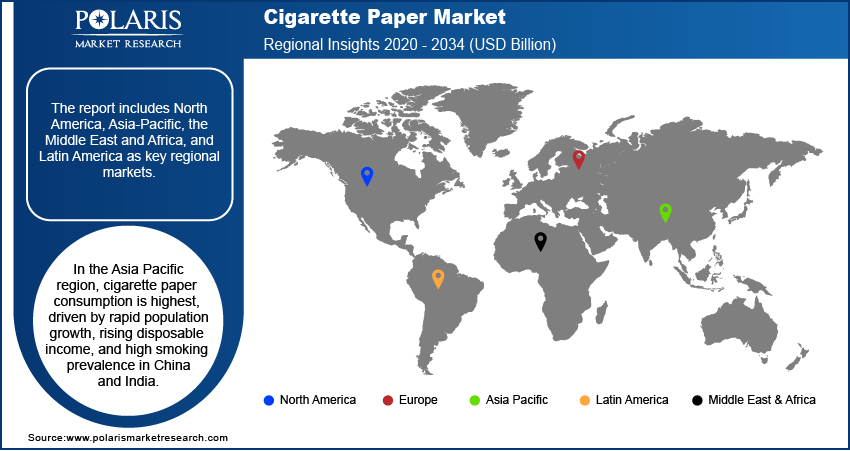

- By region, in the Asia Pacific region, the consumption of cigarette paper is the highest. This is primarily attributed to the rapid population growth and increasing disposable income, in addition to the high prevalence of smokers in countries like China and India.

Industry Dynamics

- The growth in demand for roll-your-own (RYO) products is driven by the rapid increase in demand for RYO cigarettes. A key driver of this trend is the perception that rolling papers and loose tobacco are much cheaper than buying a fully packaged cigarette, especially in tobacco tax-rich regions.

- The focus on sustainable papers is driven by general environmental consumer sentiments to buy products that are compostable, biodegradable, or produced from sustainable virgin fibers such as hemp and rice straw. These fibers are the drivers for change, pushing manufacturers to pioneer new eco-friendly production processes.

- The increase in tobacco consumption, especially in developing economies, is one of the growth drivers in the Asia Pacific region. The growth of disposable income, along with the region's dense and young population, results in ever-increasing demand for tobacco products, thus, the paper used to make cigarettes.

Market Statistics

- 2024 Market Size: USD 1.36 billion

- 2034 Projected Market Size: USD 1.91 billion

- CAGR (2025-2034): 3.5%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- With the use of machine vision and deep learning, AI systems are able to monitor production lines in real-time to identify defects or inconsistencies in the paper. This promotes maintaining set quality objectives and product standards, minimizes loss and waste, and allows for real-time changes to ky the production.

- AI systems are capable of processing extensive data within the system and process, and come up with methods to improve and optimize the processes. This includes reducing downtime and maintenance expenses by leveraging equipment failure avoidance systems, thus performing predictive maintenance.

- Forecasting customer demand and optimizing stock levels is a vital AI application for supply chain management. This assists manufacturers in reducing waste and avoiding overproduction.

Non-wood plant fibers such as flax, rice straw, & esparto are used to make cigarette paper because they are thin and lightweight. A narrow glue strip runs down one long edge of the article, which is offered in rolls & rectangular sheets. It might have flavor, color, and transparency. Its base weight is 10 and 28 g/m2, and contains much filler. This paper has additives that control burning and a porosity appropriate for the type of tobacco to maintain the smoking qualities. Permeability is an essential property of paper; smoke dilution is one of its main physical effects.

Further, increased cigarette smoking, especially among those who roll their cigarettes, has increased demand throughout the years. According to the annual Cigarette Report published by the Federal Trade Commission, producers sold 203.7 billion cigarettes in 2020, up over 202.9 billion in 2019 – a 0.4% rise. Cigarette sales surged last year amid the COVID-19 outbreak for the first time in twenty years as tobacco corporations increased government spending to promote their goods. A report shows that, in the world, almost 6.5 trillion packs of cigarettes are sold annually, or around 18 billion bags every day. Additionally, the market's expansion is being constrained by consumer preference for electronic cigarettes as a substitute for traditional cigarettes produced in factories.

Unexpected natural disasters and pandemics like COVID-19 impact all economies around the world. Due to lockdowns and declining demand from cigarette manufacturing sectors, which are the significant customers of cigarette paper, COVID-19 has also affected the market for cigarette paper. In addition, reducing the need and erratic industrial output have hampered the market. However, the demand for cigarette paper and factory production returned to pre-recession by the third period of 2021.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The government regulations for the legalization of cannabis used in cigarettes rolled on paper are the primary factor driving the cigarette paper market growth over the forecast period. Cannabis use has been made legal worldwide for both recreational and therapeutic purposes. Currently, cannabis is authorized for medical use in 34 states in the US (including Washington DC), and it is permitted for recreational use in ten additional states.

Governments of many countries are legalizing cannabis more and more to reduce the use, trafficking, and criminality associated with it while also fostering the global market for it. According to the Federal Food, Drug, and Cosmetic Act (FD&C Act) and its accompanying rules, the FDA controls the production, importation, packaging, labeling, advertising, marketing, sale, and marketing of cigarette and roll-your-own tobacco. The tobacco and cigarette rolling paper is likewise subject to FDA regulation.

Due to legislation, the minimum age for selling tobacco products will increase from 18- 21 years old. The sale of any tobacco-based product to a person under the age of 21 is prohibited by law, including the sale of cigarettes, cigars, & e-cigarettes. Over the next few years, cannabis use will significantly increase demand for roll-your-own cigarette paper.

Report Segmentation

The market is primarily segmented based on type, material, weight range, application, and region.

|

By Type |

By Material |

By Weight Range |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Hemp segment is expected to witness the fastest growth

The hemp segment is anticipated to exhibit the highest CAGR. Hemp pulp is more challenging and tear-resistant than wood pulp and has a fiber that is four to five times longer and significantly lower in lignin than that wood pulp. These traits drive the segment. Additionally, the sisal market is anticipated to exhibit the highest share. The category is expected to grow as sisal usage rises in paper, automobile, pharmaceutical, construction, and other industries.

The wood Pulp segment industry accounted for the highest market share in 2024

Wood pulp is used extensively in the production of cigarettes, accounting for more than half of the market. Wood pulp holds a high position as a significant pulp source for the production of cigarette paper due to its wide availability. Additionally, hemp and rice straws are gaining popularity due to the addition of flavors and lower ionization propensity.

The Rolling Paper segment industry accounted for the largest market share in 2024

During the projection period for cigarette paper, the rolling paper segment is anticipated to rise at a substantial CAGR and hold a significant market share in 2024. There are several architectures for rolling papers, including primary, colored, and improved varieties. These sheets provide desired air porousness, thickness, and consumption rate control.

During the anticipated time frame, the segment for cigarette tissue is also expected to increase at the fastest rate. The segmental surge is caused by cigarettes' tissues' capacity to reduce the amount of nicotine inhaled while also reducing the inhalation of potentially harmful substances. Additionally, during the projected period, the advantages of cigarette tissues will drive the segment's growth.

The demand in Asia-Pacific is expected to witness significant growth

Asia-Pacific dominated the market's growth due to being the largest producer and exporter of tobacco. The rising popularity of cigarettes and chewing tobacco will also contribute to the region's cigarette rolling paper expansion over forecasting time. Including over 300 million smokers who smoke regularly—roughly one-third of all smokers worldwide—China is the world's biggest producer and consumer of tobacco, as reported by the World Health Organization (WHO). Due to the rising demand for the tobacco paper sector, the Middle East and Africa are expected to grow considerably in the cigarette rolling paper market. Additionally, it is projected that the increasing use of water pipes or shishas will further fuel the expansion of the regional call for cigarette rolling papers in the upcoming years.

Furthermore, the rising government regulation, as well as rising cigarette consumption in North America, is driving the region's growth. As per the CDC, the main contributor to preventable illness, disability, and mortality in the US is tobacco smoking. 3.1 Mn middle & high school children used at least 1 product. Around 1,600 American teenagers under the age of 18 light up their first cigarette every day. Nearly 500,000 Americans pass away before their time each year due to smoking or being around second-hand smoke. Another 16 Mn people suffer from a severe sickness brought on by smoking. The United States spends about USD 225 Bn annually on medical treatment to treat diseases brought on by adult smoking.

Competitive Insight

Key players include Delfort Group, Glatz Group, Hangzhou Huafeng Paper, Moondust Paper, Mudanjiang Hengfeng Paper, Miquel y Costas & Miquel, Nippon Paper Papylia, PT BUKIT Muria Jaya, Pura Group, Republic Technologies International, Richer Paper, SWM international, Schweitzer-Mauduit International, & Rolling Paper Co.

Recent Developments

In June 2025, SWM International has introduced Evolute®, an innovative filtering media range designed to accelerate the transition to cellulosic fiber-based filters for all tobacco market segments.

In February 2022, under the brand name "Botani," Schweitzer Mauduit International (SWM) introduced a new product of superior hemp & botanical products. Rolling & pre-roll papers, cannabis wrappers, & hemp fillers are a few items being offered.

Cigarette Paper Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.36 billion |

| Market size value in 2025 | USD 1.40 billion |

|

Revenue forecast in 2034 |

USD 1.91 billion |

|

CAGR |

3.5% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Material, By Weight Range, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Delfort Group AG, Glatz Group, Hangzhou Huafeng Paper Co., Ltd., Moondust Paper Pvt. Ltd., Mudanjiang Hengfeng Paper Co., Ltd., Miquel y Costas & Miquel S.A., Nippon Paper Papylia Co. Ltd., PT BUKIT Muria Jaya (BMJ), Pura Group, Republic Technologies International, Richer Paper Co., Ltd., SWM international, Schweitzer-Mauduit International, Inc., and The Rolling Paper Company |

FAQ's

Cigarette Paper Market Size Worth $1.36 in 2024.

Key players include Delfort Group, Glatz Group, Hangzhou Huafeng Paper, Moondust Paper, Mudanjiang Hengfeng Paper, Miquel y Costas & Miquel, Nippon Paper Papylia, PT BUKIT Muria Jaya, Pura Group

Asia-Pacific contribute notably towards the global cigarette paper market.

The global cigarette paper market expected to grow at a CAGR of 3.5% during the forecast period.

key segments are type, material, weight range, application, and region.